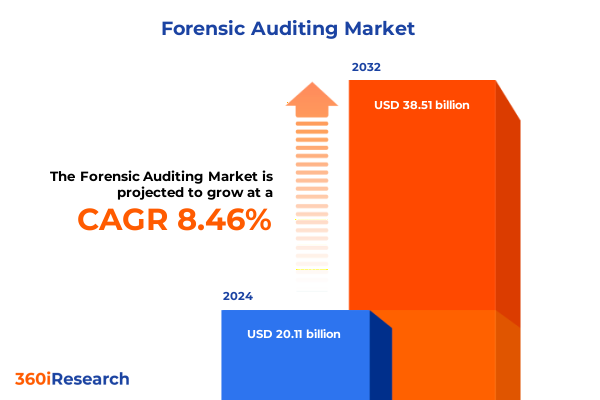

The Forensic Auditing Market size was estimated at USD 21.78 billion in 2025 and expected to reach USD 23.60 billion in 2026, at a CAGR of 8.48% to reach USD 38.51 billion by 2032.

Navigating the Evolving Landscape of Forensic Auditing as a Strategic Pillar for Enhanced Organizational Integrity and Risk Management

Forensic auditing has become an indispensable discipline at the intersection of finance, law, and technology, serving as a vital mechanism for detecting and investigating financial misconduct. Organizations are increasingly vulnerable to sophisticated schemes-from asset misappropriation to cyber fraud-requiring specialized expertise to scrutinize data trails and transactional anomalies. The Business Research Company highlights that rising white-collar crime and heightened scrutiny of corporate governance have significantly driven demand for forensic accounting services, underscoring the critical role these practices play in safeguarding organizational integrity. As companies navigate volatile economic conditions and evolving regulatory environments, forensic auditors must continuously enhance their methodologies to stay ahead of bad actors and protect stakeholder value.

According to KPMG, forensic specialists are now integrated into complex audit engagements, particularly for entities with high-risk profiles, where their objective insights challenge management assumptions and strengthen control frameworks. This trend reflects a broader shift from traditional audit approaches toward proactive risk mitigation, as organizations seek to embed forensic capabilities within their governance structures. At the same time, emerging threats such as deepfake technologies and encrypted finance channels demand agile forensic frameworks capable of synthesizing legal expertise, advanced analytics, and domain knowledge. This executive summary offers a strategic overview of the transformative shifts, regional dynamics, and actionable insights shaping the forensic auditing landscape in 2025.

Embracing Disruption Through AI, Regulatory Complexity, and Cross-Border Dynamics to Redefine the Future of Forensic Auditing Practices

The forensic auditing domain is undergoing unprecedented transformation driven by the convergence of advanced technologies, complex regulatory frameworks, and shifting workforce dynamics. In particular, the integration of generative artificial intelligence and data analytics is revolutionizing investigations, enabling teams to process vast datasets, identify hidden patterns, and predict fraudulent behaviors with greater speed and precision. Deloitte’s Internal Audit 4.0 framework underscores that while many audit functions report increased impact, only a fraction have fully harnessed these capabilities, marking a crucial inflection point for organizations to redefine their purpose and fortify risk management strategies. Looking ahead, applications of digital twins, automated anomaly detection, and robotic process automation promise to further elevate the efficiency and depth of forensic reviews.

Simultaneously, regulatory landscapes are growing more intricate, with new mandates such as enhanced privacy standards, expanded anti-money laundering rules, and emerging national AI governance frameworks reshaping compliance obligations across jurisdictions. Forensic practitioners must therefore cultivate multidisciplinary teams that blend legal acumen with technological expertise to navigate cross-border investigations and data privacy challenges. As noted by industry experts, the ability to anticipate regulatory shifts, adapt methodologies, and maintain transparent communication with stakeholders has become essential to preserving credibility and delivering actionable intelligence. These transformative dynamics are redefining the forensic auditing paradigm, positioning it as an integral component of enterprise resilience and strategic decision-making.

