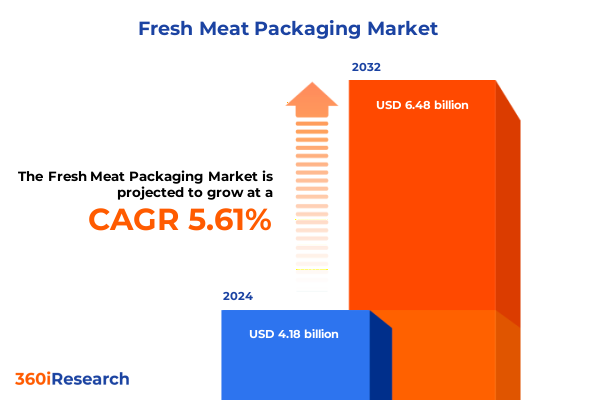

The Fresh Meat Packaging Market size was estimated at USD 4.40 billion in 2025 and expected to reach USD 4.62 billion in 2026, at a CAGR of 5.69% to reach USD 6.48 billion by 2032.

Overview of Fresh Meat Packaging Market Dynamics and Innovations Shaping Future Strategies for Industry Stakeholders and Performance

The fresh meat packaging market has witnessed profound transformation driven by evolving consumer preferences, regulatory mandates, and technological advancements. In recent years, heightened awareness of food safety and sustainability has elevated packaging from a mere containment solution to a critical component of the value chain. Contemporary consumers demand transparency in sourcing, minimal environmental footprint, and packaging that extends shelf life without compromising quality. Moreover, regulatory agencies have intensified scrutiny on material composition, recyclability, and labeling accuracy, prompting manufacturers to reengineer packaging formats at an unprecedented pace.

Against this backdrop, industry stakeholders are compelled to adopt a proactive stance, investing in research, collaboration, and innovation to remain competitive. Fresh meat producers, packaging suppliers, and retailers must collectively navigate a complex interplay of cost pressures, supply chain disruptions, and evolving trade policies. Strategic partnerships and cross-functional initiatives are key to unlocking material efficiencies and delivering differentiated offerings. This executive summary synthesizes the most salient developments reshaping fresh meat packaging, offering a clear roadmap for decision-makers to harness emerging opportunities while mitigating risks. By understanding the market’s foundational dynamics, stakeholders can align product portfolios and operational strategies with long-term sustainability and performance objectives.

Emerging Technological and Consumer-Driven Trends Reshaping Fresh Meat Packaging Landscape and Fostering Competitive Differentiation

The landscape of fresh meat packaging is being reshaped by a convergence of technological breakthroughs and consumer-driven imperatives. Innovations such as active and intelligent packaging, which integrate oxygen scavengers and RFID-enabled smart labels, are revolutionizing how freshness is monitored and communicated across the supply chain. These solutions not only reduce waste but also provide real-time data on product integrity, empowering retailers and end users to make informed decisions. Simultaneously, digital printing technologies have enabled high-resolution graphics and variable data printing, facilitating compliance with traceability requirements while enhancing brand storytelling.

Parallel to technological disruption, sustainability has emerged as a transformative force. The transition to renewable materials, such as biopolymer films and recycled trays, has accelerated in response to corporate social responsibility commitments and consumer activism. Packaging designers are exploring monomaterial structures to streamline recycling and reduce carbon footprints, while chemical recyclability initiatives aim to enable closed-loop systems. Meanwhile, regulatory frameworks in key markets are tightening restrictions on single-use plastics, pushing the industry toward eco-efficient alternatives. As these shifts gain momentum, the ability to integrate advanced functionality with green credentials will define the next era of competitive differentiation.

Analysis of the Cumulative Effects of 2025 US Import Tariffs on Raw Materials and Equipment Costs Influencing Fresh Meat Packaging Supply Chains

In 2025, cumulative U.S. import tariffs on critical packaging components and machinery have exerted significant upward pressure on production costs. Tariffs targeting polymer resins, including polyethylene and polypropylene, have increased raw material expenses, prompting suppliers to reassess sourcing strategies and, in some cases, pass on higher costs to end users. These levies have also affected specialized films used in modified atmosphere and vacuum packaging, introducing volatility into supply contracts and challenging traditional procurement cycles.

