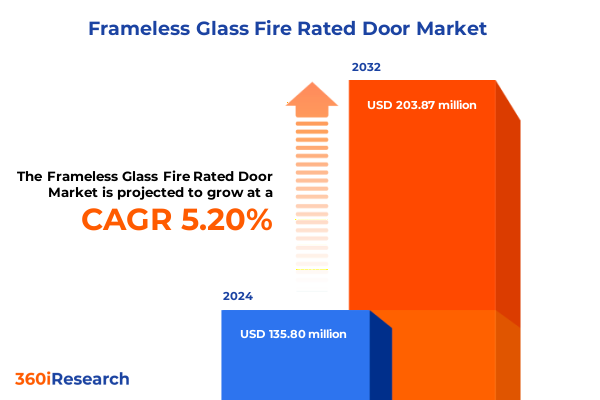

The Frameless Glass Fire Rated Door Market size was estimated at USD 142.66 million in 2025 and expected to reach USD 149.93 million in 2026, at a CAGR of 5.23% to reach USD 203.87 million by 2032.

How frameless glass fire-rated doors have become a high-stakes intersection of architectural transparency, life-safety regulation, and procurement complexity

The framing of contemporary commercial interiors is shifting: frameless glass fire-rated doors are no longer a niche aesthetic choice but an intersection point between architectural transparency, occupant safety, and regulatory compliance. This introduction orients technical leaders, architects, and procurement teams to the central premise of the report: frameless glass doors that meet fire-rated performance requirements are driving new specification workflows, pushing manufacturers to reconcile optical quality with thermal and hose-stream performance, and prompting downstream stakeholders to rethink installation, inspection, and maintenance practices. The objective here is to establish a shared vocabulary and clarify why layered considerations-standards conformance, fabrication tolerances, hardware compatibility, and supply-chain resilience-must be assessed together rather than sequentially.

Across the built environment, the desire for uninterrupted sightlines and daylighting is colliding with stricter fire and life-safety requirements. The most practical project outcomes arise when design teams engage early with tested glazing systems and integrated hardware that preserve the frameless aesthetic while satisfying third-party fire testing and code labeling. Consequently, this report focuses on the technical and commercial tradeoffs that influence specification risk, contractor selection, and long-term liability exposure. The introduction therefore prepares readers to interpret subsequent sections that examine regulatory shifts, tariff impacts, segmentation dynamics, regional differences, supply-side behaviors, and recommended actions for industry leaders.

Rapid changes in codes, glazing technologies, and procurement practices are reshaping how frameless fire-rated glass doors are specified, tested, and delivered

The landscape for frameless glass fire-rated doors is undergoing transformative shifts driven simultaneously by evolving building codes, product innovation in fire-rated glazing technologies, and changing occupant expectations for transparency and acoustic privacy. Code authorities and testing laboratories have refined test protocols and labeling conventions that make it easier for designers to match product capabilities to door and wall assemblies; at the same time, new laminated and ceramic-based glazing systems now offer combinations of visual clarity and heat/radiant performance that were previously difficult to achieve. These technical advances have expanded feasible design options, but have also increased the demands placed on specifiers to verify test evidence, installation details, and edge protection methods.

Supply chains and procurement channels are also shifting. Manufacturers are investing in low-carbon production processes and larger sheet capabilities to meet architects’ requirements for floor-to-ceiling expanses without compromising fire performance. Meanwhile, the hardware ecosystem is innovating with slimmer hinges, concealed closers, and pressure-equalized frames that enable frameless aesthetics while maintaining door assembly integrity. As a result, the specification process is becoming more collaborative and multidisciplinary: early coordination across architects, fire engineers, glazing fabricators, and door hardware vendors is now a prerequisite for predictable project outcomes. These transformations increase the premium on technical literacy among buying teams and create opportunities for vendors who can present complete tested systems rather than component-level claims. For stakeholders who adapt their procurement criteria and quality assurance practices accordingly, this period of transition offers room to reduce retrofit risk, shorten approval cycles, and improve occupant outcomes.

