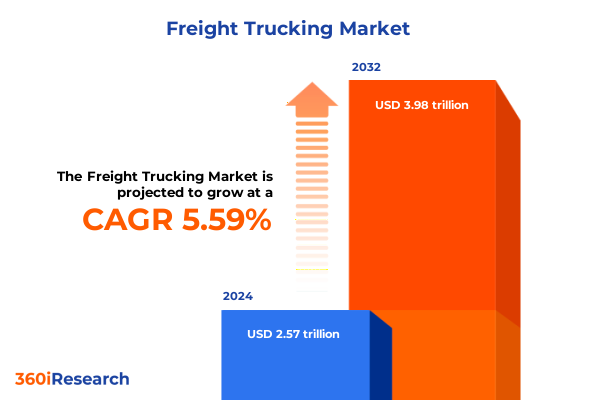

The Freight Trucking Market size was estimated at USD 1.68 trillion in 2025 and expected to reach USD 1.78 trillion in 2026, at a CAGR of 6.64% to reach USD 2.63 trillion by 2032.

Unveiling the Dynamic Forces Shaping the Freight Trucking Sector and Its Critical Role in United States Commerce and Supply Chain Efficiency

The freight trucking sector functions as the backbone of domestic commerce, moving billions of dollars’ worth of goods across diverse geographies every day. Its operational complexity spans end-to-end supply chains, requiring seamless coordination among shippers, carriers, regulators, and infrastructure providers. As demand volumes grow and customer expectations for faster, more transparent deliveries intensify, the industry is compelled to balance efficiency with resilience. In recent years, geopolitical developments and fluctuating fuel prices have added layers of uncertainty, elevating the strategic importance of data-driven decision making and adaptive network design.

Against this backdrop, carriers and third-party logistics providers are investing heavily in digital platforms, real-time telematics, and advanced analytics to enhance route optimization and predictive maintenance. At the same time, capacity constraints driven by widespread driver shortages and uneven infrastructure investments continue to strain transit corridors. These dynamics underscore the dual imperative of scaling operational excellence while fortifying the system against shocks. This introduction outlines the critical forces at play and sets the stage for a deep dive into transformative shifts, regulatory impacts, segmentation insights, regional dynamics, and strategic imperatives that define today’s freight trucking landscape.

Navigating Rapid Technological Innovations and Evolving Market Demands Transforming the United States Freight Trucking Landscape

An accelerated wave of technological innovation is redefining the freight trucking landscape, transforming legacy operating models and enhancing end-to-end visibility. Artificial intelligence algorithms now support dynamic routing adjustments in response to real-time traffic and weather disruptions, while blockchain pilots are streamlining paperwork by automating compliance protocols and proof-of-delivery records. Concurrently, telematics platforms capture granular engine performance and driver behavior data, triggering proactive maintenance alerts to minimize unplanned downtime and optimize fleet utilization.

Beyond digital technologies, the rise of e-commerce and consumer expectations for rapid, traceable deliveries has spurred growth across urban drayage networks and regional parcel hubs. This surge is complemented by expanding intermodal exchanges, where carriers leverage rail corridors to mitigate long haul costs and reduce carbon footprints. Indeed, decarbonization strategies have emerged as a critical transformative shift, with leading fleets piloting electric trucks on short haul routes and investing in aerodynamic trailers to boost fuel efficiency on long hauls. As the industry grapples with regulatory pressures to curb emissions, these sustainability initiatives are expected to converge with digital investments.

Meanwhile, the lingering effects of global supply chain disruptions have driven carriers to diversify network designs and forge strategic partnerships. Vertical integration efforts, such as direct contracts with major shippers and collaborative fulfillment centers, are reshaping traditional asset-light business models. Ultimately, these intertwined technological and market shifts are propelling the freight trucking sector toward a more interconnected, data-centric, and environmentally conscious future.

