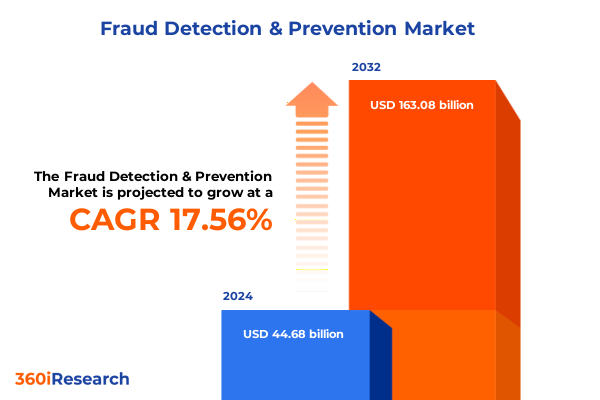

The Fraud Detection & Prevention Market size was estimated at USD 52.40 billion in 2025 and expected to reach USD 60.61 billion in 2026, at a CAGR of 17.60% to reach USD 163.08 billion by 2032.

Understanding the Complex and Rapidly Evolving Fraud Detection and Prevention Landscape Through a Comprehensive Executive Lens for Strategic Stakeholders

Organizations today are contending with an unprecedented acceleration of digital transactions that has concurrently expanded the attack surface for financial fraud. As consumers and businesses embrace mobile wallets, peer-to-peer payment applications, and embedded finance offerings, fraudsters have harnessed advanced machine learning algorithms, automation toolkits, and anonymizing technologies to execute more sophisticated schemes. Against this backdrop, executives across banking, insurance, retail, and technology sectors are faced with the dual mandate of safeguarding revenue and preserving customer trust while avoiding undue friction in the user experience.

Layered on top of evolving threat vectors is a complex and often fragmented regulatory environment. Data protection laws, risk-based authentication guidelines, and cross-border privacy mandates are increasingly shaping requirements for identity proofing and transaction monitoring. Legacy infrastructures that rely on siloed rule-based engines are struggling to keep pace with real-time demands, necessitating investments in modular architectures and cloud-enabled platforms that can ingest diverse data sources and adapt to new fraud patterns.

Against this dynamic context, this executive summary delivers strategic clarity on the forces reshaping the fraud detection and prevention landscape. It highlights transformative technological advancements, the quantitative and qualitative impacts of recent U.S. tariff policies, critical segmentation and regional adoption insights, and the competitive strategies of leading solution providers. By synthesizing expert interviews, secondary analyses, and rigorous data-validation processes, this report equips decision makers with the actionable intelligence needed to future-proof their fraud prevention initiatives.

Navigating Transformative Shifts Reshaping Fraud Detection and Prevention Strategies Amid Rapid Technological Advancements and Evolving Regulatory Frameworks

Over the past year and a half, the fraud prevention domain has experienced transformative shifts that are fundamentally redefining how organizations detect and mitigate risk. The most significant change has been the rapid pivot from traditional rule-based engines toward advanced machine learning and artificial intelligence capabilities that can dynamically learn and preempt novel attack patterns. This evolution is powered by the maturation of large-scale data lakes and real-time analytics platforms, which enable fraud teams to correlate events across disparate channels with unprecedented speed.

Simultaneously, identity verification has transcended one-size-fits-all approaches. Institutions are increasingly layering biometric modalities-such as facial recognition, behavioral analytics, and voice authentication-onto conventional knowledge-based methods. This multi-modal strategy is delivering higher levels of assurance while minimizing false positives, a balance that regulators have endorsed as part of risk-based authentication frameworks.

Another defining shift has been the emergence of orchestration platforms that unify authentication, risk scoring, transaction monitoring, chargeback management, and analytics into a cohesive workflow. These platforms leverage open APIs and microservices architectures, empowering enterprises to assemble best-of-breed components or adopt end-to-end suites based on evolving requirements. Furthermore, the integration of blockchain for secure data provenance is gaining traction, as it enables transparent audit trails without compromising sensitive customer information. These critical shifts underscore the imperative for agile, scalable architectures and deep collaboration across vendor ecosystems.