A concise assessment of how U.S. tariff adjustments through 2025 are adding procurement complexity and reshaping sourcing strategies across glazing and hardware supply chains

U.S. trade policy developments in late 2024 and into 2025 have produced a layered tariff environment that materially influences raw-material sourcing, component availability, and longer lead times for certain imports. The Office of the U.S. Trade Representative finalized adjustments to Section 301 tariffs that raised duties on several product groups and scheduled further increases on technology-intensive goods into 2025 and 2026. These tariff actions affect upstream inputs used across glass production and metal hardware manufacturing, and they have prompted some buyers to reassess sourcing footprints and inventory strategies. Changes in tariff eligibility and time-limited exclusions have introduced additional administrative overhead for procurement teams seeking relief via exclusion requests or alternative sourcing routes. The policy trajectory, including the USTR’s announced increases and the ongoing mechanism for exclusions, means that importing contractors and fabricators must monitor product-level HTS classifications closely and plan for variable landed costs and compliance documentation requirements.

Beyond headline rates, the practical consequences for the frameless fire-rated door ecosystem include pressure on delivery windows for specialty glazing and pressure on margins for small and mid-sized fabricators that cannot easily absorb duty increases. Some manufacturers have responded by accelerating domestic finishing capabilities, investing in local tempering and laminating lines, and promoting made-in-region alternatives to minimize exposure to tariff volatility. In addition, extensions and short-term exemptions for selected HTS codes have been used to smooth supply for critical manufacturing equipment and safety-related components, but these measures are temporary and require active tracking. For architects and owners focused on project scheduling, the combined effects of duty adjustments and shifting exclusion windows increase the importance of contractual clarity around lead times, supplier responsibility for tariff changes, and contingency sourcing strategies.

Actionable segmentation perspectives that explain why product type, fire classification, application, installation method, and distribution channel change specification outcomes

Segmenting the frameless glass fire-rated door space reveals distinct specification and operational pathways that influence technical risk and commercial decisions. Product-type segmentation-comparing monolithic fire-resistant glass-ceramics, intumescent laminated solutions, and modified toughened integrity-only products-determines how the system behaves under thermal load and which frame or door assembly types are compatible. Fire-rating segmentation-where E, EW, and EI performance classifications map to differing integrity and temperature-rise criteria-guides placement within doors, sidelites, and curtain walls and dictates whether additional insulation or glazed-transom strategies are required. Application segmentation distinguishes interiors where acoustic privacy and visual connectivity are paramount from exterior or egress applications that prioritize thermal insulation and hose-stream resilience.

End-user segmentation matters because institutional owners, such as healthcare and education, often apply more conservative acceptance criteria and stricter maintenance protocols than corporate offices or retail storefronts. Installation-type segmentation differentiates pre-glazed factory assemblies from site-glazed solutions; the former reduces field risk but raises transport and handling constraints, while the latter increases demands on field tolerances and installer certification. Distribution-channel segmentation-whether direct to trade fabricators, through authorized distributors, or via system integrators that bundle hardware and glazing-affects warranty clarity and the availability of tested assemblies. Taken together, these segmentation lenses explain why a single frameless aesthetic can produce divergent procurement checklists and risk profiles depending on the exact product, rating, end use, installation method, and distribution path chosen. This layered segmentation approach supports more precise RFP language, tighter acceptance testing, and clearer responsibility matrices between manufacturers, installers, and owners.

This comprehensive research report categorizes the Frameless Glass Fire Rated Door market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Door Configuration

- Installation Type

- Application

- Distribution Channel

Comparative regional analysis highlighting how regulatory interpretation, local manufacturing, and specification practices differ across the Americas, Europe Middle East & Africa, and Asia-Pacific

Regional dynamics create differentiated demand patterns and regulatory expectations that suppliers must navigate when scaling product offerings. In the Americas, U.S. and Canadian code frameworks emphasize clearly labeled fire-protective and fire-resistive glazing, and procurement teams are increasingly sensitive to lead times for specialty laminated and ceramic-based fire glazing; projects with high aesthetic requirements are balancing domestic finishing capacity against occasional reliance on European product lines. Regulatory clarity about labeling and third-party listings is especially important in this region because authority having jurisdiction reviews commonly hinge on visible, test-based evidence that matches the assembly’s intended use. In Europe, Middle East & Africa, designers frequently demand large-format fire-rated glazing with high optical quality and sustainability credentials, and European manufacturers have invested heavily in low-carbon processes and larger sheet capability that feed projects in global gateway cities. Regional standards and EN-based test classifications coexist with locally interpreted IBC/NFPA equivalencies on major international projects, which requires suppliers to supply multi-standard test reports and CE or equivalent documentation.

