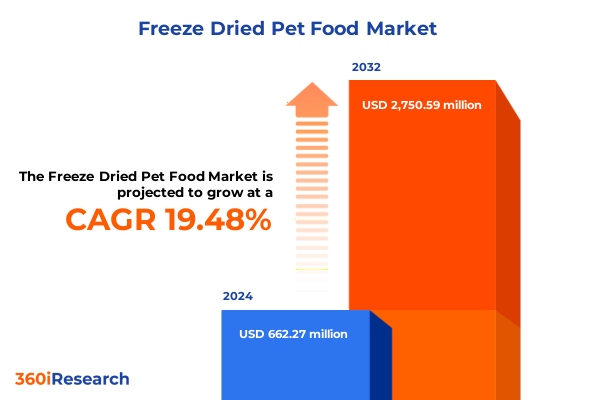

The Freeze Dried Pet Food Market size was estimated at USD 785.33 million in 2025 and expected to reach USD 936.37 million in 2026, at a CAGR of 19.60% to reach USD 2,750.58 million by 2032.

Unveiling the Evolution of Freeze Dried Pet Food as a Premium Nutritional Revolution Shaping Consumer Preferences and Pet Wellness Trends

Freeze dried pet food has emerged as a transformative force within the broader pet nutrition landscape offering unparalleled nutrient retention shelf stability and convenience for modern pet owners. Unlike traditional methods that rely on high heat or dehydration processes freeze drying preserves the structural integrity of proteins and retains essential vitamins and minerals through a gentle low-temperature sublimation technique. This distinctive approach caters to health-conscious pet caregivers seeking the premium quality of raw diets without the logistical challenges associated with refrigeration or short shelf life.

Driven by rising consumer awareness of pet wellness and an ongoing trend toward “human-grade” ingredients the freeze dried segment has experienced rapid acceptance. Pet owners balancing busy lifestyles are increasingly attracted to single-serve options that simplify feeding routines and reduce waste while delivering nutrient-dense bites that support optimal digestion coat health and immune function. Beyond the convenience factor the compatibility with e-commerce platforms and subscription services has further accelerated the distribution and adoption of freeze dried offerings across diverse markets.

As the market continues to mature manufacturers and brands are honing their value propositions through fortified formulations functional ingredients and transparent sourcing stories. These developments are defining the stage for competitive differentiation throughout the remaining sections of this summary.

Exploring Disruptive Advances in Production Technology Distribution Practices and Consumer Expectations That Are Reshaping Freeze Dried Pet Food Dynamics

Technological advancement has been at the heart of a profound transformation in freeze dried pet food production enabling greater scale efficiency and product diversity. Innovations in cycle optimization automation and real-time moisture monitoring have reduced processing time and energy consumption while ensuring consistent batch quality. Equally important is the evolution of freeze drying equipment from batch-centric models to continuous systems that can maintain optimal vacuum and temperature controls on a larger scale for both small boutique manufacturers and established pet food enterprises.

In parallel distribution practices are shifting from traditional brick-and-mortar retail toward omnichannel approaches that integrate direct-to-consumer e-commerce subscription services and strategic partnerships with veterinary clinics. This diversification allows brands to capture end consumers through personalized nutrition plans online communities and telehealth platforms while maintaining presence in high-traffic pet specialty environments. The seamless interplay between digital and in-person channels is reshaping how new product launches and consumer education take place.

Consumer expectations have also matured beyond basic nutrition to demand transparency around ingredient provenance sustainability credentials and functional benefits. Today’s pet owners expect traceability from farm to bowl employ eco-friendly packaging solutions and seek formulations tailored to life stage activity level and breed-specific requirements. These converging technological distribution and consumer dynamics are driving unprecedented innovation across the freeze dried segment.

Analyzing the Cumulative Toll of 2025 United States Tariffs on Raw Material Sourcing Manufacturing Costs and Supply Chain Resilience

In 2025 the implementation of heightened United States tariffs on imported raw ingredients has exerted significant pressure across the freeze dried pet food supply chain. Materials such as specialized proteins novel fruits and vegetables which previously offered cost-effective nutritional variety have become more expensive thereby forcing manufacturers to reassess sourcing strategies. As a result many brands have encountered volumetric cost increases that necessitate price adjustments or the introduction of value-engineered portfolios to maintain competitive positioning.

Raw material sourcing has seen a marked shift toward regional suppliers and domestic production facilities in an effort to mitigate tariff exposure and secure consistent supply. This geographic diversification has delivered benefits in lead time reduction and logistical resilience yet often entails higher base costs and complex quality assurance protocols. Companies have begun to negotiate multi-year contracts with key suppliers and invest in proprietary supply chain digitization tools to forecast demand accurately and optimize inventory buffers against future tariff fluctuations.

On the manufacturing front the cumulative cost impact has spurred investments in process efficiency improvements including enhanced freeze dryer throughput and energy recovery systems. Brands are exploring co-manufacturing partnerships and shared service models to spread capital expenditures and lower per-unit production costs. These strategies not only counterbalance the tariff-related expenses but also support scalability and flexible capacity management in response to evolving market demand.