Assessing the Broad Economic Consequences of 2025 United States Tariff Measures on Raw Materials Equipment and Freight Costs

In 2025, the cumulative impact of United States tariff policies continues to reverberate across the freight trucking ecosystem, influencing both operational costs and supply chain decisions. Section 232 levies on steel and aluminum imports, enacted earlier in the decade, have driven up the cost of trailers, chassis, and structural components, prompting carriers to extend equipment lifecycles and recalibrate maintenance schedules. These higher capital expenditures, in turn, affect fleet renewal strategies and accelerate discussions around alternative materials and design innovations.

Simultaneously, Section 301 tariffs on key consumer and industrial imports have altered freight lanes and demand flows. Shippers sourcing machinery and parts from tariffed regions face extended lead times, requiring freight carriers to revisit network density and inventory positioning. This recalibration has shifted volumes toward domestic fabrication hubs and nearshore suppliers, boosting demand for regional and local trucking services while moderating long haul traffic on transcontinental routes. As equipment manufacturers adapt their supply chains, carriers must maintain flexibility across service offerings and leverage intermodal connectors to manage cost pass-through.

Transitionally, the uncertainty surrounding potential adjustments to tariff rates and trade negotiations underscores the need for scenario-based planning. Freight trucking operators increasingly rely on predictive analytics to model cost exposure under varying trade policy outcomes and to identify hedging mechanisms, such as fuel surcharges and dedicated contract escalators. As regulatory shifts persist, the ability to transform tariff headwinds into strategic planning inputs becomes a core competency for industry leaders.

Revealing Critical Service Equipment and Customer Segmentation Patterns Driving Strategic Opportunities in United States Freight Trucking

The United States freight trucking market reveals differentiated dynamics when viewed through the prism of service type segmentation. Full truckload operations command dedicated capacity, moving large-scale shipments directly from origin to destination. In contrast, intermodal offerings harness rail-to-truck transitions that optimize cost and carbon footprint for long haul corridors. Less than truckload networks bridge the gap between parcel and full loads, with expedited services meeting time-critical needs and standard consolidation balancing cost pressures for less urgent consignments.

Equipment type introduces another layer of complexity, as dry van trailers handle the bulk of general freight, while flatbed options serve oversized or irregular cargo. Refrigerated fleets address the growing cold chain, subdivided into single temperature trailers for uniform perishables and multi temperature units that accommodate mixed-load configurations. The ability to match temperature profiles to specific cargo requirements drives margin optimization and customer satisfaction.

Distance segmentation shapes operational strategies across the local, regional, and long haul spectrum. Urban drayage and last mile dispatchers focus on dense city centers and rapid turns, whereas regional carriers traverse intra-state and neighboring state corridors to balance frequency with operational cost. Long haul fleets span cross country lanes, emphasizing driver retention programs and equipment reliability to manage multi-day runs.

End users further diversify demand patterns, from automotive manufacturers requiring just-in-time parts streams and chemical distributors bound by stringent safety protocols to food and beverage operators safeguarding perishable integrity, industrial sectors handling large machinery, and retail chains orchestrating high-frequency restocking. Ownership models also influence market positioning, distinguishing asset based carriers that manage proprietary tractors and trailers from non asset based intermediaries. These intermediaries either broker capacity through dynamic load boards or orchestrate cross border shipments as freight forwarders. Together, these segmentation insights illuminate how service mix, equipment choices, distance profiles, end user applications, and ownership structures converge to create specialized competitive arenas.

This comprehensive research report categorizes the Freight Trucking market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Equipment Type

- Operation Model

- Haul Distance

- End-Use Industry

- Booking Channel

Examining Regional Demand Profiles Regulatory Frameworks and Infrastructure Dynamics Shaping Freight Trucking across Major Global Markets

The Americas region continues to anchor global freight trucking demand, bolstered by an extensive interstate highway network and concentrated manufacturing hubs. In North America, infrastructure investments in border facilities and trucking-friendly trade agreements support robust cross-border flows between the United States, Canada, and Mexico, while Latin America’s growing e-commerce penetration fuels demand for last mile distribution and cold chain networks in major urban centers. Regulatory modernization efforts, such as harmonized electronic logging device standards and emissions rules, further streamline transnational trucking.

