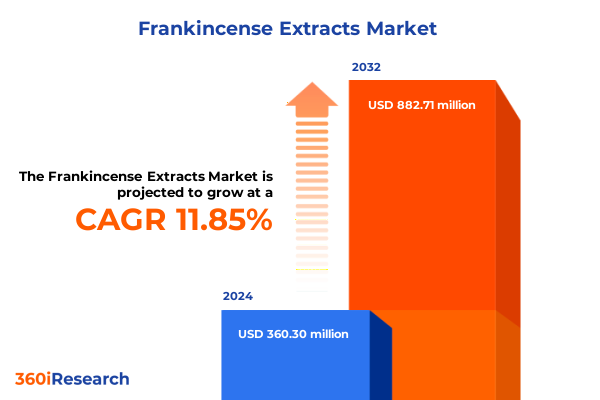

The Frankincense Extracts Market size was estimated at USD 401.54 million in 2025 and expected to reach USD 447.62 million in 2026, at a CAGR of 11.91% to reach USD 882.71 million by 2032.

Discover the Revival of Frankincense Extracts as a Transformative Natural Ingredient Driving Innovation and Health-Focused Applications Across Global Industries

The lasting allure of frankincense extracts lies in their centuries-old heritage coupled with modern scientific validation, marking a resurgence as a high-value natural ingredient. Once cherished in ancient rituals across the Mediterranean and Arabian Peninsula, the resin and essential oil have evolved into sought-after components for diverse industries. Today’s formulations leverage advanced extraction techniques to preserve the bioactive terpenes and boswellic acids, offering both aromatic complexity and potential therapeutic benefits. As consumers embrace wellness trends and demand transparency in ingredient sourcing, frankincense extracts have found a revitalized role in premium personal care, functional foods, and clinical-grade products.

Building on sustainable harvesting practices, producers are increasingly adopting traceability measures to guarantee authenticity and uphold ethical standards. Blockchain-enabled supply chains and fair-trade certifications are redefining value creation, ensuring that smallholder farmers receive equitable returns while maintaining the environmental integrity of Boswellia groves. This convergence of tradition and innovation underscores the strategic importance of frankincense extracts for manufacturers seeking distinctive, evidence-based ingredients. Consequently, stakeholders across the value chain are realigning priorities-emphasizing quality assurance, regulatory compliance, and consumer education-to fully harness the potential of this ancient resource. Transitioning from artisanal roots to scalable production models, the industry stands poised at a pivotal moment, ready to capitalize on renewed interest in natural, multifunctional compounds.

Examining the Key Transformations in Supply, Sustainability, and Consumer Demand That Are Redefining the Frankincense Extracts Industry Landscape Today

Over the past decade, the frankincense extracts landscape has undergone significant transformation, driven by heightened consumer awareness of plant-based wellness solutions and stricter sustainability mandates. The integration of advanced analytical methods-such as gas chromatography-mass spectrometry and high-performance liquid chromatography-has allowed formulators to standardize active components, bridging the gap between traditional uses and scientifically validated applications. Moreover, collaborations between botanical research institutes and ingredient manufacturers have yielded novel derivatives that enhance bioavailability, positioning extracts beyond perfumery into clinical and nutraceutical realms.

In parallel, digital innovations are reshaping sourcing and quality control. Blockchain platforms now track resin from remote Boswellia woodlands to processing facilities, offering immutable proof of origin and reducing the risk of adulteration. Automation and AI-driven sorting systems bolster consistency, enabling producers to meet rigorous regulatory benchmarks in target markets. At the same time, shifts in consumer demographics-particularly among millennials and Gen Z-have spurred demand for personalized aromatherapy and clean-label cosmetics, prompting industry players to develop bespoke blends and tailor-made formulations. Consequently, the competitive landscape has evolved from commoditized oil supply to high-value, differentiated offerings that command premium positioning.

Analyzing the Aggregate Effects of 2025 United States Tariff Measures on Frankincense Extracts Supply Chains, Cost Structures, and Global Trade Dynamics

The implementation of new tariff measures by the United States in early 2025 has had a pronounced ripple effect throughout global frankincense supply chains. Higher import duties on oleogum resin and essential oil consignments have led importers to reassess traditional sourcing origins, such as Somalia and Oman, in favor of suppliers in regions subject to preferential trade agreements. As a result, companies have reconfigured their procurement strategies, negotiating long-term contracts to secure volume discounts that help cushion the impact of elevated duties.

