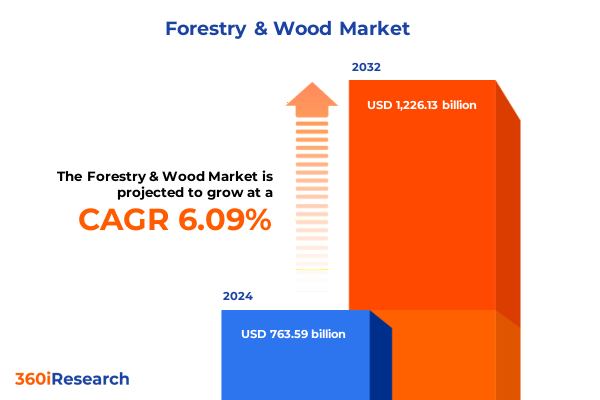

The Forestry & Wood Market size was estimated at USD 807.27 billion in 2025 and expected to reach USD 854.34 billion in 2026, at a CAGR of 6.15% to reach USD 1,226.13 billion by 2032.

Unveiling the Dynamics of the Global Forestry & Wood Sector Amidst Sustainability, Technological Innovation, and Market Evolution

The global forestry and wood sector stands at a pivotal crossroads where environmental stewardship and resource optimization intersect with commercial imperatives. Once primarily driven by conventional logging and pulp-and-paper production, the industry has evolved into a multifaceted bioeconomy underpinned by renewable energy mandates, circular material flows, and forest certification schemes aimed at mitigating deforestation risks. Companies are increasingly aligning with stringent sustainability standards to demonstrate responsible resource management, supporting both biodiversity conservation and carbon sequestration objectives while maintaining economic viability. This transition reflects a broader societal imperative to reconcile ecological priorities with continuous supply of wood raw materials for diverse downstream applications

In parallel, policy and regulatory shifts across major markets are reshaping operational frameworks. In the United States, administrative directives have relaxed certain forest land use restrictions to balance wildfire mitigation and logging demands. At the same time, the European Union’s forthcoming Deforestation Regulation is set to enforce stricter due diligence on imported timber, compelling exporters to certify traceability and legal compliance. These developments have elevated the importance of transparent supply chains, compelling stakeholders to adopt advanced monitoring techniques and harmonize with international regulatory benchmarks

Technological innovations have become central to competitive differentiation. Precision forestry utilizes satellite imagery and sensor-equipped drones for real-time forest health assessments, enabling early detection of pest outbreaks and optimizing harvest schedules. On-site automation and AI-driven sawmilling have reduced waste while improving yield, reinforcing the economic case for digital integration. Meanwhile, blockchain-based platforms are emerging to validate wood provenance and streamline transactions, bolstering trust among end users and regulators alike

Moreover, product diversity is expanding rapidly. Engineered wood solutions such as cross-laminated timber and mass timber panels are gaining traction in commercial construction due to their high strength-to-weight ratios and carbon storage advantages. Renewable energy applications, notably wood pellets and other biomass-based fuels, are receiving policy support as alternatives to fossil fuels, further diversifying revenue streams. These converging trends underscore a sector in transformation, where multi-disciplinary approaches are essential to navigate evolving market imperatives.

Strategic Market Disruptions Redefining Forestry and Wood Value Chains Through Policy, Innovation, and Sustainability Initiatives Driving Competitive Advantage

The forestry and wood industry is undergoing fundamental realignment driven by intersecting policy reforms, trade disruptions, and evolving consumer expectations. Notably, sweeping regulatory measures-such as the U.S. Section 232 national security investigation into strategic forest products and the European Union’s anti-deforestation mandate-are redefining import-export paradigms and compliance imperatives. These policy inflections demand agile risk management and strategic advocacy to safeguard uninterrupted material flows while ensuring regulatory conformity and market access

Simultaneously, trade tensions have introduced new volatility to supply chains. The U.S. imposition of countervailing and anti-dumping duties on Canadian softwood lumber, coupled with retaliatory measures from key trading partners, has eroded traditional North American trading patterns. This shifting tariff landscape is prompting companies to diversify sourcing strategies, explore alternative feedstock origins, and renegotiate long-term supply contracts to mitigate exposure to escalatory duties

