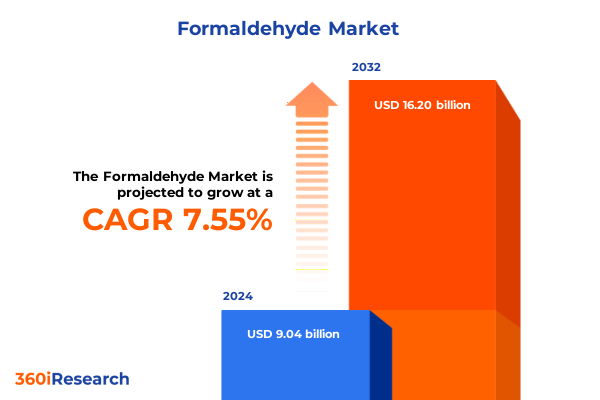

The Formaldehyde Market size was estimated at USD 9.74 billion in 2025 and expected to reach USD 10.49 billion in 2026, at a CAGR of 8.45% to reach USD 17.20 billion by 2032.

Unveiling the Dynamics Driving the Evolution of the Global Formaldehyde Market in Response to Emerging Regulatory Sustainability and Demand Trends

The formaldehyde market stands at a pivotal crossroads as regulatory pressures, sustainability mandates, and evolving application demands converge to redefine industry fundamentals. Over recent years, stricter environmental guidelines have compelled manufacturers to innovate unabated, driving a shift toward greener production methods and alternative feedstocks. Simultaneously, downstream industries have heightened their focus on product performance, safety, and lifecycle impacts. This confluence of factors underscores the imperative for stakeholders to understand the changing contours of supply and demand dynamics, as well as the technological breakthroughs that will shape future growth trajectories.

Against this backdrop, this executive summary distills critical insights into the current state of the formaldehyde landscape, revealing the underlying drivers of change and their strategic implications. By examining contemporary regulatory frameworks alongside macroeconomic trends and end use sector requirements, this analysis offers a clarity of vision vital for decision-makers. It frames the discussion around transformative shifts in market structure, policy-induced cost pressures, and segmentation nuances that inform competitive positioning. Ultimately, readers will emerge equipped with a nuanced appreciation of how the formaldehyde economy is evolving and what that means for investment, innovation, and operational excellence.

Examining the Pivotal Transformations Reshaping Formaldehyde Industry Structure from Supply Chain Innovations to End Use Sustainability Priorities

The formaldehyde industry is experiencing transformative shifts as sustainability imperatives and supply chain innovations disrupt legacy production models. Companies are increasingly investing in low-emission manufacturing processes, leveraging catalytic techniques and bio-based precursors to reduce environmental footprints. At the same time, digitalization of quality control and predictive maintenance systems has enhanced operational resilience, enabling producers to anticipate equipment downtime and optimize energy and resource utilization.

In parallel, end use sectors such as coatings and resins are exploring advanced formulations that deliver high performance while adhering to tighter formaldehyde emission standards. Disinfectant producers, spurred by heightened public health awareness, are refining concentration protocols to balance efficacy with safety compliance. Textile manufacturers are also integrating formaldehyde chemistry into performance fabrics with an emphasis on durability and wearability. Through these converging trends, the market is witnessing a redefinition of value creation, where environmental stewardship and product differentiation are becoming central to competitive advantage.

Analyzing the Far-Reaching Ramifications of 2025 United States Tariffs on Formaldehyde Trade Streams Supply Dynamics and Cost Structures

The United States’ imposition of new tariffs on imported formaldehyde and related intermediates in 2025 has substantially altered cost structures and trade flows within the global supply network. For domestic producers, the levies have offered temporary margin relief by curbing low-priced imports, yet they have also stimulated increased raw material costs for downstream segments reliant on intermediate inputs. As of mid-2025, this policy shift has intensified sourcing scrutiny, prompting many resin and chemical formulators to explore closer-to-base manufacturing partnerships to mitigate cross-border tariff exposure.

Meanwhile, importing economies outside the United States have recalibrated their export strategies, redirecting surplus shipments toward regions with more favorable trade terms. This adjustment has created pockets of oversupply in certain Asia-Pacific markets, exerting downward pricing pressure that downstream users are attempting to leverage. The net effect of these tariff measures is a more fragmented global supply landscape, wherein cost efficiencies are increasingly tied to geographic proximity and trade alliance membership. Stakeholders now face a critical juncture to assess whether adjusting supply routes or investing in localized production will deliver long-term stability amid an evolving policy environment.

Illuminating Critical Market Segment Characteristics Across Form Application Derivative Types and End Use Industries That Define Competitive Advantages

Detailed examination of market segmentation reveals the critical nuances that underpin strategic targeting and product development. When considering the form of formaldehyde, three distinct physical states define application potential and handling protocols. Gaseous variants are prized for in-line production of resins and insulation foams yet demand stringent containment procedures to ensure safety. Liquid formaldehyde, often stabilized as aqueous solutions, remains the most versatile, permeating coatings, disinfectants, and textile finishing processes. Solid forms, including polymeric paraformaldehyde, serve niche markets requiring controlled release of the active compound in adhesives and specialized surface treatments.

