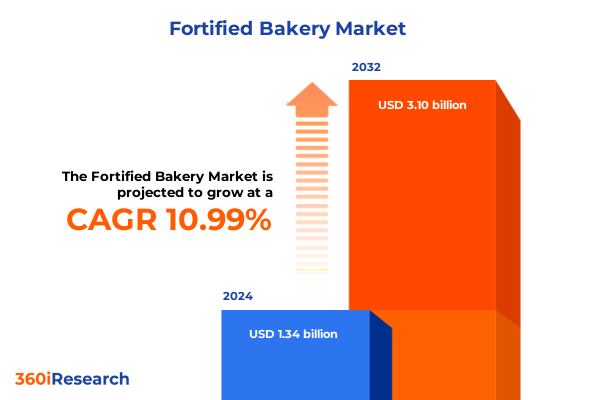

The Fortified Bakery Market size was estimated at USD 1.49 billion in 2025 and expected to reach USD 1.66 billion in 2026, at a CAGR of 11.02% to reach USD 3.10 billion by 2032.

Understanding the Rise of Fortified Bakery Products in a Health-Conscious Market Embracing Functional Nutrition and Strategic Innovation

The fortified bakery sector has swiftly ascended in prominence as consumers increasingly prioritize products that deliver both indulgence and added health benefits. This category encompasses breads, cakes, cookies, crackers, and snacks enhanced with nutrients such as calcium, fiber, iron, protein, and vitamin D. Far from simply adjusting recipes, manufacturers are integrating advanced fortification techniques-such as microencapsulation and nutrient-stable yeasts-to ensure that vitamins and minerals remain effective throughout the baking process without compromising taste or texture. This evolution reflects a broader functional food movement in which baked goods serve as vehicles for targeted nutrition, addressing everything from digestive wellness to immune support.

Key Technological and Consumer-Driven Shifts Transforming the Fortified Bakery Landscape Toward Personalization and Sustainability

Recent years have witnessed several transformative forces reshaping the fortified bakery landscape. Technological breakthroughs in ingredient science now allow for clean-label fortifications, including stable forms of vitamins D₂ and D₃, encapsulated minerals like calcium carbonate, and prebiotic fibers such as inulin. These innovations enable manufacturers to fortify products without altering sensory attributes, reinforcing the notion that health-driven formulations need not sacrifice flavor.

Simultaneously, shifting consumer preferences are driving the adoption of plant-based fortificants. Protein fortification-originally a staple of sports nutrition-has permeated mainstream bakery offerings, with plant proteins like pea and soy increasingly used to create breads, muffins, and cookies that cater to vegan, flexitarian, and clean-label trends. Moreover, the proliferation of GLP-1 weight-management therapies has underscored the importance of protein in preserving lean muscle mass, prompting many brands to spotlight their protein content through transparent labeling and innovative formats such as protein muffins and fortified snack bars.

In parallel, allergen-conscious formulations and gluten-free fortifications have expanded accessibility. Recognizing the nutritional gaps common to gluten-free diets, manufacturers are fortifying rice-, chickpea-, and lentil-based breads with calcium, iron, and fiber to ensure that consumers with celiac disease or gluten sensitivities can enjoy both safety and nutrition. This dual focus on personalization and inclusivity has propelled fortified bakery products into new market segments, setting the stage for continued innovation and growth.

Analyzing the Cumulative Effects of 2025 U.S. Tariffs on Input Costs Supply Chain Stability and Competitive Dynamics in Bakery Ingredients

The introduction of new and elevated U.S. tariffs in 2025 has had a marked cumulative effect on the fortified bakery supply chain. According to the American Bakers Association, levies ranging from 10% to 25% on imports from Canada, Mexico, and China are projected to add approximately $454 million in costs to the U.S. baking industry this year alone. These tariffs target essential ingredients-from wheat and flour blends to sweeteners and packaging-compelling manufacturers to reassess sourcing strategies and absorb higher procurement expenses.

The sugar and sweeteners segment exemplifies this pressure: a newly imposed 20% tariff on refined sugar has driven a notable 9.5% year-over-year drop in Mexican sugar exports to the U.S., while domestic refined sugar prices surged from $0.395 to $0.465 per pound in the first quarter of 2025. With tariffs on dairy-based ingredients, cocoa, and specialty inputs also in effect, fortified bakery producers are navigating fluctuating commodity costs by exploring alternative sweeteners-such as stevia and monk fruit-and prioritizing inulin-rich fiber fortificants that may hedge against price volatility.

