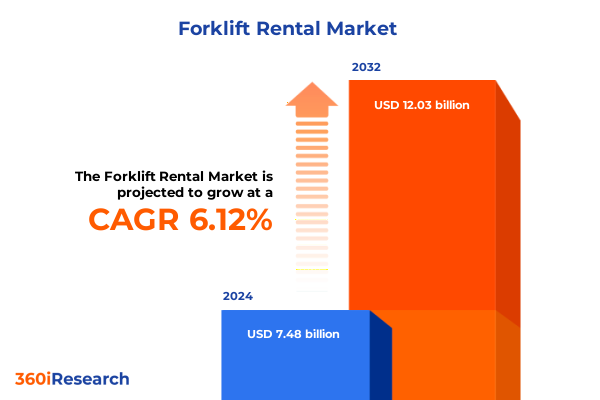

The Forklift Rental Market size was estimated at USD 7.90 billion in 2025 and expected to reach USD 8.35 billion in 2026, at a CAGR of 6.18% to reach USD 12.03 billion by 2032.

Unveiling the Strategic Importance of Forklift Rental Solutions Amidst Evolving Industrial and Logistics Demands Across Sectors and Applications

The forklift rental market has emerged as a pivotal component of modern industrial operations, driven by the need for scalable asset utilization and operational agility. As businesses navigate fluctuating demand across warehousing, manufacturing, and logistics, the ability to access high-performance lift trucks on flexible terms has become a strategic imperative. This reliance on rental services not only reduces capital expenditure but also affords organizations the opportunity to pilot advanced technologies and verify equipment suitability before committing to permanent acquisitions.

Shifting supply chain dynamics and e-commerce acceleration have further amplified the importance of rental solutions, enabling companies to rapidly adapt fleet size and powertrain composition in response to seasonal peaks and evolving regulatory standards. Meanwhile, rental providers have broadened their service portfolios, offering preventive maintenance, telematics integration, and end-to-end fleet management, transforming forklifts from mere lifting machines into data-driven assets that support predictive planning.

In this context, this executive summary outlines the critical market shifts, segmentation insights, regional nuances, and competitive strategies that are reshaping the forklift rental ecosystem. Through an exploration of tariff impacts, equipment and service innovations, and actionable recommendations, leaders will gain a holistic view of the forces driving ecosystem evolution and the pathways to sustained value creation.

Navigating the Convergence of Electrification Automation and Digitalization Transforming the Forklift Rental Landscape with Innovative Service Models

The forklift rental landscape is undergoing a profound transformation, catalyzed by the convergence of electrification, automation, and connectivity. Telematics platforms now deliver real-time performance data and utilization metrics, empowering fleet operators to fine-tune maintenance schedules and optimize asset deployment. At the same time, electrified lift trucks, in both lead-acid and lithium-ion configurations, are rapidly supplanting traditional diesel-powered units, driven by stringent emissions regulations and the pursuit of total cost of ownership reductions. Rental providers that integrate charging infrastructure and battery management solutions into their service models are enabling customers to transition seamlessly toward cleaner powertrains without incurring capital risk.

Automation is another frontier reshaping service offerings. Autonomous guided vehicles and semi-automated attachments are being bundled within rental fleets to accelerate order fulfillment in high-throughput environments. Trial programs, supported by short-term rental agreements, allow organizations to validate technology integration in live environments and scale incrementally. In parallel, digital marketplaces and on-demand rental platforms are emerging, reducing lead times and streamlining booking processes through self-service portals.

Collectively, these advances are redefining the value proposition for rental services, from simple equipment provision to comprehensive solution delivery. Stakeholders who embrace these trends will secure greater operational resilience and unlock new avenues for productivity enhancement.

Assessing the Cascading Effects of 2025 US Tariffs on Forklift Component Costs Supply Chains and Rental Service Offerings in North America

In 2025, the introduction of escalated United States tariffs on imported forklift components and subassemblies has reverberated across the rental market, placing upward pressure on procurement costs and complicating supply chain continuity. As rental companies contend with higher prices for electric batteries, specialized hydraulics, and telematics hardware sourced from overseas, many have faced compressed margins and the need to rework pricing frameworks. This environment has underscored the strategic importance of diversifying supplier bases and exploring domestic manufacturing partnerships to insulate fleets from further duty adjustments.