Furthermore, the added cost burden has stimulated innovation in logistics and processing. Some stakeholders have invested in local pilot facilities near major ports to pre-process resin and capture value before goods cross tariff thresholds. Others have explored tariff reclassification tactics, seeking classification under specialized codes for medicinal extracts that may attract lower duty rates. Despite these adaptive strategies, downstream manufacturers in aromatherapy, cosmetics, and nutraceutical segments are experiencing tighter margin pressures, compelling them to optimize formulation efficiency or reassess retail pricing. In response, industry associations and trade delegations are actively engaging with policymakers to advocate for tariff relief on sustainably sourced extracts, highlighting the importance of this natural ingredient to domestic wellness and pharmaceutical initiatives.

Uncovering Critical Segmentation Insights by Form, Ingredient Type, Distribution Channels, and Applications to Guide Positioning in Frankincense Extracts

A comprehensive segmentation lens reveals nuanced opportunities and challenges that vary by product form, ingredient type, distribution strategy, and end-use application. Within the form category, blended oils serve as versatile bases for aromatherapy and personal care, while pure essential oil maintains a premium position among high-end cosmetics brands, reflecting consumer willingness to invest in concentrated potency. Concurrently, resin powder has gained traction among dietary supplement developers, where encapsulation and microencapsulation techniques unlock new functional wellness claims.

Diving deeper, ingredient type delineates two distinct pathways: essential oil, prized for its fragrance profile and rapid absorption, and oleogum resin, favored for therapeutic modalities and sustained release in pharmaceutical formulations. This duality drives parallel research tracks and product roadmaps. Distribution channels present another layer of complexity; direct sales continue to nurture strong B2B relationships, particularly for custom bulk orders, whereas online ecosystems-spanning proprietary websites, major e-commerce platforms, and digital marketplaces-are expanding geographic reach and consumer convenience. Meanwhile, traditional retail remains vital: pharmacies uphold trust in medicinal-grade preparations, specialty shops curate artisanal blends, and supermarkets introduce entry-level variants to mainstream shoppers.

Finally, application-driven splits chart divergent growth arcs: aromatherapy remains foundational, with experiential diffusion in spas and wellness studios; cosmetics innovators embed extracts into hair care, makeup, and skin care systems; food and beverage developers integrate resin-derived flavor notes into beverages, confectioneries, and dietary supplements; and pharmaceutical researchers explore boswellic acid derivatives for anti-inflammatory and supportive therapeutic solutions. Together, these segmentation insights form a strategic roadmap for targeted product development and channel optimization.

This comprehensive research report categorizes the Frankincense Extracts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Ingredient Type

- Application

- Distribution Channel

Highlighting Distinct Regional Dynamics in the Americas, Europe, Middle East & Africa, and Asia-Pacific That Shape Frankincense Extracts Market Growth Drivers

Regional intricacies exert considerable influence on the adoption, regulation, and distribution of frankincense extracts, yielding distinct profiles across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, the narrative is shaped by robust consumer interest in clean-label and functional wellness products, driving import reliance and domestic formulation expertise. United States–based players are investing in clinical studies to substantiate health claims, while Canada emphasizes organic certification initiatives that resonate with environmentally conscious buyers.

Across Europe, Middle East & Africa, European Union regulations set stringent quality and safety standards, compelling suppliers to invest heavily in compliance testing and traceability measures. This region also benefits from proximity to historical production zones, fostering collaborative sustainability programs in the Horn of Africa and Arabia. In the Middle East, heritage and cultural affinity contribute to strong domestic demand, supplemented by export-ready processing hubs in the Gulf Cooperation Council countries.

In Asia-Pacific, rapid urbanization and rising discretionary incomes in China, India, and Southeast Asia have propelled demand for natural health ingredients in both traditional medicine contexts and contemporary consumer goods. Manufacturers are calibrating to local flavor profiles, melding indigenous wellness traditions with global trends. Government-led initiatives aimed at bolstering domestic essential oil processing capacity further underpin regional growth, while cross-border partnerships facilitate technology transfer and market access. Collectively, these regional dynamics underscore the importance of a tailored approach to product positioning and regulatory navigation.