Meanwhile, operational resilience has become paramount as stockpiling behaviors emerge among both consumers and manufacturers alike. Anecdotal reports suggest that U.S. consumers, anticipating further price hikes, are increasing bulk purchases of flour, flour-based goods, and hygiene essentials. To mitigate supply chain disruption, leading bakeries are diversifying supply networks by establishing relationships with domestic millers and leveraging tariff suspensions when available. In doing so, they seek to preserve margin integrity, sustain production volumes, and maintain reliable product availability for retailers and foodservice partners across the country.

Unveiling In-Depth Segmentation Insights to Guide Product Fortification Strategies Across Diverse Bakery Formats and Consumer Profiles

Fortified bakery markets are dissected through multiple lenses to reveal distinct growth opportunities and consumer motivations. By product type, bread occupies a central position, with subsegments including buns, rolls, and sliced loaves seamlessly accommodating fortifications like soy protein isolates, encapsulated iron, and vitamin D₃ for everyday nutrition. Cake offerings-ranging from cupcakes to layer and pound cakes-represent platforms for indulgent enrichment, often leveraging whey protein, plant-based omega-3s, and fiber blends to deliver an elevated nutritional profile without losing the celebratory essence of the format. Similarly, cookie formats extend beyond traditional biscuit varieties into chocolate chip and sandwich cookie applications, utilizing inulin and oat fiber for gut health and leveraging ferrous fumarate blends to support energy metabolism. Crackers-whether flavored, salted, or whole grain-are meeting demand for convenient on-the-go nutrition, enriched with calcium carbonate and tricalcium phosphate to bolster bone health. The snacks category, encompassing cereal bars, granola bars, and muffins, has seen a surge in high-protein and vitamin-fortified options, aligning with the need for portable wellness solutions.

Segmentation by fortificant type further stratifies the market: mineral fortification with calcium forms like carbonate and tricalcium phosphate remains foundational in supporting bone health, while fiber enhancements, primarily through inulin and oat fiber, address digestive wellness and satiety. Iron fortification, via sources such as ferrous sulfate and ferrous fumarate, targets populations vulnerable to anemia, and protein enrichment-through soy and whey protein-caters to muscle maintenance and weight management needs. Vitamin D enrichment, leveraging both D₂ and D₃ variants, responds to widespread deficiency concerns, driving immune resilience narratives.

Distribution channels shape accessibility and consumer journey: convenience store formats, spanning corner shops and gas station outlets, cater to impulse and quick-stop purchases of single-serve fortified snacks. Online retail has become a critical growth engine, with brand-owned websites and third-party marketplaces unlocking direct-to-consumer subscription models for protein-fortified breads. Specialty stores-including health food retailers and pharmacies-serve targeted audiences seeking premium immuno-supportive offerings, while supermarkets, through hypermarket and neighborhood store formats, deliver the broadest assortment of value-priced fortified loaves and cakes alongside premium artisanal variants.

End users exhibit distinct nutritional priorities: adults, whether students or working professionals, prioritize products that seamlessly integrate into meal and snack routines. Children, spanning preschool to grade school ages, benefit from micronutrient-enriched muffins and buns that support growth. Elderly consumers, particularly those aged 60 to 74 and over 75, seek products fortified with calcium, vitamin D, and fiber to support bone strength and digestive function.

Packaging innovations further differentiate offerings. Foil packaging-both aluminum and laminated variants-ensures nutrient stability and extended shelf life, while paper-based solutions like kraft and paperboard meet growing demand for recyclable footprints. Plastic formats, especially HDPE and PET, enable transparent windows and reclosable functionality, preserving sensory appeal and freshness. Through these multidimensional segmentation insights, industry stakeholders can align product development and marketing strategies to precise consumer needs.

This comprehensive research report categorizes the Fortified Bakery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Fortificant Type

- Packaging Type

- Distribution Channel

- End User

Examining Regional Variations and Growth Drivers in the Fortified Bakery Sector Across the Americas EMEA and Asia-Pacific Markets

Regional dynamics play a critical role in shaping fortified bakery trajectories. In the Americas, robust consumer adoption of protein- and fiber-enriched breads reflects a convergence of fitness and wellness trends. North America continues to lead in functional bakery innovation, driven by dietary supplement crossovers and direct-to-consumer channels that facilitate premium product launches. Latin American markets display a rising appetite for fortified options targeting micronutrient deficiencies, with affordability and familiar formats ensuring broad acceptance.