Tariffs have also influenced powertrain mix decisions. Some providers have opted to increase allocations of locally produced internal combustion engine models, particularly gasoline and LPG units, to mitigate exposure to imported battery systems. Conversely, others have accelerated investments in lithium-ion technology manufactured within free-trade zones or covered by preferential trade agreements. These choices have had both cost and operational implications, affecting rental rates, equipment availability, and total cost of ownership analyses for end users.

Moreover, the ripple effects of tariff-driven cost increases have prompted customers to extend rental durations or shift toward medium-term contracts, seeking stable pricing in an otherwise volatile procurement landscape. As rental providers navigate this period of regulatory uncertainty, building transparency around cost drivers and offering flexible contract structures will be vital to preserving customer trust and competitive positioning.

In-Depth Exploration of Equipment Type Load Capacity Industry Application and Rental Duration Segmentation Driving Customized Forklift Rental Strategies

Understanding the nuances of equipment type segmentation is essential for delivering targeted rental solutions. Electric forklifts, available in lead-acid and lithium-ion configurations, cater to customers prioritizing zero emissions and low operational noise, while internal combustion engine models, spanning diesel, gasoline, and LPG engines, address high-capacity outdoor and mixed-use applications. Rental portfolios that balance these powertrain options can meet diverse operational requirements, from cleanroom logistics to heavy yard work.

Equally important is the load capacity segmentation, which ranges from under two tons up to above ten tons. Smaller units under two tons excel in cold storage and compact warehouse aisles, while two-to-five-ton models, further divided into 2–3.5 and 3.5–5 ton classes, are the workhorse of general freight handling. Mid-range 5–10 ton units support heavier palletized goods, and above-ten-ton forklifts enable specialized material movements in metal manufacturing and construction sites.

Beyond equipment characteristics, end-use industries drive specific service requirements. Construction firms demand robust outdoor machines capable of navigating uneven terrain, whereas food and beverage companies seek sanitized electric trucks for temperature-controlled environments. Logistics and warehousing operations, whether managed in-house or through third-party logistics providers, rely heavily on mixed fleets supported by short-term, daily and weekly rental models, while automotive and electronics manufacturers often opt for monthly or yearly leases to ensure fleet consistency. Tailoring rental durations across long-term, medium-term, and short-term contracts allows providers to align with customers’ project cycles and cash-flow profiles.

Finally, application segmentation-indoor, mixed, and outdoor-further refines service design. Cleanroom and cold storage environments impose stringent performance and maintenance standards, whereas yard and construction applications demand rugged attachments and higher engine outputs. Recognizing these intersecting segments enables rental companies to curate fleets that deliver optimal uptime, compliance, and cost efficiency.

This comprehensive research report categorizes the Forklift Rental market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Load Capacity

- Rental Duration

- Application

- End Use Industry

Comprehensive Examination of Regional Dynamics Shaping Forklift Rental Demand in the Americas EMEA and Asia-Pacific Amid Global Market Shifts

Regional dynamics play a pivotal role in shaping rental demand and service design. In the Americas, extensive warehouse networks in North America and rapid e-commerce expansion in Latin America have driven increased fleet flexibility requirements. Rental providers in this region have responded by offering modular maintenance programs and fast-track service agreements to support high utilization rates across diverse geographic markets. Additionally, stringent emissions regulations in California and select Canadian provinces have accelerated the adoption of zero-emission electric models.

The Europe, Middle East & Africa region exhibits a complex regulatory mosaic that influences fleet composition and equipment standards. In Western Europe, carbon reduction targets and urban low-emission zones have incentivized the migration to electric and hydrogen-fuel cell forklifts, supported by government subsidy programs. In the Middle East, infrastructure investments and large-scale logistics hubs demand high-capacity internal combustion machines, often on medium-term leases. Africa’s growing retail and manufacturing sectors rely on cost-effective, short-term rentals, reflecting fluctuating demand patterns and limited capital expenditure capacity.