In response to these disruptions, industry participants are accelerating investments in digital and operational resilience. Integrated supply chain platforms now leverage blockchain for immutable tracking, while machine learning algorithms optimize inventory management and logistics routing under fluctuating tariff scenarios. Concurrently, a growing emphasis on circularity is manifested through investments in wood waste valorization-transforming sawmill residues and process byproducts into pellets, biochar, and advanced biochemicals that feed back into industrial value chains. Such holistic approaches are redefining competitive positioning and resilience in an era of unprecedented market complexity.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Wood Products Shaping Supply Chains, Pricing Structures, and Trade Relations

Since early 2025, the United States has introduced a layered portfolio of tariffs on forest products, fundamentally reshaping North American supply dynamics. The Trump administration’s announcement on February 4 imposed a 25% duty on imports from Canada and Mexico and established a 10% levy on Chinese wood products, triggering immediate recalibration across lumber and pulp supply chains. These duties, in turn, prompted Canada to propose export quotas on softwood lumber and Mexico to momentarily suspend reciprocal tariffs, illustrating the geopolitical consequences of abrupt trade realignments

Further intensifying market friction, the U.S. Department of Commerce’s sixth administrative review of Canadian softwood lumber imports elevated countervailing and anti-dumping rates to approximately 34.45%, representing one of the steepest tariff surges in decades. Industry observers warn that such aggressive duty hikes will elevate input costs for U.S. manufacturers and incentivize domestic producers to accelerate capacity expansions amid reduced import competition

Cross-border pulp and paper sectors have not been immune. Companies with significant export exposure to the Chinese market report order postponements and pricing hesitancy due to tariff unpredictability, while European cartonboard exporters face potential retaliatory duties that could disrupt established trade routes. This cumulative tariff onslaught has ignited concerns over supply volatility, necessitating real-time scenario planning and deeper collaboration between trade associations and policymakers to engineer sustainable resolution pathways

Unearthing Profound Segmentation Insights Across Product Types, Species, Applications, End Users, and Distribution Channels Revealing Market Dynamics

Deep analysis of market segmentation reveals that product diversification underpins strategic positioning across the forestry and wood landscape. On one hand, engineered wood categories-spanning medium density fiberboard, oriented strand board, and plywood-have become flagship growth drivers, buoyed by green building codes and mass timber adoption. Meanwhile, traditional lumber segments remain anchored by hardwood and softwood varieties, each presenting distinct market dynamics linked to species-specific attributes such as fiber strength, aesthetic appeal, and supply cycle considerations.

Species-based segmentation underscores the dichotomy between birch, maple, and oak hardwoods and the softwood cohort of cedar, Douglas fir, larch, and spruce pine fir. Hardwood species command premium pricing for high-end furniture and decorative applications, whereas softwoods maintain a stable foothold in construction and packaging due to abundant availability and favorable mechanical properties. Application segmentation paints a broad canvas, from automotive components and bespoke furniture interiors to industrial packaging and residential flooring, highlighting the sector’s pervasive integration across value chains.

End-user segmentation further refines market focus, distinguishing commercial, industrial, and residential demand drivers. Commercial construction projects increasingly leverage engineered wood for large-format elements, while industrial end users prioritize pulp and pellet outputs for process heat and power generation. Residential applications remain a cornerstone, propelled by consumer trends favoring sustainable materials in flooring, cabinetry, and outdoor structures.

Distribution channel analysis reveals a bifurcation between offline direct sales or distributor networks and burgeoning online platforms hosted on company websites and broader e-commerce marketplaces. This dual-channel architecture enables manufacturers to balance personalized service relationships against the scalability and data-driven efficiencies afforded by digital commerce, ensuring comprehensive market coverage and tailored customer engagement.

This comprehensive research report categorizes the Forestry & Wood market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Species

- Application

- End User

- Distribution Channel

Profiling Key Regional Market Characteristics and Growth Drivers Across the Americas, EMEA, and Asia-Pacific with Strategic Implications

North American markets-anchored by the United States and Canada-continue to lead in engineered wood adoption and pellet export capacity, even as recent tariff escalations prompt domestic producers to reevaluate cross-border sourcing and logistics partners. The region’s abundant timber resources, coupled with strong policy backing for renewable energy, sustain demand for wood pellets in both utility and residential heating segments, yet supply chain realignment is now imperative to mitigate duty-driven cost inflation

