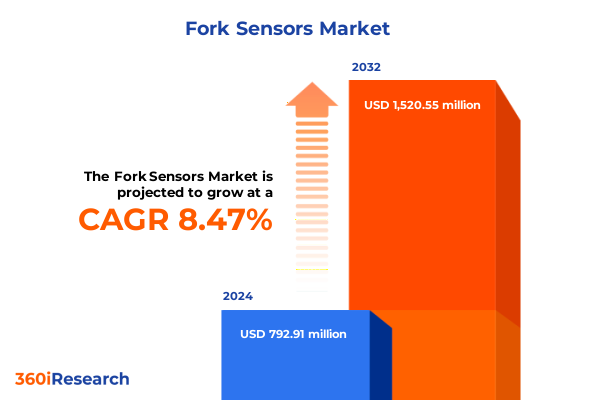

The Fork Sensors Market size was estimated at USD 856.35 million in 2025 and expected to reach USD 926.22 million in 2026, at a CAGR of 8.54% to reach USD 1,520.55 million by 2032.

Unveiling the Critical Role of Fork Sensors in Enhancing Industrial Efficiency through an Executive Market Overview

Fork sensors have become indispensable components in modern industrial environments, playing a pivotal role in enhancing safety and operational efficiency. These precision devices detect the presence, position, and motion of forklift forks, enabling seamless integration with automated material handling systems. Over the past decade, growing emphasis on worker safety, stringent regulatory requirements, and the drive toward Industry 4.0 have elevated the importance of these sensors, prompting technological innovations and widespread adoption across diverse sectors.

The advent of the Internet of Things (IoT) and artificial intelligence has accelerated the evolution of fork sensor capabilities, moving beyond simple detection to real-time diagnostics and predictive maintenance. As organizations strive to minimize downtime and optimize asset utilization, these sensors are increasingly interfaced with cloud platforms and advanced analytics tools. Consequently, stakeholders must navigate a complex ecosystem characterized by rapid technological change, regulatory shifts, and evolving end-user requirements.

This executive summary provides a comprehensive overview of the fork sensor market landscape. It highlights key trends, examines the implications of recent United States tariff measures, offers segmentation and regional insights, and profiles leading players driving innovation. The aim is to equip decision-makers with actionable intelligence to inform strategic planning and investment in next-generation sensor solutions.

Navigating the Technological Revolution Shaping Fork Sensor Development from Connectivity Advancements to Intelligent Automation

The fork sensor industry is undergoing a profound transformation fueled by several converging forces. First, connectivity advancements such as Bluetooth Low Energy and Zigbee have enabled wireless implementations that simplify installation and reduce maintenance costs. Manufacturers are increasingly leveraging Wi-Fi and Bluetooth to facilitate seamless data transfer to enterprise systems, setting the stage for more agile and scalable sensor networks.

Simultaneously, miniaturization and integration of MEMS-based sensing elements have unlocked new opportunities for embedding sensors directly into forklift carriages without compromising structural integrity. In parallel, optical and ultrasonic technologies have matured, offering enhanced accuracy in challenging operational environments. Together, these technological shifts are redefining the performance benchmarks for fork sensors, aligning them more closely with the demands of automated guided vehicles and collaborative robotics.

Looking ahead, the convergence of edge computing and machine learning will drive further innovation. By processing data locally, sensors will deliver real-time anomaly detection and prescriptive maintenance recommendations. Moreover, sustainability considerations are prompting research into low-power sensor designs and eco-friendly materials. As a result, stakeholders must remain vigilant, adopting modular architectures that can accommodate rapid technological upgrades and evolving application requirements.

Analyzing the Far-Reaching Effects of 2025 US Tariff Adjustments on Supply Chains Pricing and Operational Strategies in Fork Sensor Markets

In early 2025, the United States enacted a new round of tariffs targeting electronic components and certain sensor assemblies imported from key manufacturing hubs. These measures were intended to bolster domestic production, yet they have generated complex ripple effects across the fork sensor value chain. Suppliers dependent on low-cost imports have encountered elevated input costs, compelling them to reassess sourcing strategies and negotiate new contractual terms with end users.

