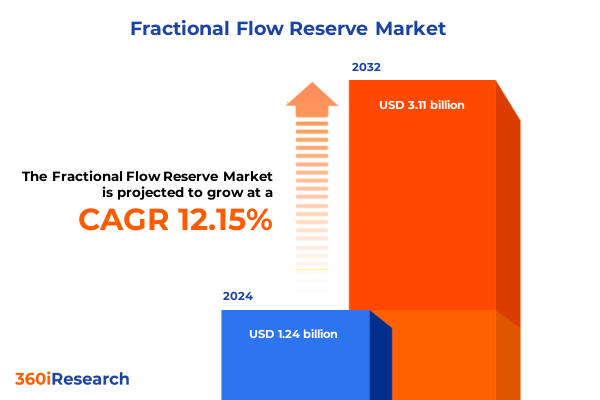

The Fractional Flow Reserve Market size was estimated at USD 1.39 billion in 2025 and expected to reach USD 1.57 billion in 2026, at a CAGR of 12.12% to reach USD 3.11 billion by 2032.

Revolutionizing Cardiac Diagnostics through Fractional Flow Reserve: Unveiling the Evolution, Clinical Significance, and Modern Best Practices

Fractional flow reserve has emerged as a pivotal tool in the assessment of coronary artery lesions, fundamentally enhancing the precision of interventional cardiology procedures. By measuring the pressure gradient across stenotic segments during maximal hyperemia, this technique offers a quantitative evaluation of the physiological impact of arterial narrowing. Consequently, it guides clinical decision-making by distinguishing lesions that warrant percutaneous coronary intervention from those that can be safely managed conservatively.

Over the past decade, clinical guidelines have increasingly recognized the value of fractional flow reserve in reducing unnecessary stenting and improving patient outcomes. The adoption of this modality has been driven by robust evidence demonstrating its ability to optimize resource allocation and mitigate procedural risks. As healthcare systems emphasize value-based care models, the integration of fractional flow reserve into routine practice underscores its role in delivering cost-effective and patient-centered diagnostic pathways.

Transformational Technological and Clinical Shifts Reshaping the Fractional Flow Reserve Landscape with Enhanced Precision and Workflow Integration

The fractional flow reserve landscape has undergone profound innovation as emerging technologies and clinical workflows converge to enhance diagnostic accuracy. Advancements in pressure wire design now incorporate fiber-optic and guidewire-based sensors, delivering heightened signal fidelity and ease of use. Parallel developments in virtual fractional flow reserve, leveraging angiography-derived and CT-derived methodologies, have introduced non-invasive alternatives that optimize lab throughput and patient comfort.

Moreover, machine learning–based computational fluid dynamics platforms are streamlining image processing and pressure estimation, reducing reliance on invasive instrumentation. Workflow integration with digital health ecosystems, including cloud-based analytics and interventional decision-support software, is facilitating real-time lesion assessment. Regulatory bodies have also updated approval pathways to accelerate the commercialization of next-generation adapters and sensor innovations, thereby expanding the toolkit available to interventional cardiologists. As clinical teams adopt these solutions, seamless data interoperability and comprehensive training initiatives are transforming procedural efficiency and reinforcing the value proposition of fractional flow reserve.

Navigating the Impact of 2025 United States Tariffs on Fractional Flow Reserve Devices Supply Chains Pricing and Strategic Sourcing

In 2025, new tariff measures introduced by the United States government have affected the importation costs of precision-engineered components used in fractional flow reserve systems. Section 301 levies on select medical device parts, particularly specialized pressure sensors and optical fiber assemblies, have compelled manufacturers to revisit supplier contracts and cost models. As a result, device producers are evaluating nearshoring and diversification strategies to mitigate exposure to customs duties.

Consequently, supply chain networks have experienced increased complexity, with extended lead times for certain sensor subassemblies and readout modules. Price adjustments have been implemented to offset duty-related margins, impacting capital expenditure planning within hospital procurement cycles. Simultaneously, the tariffs have spurred collaborative negotiations between industry associations and regulatory agencies to refine tariff code classifications, aiming to reduce the financial burden on essential diagnostic devices. Ultimately, these measures underscore the importance of resilience planning and agile sourcing in maintaining the accessibility and affordability of fractional flow reserve technologies.

Uncovering Product Type End User and Application Perspectives Driving Nuanced Insights into the Fractional Flow Reserve Market Landscape

The fractional flow reserve market exhibits intricate product type segmentation, with the pressure wire category encompassing fiber-optic sensors as well as guidewire-based platforms that utilize either nitinol or stainless steel cores, while the burgeoning virtual fractional flow reserve segment divides into angiography-derived two-dimensional and three-dimensional analyses and CT-derived computational fluid dynamics or machine learning models. Each modality offers distinct clinical advantages: the fiber-optic pressure wire excels in signal stability under high-flow conditions, whereas guidewire-based systems benefit from enhanced manoeuvrability in tortuous anatomy. The virtual approaches aim to broaden applicability in settings where invasive techniques may be constrained.