Within Europe, the Middle East, and Africa, stringent sustainability mandates and the impending EU Deforestation Regulation have heightened scrutiny on legality and traceability, driving investments in forest certification and digital tracking systems. Packaged wood products and cartonboard remain significant export streams to North America and Asia, but the prospect of retaliatory tariffs and shifting consumer preferences toward low-carbon alternatives signal a strategic pivot toward domestic processing and circular material loops

Asia-Pacific’s rapid urbanization and infrastructure expansion underpin robust demand for traditional lumber and engineered wood solutions, particularly in China, Japan, and Southeast Asia. Meanwhile, emerging biomass markets in Australia and New Zealand are harnessing advanced harvesting methods and plantation forestry to bolster pellet feedstock supplies. However, regulatory uncertainty around export levies and trade tensions with major importers introduce supply-side complexity that necessitates agile market entry and stakeholder collaboration across the region

This comprehensive research report examines key regions that drive the evolution of the Forestry & Wood market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Companies’ Strategic Maneuvers and Innovations Defining the Competitive Landscape in the Wood and Forestry Industry

Leading corporations within the forestry and wood sector are executing a spectrum of strategic maneuvers to capture emerging opportunities and inoculate against market headwinds. Major pulp and paper players are deepening vertical integration, securing raw material through long-term timber concessions and partnering with technology firms to co-develop bio-based chemicals and high-performance composite materials. Concurrently, engineered wood specialists are scaling mass timber production, collaborating with construction stakeholders to standardize panelized building systems that unlock faster assembly and improved environmental performance.

Traditional lumber conglomerates are pursuing acquisition-driven growth to consolidate capacity and optimize logistics networks, while forward-looking investment in digital supply chain solutions enhances real-time visibility and demand forecasting. In the pellet segment, leading producers are leveraging geographic diversification strategies-establishing production hubs in proximity to both feedstock sources and key export terminals-to reduce unit costs and strengthen market resilience. Meanwhile, several companies have publicly stated commitments to net-zero targets, investing in afforestation projects and carbon offset initiatives to balance emissions across their value chains.

Notably, cross-sector partnerships are proliferating, exemplified by collaborations between forestry asset managers and renewable energy firms to jointly fund co-generation facilities. Innovation-centric alliances with research institutions have also accelerated breakthroughs in lignocellulosic biomass valorization, broadening the scope of wood-derived bioproducts. Collectively, these corporate strategies reflect a decisive shift toward integrated, sustainable business models underpinned by advanced analytics and ecosystem-wide collaboration

This comprehensive research report delivers an in-depth overview of the principal market players in the Forestry & Wood market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Binderholz GmbH

- Canfor Corporation

- FRITZ EGGER GmbH & Co. OG

- Georgia-Pacific LLC by Koch Industries, Inc.

- Hampton Lumber

- Holmen AB

- Hood Industries, Inc.

- Interfor Corporation

- Klabin S.A.

- Louisiana-Pacific Corporation

- Metrie Inc.

- Moelven Industrier ASA

- NewTechWood America, Inc.

- Oji Holdings Corporation

- Pfeifer Holding GmbH

- Resolute Forest Products by Paper Excellence

- Roseburg Forest Products Co.

- Sappi Limited

- Sierra Pacific Industries

- Stella-Jones

- Stora Enso Oyj

- Sumitomo Forestry Co., Ltd.

- Svenska Cellulosa Aktiebolaget SCA

- Tolko Industries Ltd.

- UFP Industries, Inc.

- UPM-Kymmene Corporation

- West Fraser Timber Co. Ltd.

- Western Forest Products

- Weyerhaeuser Company

- Woodgrain

Empowering Industry Leaders with Actionable Strategic Recommendations to Navigate Market Complexities and Accelerate Sustainable Growth Trajectories

Industry leaders should prioritize the deployment of digital platforms that integrate satellite monitoring, AI-driven yield optimization, and blockchain-based traceability to fortify supply chain transparency and accelerate decision-making. Establishing cross-functional innovation hubs-bringing together R&D specialists, sustainability experts, and commercial strategists-can streamline the translation of technological breakthroughs into scalable product offerings while ensuring alignment with regulatory requirements and market demand.

To mitigate geopolitical risks, companies must cultivate diversified supplier portfolios, pairing domestic timber sources with reliable international partners and incorporating scenario planning to anticipate potential tariff escalations. Engaging proactively with policymakers and industry associations can also help shape balanced trade frameworks, fostering an environment conducive to stable, long-term investment in forestry infrastructure.

