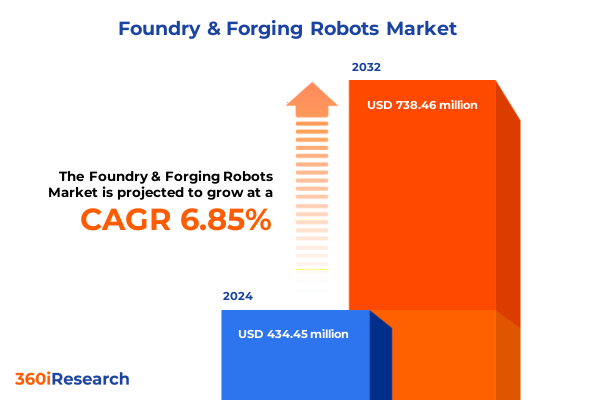

The Foundry & Forging Robots Market size was estimated at USD 461.60 million in 2025 and expected to reach USD 491.87 million in 2026, at a CAGR of 6.94% to reach USD 738.45 million by 2032.

Exploring the Critical Role of Robotics in Revolutionizing Foundry and Forging Operations through Enhanced Precision Maximized Efficiency and Unmatched Safety Benefits

Foundry and forging environments have long been characterized by high temperatures, complex material handling, and precision requirements that challenge human labor and legacy machinery. In recent years, however, robotics solutions have begun to redefine what is possible across every step of the casting and forging process, from mold preparation to post-processing operations. By introducing automation into these traditionally labor-intensive workflows, manufacturers are unlocking levels of repeatability, throughput, and safety that were previously unattainable.

This executive summary presents an overview of how advanced robots-driven by electric and hydraulic systems-are reshaping the competitive landscape of heavy industries. The discussion opens with a look at the technological foundations underpinning modern foundry and forging robotics, followed by an exploration of the forces driving adoption, including rising labor costs, stringent quality standards, and the imperative to enhance workplace safety. In this introduction, readers will gain a clear appreciation of why robotics is no longer a future aspiration but an immediate operational necessity for industry stakeholders seeking to sustain profitability and market relevance.

Examining the Transformative Technological Shifts and Industry Trends Reshaping the Foundry and Forging Robotics Landscape for Future Growth

The landscape of foundry and forging robotics is undergoing transformative shifts driven by breakthroughs in sensor integration, artificial intelligence, and collaborative automation. Advanced vision systems now enable robots to adapt in real time to variations in casting dimensions, while machine learning algorithms continuously optimize process parameters such as pouring speed, alignment, and tool paths. Meanwhile, collaborative robots are increasingly deployed alongside skilled operators to combine human dexterity with mechanical consistency, redefining traditional roles on the factory floor.

At the same time, digital twins and simulation platforms are empowering manufacturers to test new production strategies virtually, reducing the time and cost of physical trials. This virtual-first approach accelerates the deployment of forging and foundry cells by pre-validating workflows and ensuring seamless integration with upstream and downstream processes. Moreover, the convergence of edge computing and 5G connectivity is facilitating decentralized control architectures that improve responsiveness and data security. As these technological shifts continue to accelerate, organizations that embrace an integrated automation strategy will strengthen their competitive position and unlock new avenues for process innovation.

Assessing the Far-Reaching Cumulative Impact of the 2025 United States Tariff Measures on the Foundry and Forging Robotics Supply Chain and Costs

In 2025, the United States implemented a series of tariffs targeting imported industrial robots, components, and critical raw materials used in foundry and forging automation. These measures, introduced in April of that year, imposed an additional duty of up to 25 percent on a wide range of robotics equipment and spare parts. The intention was to bolster domestic manufacturing capabilities and address trade imbalances, but the immediate consequence was an uptick in the landed cost of automation solutions sourced from major exporting countries.

As a result, equipment providers and end users have faced heightened procurement expenses that have reverberated across project budgets and return-on-investment calculations. Many firms have responded by accelerating localization strategies, partnering with domestic integrators and regional suppliers for hardware, software, and servicing. Others have turned to hybrid sourcing models, combining domestic procurement of key components with selective imports where cost or technology advantages remain compelling. Over the medium term, these dynamics are expected to shift the global supply chain toward greater geographic diversification, while also intensifying innovation in locally produced robotics systems designed to meet specific foundry and forging requirements.