In Europe, Middle East & Africa, regulatory frameworks significantly influence fortification standards and permissible nutrient levels. The European Union’s voluntary fortification guidelines foster consistency, while emerging markets in the Middle East and Africa prioritize vitamin A, iron, and iodine enhancements to address public health goals. Within EMEA, specialty retail layouts and premium grocery chains provide ideal channels for fortified artisanal breads that combine traditional recipes with modern nutritional claims.

The Asia-Pacific region stands out for its rapid innovation cycles and large-scale production capabilities. In markets such as China, India, and Japan, fortified bakery products often cater to growing middle-class segments seeking fortified buns, rolls, and biscuits tailored to local flavor profiles. Digital commerce platforms and mobile-based grocery services accelerate the distribution of nutrient-enriched bakery items, bridging rural and urban consumer bases. Together, these regional insights highlight the necessity for tailored strategies that accommodate regulatory variances, consumer preferences, and distribution infrastructures across the globe.

This comprehensive research report examines key regions that drive the evolution of the Fortified Bakery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Advances and Collaboration Among Leading Ingredient Suppliers and Bakeries Driving Fortification Innovation

Leading ingredient suppliers and bakery innovators are forging strategic collaborations and launching breakthrough solutions to advance fortification capabilities. Puratos, a prominent global supplier, has introduced Cubease-a concentrated bakery improver in cube form-that streamlines dosing, reduces packaging waste by up to 75%, and enhances operational efficiency for both artisanal and industrial bakers. Alongside this, Puratos showcased Sproutgrain Rye at iba 2025, offering a moist, fiber-rich sprouted grain ingredient that boosts mineral bioaccessibility and supports indulgent, nutritious bread applications.

Cargill, a leading agribusiness player, is shaping protein trends with its 2025 Protein Profile report, revealing that 61% of American consumers increased protein intake in 2024-a notable jump from 48% in 2019-underscoring the opportunity for high-protein bakery innovations. Their efforts extend to supporting the Food Fortification Initiative, advocating for micronutrient enrichment in staple grains to close global nutrition gaps and aligning product development with Nutri-Score objectives for clean-label applicability. Recent Cargill plant-based brownie formulations exemplify the potential for sugar reduction of up to 85% coupled with high-fiber and low-sodium profiles, demonstrating a commitment to nutritious indulgence across cake applications.

On the bakery manufacturing side, Hero Bread has distinguished itself by situating production within jurisdictional regions less impacted by tariffs, leveraging domestic milling partnerships to maintain price stability amid policy uncertainties. This strategic positioning has allowed them to absorb cost pressures while continuing to offer fortified and functional products to a health-conscious consumer base. Collectively, these collaborations and initiatives among ingredient and bakery leaders are driving innovation, efficiency, and nutritional impact, setting new benchmarks for the fortified bakery segment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fortified Bakery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Bakeries Limited

- Bimbo Bakeries USA

- Britannia Industries Limited

- Campbell Soup Company

- Flowers Foods, Inc.

- Frito-Lay North America, Inc.

- General Mills, Inc.

- Grupo Bimbo, S.A.B. de C.V.

- Hindustan Unilever Limited

- ITC Limited

- Kellogg Company

- Mondelez International, Inc.

- Nestlé S.A.

- PepsiCo, Inc.

- The Hershey Company

- Unilever PLC

- Warburtons Limited

- Yamazaki Baking Co., Ltd.

Actionable Recommendations for Industry Leaders to Navigate Trade Uncertainties Leverage Segmentation and Drive Growth in Fortified Bakery Products

To navigate the complexities of today’s fortified bakery landscape, industry leaders should prioritize the adoption of advanced encapsulation and microencapsulation technologies to preserve nutrient stability and sensory quality. By partnering with ingredient experts to integrate pre-dosed solutions-such as Puratos’ Cubease-in production lines, manufacturers can reduce handling errors and optimize logistics, freeing resources for further innovation. Additionally, baking companies must reassess supply chains to mitigate tariff exposure: expanding relationships with domestic millers and exploring bilateral trade agreements can stabilize input costs and protect margins against unforeseen policy shifts.

