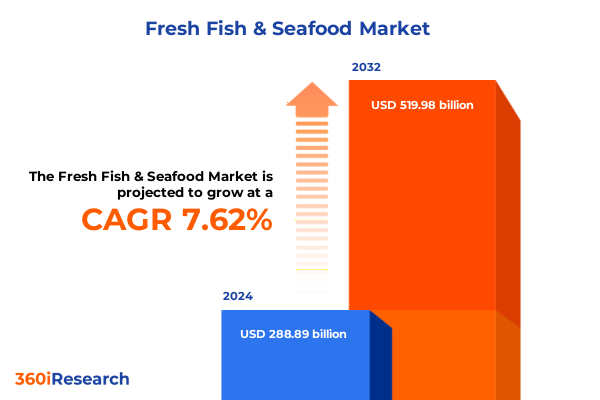

The Fresh Fish & Seafood Market size was estimated at USD 309.98 billion in 2025 and expected to reach USD 332.83 billion in 2026, at a CAGR of 7.66% to reach USD 519.98 billion by 2032.

Introducing the Dynamic World of Fresh Fish and Seafood: Understanding Market Drivers, Consumer Preferences, and Emerging Opportunities in 2025

The fresh fish and seafood sector is undergoing a pivotal transformation driven by evolving consumer expectations, heightened environmental awareness, and rapid technological innovation. In recent years, health-conscious lifestyles have fueled demand for nutrient-rich protein sources, positioning seafood as a central component of balanced diets. Simultaneously, sustainability considerations-ranging from carbon footprints in fishing operations to bycatch reduction measures-have ascended to the forefront of both regulatory scrutiny and consumer purchase criteria. Market participants are thus compelled to integrate robust traceability solutions and certification frameworks to build trust with end-users and mitigate compliance risks.

Beyond end-consumer preferences, the shifting dynamics of global supply chains have introduced new complexities in procurement and distribution. Geopolitical factors, logistical constraints, and unexpected disruptions, such as port congestion or climate-induced weather events, are influencing route optimization and cost management strategies. Against this backdrop, industry stakeholders are prioritizing agile operations, embracing digital platforms for real-time data on vessel tracking and cold-chain integrity. This introduction lays the foundation for a deeper exploration of how market drivers, competitive forces, and innovation pathways are converging to redefine the fresh fish and seafood landscape.

Navigating Transformative Shifts in Fresh Fish and Seafood: Technological Innovations, Sustainability Initiatives, and Evolving Consumer Behaviors in the Sector

The landscape of fresh fish and seafood is evolving at unprecedented speed as disruptive forces reshape traditional paradigms. Innovations in aquaculture, such as offshore farming systems and recirculating aquaculture technologies, are expanding production capacity while reducing environmental impact. Concurrently, blockchain-enabled traceability platforms are gaining traction, offering immutable records from Catch to Counter and fortifying consumer confidence. These digital interventions are complemented by advanced processing equipment that maximizes yield, minimizes waste, and supports just-in-time delivery models.

Meanwhile, sustainability initiatives have become more than a regulatory checkbox; they represent a strategic differentiator. Companies are forging partnerships with certification bodies and investing in regenerative practices to ensure healthy marine ecosystems. On the consumer front, heightened awareness around microplastics and responsible sourcing is driving retailers to curate selections that celebrate coastal communities and traditional fishing methods. This shift is fostering new marketing narratives centered on provenance and ethical stewardship. Taken together, these technological and cultural currents are propelling the fresh fish and seafood market toward a more transparent, resilient, and consumer-centric future.

Assessing the Collective Impact of United States Tariffs on Fresh Fish and Seafood Imports in 2025: Trade Dynamics, Cost Structures, and Market Adaptations

The implementation of new United States tariffs in 2025 has yielded profound and multifaceted effects on the fresh fish and seafood supply chain. Elevated duties on key imports have prompted importers to reassess sourcing strategies, resulting in increased emphasis on regional suppliers in the Americas and accelerated development of domestic aquaculture operations. While this diversification reduces exposure to tariff volatility, it introduces challenges related to capacity, seasonality, and species availability. Consequently, procurement teams are balancing cost pressures with quality and reliability considerations in novel ways.

On a pricing level, consumers have experienced modest increases at the retail and food-service counters, compelling operators to innovate menus and renegotiate supplier agreements. In reaction, some distributors are offering dynamic menu pricing tools to maintain margin thresholds without compromising value perceptions. Additionally, governmental incentives and public-private partnerships aimed at bolstering U.S. aquaculture have begun to offset capital outlays for farmers seeking to expand or modernize facilities. As stakeholders adapt to these trade policy shifts, the market is witnessing a reorientation toward integrated supply networks that marry import flexibility with growing local production capabilities.