Exploring application vectors further refines competitive dynamics. Coatings formulators value consistent cross-linking performance, while disinfectant producers prioritize rapid microbial eradication balanced against human exposure constraints. In resins, the spectrum spans highly durable melamine formaldehyde adhesives favored in automotive components, versatile phenol formaldehyde binders used in building insulation, and cost-effective urea formaldehyde resins dominating furniture manufacture. Textiles incorporate formaldehyde chemistry to impart wrinkle resistance and anti-shrink properties, with demand closely tied to apparel and home furnishing trends.

Derivative types represent another layer of strategic differentiation. Melamine derivatives offer premium hardness and water resistance in molded articles. Phenolic counterparts deliver thermal stability and flame retardancy essential in electrical component laminates. Urea variants, while less robust, are valued for cost efficiency in mass-production applications, leveraging abundant feedstock availability.

Finally, end use industries shape volume concentrations and growth trajectories. Within automotive manufacturing, formaldehyde-based resins underpin lightweight composite panels and interior trim components. The building and construction sector leans heavily on resin adhesives and insulation materials for energy efficiency mandates. In electrical and electronics, formaldehyde phenolic resins remain integral to circuit boards and insulating laminates, with demand patterns reflecting broader trends in consumer electronics and industrial equipment.

This comprehensive research report categorizes the Formaldehyde market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Derivative Type

- Application

- End Use Industry

Exploring Regional Dynamics and Growth Drivers Shaping Formaldehyde Consumption Patterns across Diverse Economic Landscapes in the Americas EMEA and Asia-Pacific

Regional dynamics in the formaldehyde landscape are molded by local regulatory regimes, infrastructure maturity, and industrial end-use concentrations. In the Americas, stringent air quality standards have elevated the adoption of low-emission formaldehyde production technology, while large automotive and construction sectors maintain steady consumption of resin intermediates. Investment in midstream capacity continues in the Gulf Coast region to service domestic and Latin American clients, fostering logistical hubs that integrate chemical manufacturing with downstream processing.

The Europe, Middle East & Africa landscape presents a complex tapestry of regulatory stringency and resource availability. Western European markets, driven by the European Green Deal initiatives, prioritize formaldehyde alternatives in consumer-grade products, challenging suppliers to innovate emission-reduction catalysts. In parallel, Middle Eastern economies leverage hydrocarbon feedstock streams to cost-effectively expand petrochemical clusters, supplying neighboring African markets where building activity and infrastructure development are on the rise.

Within Asia-Pacific, sprawling consumer markets and manufacturing megacenters have propelled formaldehyde demand across multiple segments. Rapid urbanization and industrialization fuel large-scale resin and adhesive consumption in China and India, while Southeast Asian economies are emerging as both production bases and consumption hotspots. Government incentives for domestic feedstock production are influencing capital expenditures, with integrated complexes being established to enhance supply security and cost competitiveness.

This comprehensive research report examines key regions that drive the evolution of the Formaldehyde market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Movements Undertaken by Leading Formaldehyde Manufacturers to Fortify Market Positioning and Innovation Pipelines

Leading formaldehyde manufacturers are deploying a blend of capacity expansion, green technology partnerships, and targeted M&A to solidify market positions. Major producers are actively retrofitting existing plants with advanced emission control modules and real-time monitoring systems to comply with evolving environmental legislation. Simultaneously, strategic alliances with catalyst developers and biotechnology firms are opening pathways for bio-formalins derived from renewable methanol feedstocks, setting new benchmarks in carbon footprint reduction.

In addition to sustainability pursuits, top-tier companies are diversifying their product portfolios by venturing into high-performance derivatives and specialty blends tailored to niche end uses. This includes the launch of formaldehyde-free resin systems and hybrid resin formulations designed for enhanced durability and moisture resistance. To maintain supply chain reliability, several industry leaders have secured feedstock supply through integrated operations or long-term off-take agreements, thereby insulating themselves from volatility in methanol and natural gas markets.

On the commercial front, enterprises are embracing digital sales platforms and technical service offerings to deepen customer engagement. Real-world application support, combined with data analytics on product performance, is strengthening relationships in key verticals such as automotive and electronics, where precision chemical engineering and rigorous quality standards are paramount. Through these multifaceted initiatives, leading companies are staking out competitive moats that extend beyond mere scale to encompass technological leadership and customer-centric innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Formaldehyde market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Alder S.p.A.

- Balaji Formalin Private Limited

- BASF SE

- Bayer AG

- Celanese Corporation

- Chemanol

- Dynea AS

- Georgia-Pacific Chemicals LLC

- Hexion Inc.

- Huntsman Corporation

- INEOS Group Limited

- Kanoria Chemicals & Industries Limited

- LyondellBasell Industries N.V.

- Metafrax Chemicals JSC

- Mitsubishi Gas Chemical Company, Inc.

- Perstorp Holding AB

- Rashtriya Chemicals and Fertilizers Limited

- Shandong Shuangqi Chemical Co., Ltd.