From an end-user perspective, ambulatory surgery centers and dedicated cardiac and multispecialty centers, whether clinic-based or hospital-based, as well as community and tertiary care hospitals and research institutes, adopt fractional flow reserve solutions based on procedural volume and reimbursement frameworks. In urban tertiary care facilities, advanced virtual platforms complement invasive assessments, while rural community hospitals often prioritize cost-effective fiber-optic wire options. Across research institutes, both invasive and non-invasive modalities fuel clinical trials exploring neurovascular aneurysm assessments and peripheral arterial pressure mapping.

Application-wise, fractional flow reserve is deployed in coronary artery disease management, spanning acute coronary syndrome and stable angina subtypes, with further focus on NSTEMI, STEMI, multi-vessel, and single-vessel presentations. Neurovascular applications include both ruptured and unruptured aneurysm assessment and hemorrhagic and ischemic stroke diagnosis, while peripheral vascular disease applications target lower extremity and renal artery evaluations, addressing popliteal and superficial femoral segments as well as main and accessory renal arteries. This multifaceted segmentation underscores the versatility of fractional flow reserve across cardiovascular specialties, guiding targeted technology investments and service line expansions.

This comprehensive research report categorizes the Fractional Flow Reserve market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End User

- Application

Analyzing Geographic Trends Impacting Adoption Reimbursement and Growth Opportunities across Americas Europe Middle East Africa and Asia Pacific

The Americas continue to lead in fractional flow reserve adoption, underpinned by well-established reimbursement pathways and high procedural volumes in cardiac catheterization laboratories. In the United States, integrated health systems leverage invasive and non-invasive modalities to streamline interventional workflows, while Canada’s universal coverage model supports equitable technology access across provinces. Transitioning southward, Brazil’s evolving healthcare infrastructure is gradually incorporating angiography-derived fractional flow reserve into tertiary centers, aided by international training initiatives.

In Europe, the Middle East, and Africa, heterogeneous reimbursement and regulatory landscapes influence adoption rates. Western European nations benefit from robust health technology assessment frameworks that validate the clinical and economic benefits of fractional flow reserve, whereas select Gulf Cooperation Council states are investing heavily in cutting-edge imaging infrastructure to attract medical tourism. In contrast, sub-Saharan markets face challenges related to equipment financing and specialist training, limiting widespread adoption despite growing cardiovascular disease prevalence.

Asia-Pacific presents a dynamic environment, with Japan and South Korea offering advanced integration of virtual and invasive platforms in high-volume centers. India and Southeast Asia, balancing resource constraints with large patient populations, are increasingly adopting cost-efficient fiber-optic wire systems and leveraging public-private partnerships to expand access. Moreover, China’s domestic innovation in machine learning–driven computation and sensor development promises to reshape competitive dynamics across the region. These geographic trends highlight distinct growth pathways tied to reimbursement policy, infrastructure investment, and local manufacturing capabilities.

This comprehensive research report examines key regions that drive the evolution of the Fractional Flow Reserve market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Competitive Dynamics and Strategic Initiatives of Leading Innovators Shaping the Fractional Flow Reserve Device Ecosystem

Leading innovators in the fractional flow reserve landscape have pursued diverse strategies to sustain competitive advantage. Prominent cardiovascular diagnostics companies have introduced next-generation pressure wire platforms featuring enhanced sensor durability and integrated wireless communication, while simultaneously expanding software-as-a-service offerings for virtual pressure assessment. Collaborations with academic institutions and startup accelerators are yielding machine learning algorithms that refine lesion-specific hemodynamic modeling and predictive outcome analytics.

Furthermore, established device manufacturers are engaging in targeted mergers and acquisitions to broaden their R&D pipelines and gain market access in emerging territories. Strategic alliances between sensor specialists and interventional cath lab system providers have fostered seamless compatibility across digital angiography suites. Concurrently, niche technology firms are focusing on miniaturized catheter-tip sensors and real-time flow visualization tools, positioning themselves as potential acquisition targets. Collectively, these initiatives underscore a competitive ecosystem where innovation, strategic partnerships, and regulatory alignment are key drivers of market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fractional Flow Reserve market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- ACIST Medical Systems, Inc.

- B. Braun Melsungen AG

- Biosensors International Group Ltd.

- BIOTRONIK SE & Co KG

- Bluesail Medical Co. Ltd.

- Boston Scientific Corporation

- Bracco SpA

- Canon Medical Systems Corporation

- CathWorks Ltd.

- Esaote SpA

- General Electric Company

- HeartFlow, Inc.

- Koninklijke Philips N.V.