A renewed emphasis on circularity will unlock additional value from process residues, incentivizing the development of pellet production lines, biochar facilities, and lignin refinement units. Embedding sustainability metrics into executive performance incentives and aligning with recognized forest stewardship certifications will empower organizations to demonstrate accountability and secure preferential access to environmentally conscious end users. By intertwining strategic foresight with operational agility, industry participants can navigate evolving market complexities and capture new growth avenues

Illuminating the Research Methodology Employed to Derive In-Depth Market Insights Through Rigorous Qualitative and Quantitative Analyses

This research synthesized insights from rigorous primary interviews conducted with C-level executives, supply chain managers, and technical directors across leading forestry and wood enterprises. These qualitative dialogues were complemented by structured surveys of distributors, end users, and policy advisors to gauge evolving preferences and regulatory compliance approaches. Secondary data sources included trade association publications, government databases, and authenticated reports on forest certification metrics to triangulate market intelligence and validate emergent trends.

Quantitative analyses leveraged time-series data on production volumes, trade flows, and tariff rates, employing scenario modeling to assess the impact of policy shifts and supply chain disruptions. Advanced clustering techniques were applied to segmentation variables-encompassing product type, species composition, application end use, and distribution channel-to distill actionable submarket profiles. Geospatial analytics informed regional benchmarking, mapping resource availability against infrastructure capacities and export gateways.

Finally, findings were peer-reviewed by an independent panel of industry experts, including forestry economists and sustainability auditors, ensuring methodological robustness and minimizing bias. This multi-tiered approach underpins the report’s credibility, equipping stakeholders with reliable, evidence-based insights to support strategic planning and investment prioritization

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Forestry & Wood market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Forestry & Wood Market, by Product Type

- Forestry & Wood Market, by Species

- Forestry & Wood Market, by Application

- Forestry & Wood Market, by End User

- Forestry & Wood Market, by Distribution Channel

- Forestry & Wood Market, by Region

- Forestry & Wood Market, by Group

- Forestry & Wood Market, by Country

- United States Forestry & Wood Market

- China Forestry & Wood Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Reflections on the Evolving Forestry and Wood Market Landscape Highlighting Strategic Imperatives for Future Resilience

In recapitulation, the forestry and wood sector is navigating an era marked by converging policy imperatives, market disruptions, and innovation trajectories that will define its future contours. Tariff-induced supply realignments, notably within North America, have underscored the necessity for diversified sourcing strategies and proactive stakeholder engagement to maintain operational resilience. Meanwhile, stringent sustainability regulations and burgeoning consumer demand for low-carbon materials are catalyzing shifts toward certified supply chains and next-generation bioproduct portfolios.

Technological advancements-in digital monitoring, engineered wood fabrication, and biomass valorization-have emerged as critical enablers of efficiency gains and new revenue streams. Companies equipped to integrate these capabilities holistically will be well-positioned to capture value across traditional and emerging market segments. Strategic alliances and vertical integration models are further reshaping competitive dynamics, revealing the imperative for agile, data-driven decision frameworks.

Looking ahead, aligning innovation investments with evolving regulatory landscapes and end-user expectations will be paramount. Firms that proactively invest in circular economy solutions, foster inclusive stakeholder collaborations, and leverage advanced analytics can anticipate and harness forthcoming market opportunities. By grounding future strategies in the insights presented herein, decision-makers can steer their businesses toward sustained growth and environmental stewardship in an increasingly complex global environment

Drive Your Competitive Edge Today by Securing Comprehensive Forestry and Wood Market Intelligence Directly from Our Associate Director of Sales & Marketing

For organizations seeking to solidify their market position and harness comprehensive insights into the intricate dynamics of the forestry and wood sector, engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, ensures access to the full breadth of our in-depth research findings and strategic analyses. This report encapsulates critical intelligence on evolving regulatory landscapes, transformative technological advancements, segmentation nuances, and actionable strategic recommendations tailored for leaders aiming to thrive amid market complexities. By partnering with Ketan Rohom, decision-makers can customize deliverables to address specific organizational priorities, validate investment theses, and benchmark performance against regional and global best practices. Secure your access to this authoritative resource today to drive informed decisions, unlock latent growth opportunities, and foster resilient, sustainable business models that will define the future of forestry and wood industries.

- How big is the Forestry & Wood Market?

- What is the Forestry & Wood Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?