- Shandong Tralin Group Co., Ltd.

- Simalin Chemicals Industries Limited

- Xinjiang Markor Chemical Industry Co., Ltd.

Outlining Practical Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities Enhance Operational Resilience and Drive Sustainable Growth

To thrive amid regulatory tightening and supply chain complexity, industry leaders must pursue a dual agenda of operational excellence and strategic adaptability. Companies should prioritize the deployment of best-in-class emission reduction technologies and predictive maintenance protocols to bolster plant efficiency and environmental compliance. Complementary investments in digital twins and analytics frameworks can unlock performance gains by simulating process adjustments and preempting downtime.

On the strategic front, executives are advised to explore joint ventures with feedstock producers or catalyst innovators to secure early access to low-carbon formaldehyde alternatives. By co-developing bio-based or recycled feedstock streams, organizations can build differentiated product offerings that align with customer sustainability objectives and regional decarbonization goals.

Further, leadership teams must cultivate agility in sourcing by balancing long-term off-take contracts with spot market engagement, thereby preserving supply continuity without forfeiting cost advantages. Expanding technical service capabilities and digital customer portals will also be critical for reinforcing value propositions and fostering stickiness across key end use sectors such as automotive, construction, and electronics. Taken together, these actions will position industry players to capitalize on emerging growth pockets while mitigating exposure to policy shifts and raw material fluctuations.

Detailing Rigorous Research Methodology Employed to Ensure Comprehensive Data Collection Analysis and Validation within the Formaldehyde Market Study

The research methodology underpinning this analysis integrates primary data collection, in-depth expert interviews, and secondary source validation to ensure robustness and reliability. Primary research encompassed structured interviews with executives across the formaldehyde value chain, including production, distribution, and end use segments. These dialogues provided qualitative insights into capacity planning, regulatory compliance strategies, and technology adoption roadmaps.

Secondary research involved systematic review of industry regulations, patent filings, scientific publications, and corporate disclosures to triangulate findings. Market intelligence platforms and regional trade databases were consulted to map production capacities, trade flows, and feedstock availability. Data analytics tools were employed to cleanse and aggregate large datasets, enabling trend identification and gap analysis.

To enhance the credibility of projections, a cross-functional team of chemical engineers, market analysts, and environmental experts peer reviewed the methodology at key milestones. Rigorous cross-verification protocols were applied to reconcile divergent data points, ensuring that conclusions reflect the consensus of multiple reputable inputs. This multi-layered approach guarantees a comprehensive and validated comprehension of the evolving formaldehyde landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Formaldehyde market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Formaldehyde Market, by Form

- Formaldehyde Market, by Derivative Type

- Formaldehyde Market, by Application

- Formaldehyde Market, by End Use Industry

- Formaldehyde Market, by Region

- Formaldehyde Market, by Group

- Formaldehyde Market, by Country

- United States Formaldehyde Market

- China Formaldehyde Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Key Insights and Strategic Imperatives That Chart the Path Forward for Stakeholders Navigating the Evolving Formaldehyde Business Environment

This executive summary has charted the trajectory of a formaldehyde market in flux, underscored by environmental imperatives, tariff realignments, and nuanced segmentation drivers. From the accelerated adoption of green manufacturing technologies to the strategic reconfiguration of global supply chains, stakeholders are navigating unprecedented complexity. In dissecting the interplay between form factors, derivative types, and end use industries, we have illuminated the vectors shaping competitive advantage.

Regional variance further accentuates the need for localized strategies, as regulatory stringency and resource endowments diverge across the Americas, EMEA, and Asia-Pacific markets. Leading firms are responding with targeted investments in emission controls, bio-based alternatives, and digital customer engagement, crafting defensive and offensive plays to secure market share.

For decision-makers, the path forward demands a balanced focus on compliance, cost leadership, and innovation. By leveraging the segmentation and regional insights distilled herein, executives can align investment priorities with emerging growth pockets and policy trajectories. Equipped with an understanding of the cumulative impact of tariffs and the imperatives of sustainability, stakeholders will be poised to capitalize on the next wave of formaldehyde market evolution.

Engage with Ketan Rohom to Secure Comprehensive Formaldehyde Market Insights and Drive Informed Strategic Decisions with a Tailored Research Partnership

To secure unparalleled visibility into the forces driving formaldehyde market shifts and to equip your organization with the strategic intelligence needed for agile decision-making, contact Ketan Rohom to explore personalized research packages designed to address your specific business challenges. Leverage his expertise in synthesizing market data, forecasting industry inflection points, and identifying partnership opportunities that align with your corporate objectives. Engage today to discuss how his insights can enhance your commercialization plans, refine your product development roadmaps, and optimize your competitive positioning. By partnering directly with Ketan Rohom, you gain direct access to thought leadership, ongoing market tracking, and bespoke analysis tailored to your priorities. Reach out now and transform raw data into actionable intelligence that propels your organization toward sustained success in the dynamic formaldehyde landscape

- How big is the Formaldehyde Market?

- What is the Formaldehyde Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?