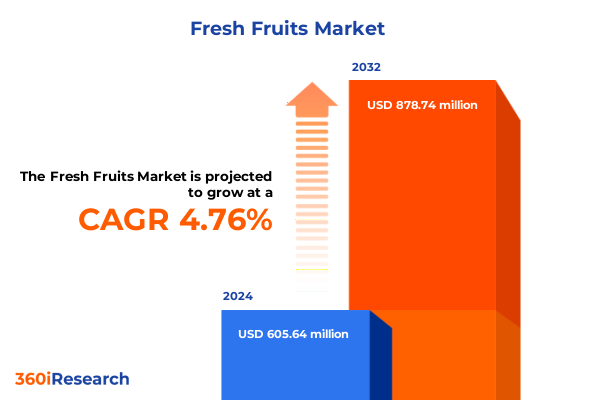

The Fresh Fruits Market size was estimated at USD 634.56 million in 2025 and expected to reach USD 666.02 million in 2026, at a CAGR of 4.76% to reach USD 878.75 million by 2032.

Unveiling the dynamic interplay of consumer health consciousness, supply chain innovation, and market forces driving the fresh fruits sector’s rapid evolution

The fresh fruits industry is undergoing a period of unprecedented transformation as evolving consumer priorities and external market forces converge to reshape traditional models. Across the value chain, heightened health consciousness among consumers is driving demand for nutrient-rich options, positioning fresh fruits as a cornerstone in modern wellness and snacking routines. Consequently, retailers and producers alike are innovating to deliver quality, convenience, and transparency, responding to a marketplace that values both taste and traceability.

Meanwhile, supply chains are adapting to disruptions caused by global events, from weather-related production challenges to logistics constraints. Enhanced cold-chain infrastructure and real-time monitoring technologies are becoming indispensable tools for maintaining product integrity from farm to fork. In parallel, digitization-ranging from blockchain-enabled traceability to predictive analytics for yield forecasting-is redefining how stakeholders collaborate, anticipate consumer needs, and mitigate risk.

Furthermore, sustainability initiatives are gaining momentum as environmental considerations play an influential role in purchasing decisions, prompting growers and distributors to adopt eco-friendly farming practices and recyclable packaging solutions. Together, these trends underscore the critical intersections of health, technology, and sustainability that are propelling the fresh fruits sector forward, setting the stage for strategic decisions that align with emergent consumer and industry priorities.

Mapping the groundbreaking shifts in production, distribution, and consumer engagement revolutionizing the fresh fruit landscape in an increasingly health-focused era

In today’s marketplace, transformative shifts are redefining every facet of the fresh fruits landscape. From on-farm production techniques to shelf-level merchandising, industry participants are reimagining processes to stay ahead of evolving expectations. Advanced cultivation methods, such as precision agriculture and controlled-environment farming, are unlocking new possibilities for yield optimization, resource efficiency, and off-season availability. As a result, producers can deliver consistent quality even amidst climate variability.

Simultaneously, the rise of digital commerce has expanded retail footprints beyond brick-and-mortar channels. Direct-to-consumer subscription models and online marketplaces are reshaping how consumers source fresh fruits, offering personalized bundles and traceable origin stories. This expansion is complemented by smart fulfillment centers that leverage AI-driven sorting and automated packing lines to accelerate order processing and reduce waste.

Equally significant is the growing emphasis on circularity and packaging innovation. Biodegradable materials and reuse programs are addressing both consumer preference and regulatory momentum toward waste reduction. In this new landscape, partnerships between producers, packaging specialists, and waste management firms are becoming essential to developing closed-loop solutions that align economic viability with environmental stewardship.

Moreover, consumer engagement is evolving through immersive experiences such as virtual farm tours and interactive labeling, which elevate transparency and deepen brand loyalty. These sweeping changes collectively underscore a period of radical innovation-one where sustainability, technology, and consumer-centric business models converge to chart the future course of fresh fruits.