As price pressures mount, some manufacturers are exploring nearshoring options to mitigate tariff overheads and shorten lead times. Latin American facilities, alongside select Southeast Asian partners, have gained renewed attention as alternative production bases. While these moves offer potential cost relief, they also introduce operational challenges tied to workforce training, quality assurance, and logistics realignment.

Moreover, compliance burdens have increased for global enterprises operating across multiple jurisdictions. Companies must now navigate a patchwork of tariff classifications, potential exemptions, and certification requirements. In response, forward-thinking stakeholders are investing in automated trade-compliance platforms that integrate with sensor procurement workflows. By doing so, they can track cost variances in real time and make data-driven decisions to preserve margins and maintain competitive pricing.

Overall, the cumulative impact of these tariffs underscores the imperative for flexible supply chain models and proactive risk management. Organizations that anticipate policy shifts and diversify sourcing will be better positioned to thrive amid ongoing geopolitical uncertainties.

Deriving Deep Insights from Product to Distribution Channel Segmentation Driving Differentiation and Growth Trajectories in Fork Sensor Applications

Understanding the fork sensor market requires an in-depth look at how product types influence performance and application scope. Sensors based on wired configurations, such as those leveraging Ethernet and RS-232 interfaces, continue to be favored where legacy system compatibility and high data integrity are paramount. Within this wired segment, USB variants-particularly USB 3.0-are gaining traction for their superior bandwidth and ease of integration. Conversely, wireless options harnessing Bluetooth Low Energy, Wi-Fi, and Zigbee technologies offer easier deployment in dynamic warehouse layouts, with Bluetooth Classic often reserved for high-throughput scenarios.

End-user dynamics further shape market strategies. Large enterprises seek centralized monitoring platforms capable of managing sensor fleets across multiple distribution centers, whereas smaller organizations prefer modular solutions that align with limited IT resources. Among smaller enterprises, micro-operators prioritize simple plug-and-play functionality, while small businesses value sensors that offer a balance between cost-effectiveness and performance robustness.

Technological differentiation is another key insight. MEMS-based fork sensors employing capacitive measurement excel in compactness and low power draw, whereas piezoelectric variants deliver rapid response times under heavy load conditions. Optical solutions based on infrared imaging enable precise alignment detection, and laser Doppler techniques deliver unparalleled sensitivity. Ultrasonic approaches using Doppler Shift and Time of Flight methodologies are especially effective in dusty or low-visibility environments, ensuring uninterrupted operation.

Application-driven segmentation reveals distinct requirements across industries. In automotive manufacturing, sensors integrated within safety systems and powertrain assembly lines must meet stringent reliability standards. Consumer electronics deployments often emphasize sleek form factors for integration into smart home and wearable devices. Healthcare applications demand rigorous compliance for diagnostics and patient monitoring, while industrial use cases in manufacturing, warehousing, and material handling necessitate robust designs capable of withstanding harsh operating conditions. Distribution channels also play a vital role. Traditional offline channels remain essential for customers requiring hands-on evaluation, while online platforms-whether through manufacturer websites or third-party marketplaces-provide rapid access to a diverse sensor portfolio.

This comprehensive research report categorizes the Fork Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End User

- Technology

- Application

- Distribution Channel

Assessing Regional Dynamics across Americas EMEA and Asia-Pacific Revealing Unique Growth Drivers and Adoption Patterns for Fork Sensors

Regional dynamics in the Americas reveal a mature market led by the United States and Canada, where established infrastructure investments and advanced automation initiatives drive demand. Mexico’s growing manufacturing sector offers lower-cost production capabilities, attracting sensor manufacturers seeking to optimize supply chain economics. Latin American markets are gradually embracing material handling automation, with increased interest in retrofit sensor solutions that can extend the life of existing forklift fleets.