Assessing the Cumulative Impact of 2025 United States Tariff Policies on Financial Crime Risks, Compliance Challenges, and Forensic Auditing Strategies

In 2025, a series of United States tariff policies have cumulatively reshaped the global trade environment, introducing new layers of complexity for forensic auditors. The trade war initiated by executive orders on February 1 imposed 25 percent tariffs on all imports from Canada and Mexico-excluding Canadian energy exports-and an additional 10 percent on goods from China, triggering simultaneous retaliatory measures. Shortly thereafter, on March 12, the administration extended 25 percent duties to steel and aluminum imports to protect domestic industries, while automotive products and parts faced a separate 25 percent levy effective April 3, reflecting broader efforts to leverage trade policy for economic objectives.

These shifting tariff regimes have profound implications for forensic auditing, as organizations contend with evolving customs classifications, valuation disputes, and supply chain transparency requirements. Audit teams must now incorporate deeper analysis of tariff-related documentation, assess potential misclassification risks, and evaluate the integrity of origin certifications. Additionally, reciprocal tariff measures announced in April have introduced uniform 10 percent duties on all imports, further complicating compliance reviews and cost allocation analyses. Forensic practitioners are increasingly called upon to investigate potential duty evasion schemes, assist in tariff engineering assessments, and provide litigation support in customs disputes, underscoring the need for specialized expertise at the intersection of trade law and financial forensics.

Deep Dive Into Market Segmentation Insights Across Service Types, Deployment Models, Organization Sizes, Industry Verticals, Applications, and Technologies Shaping Forensic Auditing

A comprehensive understanding of forensic auditing market segments reveals diverse demand drivers and service priorities. Demand for compliance audits remains foundational, supporting adherence to financial regulations and corporate governance standards, while cybersecurity audits are gaining prominence amid escalating threats to digital assets. Financial audits continue to underpin credibility in stakeholder reporting, and operational audits emphasize process integrity and efficiency across business units. Deployment models have likewise evolved, with cloud-based platforms-both private and public-facilitating scalable analytics, while hybrid and multicloud architectures offer flexibility and redundancy to meet stringent data residency requirements.

Market dynamics also vary by organizational size: large enterprises often maintain robust in-house forensic teams to address high-volume investigations, whereas microenterprises and small and medium enterprises tend to outsource targeted investigations or adopt modular service offerings. Industry verticals shape specific risk profiles, with banking, capital markets, and insurance focusing on asset misappropriation and anti-money laundering, and government entities prioritizing investigative audits in public sector projects. Healthcare investigations center on HIPAA compliance and pharmaceutical litigation support, while technology and telecom firms emphasize intellectual property protection and data breach forensics. Manufacturing sectors grapple with supply chain fraud in automotive, chemicals, and electronics, and retailers manage unique challenges in brick-and-mortar and e-commerce fraud detection.

Applications of forensic auditing span fraud detection-encompassing asset misappropriation, cyber fraud, and financial statement manipulations-regulatory compliance programs for GDPR, HIPAA, and Sarbanes-Oxley, and risk management frameworks addressing credit, market, and operational risk. Underpinning these practices are emerging technologies such as artificial intelligence, which leverages deep learning and machine learning models for anomaly detection; blockchain applications for immutable audit trails; descriptive and predictive data analytics; and robotic process automation to streamline routine investigative workflows. This multifaceted segmentation underscores the tailored strategies required to address complex, sector-specific forensic challenges.

This comprehensive research report categorizes the Forensic Auditing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Organization Size

- Industry Vertical

- Technology

- Deployment Model

- Application

Unearthing Regional Dynamics, Regulatory Environments, and Growth Drivers Shaping Forensic Auditing Across the Americas, EMEA, and Asia-Pacific

Regional dynamics in forensic auditing reflect the interplay of regulatory environments, economic conditions, and technological adoption across global markets. In the Americas, forensic services are heavily influenced by stringent enforcement of financial crime regulations and evolving sanctions regimes, prompting organizations to bolster in-house investigative capabilities and engage specialized advisory partners. Senior professionals in the United States report cybersecurity threats and data breaches as primary drivers of risk, with many firms accelerating investments in AI-powered detection tools to stay ahead of sophisticated fraud schemes.