Across Europe, Middle East, and Africa, established trade corridors link high-density economic zones, but operators face diverse regulatory landscapes and tariff complexities. In the European Union, cabotage rules and driver working time limits shape capacity allocation, prompting carriers to adopt agile network strategies. The Middle East’s expanding port infrastructure and free trade zones accelerate freight volumes across Gulf Cooperation Council states, while Africa’s emerging corridors present both growth potential and infrastructure constraints that spur local partnerships.

In the Asia-Pacific, rapid industrialization and an uptick in nearshoring initiatives are generating new long haul and intermodal opportunities. Southeast Asia’s port-to-door logistics model benefits from expanding container fleets, necessitating integrated trucking fleets for feeder services. Australia’s vast span and sparse population require a focus on driver retention and equipment uptime for cross-state runs, and the region’s increasing emphasis on sustainability encourages trials of electric and hydrogen-powered trucks. Each region’s unique blend of demand drivers, regulatory frameworks, and infrastructure capacity informs tailored market entry and expansion strategies.

This comprehensive research report examines key regions that drive the evolution of the Freight Trucking market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Logistics Providers and Their Innovative Strategic Initiatives That Are Reshaping the Competitive Freight Trucking Industry Landscape

Leading logistics providers are deploying digital platforms and ecosystem partnerships to sustain competitive advantages. Major carriers have accelerated investments in telematics and machine learning to predict maintenance needs and to dynamically optimize load planning. Several providers have expanded asset light models by integrating brokerage services with proprietary lanes, enabling them to maintain asset utilization while offering flexible capacity.

Fleet modernization initiatives have emerged as another common theme, with forward-looking operators investing in electric and alternative fuel vehicles to test zero-emission corridors and to pre-position for forthcoming environmental regulations. Concurrently, collaborations with technology startups have introduced innovations such as platooning solutions to improve highway efficiency and to enhance driver safety on long haul routes. These strategic alliances provide incumbents with rapid access to emerging capabilities without the burden of full in-house development.

In parallel, customer centricity drives differentiated service models. Providers are embedding digital shipment tracking portals with predictive ETA features and algorithmic exception alerts, enabling shippers to proactively manage inventory and to reduce stock-outs. Third-party providers further distinguish themselves through specialized offerings tailored to vertical markets, such as temperature-controlled pharmaceutical transport and oversize industrial load handling. By aligning value propositions with evolving shipper requirements, these companies are reshaping traditional freight trucking boundaries and setting new benchmarks for integrated logistics solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Freight Trucking market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- United Parcel Service, Inc.

- DHL Group

- FedEx Corporation

- J.B. Hunt Transport Services, Inc.

- XPO, Inc.

- Kuehne + Nagel Group

- Estes Express Lines

- Total Quality Logistics, LLC

- Old Dominion Freight Line, Inc.

- DSV A/S

- Schneider National, Inc.

- ArcBest Corporation

- Averitt Express Inc.

- BlackRock Group

- CEVA Logistics by CMA CGM Group

- Day & Ross Inc.

- Flock Freight, Inc.

- Hub Group, Inc.

- Kerry Logistics Network Limited

- KLN Logistics Group Limited

- Knight-Swift Transportation Holdings Inc.

- Landstar Systems Inc.

- Lineage, Inc.

- Nippon Express Holdings, Inc.

- Penske Logistics

- R+L Carriers, Inc.

- Ryder System, Inc.

- Saia Inc.

- Schenker AG

- TCI Group

- Toll Holdings Limited

- Werner Enterprises, Inc.

Empowering Industry Leaders with Practical Strategies for Digital Innovation Flexibility and Resilience in Freight Trucking Operations

Industry leaders must embrace a multi-pronged strategy that prioritizes digital transformation alongside operational resilience. They should first establish integrated data architectures that collect real-time telematics, customer orders, and regulatory updates into unified analytics platforms. This foundation enables advanced routing algorithms and predictive maintenance modules, reducing empty miles and minimizing unplanned downtime.

Furthermore, carriers need to cultivate flexible workforce models by enhancing driver training programs, offering retention incentives, and exploring autonomous vehicle pilots for corridors where regulatory conditions permit. Simultaneously, investing in alternative fuel infrastructure and electrified fleets will prepare operations for stricter emissions standards, while reinforcing commitments to corporate sustainability.