Product portfolios should be aligned with nuanced segmentation insights to resonate with distinct consumer demographics. This involves tailoring fortificant blends-emphasizing fiber-rich inulin for gut health, plant-based proteins for muscle maintenance, or micronutrient complexes addressing region-specific deficiencies-for each channel, from convenience store grab-and-go formats to premium specialty retail shelves. Leveraging clean-label claims, transparent packaging, and SmartLabel™ QR codes can foster trust and empower informed purchasing decisions, driving repeat engagement and brand loyalty.

Finally, cultivating regional agility is essential. Executives must develop nimble go-to-market strategies that reflect the regulatory and cultural landscapes across the Americas, EMEA, and Asia-Pacific. Investing in digital commerce platforms and direct-to-consumer initiatives can accelerate product rollouts, while pilot bakery facilities-such as the Puratos-AMF collaboration-provide controlled environments for rapid prototyping and consumer testing. By integrating these actionable recommendations, fortified bakery stakeholders can drive sustainable growth, deliver tangible health benefits, and secure competitive advantage in an increasingly crowded marketplace.

Detailing Rigorous Methodology Combining Primary Expert Interviews and Secondary Data Analysis to Ensure Comprehensive Fortified Bakery Market Insights

This analysis draws on a comprehensive research methodology combining primary and secondary approaches to ensure robust and credible insights. Primary research included in-depth interviews with key stakeholders-ingredient suppliers like Puratos and Cargill, manufacturing leaders within the American Bakers Association, and executives from emerging specialty bakeries-providing nuanced perspectives on operational challenges, innovation priorities, and market adoption barriers.

Secondary data was meticulously gathered from reputable trade publications, regulatory filings, and government sources, including detailed tariff analyses from USDA and USTR reports, pricing trends from Statista, and process innovations reported in industry journals such as FoodNavigator and Snack Food & Wholesale Bakery. Citations from publicly available whitepapers and press releases, combined with validated datasets on supply chain dynamics, underpin the segmentation and regional insights presented. Together, these research methods deliver a comprehensive, fact-based foundation for strategic decision-making within the fortified bakery sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fortified Bakery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fortified Bakery Market, by Product Type

- Fortified Bakery Market, by Fortificant Type

- Fortified Bakery Market, by Packaging Type

- Fortified Bakery Market, by Distribution Channel

- Fortified Bakery Market, by End User

- Fortified Bakery Market, by Region

- Fortified Bakery Market, by Group

- Fortified Bakery Market, by Country

- United States Fortified Bakery Market

- China Fortified Bakery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Concluding Perspectives on the Future Direction of Fortified Bakery Products in an Evolving Landscape of Health Trends Regulation and Trade Dynamics

In conclusion, the fortified bakery market stands at the intersection of technological innovation, shifting consumer health priorities, and evolving trade landscapes. Advances in nutrient stabilization-such as microencapsulation and ready-to-use sprouted grains-have unlocked opportunities for personalized, functional baked goods that cater to diverse dietary needs. Meanwhile, U.S. tariffs have underscored the importance of supply chain resilience and regional adaptability, prompting manufacturers to explore domestic sourcing and tariff relief mechanisms to safeguard cost structures.

By harnessing detailed segmentation frameworks across product types, fortificant portfolios, distribution networks, end-user demographics, and packaging formats, industry participants can tailor offerings to precise consumer demands. When coupled with strategic partnerships, agile go-to-market strategies, and actionable operational recommendations, these insights equip stakeholders to capitalize on growth drivers, enhance product differentiation, and foster consumer trust. The fortified bakery sector’s future will be defined by its ability to blend indulgence with tangible nutrition, driving sustainable success at the nexus of taste and wellness.

Capitalize on Exclusive Fortified Bakery Market Intelligence by Securing Your Comprehensive Report Through Direct Engagement with Expert Ketan Rohom

For a deeper dive into these insights and to secure a bespoke fortified bakery market research report tailored to your strategic objectives, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise and guidance will ensure you have the comprehensive data and analysis required to outpace competitors and capitalize on emerging opportunities. Reach out today to elevate your market positioning and drive profitable growth in the fortified bakery sector.

- How big is the Fortified Bakery Market?

- What is the Fortified Bakery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?