Examining the far-reaching consequences of 2025 US tariff adjustments on import costs, supply reliability, and pricing strategies across the fresh fruit market

The adjustments to United States tariff policies in 2025 have introduced new dynamics across the fresh fruits market. Changes in duty structures for key imports have prompted importers to reevaluate cost structures and sourcing geographies. As import costs rise, domestic producers have an opportunity to capture incremental volume, yet they face the imperative of scaling operations without compromising on quality or sustainability commitments.

Consequently, wholesalers and retailers are recalibrating their pricing strategies to balance margin preservation with consumer sensitivity to price fluctuations. Some industry players are absorbing a portion of the increased import costs to maintain stable shelf prices, banking on sustained demand for premium produce. Others are diversifying their supplier base by exploring emerging growing regions, leveraging trade agreements that offer tariff relief or reduced duty rates.

In parallel, logistics providers are adjusting distribution networks to optimize cross-border flows, minimizing dwell times at customs and maximizing cold-chain continuity. This operational agility is critical to mitigating spoilage risk and ensuring that perishable goods maintain peak freshness upon arrival. Meanwhile, strategic alliances with shipping carriers and bonded warehouses are gaining traction to secure preferential transit windows.

Ultimately, the evolving tariff landscape underscores the importance of flexible sourcing and robust supply chain orchestration. Entities that can swiftly realign procurement strategies while safeguarding quality, cost-efficiency, and compliance will emerge as the most resilient in navigating the implications of 2025’s tariff environment.

Revealing segmentation insights across consumer categories, product forms, production methods, sales channels, packaging types, and fruit classifications

In-depth analysis of consumer type segmentation reveals a clear dichotomy: the professional hospitality segment-encompassing hotels, restaurants, and catering operations-prioritizes bulk procurement and consistent supply, whereas household consumers increasingly demand pre-portioned convenience and premium quality for everyday use. The product form segmentation further illustrates this evolution, where demand for whole fresh produce coexists with rapid growth in cut offerings. Fruit salads, pre-sliced assortments, and ready-to-eat packs cater to time-pressed consumers seeking healthy snacking solutions without preparation overhead.

Production methods offer another lens into consumer priorities, with the conventional approach maintaining its foothold through cost competitiveness, while organic fruit batches command a premium by appealing to health-conscious demographics and those valuing eco-friendly practices. Sales channel segmentation highlights the fragmentation of distribution pathways: traditional retail locations remain indispensable for broad market coverage, supermarkets and hypermarkets deliver one-stop shopping experiences, online retail platforms provide convenience and personalized offers, and convenience stores fill the gap for immediate, on-the-go consumption needs.

Packaging type has emerged as a critical competitive differentiator, with bags and bulk formats serving high-volume buyers, clamshell containers bolstering visibility and freshness preservation, and tray-based solutions offering stackable convenience. Finally, fruit type segmentation underscores the sector’s diversity: core staples like apples and bananas sit alongside a burgeoning array of berries-encompassing blackberries, blueberries, raspberries, and strawberries-while citrus subdivisions include grapefruits, lemons & limes, mandarins & tangerines, and oranges. Grapes sustain classic appeal, and stone fruits such as apricots, cherries, peaches & nectarines, and plums deliver seasonal excitement. The tropical category-featuring avocados, mangoes, papayas, and pineapples-continues to drive exploratory consumer purchases and menu innovations.

This comprehensive research report categorizes the Fresh Fruits market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Consumer Type

- Product Form

- Production Method

- Packaging Type

- Fruit Type

- Sales Channel

Spotlighting regional differentiators in consumer preferences, distribution networks, regulatory frameworks, and growth catalysts across global territories

Regional dynamics shape the fresh fruits sector in distinctive ways, driven by consumer preferences, regulatory frameworks, and infrastructural capacities. In the Americas, where production diversity spans temperate and tropical zones, strong proximity markets benefit from integrated cold-chain corridors that facilitate rapid cross-border trade. Meanwhile, evolving consumer tastes in North America emphasize convenience formats and exotic fruit assortments, encouraging retailers to expand cut-fruit sections and introduce subscription-based fruit box offerings.