This comprehensive research report examines key regions that drive the evolution of the Frankincense Extracts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Major Players’ Strategic Movements, Collaborations, and Innovation Approaches That Are Redefining Competitive Leadership in the Frankincense Extracts

Industry leadership within the frankincense extracts domain is defined by a combination of heritage expertise, technological innovation, and supply chain integration. Vertically integrated producers have secured competitive advantage by controlling every stage from sustainable resin harvesting to advanced extraction, enabling them to guarantee consistency and reduce exposure to tariff fluctuations. Simultaneously, specialized ingredient houses are forging strategic alliances with biotechnology firms to develop standardized formulations with enhanced bioactivity, targeting clinical and pharmaceutical applications.

Cosmetic and personal care conglomerates are investing in exclusive partnerships that deliver branded frankincense oil lines, leveraging trademarked sourcing origins for premium positioning. At the same time, emerging startups are disrupting traditional models by employing green extraction technologies such as supercritical CO2 and water-based distillation, minimizing solvent residues and ecological impact. Their agile structures allow rapid experimentation with novel product formats, from microemulsions to aerosol-free diffusers, capturing niche segments and driving broader adoption.

Mergers and acquisitions continue to reshape the ecosystem, as larger players integrate niche innovators to expand their application portfolios and geographic footprint. Cross-industry collaborations with food and beverage companies have yielded functional drinks and confections that foreground resin-derived wellness benefits, while joint ventures with pharmaceutical manufacturers are advancing clinical trials for boswellic acid–based interventions. Together, these strategic movements illustrate how a diverse set of actors is collectively elevating quality standards, broadening application horizons, and fortifying the competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Frankincense Extracts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aksu Vital Natural Products and Cosmetics Co., Ltd.

- Albert Vieille SAS

- AMEO GmbH & Co. KG (AMEO)

- AOS Products Private Limited

- Aromaaz International Pvt. Ltd.

- Avi Naturals Inc.

- De Monchy Aromatics Limited

- Derman Oil Ltd.

- doTERRA International, LLC

- Edens Garden, Inc.

- Herbo Nutra Private Limited

- Himalayan Herbaria, Inc.

- Indian Spice Oil Industries Pvt. Ltd.

- Mountain Rose Herbs, LLC

- Nature’s Sunshine Products, Inc.

- NOW Health Group, Inc.

- Plamed Green Science Group, Inc.

- Plant Therapy, Inc.

- Sabinsa Corporation

- Scents of Earth, LLC

- Shaanxi Jintai Biological Engineering Co., Ltd.

- Shaanxi Sinuote Biological Engineering Co., Ltd.

- Young Living Essential Oils, LC

Driving Future Growth Through Innovation, Sustainability, and Strategic Partnerships: Actionable Pathways for Leaders in Frankincense Extracts

To capitalize on prevailing trends and emerging opportunities, industry leaders should prioritize sustainable sourcing alliances that empower local harvesting communities and safeguard supply resilience. Establishing long-term procurement agreements coupled with community-driven agroforestry initiatives will not only secure consistent resin quality but also reinforce corporate responsibility narratives. Simultaneously, digital traceability solutions can elevate brand transparency, fostering consumer trust and enabling premium product differentiation.

Investments in targeted research and development are equally critical. By validating bioactive constituents through clinical and mechanistic studies, companies can substantiate health claims and unlock regulatory pathways for pharmaceutical-grade products. Tailoring extract formulations to specific end-use segments-whether high-purity essential oil for skincare or encapsulated resin powder for nutraceuticals-will further enhance market relevance. Complementing formulation work, firms should diversify distribution strategies, integrating proprietary direct-to-consumer channels with optimized online marketplaces, while maintaining visibility in pharmacies, specialty stores, and supermarkets.

Finally, proactive engagement with policymakers and trade organizations can mitigate tariff risks and influence favorable regulatory outcomes. Advocating for tariff exemptions on sustainably sourced extracts and harmonizing classification standards will reduce cost pressures and streamline cross-border trade. By combining these strategic initiatives-sustainability collaboration, R&D excellence, channel optimization, and policy advocacy-industry stakeholders can forge a resilient, innovation-driven future.