Assessing the Cumulative Impact of 2025 United States Tariffs on Fraud Detection Supply Chains Operational Costs and Industry Competitive Dynamics

In early 2025, newly enacted U.S. tariffs on semiconductor components, networking hardware, and certain software products began influencing the global supply chains that underpin fraud detection solutions. For organizations maintaining on-premise infrastructures, increased duties on chips and intermediary devices have translated into higher capital expenditures, prompting many to reevaluate their deployment strategies. This recalibration has led to an accelerated migration toward cloud-native platforms, where tariff exposure is minimized and operational expenditures follow predictable subscription models.

Solution providers, in response, are redesigning their market approaches. Several vendors have announced plans to relocate manufacturing facilities, diversify supplier bases, and increase the proportion of locally sourced components to circumvent punitive duties. These supply chain adjustments have ripple effects on implementation timelines and service delivery agreements, compelling enterprises to engage in early vendor lock-in discussions and to negotiate more flexible procurement terms.

Furthermore, professional services engagements related to system integration, customization, and change management are being repriced to accommodate elevated hardware costs. Conversely, managed service offerings are evolving to include hardware provisioning and lifecycle maintenance as bundled components, providing customers with turnkey solutions that shield them from the direct impact of tariff fluctuations. As industry stakeholders navigate this complex policy environment, the capacity to pivot sourcing strategies and collaborate closely with vendors has become a critical determinant of operational resilience.

Uncovering Critical Insights from Component-Based Services and Solutions Deployment Organization Size Technology and End Use Verticals in Fraud Prevention

Examining component dynamics reveals that solutions and services each offer unique value propositions for fraud prevention strategies. Services are subdivided into managed offerings, which deliver 24/7 threat monitoring and incident response, and professional services, which focus on strategic advisory, implementation, and customization. Contrastingly, solution portfolios are organized around discrete functional modules, including user authentication, chargeback management, advanced fraud analytics, identity verification, risk scoring, and real-time transaction monitoring, allowing organizations to adopt integrated suites or best-of-breed components based on risk appetite and architectural preferences.

Deployment considerations further differentiate market offerings. Cloud environments provide rapid scalability, lower upfront capital requirements, and built-in resilience against on-premise hardware tariffs, whereas on-premise deployments offer greater control over data residency and customization for highly regulated enterprises. Moreover, organizational size influences solution adoption patterns: large enterprises tend to leverage a combination of extensive in-house teams and external providers to manage complex multi-jurisdictional compliance needs, while small and medium enterprises often prioritize turnkey, subscription-based platforms that reduce internal resource demands.

Technological advancements also serve as a key segmentation axis, with organizations evaluating biometric authentication, blockchain-powered data provenance, identity management frameworks, machine learning-fueled decision engines, and rules-based filters in varying degrees. Finally, end-use verticals-from banking, financial services, and insurance to government, healthcare, IT and telecom, and retail and e-commerce-demonstrate distinct requirements. Each sector’s unique transaction volumes, regulatory mandates, and risk profiles shape preferences for specific technologies, deployment modes, and service models.

This comprehensive research report categorizes the Fraud Detection & Prevention market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Type

- Technology

- Organization Size

- End Use

Examining Regional Adoption Patterns and Market Evolution for Fraud Detection and Prevention Across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics in fraud detection and prevention exhibit pronounced divergences rooted in regulatory environments, infrastructure maturity, and cultural attitudes toward data privacy. In the Americas, North American institutions lead in adopting advanced analytics and AI-driven monitoring, leveraging high volumes of digital transactions to refine anomaly detection algorithms. Regulatory frameworks such as the California Consumer Privacy Act have spurred demand for privacy-preserving identity verification solutions, driving innovation in tokenization and encryption methodologies.