Across Europe, the Middle East & Africa, regulatory rigor around pesticide use and carbon emissions is influencing both import standards and domestic production protocols. European consumers exhibit heightened awareness of origin transparency and sustainability credentials, prompting brands to showcase eco-labels and traceability data. In parts of the Middle East, burgeoning urban populations are fueling demand for imported citrus and berries, while African producers are exploring value-add opportunities through processing and export partnerships.

In the Asia-Pacific region, rising income levels and shifting urban lifestyles are driving demand for premium varieties and exotic flavors. Domestic production hubs in Australia and New Zealand leverage advanced cultivation technologies to meet both local consumption and export quotas. Simultaneously, Southeast Asian economies are expanding infrastructure investments to bolster cold storage and port facilities, positioning the region as a key supplier to global markets. Collectively, these regional nuances underscore the importance of market-specific strategies that align with consumer expectations, policy environments, and logistical realities.

This comprehensive research report examines key regions that drive the evolution of the Fresh Fruits market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading industry players, innovative challengers, and strategic alliances that define competitive dynamics in the fresh fruits domain

Leading players in the fresh fruits domain are balancing legacy scale with innovation to navigate competitive pressures and shifting consumer demands. Large multinationals leverage their global sourcing networks and capital investments to ensure year-round availability and drive cost efficiencies, while emerging challengers differentiate through niche portfolios and agile go-to-market approaches. Strategic alliances between growers, logistics firms, and technology providers are becoming increasingly prevalent, enabling rapid adoption of traceability systems and digital marketing platforms.

Innovation-minded companies are also experimenting with value-added formats, introducing unique flavor combinations, and leveraging packaging design to enhance shelf appeal. Partnerships with research institutions support the development of new cultivars that offer extended shelf life and improved resistance to environmental stressors. At the same time, technology startups are forging collaborations around cold-chain monitoring, farm-to-consumer traceability apps, and AI-driven demand forecasting tools.

Meanwhile, mid-market players have carved out sustainable growth paths by focusing on organic and regenerative agriculture certifications, catering to ethically conscious consumers. These companies often emphasize local sourcing and community engagement, building brand loyalty through transparent storytelling and social media activations. Together, these diverse corporate strategies illuminate how scale, specialization, and collaboration intersect to define competitive landscapes within the fresh fruits sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fresh Fruits market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Capespan Group Limited

- Costa Group Holdings Limited

- Del Monte Pacific Limited

- Dole plc

- Fresh Del Monte Produce Inc.

- Fyffes Limited

- GESEXPORT SAC

- Giddings Fruit Company

- Giumarra Companies

- Grimmway Farms, Inc.

- Jac. Vandenberg, Inc.

- M&J Importers Inc.

- Mazzoni S.p.A.

- Misionero Vegetables

- Naturipe Farms, LLC

- S&A Produce Corp.

- Subsole S.A.

- Sunkist Growers, Inc.

- Unifrutti Group S.p.A.

- Wish Farms, Inc.

Delivering targeted strategic directives that empower industry leaders to capitalize on emerging opportunities and overcome market challenges effectively

Industry leaders can unlock new avenues for growth by prioritizing investment in robust cold-chain infrastructure, ensuring that temperature-sensitive produce arrives at peak freshness. By collaborating with specialized logistics providers and deploying real-time monitoring solutions, companies can significantly reduce spoilage and build operational resilience. Moreover, diversifying sourcing regions mitigates exposure to localized risks, such as extreme weather or regulatory shifts, while also enabling portfolio expansion into emerging tropical and superfruit categories.

Digital transformation remains an imperative. Embracing e-commerce platforms, direct-to-consumer subscription models, and AI-driven demand forecasting will empower stakeholders to align inventory with consumer behaviors and minimize waste. Combining these tools with consumer engagement initiatives-such as interactive labeling and loyalty programs-can deepen trust and foster differentiated brand experiences.