Elucidating the Rigorous Research Design, Data Collection Techniques, and Analytical Frameworks Underpinning Our Comprehensive Study on Frankincense Extracts

This research employed a robust, multi-faceted approach to capture the complexities of the global frankincense extracts sector. Extensive secondary research canvassed academic journals, botanical compendiums, regulatory filings, and trade databases to map historical trends and identify critical drivers. Simultaneously, primary interviews with resin harvesters in East Africa, essential oil distillers in the Middle East, and formulation experts in North America provided granular insights into production practices and supply chain dynamics.

Quantitative data points were triangulated across customs records, company disclosures, and sector-specific trade analytics, ensuring consistency and reliability. Qualitative case studies of flagship product launches highlighted successful integration of frankincense extracts in diverse end-use categories. To assess competitive intensity and regulatory headwinds, analytical frameworks such as PESTEL analysis and Porter’s Five Forces were systematically applied. Data integrity was maintained through iterative validation cycles with an expert panel comprising botanists, formulation chemists, and trade association representatives, who reviewed preliminary findings and contributed to refining interpretations.

Finally, this research synthesized these inputs through a structured framework, yielding actionable segmentation matrices, regional profiles, and thematic insights. Peer review by cross-functional specialists further enhanced the relevance and applicability of recommendations, ensuring that the final deliverable provides a comprehensive, evidence-based foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Frankincense Extracts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Frankincense Extracts Market, by Form

- Frankincense Extracts Market, by Ingredient Type

- Frankincense Extracts Market, by Application

- Frankincense Extracts Market, by Distribution Channel

- Frankincense Extracts Market, by Region

- Frankincense Extracts Market, by Group

- Frankincense Extracts Market, by Country

- United States Frankincense Extracts Market

- China Frankincense Extracts Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding Insights That Synthesize Market Evolution, Emerging Opportunities, and Strategic Imperatives to Empower Decision-Makers in Frankincense Extracts

The journey through the evolving frankincense extracts landscape highlights the enduring value of this botanical treasure, while underscoring the necessity of strategic agility and innovation. From the resurgence of consumer interest in clean-label, wellness-focused ingredients to the transformative effects of digital traceability and advanced extraction technologies, the industry has demonstrated remarkable resilience. At the same time, external factors such as the 2025 U.S. tariff measures have tested supply chain adaptability, prompting creative procurement and processing strategies that will continue to shape competitive dynamics.

Segmentation and regional analyses reveal that tailored approaches-whether optimizing formulations for aromatherapy, cosmetics, food and beverage, or pharmaceutical use-are essential for capturing value. Moreover, understanding the distinct regulatory landscapes and consumer preferences across the Americas, Europe, Middle East & Africa, and Asia-Pacific is critical for informed market entry and expansion plans. Leading companies that integrate sustainability, evidence-based validation, and omnichannel distribution are already setting the benchmark for excellence.

As market actors navigate these complexities, the insights presented in this report provide a clear roadmap for leveraging heritage, science, and strategic partnerships. By embracing data-driven decision-making and fostering collaborative initiatives across the value chain, stakeholders can unlock new growth horizons and cement frankincense extracts as a cornerstone of future natural ingredient innovations.

Take the Next Step Toward Unmatched Market Intelligence and Connect with Our Associate Director of Sales & Marketing to Secure Your Frankincense Extracts Report

For a deeper dive into the comprehensive analysis, exclusive data breakdowns, and actionable intelligence that can elevate your strategic planning and competitive positioning, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan will enable you to access the full report, which offers expert interpretation of evolving consumer demands, tariff implications, and segmentation opportunities across form, ingredient type, distribution channels, and applications. By securing this detailed resource, you will gain prioritized recommendations, regional nuances, and company benchmarking that can drive decisive action and sustainable growth. Don’t miss the opportunity to harness the insights that will shape the future of frankincense extracts within your organization’s portfolio and strategic roadmap. Contact Ketan today to obtain the full report and transform your market understanding into a powerful competitive advantage.

- How big is the Frankincense Extracts Market?

- What is the Frankincense Extracts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?