Unveiling Key Market Segmentation Insights to Understand How Diverse Robot Types Components Applications and Industries Drive Strategic Focus

An in-depth exploration of market segments reveals how different types of drive systems, robot architectures, software platforms, and end-use applications are converging to shape investment priorities. Electric drive robots, known for their energy efficiency and precision, coexist with hydraulic robots that deliver high force density for heavy-duty forging tasks. Both drive technologies are supported by modular controllers and advanced sensor suites that enable seamless integration of safety-rated vision, force sensing, and real-time analytics.

Beyond hardware variation, market participants are differentiating themselves through comprehensive service offerings, including installation, preventive maintenance, and operator training. Software, too, plays a pivotal role-platforms for offline programming, predictive maintenance, and quality inspection are driving continuous improvement cycles. When considering robot types, articulated and SCARA models dominate flexible handling applications, while delta and Cartesian robots excel in high-speed core extraction. Collaborative robots are gaining ground across finishing processes such as grinding and polishing, where human-robot collaboration optimizes both throughput and ergonomics. In terms of application, casting extraction, core assembly, and ladling demand precise motion control and force management, while mold handling leverages custom end effectors to elevate operational agility. Finally, these solutions find traction across diverse industries-from aerospace and defense to consumer goods-underscoring how each end-user vertical prioritizes distinct performance metrics and compliance standards.

This comprehensive research report categorizes the Foundry & Forging Robots market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Robot Type

- Application

- End-Use Industry

Highlighting Regional Market Dynamics and Growth Drivers across the Americas Europe Middle East Africa and Asia-Pacific in Foundry and Forging Robotics

Regional dynamics play a critical role in shaping adoption patterns and competitive advantage in foundry and forging robotics. In the Americas, robust investment in automotive and aerospace production lines is driving demand for high-throughput articulated robots, supported by a dense network of system integrators and service providers. Meanwhile, domestic policy incentives and reshoring initiatives encourage manufacturing firms to upgrade legacy lines with advanced automation.

Across Europe, the Middle East, and Africa, regulatory emphasis on energy efficiency and environmental standards is steering foundry and forging facilities toward electric drive solutions and smart control systems. Collaborative robots are also gaining traction in small to medium enterprises, where low-code programming interfaces reduce the barrier to entry. In the Asia-Pacific region, rapid industrial expansion and government-backed automation programs have fueled widespread adoption of both hydraulic and electric robots. Here, equipment manufacturers are forging partnerships with local integrators to deliver turnkey cells optimized for high-mix, low-volume production, particularly in electronics and consumer goods segments. These regional distinctions highlight the importance of tailoring go-to-market strategies to the regulatory environment, supply chain maturity, and prevalent end-use industries within each territory.

This comprehensive research report examines key regions that drive the evolution of the Foundry & Forging Robots market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Presenting Strategic Outlook on Leading Robotics and Automation Companies Shaping Innovation Partnerships and Competitive Positioning in Foundry Forging

A survey of leading players underscores the competitive intensity and innovation focus within the robotics ecosystem. Global robotics OEMs are investing heavily in R&D to introduce next-generation actuators, digital control platforms, and AI-driven quality inspection tools. At the same time, technology partnerships between sensor manufacturers and automation specialists are yielding integrated hardware-software solutions that simplify deployment and performance monitoring.

Service providers and system integrators have also strengthened their market position by offering end-to-end project delivery, from initial feasibility studies to continuous improvement programs. Some have established regional training centers to upskill operators, while others leverage cloud-based analytics to provide remote monitoring and predictive maintenance. Further down the value chain, specialist vendors are emerging with niche offerings-such as custom high-temperature grippers or force-torque sensing modules-that address the unique demands of foundry and forging environments. This blend of broad-based automation giants and agile technology-focused entrants creates a dynamic competitive landscape, where collaboration and ecosystem-building are as vital as product innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Foundry & Forging Robots market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Acieta, LLC.

- BGR NEO Ltd.

- Borunte Robot Co., Ltd.

- Bosch Rexroth AG

- Comau S.p.A.

- Difacto Robotics and Automation Pvt. Ltd.

- Doosan Robotics Inc.

- ENGEL AUSTRIA GmbH

- FANUC CORPORATION

- Kawasaki Heavy Industries, Ltd.

- KUKA AG

- Mitsubishi Electric Corporation

- Nachi-Fujikoshi Corp.

- Seiko Epson Corporation

- Siemens AG

- Sintokogio, Ltd.

- SIR Spa

- Stäubli International AG.

- TECHMAN ROBOT INC.

- Universal Robots A/S by Teradyne

- Yamaha Motor Co., Ltd.