The Asia-Pacific region blends strong local manufacturing capacity with rapidly evolving code adoption in growing urban centers; several APAC producers offer competitively priced intumescent-laminated and ceramic solutions and are expanding export footprints for projects in other regions. Across all regions, hardware compatibility, certified installation practices, and correctly labeled test evidence remain common themes; however, regional differences in approved labeling conventions, permitted installation tolerances, and lifecycle maintenance expectations mean vendors must adapt technical documentation and service models accordingly to reduce approval friction and installation rework. These regional nuances influence sourcing choices, project milestones, and the commercial case for domestic finishing versus importation.

This comprehensive research report examines key regions that drive the evolution of the Frameless Glass Fire Rated Door market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key company-level observations showing why tested system portfolios, local finishing capability, and installer authorization drive competitive advantage in fire-rated frameless glazing

A focused review of leading suppliers and system integrators shows a market where established glass producers and specialized fire-glazing brands are advancing complementary strategies. Global float and specialty glass producers have expanded product lines to include tested fire-rated glazing options that combine thermal performance with improved optics, while independent safety glass brands and system houses supply certified door assemblies and detailing guidance that accelerate approval. Major manufacturers emphasize integrated product portfolios-glass, tested framing details, and compatible hardware-which reduces the burden on architects and authorities during plan review. Several established providers have invested in near-site finishing, local stocking, and product families designed for butt-jointed, frameless systems to capture higher-value design projects.

At the supplier level, product differentiation often rests on two axes: demonstrable lab-tested fire performance across multiple standards and the ability to supply larger sizes, slimmer sightlines, and lower embodied-carbon alternatives. Vendors that combine a clear chain-of-custody for recycled content, transparent test evidence for multiple standards, and an authorized installer network present a compelling value proposition for owners seeking to minimize approval risk and long-term maintenance liabilities. Equally important are specialist fabricators and hardware manufacturers who can validate their components within the door assembly and offer documented installation protocols. For specifiers and procurement leads, assessing companies through the lens of tested systems, local finishing capability, and installer-authorized warranty is more predictive of project success than component-only comparisons.

This comprehensive research report delivers an in-depth overview of the principal market players in the Frameless Glass Fire Rated Door market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- Allegion plc

- ASSA ABLOY AB

- C.R. Laurence Co., Inc.

- Compagnie de Saint-Gobain S.A.

- Etex Group

- Guardian Industries Corp.

- Kawneer Company, Inc.

- Kuraray Co., Ltd.

- Nippon Sheet Glass Co., Ltd.

- SCHOTT AG

Practical, high-impact recommendations for manufacturers, specifiers, and owners to reduce risk and accelerate compliant delivery of frameless fire-rated glass doors

Industry leaders should prioritize actions that close the gap between design intent and code-compliant, installable outcomes. First, accelerate early-stage collaboration by requiring tested system submittals and manufacturer-signed compatibility letters at schematic design, not just at shop-drawing stage; doing so reduces change orders and shortens plan-review cycles. Second, build sourcing strategies that combine domestic finishing options with vetted imports: when tariff or logistics risk rises, local finishing capacity reduces schedule exposure while preserving optical quality for large-format requirements. Third, require suppliers to deliver cross-standard test packs that include UL/ASTM and EN or other applicable regional reports so that multi-jurisdiction projects can proceed without duplicative re-testing.

Operationally, owners and contractors should adopt tighter acceptance protocols for glazing installation and preserve procurement leverage by specifying installer certification as a condition of warranty. Implement a project-level QA checklist that documents label verification, edge protection details, joint tolerances, and hardware compatibility before concealment. Finally, incorporate a lifecycle maintenance clause into procurement contracts that assigns responsibility for periodic inspection and replacement of fire-rated glazing and associated hardware; this reduces long-term liability and improves operational readiness. Taken together, these steps reduce schedule and compliance risk, clarify commercial responsibility, and preserve the design benefits of frameless glass while ensuring occupant safety.