Supply chain resilience has become a core organizational competency as firms implement advanced trade compliance frameworks and dual-shoring initiatives. By combining alternative trade routes with dynamic tariff engineering and proactive inventory placement companies are better equipped to navigate future policy changes and maintain seamless operations.

Revealing Segmentation Nuances Across Animal Types Packaging Formats Product Forms and Distribution Channels Driving Tailored Strategies

When viewed through the lens of animal type segmentation the freeze dried pet food market reveals distinct consumption patterns between cat and dog owners. Cat food formulations are segmented into adult kitten and senior variations each emphasizing tailored protein levels and micronutrient blends to support growth maintenance or age-related joint health. Conversely dog food extends to adult puppy and senior segments with a strong focus on digestive health probiotics and joint mobility ingredients which reflect the nuanced nutritional requirements of each life stage.

Packaging formats play a critical role in shaping purchasing decisions and consumption behaviors. Bulk offerings serve multi-pet households seeking cost efficiencies while pouch formats appeal to convenience-driven purchasers who value resealable freshness. Single-serve packaging has gained momentum among travelers and urban consumers by delivering precise daily portions that eliminate spoilage and overfeeding concerns. Tray packaging further differentiates on the basis of portion control and premium positioning often commanding higher price points in premium retail outlets.

The variety of product forms including chips flakes and pourable crumble influences both user experience and formulation development. Chips provide a textural appeal akin to traditional kibble yet maintain the functional benefits of freeze drying. Flakes allow for creative mixing with wet or dry diets enhancing palatability and visual appeal. Pourable crumble offers the ultimate in convenience enabling pet owners to sprinkle nutrition boosts atop meals or through treat dispensing toys with minimal mess and maximum flexibility.

Distribution channel segmentation spans online retail pet specialty stores supermarkets hypermarkets and veterinary clinics each presenting unique growth drivers. E-commerce platforms capitalize on subscription models and targeted digital marketing while specialty retailers leverage expert advisory services that build trust. Supermarkets and hypermarkets deliver mass-market reach and promotional visibility for new product trials and veterinary clinics offer clinical endorsements that reinforce premium quality claims and support higher price tiers.

This comprehensive research report categorizes the Freeze Dried Pet Food market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Animal Type

- Packaging

- Distribution Channel

Highlighting Regional Dynamics and Growth Drivers in the Americas Europe Middle East Africa and Asia Pacific for Freeze Dried Pet Food

In the Americas the freeze dried segment benefits from a mature pet ownership culture and strong discretionary spending. The United States leads with high per capita consumption driven by premiumization trends and robust e-commerce infrastructure. Canada follows closely fueled by pet humanization and health-conscious consumer segments. Latin American markets are emerging with younger urban pet populations that demonstrate growing interest in advanced nutrition but remain sensitive to price-performance trade-offs.

Europe Middle East and Africa exhibit diverse regional characteristics within the freeze dried category. Western Europe hosts sophisticated demand underpinned by stringent nutritional and safety regulations with Germany France and the United Kingdom leading innovation adoption. The Middle East shows accelerated growth in premium pet care services and high-income urban centers while Africa remains nascent but gradually developing through expanding pet clinic networks and increasing awareness of pet wellness among affluent consumers.

Asia Pacific represents the fastest-growing region as rapid urbanization rising disposable incomes and evolving lifestyles drive pet ownership across China Japan South Korea and Australia. Growing awareness of pet health has triggered a shift from commodity pet food toward niche freeze dried offerings. Regulatory alignment with international safety standards along with expanding modern trade channels and digital marketplaces is further accelerating adoption across the region.

This comprehensive research report examines key regions that drive the evolution of the Freeze Dried Pet Food market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Competitive Strategies Innovations and Partnerships Among Leading Companies in the Freeze Dried Pet Food Sphere

Leading companies in the freeze dried pet food space are distinguished by their commitments to ingredient transparency innovative formulations and strategic brand positioning. The Honest Kitchen has championed human-grade processing and single-ingredient recipes that resonate deeply with pet owners seeking clean-label solutions. Primal Pet Foods leverages its raw diet heritage to deliver nutrient-dense blends while Stella & Chewy’s captures market share through targeted flavor innovations and holistic wellness claims.

Strategic partnerships and acquisitions have also shaped the competitive landscape as established pet food conglomerates enter the segment to expand premium portfolios. Several brands have embraced joint ventures with specialized co-manufacturers to accelerate product launch timelines and reduce capital intensity. Meanwhile private label entrants backed by large-scale retailers have introduced value-driven freeze dried lines, intensifying price competition and encouraging brands to double down on differentiation through functional benefits and sustainability credentials.

Innovation remains a core competitive lever with companies investing in new ingredient ecosystems such as novel proteins exotic botanicals and advanced nutraceutical additives. Sustainability initiatives spanning recyclable packaging renewable energy use and ethical sourcing further distinguish market leaders that aim to align their supply chain practices with rising consumer environmental expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Freeze Dried Pet Food market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Answers Pet Food, Inc.

- Bravo Pet Foods, LLC

- Frozen to Fresh Pet Foods, Inc.