Sustainability must be integrated into every strategic decision, from adopting regenerative agriculture practices to transitioning towards reusable or biodegradable packaging materials. Working closely with upstream partners to improve water and land-use efficiencies not only resonates with eco-conscious customers but also safeguards long-term resource availability. Finally, flexible pricing strategies, supported by dynamic cost analyses, allow companies to navigate tariff fluctuations without eroding consumer confidence. By implementing these recommendations, industry leaders can create a resilient, future-ready fresh fruits business that thrives amid evolving market landscapes.

Outlining the rigorous research framework, data collection protocols, and analytical techniques underpinning comprehensive fresh fruits market insights

The research methodology underpinning this analysis combines rigorous primary and secondary approaches to deliver robust, actionable insights. Primary data collection involved in-depth interviews with key stakeholders across the value chain, including growers, distributors, retailers, and industry experts. These conversations provided granular perspectives on operational challenges, innovation roadmaps, and evolving consumer behaviors.

Secondary research encompassed a comprehensive review of industry publications, regulatory documents, and trade association reports to contextualize emerging trends. Data triangulation techniques were applied to reconcile quantitative findings with qualitative feedback, ensuring the reliability of thematic conclusions. Supply chain mapping exercises illuminated logistical nodes and potential bottlenecks, while case study analyses showcased best practices in sustainability and digital adoption.

Analytical frameworks leveraged advanced statistical techniques to identify segmentation patterns and forecast scenario implications, without relying on speculative market sizing. Geospatial analysis of production and distribution hubs highlighted regional strengths and expansion opportunities. Throughout the process, methodological rigor was maintained through iterative validation, peer reviews, and a transparent audit trail of data sources. This multi-faceted approach guarantees that the insights presented are both credible and directly applicable to strategic decision-making in the fresh fruits domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fresh Fruits market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fresh Fruits Market, by Consumer Type

- Fresh Fruits Market, by Product Form

- Fresh Fruits Market, by Production Method

- Fresh Fruits Market, by Packaging Type

- Fresh Fruits Market, by Fruit Type

- Fresh Fruits Market, by Sales Channel

- Fresh Fruits Market, by Region

- Fresh Fruits Market, by Group

- Fresh Fruits Market, by Country

- United States Fresh Fruits Market

- China Fresh Fruits Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing core findings and future-ready insights to highlight pivotal takeaways and strategic imperatives for sustained success in the fresh fruits sector

Bringing together the core findings reveals a market defined by rapid innovation, shifting trade dynamics, and evolving consumer preferences. The surge in health-focused consumption, the proliferation of cutting-edge digital tools, and the intensifying focus on sustainability collectively shape a complex environment where agility and strategic foresight are paramount. Companies that excel align sourcing flexibility, technological investment, and environmental stewardship to create distinct value propositions.

Tariff adjustments in 2025 underscore the need for dynamic supply chain strategies and diversified procurement channels. Segmentation analyses highlight the importance of tailored approaches-from catering to time-pressed household consumers with convenient cut-fruit formats to meeting the bulk requirements of professional Horeca clients. Regional insights further emphasize that market-specific considerations, such as regulatory landscapes and infrastructure maturity, inform successful go-to-market plans.

Ultimately, the fresh fruits sector stands at an inflection point, where proactive adaptation to external pressures and focused innovation will determine the winners. Organizations that integrate the recommendations outlined-bolstering cold-chain capabilities, embracing digital commerce, and embedding sustainability at the core-will be best positioned for sustained growth and resilience. These pivotal takeaways form the foundation for strategic imperatives that drive long-term success.

Drive actionable market intelligence and accelerate business growth with an exclusive fresh fruits insights report you can secure today

For a deeper dive into these comprehensive insights and to secure a competitive advantage, don’t miss the opportunity to request the full market research report. Our Associate Director of Sales & Marketing, Ketan Rohom, is ready to guide you through the data, answer any specific questions, and tailor the findings to your strategic objectives. Engage with Ketan to understand how the latest dynamics in consumer trends, tariff impacts, and segmentation nuances can be leveraged to unlock growth and operational efficiencies in your fresh fruits business. Reach out today to transform these actionable insights into informed decisions that will propel your organization forward.

- How big is the Fresh Fruits Market?

- What is the Fresh Fruits Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?