A transparent research methodology combining standards review, manufacturer test verification, expert interviews, and field submittal analysis to ensure practical, verifiable conclusions

This research synthesizes a mix of primary and secondary investigative approaches designed to produce actionable intelligence for commercial stakeholders. Secondary research consisted of a structured review of current test standards, building-code guidance, and manufacturer technical literature to map performance classes and labeling conventions to common door assembly scenarios. Regulatory sources, laboratory listings, and product datasheets were cross-checked for consistency, and code interpretation notes were validated against authoritative standard summaries. Primary inputs included structured interviews with practicing architects, glazing fabricators, and door hardware specialists to surface recurring installation risk factors and to document how procurement teams are adapting to tariff and supply-chain variability.

Material evidence was prioritized: actual test reports and third-party listings were treated as the primary determinants of product suitability rather than marketing claims. Field-level validation involved reviewing recent project submittals and as-built documentation to identify common failure modes during plan review and installation. The limitations include reliance on available public test evidence and interview access to a subset of fabricators; where product-specific gaps existed, the analysis called for targeted technical confirmation through manufacturer testing or witnessed field mockups. The approach emphasizes reproducibility: readers can adopt the same verification workflow-request test reports across relevant standards, confirm labeling consistency, and require installer authorization-to reduce approval and operational risk.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Frameless Glass Fire Rated Door market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Frameless Glass Fire Rated Door Market, by Door Configuration

- Frameless Glass Fire Rated Door Market, by Installation Type

- Frameless Glass Fire Rated Door Market, by Application

- Frameless Glass Fire Rated Door Market, by Distribution Channel

- Frameless Glass Fire Rated Door Market, by Region

- Frameless Glass Fire Rated Door Market, by Group

- Frameless Glass Fire Rated Door Market, by Country

- United States Frameless Glass Fire Rated Door Market

- China Frameless Glass Fire Rated Door Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

A concise synthesis emphasizing system-level specification, verified test evidence, and procurement practices that preserve design while ensuring life-safety compliance

In conclusion, frameless glass fire-rated doors now occupy a strategic place in modern commercial architecture where safety, sustainability, and design meet. Advances in glass-ceramic, intumescent-laminated, and modified toughened products have widened the palette available to designers, but the expanded options come with greater demands on specification rigor, cross-standard test evidence, and installation discipline. Trade-policy shifts through 2024–2025 have added procurement complexity, making local finishing and verified supply chains more valuable in projects with tight schedules. Code and labelling clarity reduces approval friction when product documentation and tested assemblies are supplied proactively, and companies that package glazing with compatible hardware and authorized installation services materially reduce owners’ downstream risk.

For executives and technical leads, the actionable imperative is clear: treat frameless fire-rated glazing as a system, not a collection of components. Investing in upstream verification, on-site inspection regimes, and contractual clarity around supply and warranty delivers predictable outcomes that preserve design intent while meeting life-safety obligations. When done well, frameless fire-rated doors deliver both an elevated occupant experience and a defensible technical basis for regulatory approval.

Direct next steps to buy the full research report and tailored briefings from the Associate Director, Sales & Marketing to operationalize the findings

For decision-makers ready to convert insight into action, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, to acquire the full market research report and supporting datasets. The full report contains detailed regulatory crosswalks, product-level technology reviews, supplier scorecards, and practical commercial playbooks that will help procurement, specification, and product development teams move from hypothesis to implementation. When contacting Ketan, describe your primary use case-procurement optimization, specification compliance, competitive benchmarking, or product innovation-and he will guide you to the research package and optional advisory add-ons that best align with your timeline and implementation needs.

Purchasing the report grants access to a structured executive briefing, a technical appendix that maps fire-rated glazing standards to common framing systems, and a prioritized set of vendor shortlists keyed to the applications you care about. If you require a tailored briefing for stakeholders such as architects, life-safety specialists, or procurement leads, ask Ketan about expedited briefing options and custom slide packs. This is the fastest route to operationalize the insights in this executive summary and convert them into procurement specifications, bid documents, and product roadmaps.

- How big is the Frameless Glass Fire Rated Door Market?

- What is the Frameless Glass Fire Rated Door Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?