Asia-Pacific’s dynamic industrial landscape, spanning China’s manufacturing belt to Southeast Asia’s distribution centers, has seen robust uptake of rental services powered by digital booking platforms and integrated telematics. Localized battery production in China is lowering the barrier to electric fleet penetration, while infrastructure projects in Australia and India are sustaining demand for diesel-powered heavy-duty forklifts. Across the region, providers that tailor service bundles to address regional energy landscapes and regulatory frameworks achieve competitive advantage by aligning offerings with local market intricacies.

This comprehensive research report examines key regions that drive the evolution of the Forklift Rental market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Market Strategies and Competitive Advantages of Leading Forklift Rental Service Providers Shaping the Industry’s Future Landscape

Leading rental service providers have adopted distinct strategic approaches to secure market share and customer loyalty. Some organizations have innovated through vertically integrated service platforms, combining fleet provisioning with predictive maintenance and data analytics, thereby enhancing fleet availability and reducing downtime. Others have pursued strategic partnerships with OEMs to co-develop electric powertrains and charging infrastructure, positioning themselves at the forefront of the zero-emission transition.

Competitive advantages have also emerged from differentiated financing structures. By offering hybrid ownership models that blend rental and lease-to-own options, rental companies can attract clients seeking gradual asset acquisition with the benefits of rental flexibility. Moreover, investments in digital customer experiences-such as on-demand ordering apps and virtual fleet tours-have enabled providers to engage a broader SME customer base accustomed to seamless e-commerce interactions.

In parallel, consolidation and geographic expansion remain central tactics. Key players have established regional service centers and mobile maintenance units to ensure consistent service levels across dispersed sites. Some have targeted emerging markets through joint ventures with local distributors, leveraging established networks to fast-track market entry and gain cultural insights. Through these varied strategies, industry leaders are shaping a rental ecosystem that emphasizes reliability, innovation, and customer centricity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Forklift Rental market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alta Equipment Group.

- Associated Equipment Rentals Private Limited

- Briggs Equipment

- Caterpillar Inc

- Combilift Depot

- Crown Equipment Corporation

- Eastern Lift Truck Co., Inc

- Gregory Poole Lift Systems

- H&E Equipment Services, Inc.

- Herc Rentals Inc.

- Hyster-Yale Group, Inc.

- Kanoo Machinery

- Knightsbridge Mechanical Handling

- Komatsu

- Linde Material Handling by KION GROUP AG

- MacAllister Machinery Co., Inc.

- Mitsubishi Corporation

- Ogden Forklifts Inc.

- Quinn Company

- Sunbelt Rentals, Inc.

- The Home Depot, Inc.

- The Papé Group, Inc.

- Thompson Tractor Co., Inc.

- Toyota Material Handling Australia Pty Limite

- United Rentals, Inc.

Proactive Strategic Pathways and Operational Tactics for Industry Leaders to Elevate Forklift Rental Services and Capitalize on Emerging Market Opportunities

Industry leaders should prioritize investments in telematics integration and data analytics to unlock predictive maintenance capabilities and maximize fleet uptime. By partnering with technology vendors or developing in-house analytics teams, organizations can transition from reactive repairs to condition-based servicing, reducing unplanned downtime and controlling maintenance costs.

To address shifting demand patterns and regulatory imperatives, rental providers must diversify their powertrain portfolios, ensuring a balanced mix of electric, lead-acid, and lithium-ion units alongside diesel, gasoline, and LPG models. Establishing relationships with domestic component manufacturers and exploring free-trade‐zone battery sourcing will mitigate tariff exposure. Concurrently, expanding flexible rental durations-from daily and weekly to monthly and yearly options-will accommodate both project-based clients and those requiring sustained fleet stability.