Unraveling Key Segmentation Insights Across Species Varieties, Product Forms, Distribution Channels, and Packaging Types in Fresh Fish and Seafood Market

A nuanced understanding of segmentation reveals divergent opportunities and challenges across species categories, product forms, distribution pathways, and packaging solutions. Species segmentation spans from cod varieties, including Atlantic and Pacific cod, to salmon selections featuring Atlantic salmon and Pacific salmon. Shrimp offerings encompass both tiger shrimp and whiteleg shrimp, while tuna assortments incorporate albacore, skipjack, and yellowfin variants, each commanding unique consumer and culinary applications. Product form differentiation is equally critical, with traditional fillets, minced preparations, precision-cut portions, steaks, and whole fish formats aligning with diverse end-user needs from home kitchens to industrial processors.

Distribution channels further influence market dynamics, as food-service operators-such as hotels and hospitality groups, institutional catering services, and restaurants that include full-service and quick-service concepts-demand consistent supply and specialized formats. The online channel, divided between direct-to-consumer platforms and multi-vendor marketplaces, capitalizes on digital convenience and subscription models. Simultaneously, brick-and-mortar retailers engage specialty stores, supermarkets and hypermarkets-spanning independent grocers and large retail chains-and traditional wet markets to capture distinct shopper segments. Packaging innovations, ranging from basic ice-packed shipments to advanced modified atmosphere packaging, vacuum-packed products and unpackaged options, play a decisive role in shelf life, logistics efficiency, and consumer perception. Integrating these segmentation insights enables market players to tailor strategies that accommodate end-to-end value chain complexities.

This comprehensive research report categorizes the Fresh Fish & Seafood market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Species

- Source

- Packaging Type

- Application

- Distribution Channel

Delivering Regional Perspectives and Insights for Fresh Fish and Seafood Demand Patterns and Growth Opportunities in the Americas, EMEA, and Asia-Pacific

Regional considerations are indispensable for capturing the full picture of fresh fish and seafood demand and supply dynamics. In the Americas, robust consumer demand is fueled by health trends and established aquaculture hubs in North and South America. Shifts toward locally sourced products have empowered coastal communities and small-scale producers, while enhanced port infrastructure and logistics corridors facilitate efficient export flows to Europe and Asia. The Europe, Middle East & Africa region brings a tapestry of gastronomic traditions and regulatory regimes that influence species preferences, import patterns, and certification requirements, especially in Mediterranean markets with deep culinary ties to seafood.

In the Asia-Pacific region, the world’s largest aquaculture producers and consumers continue to champion both wild-catch and farmed varieties, from premium salmon in Northeast Asia to shrimp farming dominance in Southeast Asia. Rapidly expanding middle-class populations and digital marketplaces amplify demand for convenient formats, traceable origins, and innovative flavors. Moreover, environmental imperatives are steering investments toward sustainable farming practices and circular economy initiatives. Collectively, these regional insights underscore the imperative for market participants to adopt context-specific strategies, leveraging local strengths while anticipating regulatory and consumer behavior shifts across geographies.

This comprehensive research report examines key regions that drive the evolution of the Fresh Fish & Seafood market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Players and Their Strategic Initiatives Shaping Innovation, Sustainability, and Competitive Advantage in the Fresh Fish and Seafood Industry

Leading companies are distinguishing themselves through a confluence of sustainability commitments, vertical integration, and digital transformation. Major aquaculture operators have scaled offshore and land-based facilities with recirculating systems, while forging alliances with feed suppliers to develop alternative protein diets that reduce environmental footprints. Integrated seafood processors are deploying state-of-the-art processing lines to optimize yield and consistency, and utilizing blockchain-backed traceability to deliver verifiable origin stories to retailers and end consumers.

Additionally, a number of distributors and food-service providers are establishing direct sourcing programs to ensure quality control and ethical practices from vessel to plate. Strategic investments in cold-chain logistics assets, including temperature-controlled warehouses and last-mile delivery fleets, are enhancing freshness claims and shrinking lead times. Innovative partnerships between traditional operators and tech startups are accelerating automation in quality inspection and inventory management, setting new benchmarks for responsiveness. These collective initiatives illustrate how market leaders are proactively reinforcing their competitive edge through comprehensive sustainability frameworks, supply chain resilience measures, and consumer-centric offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fresh Fish & Seafood market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Fish & Seafood Inc.

- AquaChile by Agrosuper S.A.

- Austevoll Seafood ASA

- Austral Group S.A.A.

- Cargill, Incorporated

- Cermaq Group AS

- Coldwater Seafood, LLC

- Cooke Aquaculture Inc.

- Cremonini S.p.A.

- Faroe Seafood

- Grieg Seafood

- Gulf Shrimp Company

- Icelandic Trademark Holding

- Kai Gourmet, LLC

- KYOKUYO CO.,LTD.

- Lee Fish USA

- Lerøy Seafood Group ASA

- Maruha Nichiro Corporation

- Mowi ASA

- NEW ENGLAND SEAFOOD

- Nissui Corporation

- Nueva Pescanova, S.L.

- Ocean Beauty Seafoods LLC

- Pelagia AS

- Pescafresh by Brahm Group

- SalMar ASA

- Siam Canadian (Asia) Limited

- Tassal Group Limited

- Tesco plc

- Thai Union Group Public Company Limited

- Trident Seafoods Corporation

- UniSea, Inc.