In Europe, Middle East, and Africa, demand is fragmented yet promising. Western European countries prioritize sustainability and energy efficiency, leading to adoption of low-power fork sensor designs. Central and Eastern European manufacturers are upgrading legacy factories, spurring interest in modular sensor systems. Gulf Cooperation Council nations are investing heavily in logistics hubs and smart port facilities, creating opportunities for advanced material handling sensors. Across Africa, the rollout of industrial parks and incentives for foreign investment are gradually catalyzing initial uptake of industrial sensor technologies.

Asia-Pacific stands out for its rapid growth trajectory. China remains a manufacturing powerhouse, driving both large-scale production and domestic consumption of fork sensors. Japan’s focus on precision engineering has resulted in highly specialized sensor offerings, particularly in automotive assembly plants. South Korea and Taiwan lead the way in semiconductor-enabled sensor development, while Southeast Asian nations such as Thailand and Vietnam are emerging as key production bases. India’s expanding e-commerce sector is also fueling demand for warehouse automation, with fork sensors playing a critical role in streamlining operations.

This comprehensive research report examines key regions that drive the evolution of the Fork Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Moves and Innovation Portfolios of Leading Fork Sensor Providers Shaping Competitive Landscapes and Partnerships

Leading industry players are strengthening their positions through strategic partnerships, advanced R&D, and targeted acquisitions. Companies with a historical emphasis on industrial automation have broadened their sensor portfolios to include both wired and wireless solutions, thereby addressing a wider array of customer requirements. Others have forged alliances with IoT platform providers to deliver end-to-end monitoring and predictive maintenance services, adding significant value beyond basic sensing capabilities.

Investment in proprietary technologies is another hallmark of top-tier organizations. Firms focusing on MEMS and piezoelectric sensor development are collaborating with material science specialists to create next-generation sensing elements capable of higher sensitivity and reduced power consumption. Meanwhile, providers of optical and ultrasonic sensors are integrating machine vision and AI algorithms to enhance detection accuracy, particularly in challenging environmental conditions.

Competitive differentiation also stems from robust aftermarket support and service offerings. Market leaders are deploying cloud-based analytics dashboards that offer intuitive visualization and actionable alerts. By offering seamless integration with existing enterprise resource planning systems, these vendors enable real-time performance tracking and rapid fault diagnosis. As a result, they have cemented their reputations as trusted partners committed to long-term client success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fork Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Balluff GmbH

- Banner Engineering Corporation

- Baumer Electric AG

- Binex Controls

- Datalogic S.p.A.

- Di-Soric GmbH & Co. KG

- Hans Turck GmbH & Co. KG

- IFM Electronic GmbH

- IMO Precision Controls Ltd

- Kistler Group

- Leuze Electronic B.V.

- Newly added:

- Omega Engineering, Inc.

- Omron Corporation

- Pepperl+Fuchs SE

- Photon Controls India Pvt. Ltd.

- Rockwell Automation, Inc.

- Rohm Co., Ltd.

- Sapcon Instruments Pvt Ltd

- Schneider Electric SE

- SensoPart Industriesensorik GmbH

- Sick AG

- Telco Sensors Inc.

- Venture Measurement Co. LLC

- Wenglor Sensoric GmbH

Empowering Industry Leaders with Actionable Strategies to Capitalize on Emerging Trends and Mitigate Disruptions in Fork Sensor Markets

To capitalize on emerging trends, industry leaders should prioritize the development of modular sensor platforms that can be tailored to diverse application scenarios. By building configurable hardware frameworks and open APIs, organizations can accelerate time-to-market and facilitate integration with a wide range of automation systems. This approach not only addresses the needs of large enterprises but also opens high-margin opportunities in the small and micro enterprise segments.

Supply chain resilience must be fortified through diversification and risk mitigation strategies. Companies are advised to invest in dual-sourcing agreements across multiple regions and to establish nearshore manufacturing capabilities where feasible. Furthermore, implementing advanced digital trade compliance tools will streamline tariff assessment and cost allocation, ensuring transparent pricing for end users and preserving profitability under shifting regulatory regimes.

A focus on data-driven services will unlock new revenue streams. Organizations should leverage edge computing and machine learning to offer predictive maintenance subscriptions, thereby reducing unplanned downtime for customers. Additionally, developing intuitive cloud-based dashboards that consolidate sensor data across the entire forklift fleet will enhance operational visibility and support proactive decision-making.