Beyond film substrates, duties on metal cans and aluminum sealing lids have impacted hybrid packaging solutions that combine trays and metallized films. Import restrictions on advanced sterilization equipment have delayed capacity expansions for aseptic packaging providers, constraining their ability to scale operations. In response, some manufacturers have accelerated domestic tooling investments to bypass import barriers, while others have renegotiated long-term agreements with overseas partners to lock in favorable terms. Moreover, the tariff-induced shifts have catalyzed a broader evaluation of packaging designs, leading to increased adoption of locally available materials and modular equipment architectures that can accommodate multiple sterilization and sealing modalities.

As trade policies continue to evolve, stakeholders must remain agile, leveraging cross-border partnerships and supply chain diversification to mitigate risk. Proactive engagement with governmental agencies and participation in trade associations can also help shape future tariff frameworks and secure exemptions for essential packaging innovations.

Comprehensive Segmentation Analysis Highlighting Packaging Types, Materials, Meat Varieties, Applications, and End Users Driving Market Developments

A granular examination of market segmentation reveals distinct drivers shaping demand across packaging types, materials, meat categories, applications, and end users. When evaluating by packaging type, the market can be dissected into aseptic packaging further divided into gamma radiation and UHT sterilization, modified atmosphere packaging subdivided into carbon dioxide, nitrogen, and oxygen mixtures, skin packaging differentiated between biopolymer skin film and PVC skin film, trays overwrap categorized into PET and RPET trays, and vacuum packaging classified by chamber and chamberless systems. These diverse formats cater to specific shelf-life goals and handling requirements, reflecting the nuanced quality expectations of both processors and retailers.

Material selection further defines market dynamics, with biodegradable films gaining traction amid rising sustainability mandates alongside traditional paper-based formats, versatile plastic films, and rigid trays that balance stiffness and barrier performance. Meat type segmentation underscores varying consumer patterns, as beef and pork segments compete on premium presentation while poultry benefits from streamlined packaging in high-speed retail settings. Applications range from minimally processed fresh cuts and marinated specialties to highly processed meat snacks and Ready Meals designed for convenience. Finally, end users comprise a bifurcation between food service operators demanding bulk formats for back-of-house efficiency and retail channels focusing on retail-ready packs optimized for shelf appeal and unit economics.

By understanding the intersection of these segmentation vectors, stakeholders can tailor product portfolios and channel strategies to capture emerging niches and optimize resource allocation.

This comprehensive research report categorizes the Fresh Meat Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Type

- Material Type

- Meat Type

- Application

- End User

Strategic Regional Perspectives Revealing Demand Patterns, Regulatory Frameworks, and Market Drivers Across the Americas, EMEA, and Asia-Pacific

Regional market dynamics exhibit considerable variation across the Americas, Europe, Middle East & Africa, and Asia-Pacific, driven by divergent regulatory landscapes, consumption patterns, and infrastructure maturity. In the Americas, the emphasis on convenience and online grocery adoption underscores the need for packaging that balances extended shelf life with reheating compatibility, while the robust domestic packaging manufacturing base facilitates rapid material innovation. Cross-border trade agreements within North America further streamline supply chains, although localized labeling requirements and state-level recycling mandates introduce complexity.

Across Europe, the Middle East, and Africa, regulatory rigor around single-use plastics and recycling quotas has accelerated the migration to recyclable monomaterials and compostable alternatives. Consumer demand for premium meat products in Western Europe contrasts with emerging market growth in the Gulf Cooperation Council, where cold chain investments underpin expanding retail formats. In sub-Saharan Africa, infrastructural constraints favor bulk packaging and vacuum solutions that enhance shelf life in regions with limited refrigeration.

The Asia-Pacific region is characterized by high-growth markets such as China and India, where rapid urbanization and rising protein consumption drive investment in modern retail and food service packaging. Localized preferences for small-format packs and spicy ready-to-cook meals have spurred design innovation, while stringent food safety regulations in developed economies like Japan and Australia mandate advanced barrier films and traceability features. Together, these regional insights guide tailored strategies for product development, investment prioritization, and partnership formation.