- Grandma Lucy’s, LLC

- K9 Natural Ltd.

- Merrick Pet Care, Inc.

- Nature's Variety, Inc.

- Northwest Naturals, LLC

- Primal Pet Foods LLC

- Regal Pet LLC

- Stella & Chewy's LLC

- The Honest Kitchen, Inc.

- Vital Essentials, LLC

- ZIWI Limited

- Ziwipeak Limited

Formulating Impactful Actionable Recommendations for Industry Leaders to Capitalize on Evolving Consumer Trends and Operational Efficiencies

Industry leaders are advised to refine product portfolios by aligning formulations with emerging functional trends such as digestive health immune support and joint mobility. A robust research and development pipeline that integrates cutting-edge ingredient science will facilitate the launch of differentiated offerings that command premium positioning. Concurrently, brands should evaluate each life stage and species segment to identify underpenetrated opportunities and address specific nutritional gaps.

Strengthening digital channels remains critical as direct-to-consumer e-commerce and subscription services continue to capture substantial market share. Deploying data-driven marketing tactics that leverage first-party consumer insights and predictive analytics will enhance customer acquisition and retention efforts. Personalized nutrition recommendations and loyalty programs can further cement brand relationships by offering tailored feeding solutions and incentivizing repeat purchases.

Enhancing supply chain resilience through strategic supplier diversification nearshoring initiatives and dynamic inventory management will mitigate exposure to external shocks such as tariffs or geopolitical disruptions. Collaboration with logistics partners to optimize warehousing and last-mile delivery can reduce lead times and improve order fulfillment reliability. Finally adopting sustainable packaging innovations such as compostable films and refillable systems will resonate with eco-conscious consumers and contribute to long-term brand equity.

Detailing a Robust Research Methodology Combining Primary Expert Interviews Data Triangulation and Comprehensive Secondary Analysis

This research combined a comprehensive secondary review of industry publications regulatory filings and reputable trade journals to establish a foundational understanding of the freeze dried pet food landscape. Key performance indicators regulatory shifts and competitor activities were synthesized to inform an analytical framework. In addition quantitative data from import export databases and customs records provided clarity on material flows and cost structures.

Primary research was conducted through in-depth interviews with industry experts that spanned senior leaders at manufacturing firms ingredient suppliers channel distributors and veterinary nutritionists. These interviews delivered nuanced perspectives on operational challenges emerging consumer behaviors and strategic priorities that underpin forward-looking market dynamics.

The findings from both primary and secondary sources were triangulated through cross-validation techniques to ensure consistency and reliability. Qualitative themes were coded and integrated with quantitative trends to create a robust narrative. Statistical analysis of historical data points provided contextual grounding for tariff impact assessments and regional growth projections.

A rigorous peer review process involving independent subject matter experts was employed to refine key takeaways and validate methodological assumptions. Quality assurance checks at each stage of research execution ensure the highest level of accuracy and objectivity in the final analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Freeze Dried Pet Food market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Freeze Dried Pet Food Market, by Product Form

- Freeze Dried Pet Food Market, by Animal Type

- Freeze Dried Pet Food Market, by Packaging

- Freeze Dried Pet Food Market, by Distribution Channel

- Freeze Dried Pet Food Market, by Region

- Freeze Dried Pet Food Market, by Group

- Freeze Dried Pet Food Market, by Country

- United States Freeze Dried Pet Food Market

- China Freeze Dried Pet Food Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Insights and Strategic Imperatives to Guide Stakeholders in Navigating the Competitive Freeze Dried Pet Food Landscape

The freeze dried pet food market is undergoing rapid evolution driven by innovative production technologies shifting distribution paradigms and heightened consumer expectations for premium, functional nutrition. At the same time United States tariffs introduced in 2025 have reshaped sourcing strategies and reinforced the importance of supply chain resilience across every segment and region.

Segment-specific dynamics underscore the need for tailored approaches in animal type packaging format product form and distribution channel strategies. Regional insights reveal that while the Americas and Europe Middle East Africa exhibit maturity and demand for clean-label premiumization, Asia Pacific is poised for the most accelerated growth as pet ownership rises and modern trade infrastructures expand.

To thrive in this competitive environment stakeholders must prioritize product differentiation through R&D investments, strengthen digital and direct-to-consumer channels, and fortify supply chains against external shocks. Sustainability credentials and transparent communication will remain vital differentiators that build consumer trust and loyalty.

By leveraging the strategic recommendations and rigorous research methodologies outlined in this report decision-makers will be well-equipped to capitalize on emerging opportunities and navigate the complexities of the freeze dried pet food landscape with confidence.

Seize Competitive Advantage Today by Partnering with Ketan Rohom to Gain Exclusive Access to the Comprehensive Freeze Dried Pet Food Market Intelligence

To explore the full insights and unlock strategic opportunities in the freeze dried pet food market we invite you to connect with Ketan Rohom Associate Director Sales & Marketing at 360iResearch to acquire your copy of the comprehensive market research report and discuss tailored solutions for your organization’s growth aspirations

- How big is the Freeze Dried Pet Food Market?

- What is the Freeze Dried Pet Food Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?