- Medis Medical Imaging B.V.

- Medtronic plc

- Meril Life Sciences Pvt. Ltd.

- Opsens Inc.

- Pie Medical Imaging B.V.

- Radi Medical Systems AB

- Siemens Healthineers AG

- Terumo Corporation

Strategic Roadmap Recommendations Guiding Industry Leaders to Optimize Technological Adoption Supply Chains and Commercial Success in FFR

Industry leaders seeking to optimize their market position should prioritize investment in scalable digital platforms that unify invasive and virtual fractional flow reserve workflows, thereby enhancing procedural throughput and data analytics capabilities. It is critical to diversify supply chain networks by cultivating partnerships with regional component manufacturers and exploring nearshore contract manufacturing to attenuate tariff-driven cost volatility.

Engagement with reimbursement agencies and payers is essential to reinforce the value proposition of fractional flow reserve in clinical guidelines and diagnostic coding frameworks, fostering accelerated adoption. Additionally, collaborative training programs with interventional cardiology societies will ensure that clinicians achieve proficiency in both wire-based and computational methodologies. To future-proof portfolios, organizations should allocate resources toward research collaborations in emerging application areas such as neurovascular and peripheral vascular diagnostics. By integrating these strategic actions, executives can drive sustainable growth and maintain technological leadership in the evolving fractional flow reserve landscape.

Detailing Robust Research Methodology Utilizing Rigorous Primary Secondary Data Collection Validation and Analytical Techniques for Comprehensive Market Insight

This research leverages a blend of primary interviews with key opinion leaders, including interventional cardiologists, clinical researchers, and healthcare executives, alongside secondary data gathered from peer-reviewed publications, regulatory filings, and industry white papers. A structured questionnaire framework supported qualitative insights into clinical adoption drivers, while quantitative data points were validated through triangulation across multiple sources to ensure reliability.

Segmentation analyses were constructed using hierarchical frameworks spanning product types, end-user categories, and application domains, with each stratum rigorously assessed for clinical relevance and market potential. Regional market dynamics were informed by policy reviews and reimbursement landscape audits, complemented by direct dialogues with local distributors and procurement specialists. Analytical techniques included scenario mapping, cost-benefit modeling, and sensitivity testing to identify upside opportunities and potential risks. The synthesis of these methodologies has produced robust, actionable insights designed to guide strategic decision-making in complex healthcare markets.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fractional Flow Reserve market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fractional Flow Reserve Market, by Product Type

- Fractional Flow Reserve Market, by End User

- Fractional Flow Reserve Market, by Application

- Fractional Flow Reserve Market, by Region

- Fractional Flow Reserve Market, by Group

- Fractional Flow Reserve Market, by Country

- United States Fractional Flow Reserve Market

- China Fractional Flow Reserve Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 3657 ]

Concluding Perspectives on the Evolution Trajectory Collaborative Innovations and Future Outlook of Fractional Flow Reserve in Cardiac Care

As fractional flow reserve technologies continue to mature, the convergence of invasive and non-invasive diagnostic modalities will redefine the standards of care in interventional cardiology. Collaborative innovations in sensor design, computational modeling, and digital integration are expanding clinical capabilities and improving patient outcomes. Moreover, evolving reimbursement paradigms and tariff landscapes underscore the importance of agile supply chains and strategic stakeholder engagement.

Looking ahead, the trajectory of fractional flow reserve will be shaped by cross-disciplinary research in neurovascular and peripheral vascular applications, as well as by the maturation of machine learning–driven workflows. By understanding the interplay between technological advancements, regulatory shifts, and regional market dynamics, stakeholders can anticipate disruptions and capitalize on emerging opportunities. The insights presented herein furnish a comprehensive foundation for strategic planning and operational execution in this rapidly evolving domain.

Empowering Decision Makers to Secure Comprehensive Fractional Flow Reserve Market Intelligence through Strategic Collaboration with Ketan Rohom

To gain unparalleled strategic insights and detailed market intelligence on fractional flow reserve, we invite executives and decision-makers to collaborate with Ketan Rohom, Associate Director of Sales & Marketing. By engaging directly, stakeholders can access tailored analyses, priority briefing sessions, and customized data packages that align with organizational objectives. This collaboration ensures the delivery of the most relevant findings and empowers teams to make informed investment, product development, and partnership decisions.

Ketan Rohom brings extensive expertise in cardiovascular diagnostics market research and personalized client support. His guidance will streamline the procurement process, clarify report components, and facilitate the integration of market insights into corporate strategies. Leadership teams will benefit from exclusive pre-publication summaries and post-delivery consultations to maximize the actionable value of the research. Reach out today to secure your competitive advantage with a comprehensive exploration of fractional flow reserve market dynamics.

- How big is the Fractional Flow Reserve Market?

- What is the Fractional Flow Reserve Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?