Across Europe, the Middle East, and Africa, the convergence of the EU’s Digital Operational Resilience Act, expanded AML directives, and region-specific anti-corruption initiatives demands intricate forensic responses. European entities grapple with harmonizing cross-border data transfers under GDPR while monitoring compliance with evolving risks in supply chains and third-party networks. Concurrently, financial crime units in the Middle East and Africa adapt to emerging AML frameworks and digital infrastructure investments, leveraging forensic audits to support transparency efforts and fortify investor confidence.

The Asia-Pacific region is experiencing rapid growth in financial crime compliance costs, driven by regulatory intensification and the rising sophistication of illicit activities, including cryptocurrency-based schemes and AI-enabled fraud. Organizations in APAC markets are prioritizing cost-effective forensic solutions to address regulatory expectations and operational risks, while technology platforms offering integrated data analytics and real-time monitoring are gaining traction. These regional insights highlight the necessity for adaptable forensic frameworks that balance global best practices with localized compliance imperatives.

This comprehensive research report examines key regions that drive the evolution of the Forensic Auditing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Firms and Emerging Innovators Driving Excellence, Innovation, and Competitive Advantage in Forensic Auditing

A diverse array of global firms and specialized consultancies are spearheading innovation in forensic auditing, combining deep domain knowledge with advanced technological capabilities. Established professional service networks such as EY, Deloitte, and PwC lead comprehensive investigations, blending forensic accounting, litigation support, and compliance advisory to meet high-stakes client demands. Their global footprints and multidisciplinary teams enable seamless cross-border collaboration, while proprietary platforms and integrated analytics enhance the speed and accuracy of investigative outcomes.

Simultaneously, boutique advisory firms and independent experts are carving out niche positions by focusing on specialized practice areas and proprietary toolsets. Kroll, for instance, has distinguished itself in financial crime advisory through a blend of seasoned investigative professionals and AI-driven intelligence, addressing complex cyber and sanctions-related cases. Technology innovators such as Relativity and OpenText’s EnCase series are equipping investigators with robust eDiscovery and digital forensics solutions, while emerging software providers are introducing cloud-based audit management systems that seamlessly integrate machine learning modules for anomaly detection and predictive risk analysis. Grant Thornton, FTI Consulting, and BDO further diversify the market by offering tailored forensic packages that address sector-specific challenges in healthcare, retail, and manufacturing, reflecting a competitive ecosystem focused on agility, depth of expertise, and technological differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Forensic Auditing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AlixPartners, LLP

- Alvarez & Marsal Holdings, LLC

- Baker Tilly International

- BDO International Limited

- Berkeley Research Group

- CaseWare International, Inc.

- CBIZ, Inc.

- Control Risks Group Limited

- Deloitte Touche Tohmatsu Limited

- Duff & Phelps, LLC

- Ernst & Young Global Limited

- Forensic Risk Alliance

- FTI Consulting, Inc.

- Grant Thornton International Ltd

- K2 Integrity

- KPMG International Cooperative

- MDD Forensic Accountants

- Nardello & Co.

- Parker Randall

- Pinkerton Consulting & Investigations, Inc.

- PricewaterhouseCoopers International Limited

- Protiviti Inc.

Strategic and Actionable Recommendations Empowering Industry Leaders to Enhance Forensic Auditing Capabilities and Foster Proactive Risk Management

Industry leaders aiming to fortify their forensic auditing functions should prioritize strategic investments in advanced analytics and artificial intelligence to enhance fraud detection capabilities and reduce investigation cycle times. By establishing a centralized data repository and deploying machine learning algorithms for pattern recognition, organizations can proactively identify anomalies, refine risk models, and allocate investigative resources more effectively. Emphasizing talent development-particularly in data science, cyber forensics, and regulatory affairs-will ensure that teams possess the cross-functional expertise required to navigate complex, technology-enabled investigations.