Strengthening digital engagement through customer portals that enable real-time booking, fleet tracking, and service history reviews will elevate the user experience and foster loyalty. Additionally, exploring value-added services such as operator training, equipment retrofits, and remote diagnostics will differentiate service offerings and drive incremental revenue. By adopting these proactive measures, industry leaders can position themselves for sustained growth and resiliency in an increasingly competitive and technology-driven market.

Rigorous Research Framework and Analytical Approaches Ensuring Robust Insights into the Multifaceted Forklift Rental Market Ecosystem

This research employed a comprehensive, multi-tiered methodology to capture the complexities of the forklift rental market. Primary research included structured interviews with fleet managers, rental executives, and end-user procurement specialists, complemented by on-site visits to distribution centers, manufacturing plants, and construction project sites. These insights provided qualitative context around operational challenges, procurement priorities, and technology adoption barriers.

Secondary research integrated industry publications, regulatory filings, and academic journals to track innovations in powertrain development, emissions standards, and digital service models. Company websites, press releases, and public financial records were analyzed to map competitive landscapes and strategic partnerships. Data triangulation was achieved by cross-referencing primary findings with secondary sources, ensuring the validity and reliability of conclusions.

The segmentation framework informed both primary and secondary investigations, guiding the interrogation of equipment types, load capacities, end-use industries, applications, and rental durations. Regional analyses were calibrated using macroeconomic indicators and logistics infrastructure data specific to the Americas, Europe, Middle East & Africa, and Asia-Pacific. Quality assurance measures included peer reviews and methodological audits to uphold research rigor and transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Forklift Rental market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Forklift Rental Market, by Equipment Type

- Forklift Rental Market, by Load Capacity

- Forklift Rental Market, by Rental Duration

- Forklift Rental Market, by Application

- Forklift Rental Market, by End Use Industry

- Forklift Rental Market, by Region

- Forklift Rental Market, by Group

- Forklift Rental Market, by Country

- United States Forklift Rental Market

- China Forklift Rental Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesis of Critical Insights Underscoring the Transformational Trajectory of the Forklift Rental Sector and its Strategic Implications

The forklift rental sector is experiencing a transformative trajectory characterized by accelerated technology adoption, shifting regulatory landscapes, and evolving customer expectations. Electric powertrains and digital service platforms have moved from niche offerings to core elements of rental portfolios, enabling providers to deliver superior uptime and lower total cost of operation. At the same time, tariff dynamics and regional exigencies underscore the importance of supply chain agility and cost management.

Segmentation insights reveal that a tailored approach-balancing electric and internal combustion options across capacity classes, application environments, and contract durations-remains central to capturing diverse market needs. Regional variations further necessitate localized strategies that align with regulatory incentives, infrastructure maturity, and end-user procurement behaviors. Competitive differentiation will hinge on integrated service offerings, data-driven maintenance, and flexible financing options.

Looking ahead, the interplay of sustainability mandates, digital innovation, and customer-centric service models will define the next wave of industry leaders. By embracing these imperatives, both providers and end users can unlock value through enhanced operational resilience, cost efficiency, and strategic alignment with broader enterprise objectives.

Engaging Direct Consultation Offer with Ketan Rohom to Drive Informed Procurement of Comprehensive Forklift Rental Market Intelligence

To gain a deeper understanding of the factors shaping forklift rental strategies or to explore a customized package tailored to specific operational requirements, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise in lease models, fleet management, and emerging technology adoption positions him to guide decision-makers through a comprehensive evaluation of service options, ensuring alignment with budgetary parameters and performance objectives.

By engaging with Ketan, organizations can unlock exclusive insights into market dynamics, negotiate flexible terms, and leverage strategic value-added services that enhance uptime and drive cost efficiencies. This direct consultation paves the way for a more informed procurement process, empowering stakeholders to confidently invest in rental solutions that deliver measurable returns and scalable capacity. Take the next step toward operational excellence and competitive advantage by connecting with Ketan Rohom to secure the full forklift rental market research report and unlock actionable intelligence.

- How big is the Forklift Rental Market?

- What is the Forklift Rental Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?