Finally, forging collaborative partnerships with logistics integrators, robotic system vendors, and enterprise software providers will extend market reach. By aligning sensor development roadmaps with broader automation ecosystem requirements, companies can deliver comprehensive solutions that address end-to-end material handling challenges.

Detailing the Robust Multi-Phase Research Methodology Ensuring Data Integrity Validity and Comprehensive Coverage of Fork Sensor Ecosystems

This research was structured around a multi-phase approach to ensure methodological rigor and comprehensive coverage of the fork sensor ecosystem. The initial phase involved extensive secondary research, encompassing peer-reviewed journals, technical white papers, patent databases, and publicly available regulatory filings. This groundwork provided foundational knowledge on sensor technologies and market developments.

Subsequently, primary research was conducted through in-depth interviews with key stakeholders, including manufacturing engineers, procurement directors, and automation integrators. These conversations yielded first-hand insights into adoption challenges, performance expectations, and future technology roadmaps. Expert opinions were triangulated with quantitative data to validate emerging trends and identify critical success factors.

Data triangulation and cross-validation were integral to our analytical framework. Information from industry conferences, standards bodies, and specialized databases was corroborated against interview findings, ensuring consistency and accuracy. A rigorous quality-assurance process was applied throughout, with multiple review cycles conducted by domain experts to refine segment definitions and regional classifications.

Finally, the research output was synthesized into actionable insights and strategic recommendations. All findings were subjected to an internal peer review process that emphasized transparency and traceability, ensuring that every conclusion is underpinned by verifiable evidence and can withstand scrutiny under dynamic market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fork Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fork Sensors Market, by Product Type

- Fork Sensors Market, by End User

- Fork Sensors Market, by Technology

- Fork Sensors Market, by Application

- Fork Sensors Market, by Distribution Channel

- Fork Sensors Market, by Region

- Fork Sensors Market, by Group

- Fork Sensors Market, by Country

- United States Fork Sensors Market

- China Fork Sensors Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Synthesizing Key Findings to Illuminate the Path Forward for Stakeholders Investing in Next-Generation Fork Sensor Technologies

In conclusion, the fork sensor market stands at a pivotal juncture, propelled by advancements in connectivity, miniaturization, and intelligent analytics. While the 2025 tariff landscape introduces new complexities, forward-thinking organizations are leveraging diversified sourcing and digital trade-compliance solutions to sustain growth. Segmentation insights reveal strategic pathways for catering to distinct end-user needs, with robust opportunities across wired and wireless implementations, advanced sensing technologies, and specialized application domains.

Regional analysis underscores the importance of localized strategies: mature markets in the Americas demand scalable enterprise-grade platforms, while EMEA regions embrace energy-efficient and sustainable designs, and Asia-Pacific presents rapid growth fueled by manufacturing expansion and e-commerce automation. Leading companies are differentiating through innovation partnerships, advanced aftersales services, and integrated data-driven offerings, thereby setting new performance benchmarks.

As the industry evolves, stakeholders must adopt modular, future-proof sensor architectures, invest in predictive service models, and establish resilient supply chains. By aligning technological roadmaps with emerging customer requirements, sensor manufacturers and solution providers can seize market share and drive long-term value. This executive summary serves as a strategic compass, guiding investment, development, and collaboration decisions in the dynamic fork sensor ecosystem.

Take Immediate Action to Secure In-Depth Fork Sensor Market Intelligence by Collaborating Directly with Associate Director Ketan Rohom

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, for a personalized discussion tailored to your organizational needs. By engaging directly with this experienced industry professional, you will gain unparalleled insights into the nuances of the fork sensor market and access exclusive intelligence that can inform strategic decisions. Reach out today to arrange a briefing, uncover bespoke analytical support, and secure access to the comprehensive market research report that will empower your next move in this rapidly evolving sector. Elevate your competitive edge by partnering with Ketan Rohom to transform market intelligence into actionable business value

- How big is the Fork Sensors Market?

- What is the Fork Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?