Across Europe, the Middle East, and Africa, a heterogeneous landscape emerges. Western European markets prioritize compliance with PSD2 regulations and the General Data Protection Regulation, resulting in widespread implementation of multi-factor authentication and risk-based transaction monitoring. In contrast, emerging economies within the region are increasingly embracing mobile-first fraud prevention tools, often coupled with managed services to offset local talent shortages. Meanwhile, the Middle East is experiencing rapid uptake of biometric enrollment programs, reflecting government-led initiatives to secure digital identities.

In Asia-Pacific, growth is propelled by the proliferation of super-apps and e-commerce ecosystems, which generate vast data streams for real-time fraud analytics. Countries such as Singapore and Australia have become regional hubs for cloud-native fraud prevention platforms, while high-growth markets like India and Indonesia are rapidly scaling identity verification deployments to support financial inclusion agendas. These regional nuances underscore the importance of tailoring solution portfolios and service models to local market conditions.

This comprehensive research report examines key regions that drive the evolution of the Fraud Detection & Prevention market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Corporate Innovators Propelling Fraud Detection and Prevention Advances Through Strategic Partnerships and Technological Breakthroughs

The competitive landscape in fraud prevention is anchored by established leaders and emerging innovators. Legacy technology firms have fortified their positions through strategic acquisitions, integrating advanced analytics and identity verification engines into their core offerings. Conversely, pure-play vendors have gained traction by delivering specialized modules for chargeback management, behavioral biometrics, and AI-driven risk scoring that can seamlessly integrate via open APIs into broader orchestration platforms.

Partnership ecosystems have become a critical battleground, with leading corporations forging alliances with cloud infrastructure providers to ensure global scalability and resiliency. At the same time, a wave of mergers and acquisitions is consolidating capabilities, as organizations seek to deliver end-to-end prevention suites rather than point solutions. Investment into research and development is heavily skewed toward expanding machine learning libraries, diversifying biometric modalities, and enhancing natural language processing for real-time alert triage.

In parallel, smaller disruptors are capturing niche segments by offering ultra-lightweight, developer-friendly SDKs that accelerate integration with mobile and web applications. These entrants are capitalizing on agile go-to-market strategies and consumption-based pricing to win business among digital-native companies. Collectively, these competitive dynamics are driving rapid innovation cycles, elevating customer expectations for seamless integration, customizable workflows, and measurable return on investment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fraud Detection & Prevention market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACI Worldwide, Inc.

- Akamai Technologies, Inc.

- BAE Systems PLC

- Cisco Systems, Inc.

- DXC Technology Company

- Experian Information Solutions, Inc.

- FICO

- Fiserv, Inc.

- International Business Machines Corporation

- LogRhythm, Inc.

- Micro Focus International plc

- NICE Ltd.

- Oracle Corporation

- Palo Alto Networks, Inc.

- RELX PLC

- RSA Security LLC

- SAS Institute Inc.

Delivering Actionable Recommendations for Industry Leaders to Enhance Fraud Prevention Postures and Accelerate Competitive Differentiation

To maintain a strategic advantage, industry leaders must adopt a proactive posture toward threat intelligence and operational resilience. First, enterprises should invest in unified fraud orchestration platforms that consolidate authentication, risk scoring, analytics, and chargeback management under a single pane of glass, fostering cross-functional visibility and reducing investigation times. This integrated approach enables security teams to pivot rapidly in response to emerging attack vectors and to apply predictive analytics to thwart advanced persistent threats.

Next, organizations must cultivate a diverse intelligence ecosystem by establishing partnerships with fintech disruptors, academic research institutions, and consortiums focused on shared threat databases. By contributing anonymized transactional datasets to collective knowledge bases, companies can benefit from broader pattern recognition without compromising customer privacy. In addition, deploying adaptive authentication journeys that dynamically adjust friction based on real‐time risk assessments will help strike the optimal balance between security and user experience.