To mitigate tariff risks, logistics executives should incorporate scenario planning into contractual frameworks, embedding dynamic surcharge mechanisms that preserve margin integrity when input costs fluctuate. They should also explore nearshoring partnerships and intermodal collaborations that diversify supply chains and reduce reliance on single trade lanes. By executing these tactical measures in concert, freight trucking organizations can fortify their competitive position, drive cost efficiencies, and deliver elevated service levels in an increasingly volatile market.

Detailing the Robust Multi-Source Methodological Framework Guiding Comprehensive and Transparent Freight Trucking Market Analysis

This research study integrates both primary and secondary data sources to ensure comprehensive market analysis. Primary inputs derive from in-depth interviews with senior executives across carrier organizations, shippers, industry associations, and regulatory bodies, providing qualitative perspectives on emerging trends and strategic priorities. In parallel, a structured survey of fleet operators and third-party providers quantifies operational practices, technology adoption rates, and investment outlooks across service and equipment categories.

Secondary research encompasses a thorough review of trade publications, regulatory filings, infrastructure development reports, and proprietary databases tracking freight volumes and transportation costs. Publicly available government statistics inform baseline metrics for freight flows, vehicle miles traveled, and industry workforce demographics. All data points are triangulated using a bottom-up approach, validating findings through multiple sources and reconciling any discrepancies.

Advanced analytical techniques, including scenario modeling and sensitivity analysis, underpin the assessment of regulatory impacts and competitive dynamics. The combined methodology fosters transparency and reliability, ensuring that the resulting insights can confidently inform strategic decisions and operational planning for freight trucking stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Freight Trucking market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Freight Trucking Market, by Service Type

- Freight Trucking Market, by Equipment Type

- Freight Trucking Market, by Operation Model

- Freight Trucking Market, by Haul Distance

- Freight Trucking Market, by End-Use Industry

- Freight Trucking Market, by Booking Channel

- Freight Trucking Market, by Region

- Freight Trucking Market, by Group

- Freight Trucking Market, by Country

- United States Freight Trucking Market

- China Freight Trucking Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Summarizing the Strategic Imperatives and Market Dynamics That Will Define Success in the Future Freight Trucking Ecosystem

The freight trucking market today sits at the intersection of technological ingenuity, regulatory complexity, and evolving customer demands. Carriers that master data-driven operations will outpace peers by optimizing asset utilization, anticipating disruptions, and tailoring service offerings to specific shipper needs. At the same time, proactive strategies to navigate tariff regimes and to adopt sustainable fleet innovations will define competitive resilience.

Segmentation analysis highlights the importance of aligning service portfolios and equipment configurations with targeted end user requirements, whether that involves expedited less than truckload shipments for time-sensitive freight or multi temperature refrigerated units for perishable goods. Regional assessments further underscore that infrastructure quality and regulatory environments vary widely, requiring localized network strategies.

As the industry continues to evolve, success will favor organizations that maintain strategic agility, leverage partnerships to broaden capabilities, and embed continuous improvement into their operational DNA. By synthesizing these imperatives, stakeholders can chart a course toward enhanced profitability, reduced environmental impact, and superior customer experiences that will sustain the future freight trucking ecosystem.

Take Action Now to Secure Expert Insights and Drive Your Business Forward by Accessing the Comprehensive Freight Trucking Market Research Report

For tailored insights and strategic depth that empower your organization to navigate the rapidly evolving freight trucking environment with confidence, secure exclusive access to this comprehensive market research report. The analysis provides a meticulous exploration of technological advancements, regulatory impacts, and segmentation nuances, enabling you to benchmark performance and identify high-value opportunities. With detailed profiles of leading carriers and actionable recommendations grounded in robust methodology, your leadership team can make informed decisions that optimize operations and drive sustainable growth. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to discuss your specific research requirements, unlock custom data slices, and obtain package options that align with your organizational objectives. Take the next step today to transform market intelligence into competitive advantage and future-proof your freight trucking strategy.

- How big is the Freight Trucking Market?

- What is the Freight Trucking Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?