Developing Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends, Enhance Supply Chain Resilience, and Drive Sustainable Growth

To capitalize on emerging opportunities and mitigate evolving risks, industry leaders must pursue coordinated actions across sourcing, operations, and go-to-market strategies. Prioritizing investments in traceability platforms will not only satisfy regulatory and certification demands but also foster consumer trust in provenance claims. Expanding domestic aquaculture capabilities through partnerships with technology providers and local governments can diversify supply sources, reduce tariff exposure, and strengthen local economies. Simultaneously, forging strategic alliances with logistics specialists specializing in cold-chain integrity will enable better control over product quality from harvest through delivery.

On the consumer engagement front, leveraging data-driven marketing to highlight sustainability credentials and storytelling around coastal communities will differentiate brands in a crowded marketplace. Embracing omnichannel distribution strategies that blend direct-to-consumer subscriptions, online marketplace visibility, and curated retail experiences will capture a broader spectrum of consumer preferences. Finally, focusing on packaging innovation-balancing environmental considerations with shelf-life extension-will deliver tangible value to both consumers and supply chain partners. Collectively, these recommendations outline a roadmap for leaders to drive resilient growth and maintain a competitive posture amid dynamic market conditions.

Explaining Robust Research Methodology and Analytical Frameworks Employed to Ensure Comprehensive Insights into the Fresh Fish and Seafood Market

The research underpinning this report employs a rigorous, multi-tiered methodology designed to deliver comprehensive, high-fidelity insights into the fresh fish and seafood market. Primary research involved in-depth interviews with executive-level stakeholders, including C-suite decision-makers, sustainability officers, procurement leads, and culinary experts across multiple regions. These conversations provided qualitative perspectives on supply chain bottlenecks, consumer sentiment, and technology adoption curves. Secondary research encompassed a thorough review of public filings, industry association publications, government databases, and independent sustainability audits to triangulate data sources and validate emerging themes.

Quantitative analyses integrated shipment and customs data, trade flows, and production statistics to map historical patterns and detect inflection points. Advanced analytical frameworks, such as Porter’s Five Forces and value chain analysis, were applied to assess competitive intensity and margin pressures. Scenario-planning exercises evaluated the potential repercussions of policy changes, environmental shocks, and technological disruptions. The combination of these methodologies ensures the report’s findings are both robust and actionable, offering stakeholders a solid foundation for strategic planning and operational optimization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fresh Fish & Seafood market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fresh Fish & Seafood Market, by Product Form

- Fresh Fish & Seafood Market, by Species

- Fresh Fish & Seafood Market, by Source

- Fresh Fish & Seafood Market, by Packaging Type

- Fresh Fish & Seafood Market, by Application

- Fresh Fish & Seafood Market, by Distribution Channel

- Fresh Fish & Seafood Market, by Region

- Fresh Fish & Seafood Market, by Group

- Fresh Fish & Seafood Market, by Country

- United States Fresh Fish & Seafood Market

- China Fresh Fish & Seafood Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3498 ]

Drawing Informed Conclusions on Market Dynamics, Growth Catalysts, and Strategic Imperatives Driving the Success of Fresh Fish and Seafood Ecosystem

Synthesizing the extensive market analysis yields several key conclusions about the trajectory of the fresh fish and seafood ecosystem. First, the convergence of consumer demand for healthful, transparent, and sustainably sourced products is driving transformative investment in aquaculture technologies and digital traceability. Second, geopolitical developments and trade policy shifts-most notably the new tariffs-are catalyzing a reconfiguration of supply networks, with a pronounced tilt toward regional diversification and domestic production scaling.

Third, segmentation dynamics across species, product forms, distribution channels, and packaging types underscore the importance of tailored strategies that align with end-user requirements and logistical constraints. Fourth, regional distinctions in the Americas, EMEA, and Asia-Pacific highlight the need for localized market approaches that respect culinary traditions, regulatory landscapes, and infrastructure capabilities. Finally, leading companies are demonstrating that sustainability and innovation go hand in hand, with integrated supply chains and collaborative partnerships serving as the foundation for long-term competitive advantage. These strategic imperatives form the bedrock for stakeholders seeking to navigate uncertainty and capitalize on growth opportunities.

Empowering Decision-Makers with Exclusive Fresh Fish and Seafood Market Intelligence—Reach Out to Ketan Rohom to Secure Your Comprehensive Report Today

Unlock unparalleled market intelligence and actionable insights by securing the comprehensive Fresh Fish and Seafood market research report. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored data that supports strategic decision-making, uncovers emerging opportunities, and propels your organization ahead of the competition. Take decisive steps today to leverage expert analysis, exclusive commentary, and practical recommendations designed to optimize your market positioning and drive sustainable growth. Reach out for personalized guidance, flexible licensing options, and immediate access to in-depth findings that will inform every facet of your seafood business strategy.

- How big is the Fresh Fish & Seafood Market?

- What is the Fresh Fish & Seafood Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?