- YASKAWA Electric Corporation

Delivering Actionable Strategic Recommendations for Industry Leaders to Accelerate Innovation Optimize Operations and Capitalize on Emerging Robotics Opportunities

For executive teams seeking to harness the full potential of robotics in foundry and forging, a multi-pronged strategy is essential. Organizations should begin by conducting a comprehensive automation maturity assessment to identify high-impact processes and map them against available robot types and control architectures. Pilot programs, supported by digital twins and simulation, can validate expected performance gains and inform scale-up roadmaps with minimal disruption to existing operations.

Leveraging local partnerships will be critical in the context of evolving trade policies and tariff landscapes. Collaborating with domestic system integrators and hardware suppliers can mitigate cost pressures while ensuring faster response times for servicing and spare parts. Concurrently, investing in workforce development through dedicated training services will build the skills needed to operate and maintain increasingly sophisticated robotic cells. Lastly, establishing an ongoing improvement framework-anchored by predictive maintenance, real-time analytics, and continuous feedback loops-will drive sustainable quality enhancements and yield improvements over time.

Outlining Robust Research Methodology Employed in Analyzing Foundry and Forging Robotics Market Trends Data Sources and Analytical Frameworks to Ensure Accuracy

This report is grounded in a rigorous research methodology combining primary interviews with C-level executives, engineering leaders, and supply chain managers from across the foundry and forging ecosystem. Secondary research sources include industry white papers, trade association publications, and regulatory filings to capture the latest policy developments and technology roadmaps. Market segmentation analysis is supported by detailed case studies of automation deployments spanning diverse end-use industries, from aerospace to heavy manufacturing.

Quantitative insights are derived from a comprehensive database of global robotics shipments, trade flow statistics, and published financial reports from major OEMs and integrators. Qualitative assessments incorporate insights from on-site facility visits and expert panel discussions, ensuring that operational realities inform the strategic narratives. Where applicable, scenarios are stress-tested through sensitivity analysis of key variables-such as tariff rates, energy costs, and labor availability-to illustrate potential risk and opportunity arcs for stakeholders in this dynamic market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Foundry & Forging Robots market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Foundry & Forging Robots Market, by Type

- Foundry & Forging Robots Market, by Component

- Foundry & Forging Robots Market, by Robot Type

- Foundry & Forging Robots Market, by Application

- Foundry & Forging Robots Market, by End-Use Industry

- Foundry & Forging Robots Market, by Region

- Foundry & Forging Robots Market, by Group

- Foundry & Forging Robots Market, by Country

- United States Foundry & Forging Robots Market

- China Foundry & Forging Robots Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Takeaways and Conclusive Reflections on the Strategic Imperatives for Stakeholders in the Foundry and Forging Robotics Ecosystem

In conclusion, the integration of advanced robotics into foundry and forging operations represents a pivotal shift toward higher precision, safety, and cost efficiency. The interplay between electric and hydraulic drive technologies, coupled with intelligent software platforms and collaborative automation, is unlocking new process capabilities and driving competitive differentiation. Despite near-term cost pressures stemming from trade policy changes, the impetus to localize supply chains and invest in digital tools is reinforcing long-term growth trajectories.

Stakeholders across OEMs, integrators, and end users must adopt a proactive stance-embracing pilot projects, strengthening local partnerships, and embedding continuous improvement mechanisms-to capture emerging opportunities. By aligning strategic priorities with technological capabilities and regional market dynamics, industry leaders can position themselves at the forefront of a transformation that is redefining traditional manufacturing and paving the way for the next generation of high-value production environments.

Engaging Industry Professionals with a Direct Call to Action to Collaborate with Ketan Rohom for In-Depth Market Research Insights and Business Growth Opportunities

The comprehensive analysis provided in this report lays a solid foundation for informed decision-making by industry leaders, investors, and technology partners. To explore custom insights, detailed market data, and strategic frameworks tailored to your organization’s unique challenges and opportunities, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). His expertise in robotics and automation procurement will ensure you receive the guidance and tools necessary to transform your operations, secure competitive advantage, and accelerate growth in the rapidly evolving foundry and forging robotics market.

Engaging with Ketan Rohom will enable you to access the full breadth of this in-depth market research, including proprietary analysis, scenario modeling, and actionable recommendations. Whether you seek to refine your automation roadmap, align your supply chain strategy with emerging trade policies, or identify high-potential application areas, his insights will connect you with the critical data and strategic counsel needed to drive success. Don’t miss the opportunity to leverage this unparalleled resource and position your organization at the forefront of robotics-driven innovation in foundry and forging.

- How big is the Foundry & Forging Robots Market?

- What is the Foundry & Forging Robots Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?