Finally, senior executives should embed fraud prevention metrics into enterprise-wide performance dashboards, aligning security outcomes with corporate objectives such as revenue protection and customer retention. By eliminating silos between IT, risk management, and business units, organizations can ensure that fraud insights translate into actionable policy adjustments, budget reallocations, and targeted training programs. This holistic strategy will accelerate the journey from reactive incident response to preemptive fraud resilience.

Detailing a Rigorous Research Methodology Integrating Primary Expert Consultations Secondary Industry Publications and Quantitative Data Validation Processes

This research report employs a multi-tiered methodology designed to deliver rigorous, unbiased insights into the fraud detection and prevention market. Primary research components include structured interviews with over fifty senior executives, risk analysts, and technology architects across financial services, retail, telecommunications, and government agencies. These discussions provided qualitative perspectives on emerging threats, technology adoption drivers, and procurement criteria.

To complement primary findings, the study leverages an extensive review of secondary sources, including peer-reviewed journals, industry white papers, regulatory filings, and trusted news outlets. The analysis incorporates quantitative data gathered from financial disclosures and publicly available technology deployment statistics to validate thematic trends and ensure representativeness across geography and industry vertical.

Data validation processes are anchored by triangulation techniques, wherein insights from primary interviews are cross-referenced with secondary data and proprietary historical datasets to identify congruence and reconcile discrepancies. Quality control protocols, such as peer reviews by subject matter experts and consistency checks against established market benchmarks, further enhance the report’s credibility. This robust methodology underpins the executive recommendations and strategic insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fraud Detection & Prevention market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fraud Detection & Prevention Market, by Component

- Fraud Detection & Prevention Market, by Deployment Type

- Fraud Detection & Prevention Market, by Technology

- Fraud Detection & Prevention Market, by Organization Size

- Fraud Detection & Prevention Market, by End Use

- Fraud Detection & Prevention Market, by Region

- Fraud Detection & Prevention Market, by Group

- Fraud Detection & Prevention Market, by Country

- United States Fraud Detection & Prevention Market

- China Fraud Detection & Prevention Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Core Conclusions and Strategic Implications to Empower Decision Makers in Steering the Future of Fraud Detection and Prevention Initiatives

This executive summary captures the strategic inflection points shaping the fraud detection and prevention ecosystem. From the adoption of AI-driven analytics and multi-modal identity verification to the operational shifts prompted by U.S. tariff policies, the landscape is defined by rapid technological advancement and shifting regulatory imperatives. Segmentation analysis underscores the nuanced needs of organizations based on component preferences, deployment approaches, organizational scale, technology priorities, and end-use domains, while regional insights reveal heterogeneous adoption patterns across the Americas, EMEA, and Asia-Pacific.

Competitive profiling demonstrates a dynamic market where legacy leaders and agile disruptors vie for ascendency through partnerships, acquisitions, and relentless innovation. Against this backdrop, actionable recommendations emphasize the importance of unified orchestration platforms, collaborative threat intelligence consortia, adaptive authentication strategies, and executive-level integration of fraud metrics into corporate performance frameworks.

In today’s environment, reactive controls are insufficient. Organizations must transition toward preemptive resilience by leveraging predictive analytics, modular architectures, and strategic vendor ecosystems. By internalizing the insights and best practices outlined in this report, decision makers will be well positioned to transform fraud prevention from a defensive cost center into a proactive driver of customer trust, operational efficiency, and competitive differentiation.

Engaging with Ketan Rohom Associate Director of Sales and Marketing to Explore Tailored Fraud Prevention Insights and Acquire the Market Research Report

Ready to strengthen your organization’s fraud prevention capabilities? Connect with Ketan Rohom, Associate Director of Sales and Marketing, to explore how our comprehensive market research report can deliver tailored insights that address your unique challenges and strategic objectives. Gain direct access to in-depth analysis, competitive intelligence, and best-practice frameworks designed to inform your next generation of fraud detection initiatives. Reach out today to secure your copy of the report and embark on a data-driven journey toward more robust, adaptive, and cost-effective fraud prevention strategies.

- How big is the Fraud Detection & Prevention Market?

- What is the Fraud Detection & Prevention Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?