Furthermore, forging collaborative partnerships with regulatory bodies and technology vendors can provide early access to emerging threat intelligence and compliance updates. Implementing continuous monitoring frameworks-augmented by robotic process automation-will strengthen oversight of critical processes and reduce the likelihood of systemic gaps. Lastly, embedding forensic considerations within broader enterprise risk management practices will drive alignment between audit committees, legal counsel, and operational managers, fostering a culture of accountability and resilience. Collectively, these actionable recommendations empower industry leaders to transform forensic auditing into a strategic capability that reinforces governance structures and mitigates emerging risks.

Robust Research Methodology Employing Qualitative and Quantitative Techniques to Ensure Rigor, Reliability, and Comprehensive Forensic Auditing Insights

This research combines qualitative and quantitative approaches to deliver a rigorous analysis of the forensic auditing landscape. Primary data collection included structured interviews with senior forensic practitioners, compliance officers, and audit committee members to capture insights into emerging challenges, technology adoption, and service delivery models. Secondary research encompassed an exhaustive review of industry reports, regulatory filings, and peer-reviewed publications to contextualize market trends and validate findings. Data triangulation was employed to reconcile divergent perspectives and ensure the reliability of sector-specific observations.

Market segmentation analyses utilized a combination of firmographic data, service utilization patterns, and geographic distribution metrics to map demand across service types, deployment models, organization sizes, industry verticals, applications, and technologies. Regional dynamics were assessed by integrating regulatory frameworks, enforcement activity, and economic indicators to understand localized growth drivers. Leading companies were evaluated based on service portfolios, technological investments, and strategic initiatives, with comparative benchmarking highlighting innovation differentiators. This multifaceted methodology ensures comprehensive coverage and supports evidence-based recommendations for stakeholders across the forensic auditing ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Forensic Auditing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Forensic Auditing Market, by Service Type

- Forensic Auditing Market, by Organization Size

- Forensic Auditing Market, by Industry Vertical

- Forensic Auditing Market, by Technology

- Forensic Auditing Market, by Deployment Model

- Forensic Auditing Market, by Application

- Forensic Auditing Market, by Region

- Forensic Auditing Market, by Group

- Forensic Auditing Market, by Country

- United States Forensic Auditing Market

- China Forensic Auditing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3021 ]

Concluding Reflections on the Evolution of Forensic Auditing and Its Strategic Role in Safeguarding Organizational Integrity and Reputation

Forensic auditing in 2025 stands at a critical juncture, shaped by technological breakthroughs, regulatory evolution, and global trade complexities. Organizations that embrace advanced analytics, AI-driven investigations, and integrated compliance frameworks will gain a decisive advantage in detecting and preventing financial misconduct. Regional variations underscore the need for adaptive strategies that align global best practices with local requirements, while segmentation insights emphasize the importance of tailored service delivery across industries and organizational sizes.

As the forensic auditing function evolves from reactive investigations to proactive risk mitigation, it becomes an indispensable component of enterprise governance and strategic planning. By applying the actionable recommendations outlined herein, industry leaders can build robust forensic capabilities that not only address current threats but also anticipate future challenges. Ultimately, the value of forensic auditing lies in its power to reinforce trust, protect reputation, and safeguard financial integrity in an increasingly complex and interconnected world.

Secure tailored forensic auditing intelligence and strategic support by engaging Ketan Rohom to access a comprehensive market research report

If you are seeking an unparalleled depth of analysis and strategic foresight in forensic auditing, I invite you to partner with Ketan Rohom, Associate Director of Sales & Marketing. By contacting Ketan, you will gain direct access to tailored support, flexible licensing options, and insights into how our comprehensive market research report can inform your decision-making and enhance your competitive positioning. Don’t miss the opportunity to leverage this in-depth resource to navigate complex risk landscapes with confidence; reach out today to secure your copy and unlock the next level of forensic auditing intelligence.

- How big is the Forensic Auditing Market?

- What is the Forensic Auditing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?