This comprehensive research report examines key regions that drive the evolution of the Fresh Meat Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Participants Driving Innovation in Fresh Meat Packaging Through Advanced Solutions and Strategic Collaborations

Leading players in the fresh meat packaging arena have differentiated themselves through targeted innovation, strategic partnerships, and focused expansions. Multinational packaging providers have leveraged R&D investments to introduce compostable films with comparable barrier properties to conventional plastics, addressing sustainability goals without sacrificing performance. At the same time, collaborations between film manufacturers and machinery suppliers have optimized line speeds for advanced shrink and skin packaging systems, enhancing throughput and reducing downtime.

Some companies have pursued vertical integration, aligning resin production with film extrusion capabilities to capture margin efficiencies and ensure supply continuity amid tariff-related disruptions. Others have established innovation centers and pilot plants in key markets to co-develop customized packaging solutions with local processors, reflecting a shift toward customer-centric models. Acquisitions of niche technology firms specializing in smart labeling and antimicrobial coatings have further expanded portfolios, enabling comprehensive freshness monitoring and food safety assurance.

Investment in digital platforms has also emerged as a competitive differentiator, with cloud-based inventory management and packaging design software facilitating rapid prototyping and quality control. By combining material science expertise with data-driven insights, these leading firms are shaping the future of fresh meat packaging, driving higher value offerings and fostering collaborative ecosystems that extend beyond traditional supplier–customer relationships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fresh Meat Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor PLC

- Amerplast Ltd.

- Berry Global Group, Inc.

- Bio4Pack GmbH

- Bolloré SE

- Cascades Inc.

- Coveris Management GmbH

- DS Smith PLC

- DuPont de Nemours, Inc.

- EasyPak LLC

- Faerch A/S

- Kureha Corporation

- Mondi PLC

- Pactiv Evergreen Inc.

- Reynolds Consumer Products Inc.

- Reynolds Group Limited

- Sealed Air Corporation

- Sealpac International BV

- Smurfit Kappa Group PLC

- Sonoco Products Company

- SÜDPACK Holding GmbH

- ULMA Group

- Winpak Ltd.

Practical Strategic Recommendations for Industry Leaders to Navigate Regulatory Complexities, Embrace Sustainability, and Capitalize on Emerging Trends

Industry leaders must adopt a multi-faceted strategy to thrive amid evolving market conditions. Prioritizing investment in sustainable materials will not only align with regulatory requirements but also resonate with environmentally conscious consumers. This entails collaborating with biopolymer developers and recyclers to establish circular value chains and exploring mono-material structures that simplify end-of-life processing. Concurrently, integrating digital technologies such as smart labels and blockchain-based traceability systems can enhance quality assurance and strengthen transparent communication across the supply chain.

To mitigate tariff-related cost inflation, organizations should diversify sourcing by forging partnerships with domestic and regional suppliers and by qualifying alternative resins with comparable performance. Establishing flexible manufacturing lines capable of handling multiple packaging formats will allow rapid adaptation to material availability and market demand. Moreover, proactive engagement with government agencies and industry associations can facilitate tariff exemptions for critical innovation components and shape future trade policies.

Finally, targeting high-potential segments through tailored value propositions is essential. By aligning packaging designs with specific meat types, applications, and end-user requirements, companies can unlock premium pricing and deepen customer loyalty. A disciplined approach to segmentation, underpinned by robust market intelligence, will enable targeted R&D investments and coherent go-to-market strategies across diverse geographic regions.

Detailed Research Approach Combining Primary Interviews, Secondary Data Synthesis, and Analytical Frameworks Ensuring Fresh Meat Packaging Market Insights

This study employs a rigorous research methodology combining primary interviews, secondary data analysis, and analytical frameworks to ensure the validity and depth of insights. Primary research involved structured interviews with senior executives in packaging innovation, procurement, and quality assurance across fresh meat processors, retail chains, and food service operators. These dialogues provided firsthand perspectives on material preferences, operational challenges, and strategic priorities.

Secondary research encompassed a comprehensive review of regulatory documents, trade association publications, patent filings, and technical white papers. Material science journals and environmental impact assessments were examined to track advancements in biopolymer films, recycling technologies, and barrier coatings. Proprietary databases on trade flows and import tariffs were analyzed to evaluate the cumulative effect of U.S. duties on supply chain economics.

Analytical techniques included PESTEL analysis to contextualize macro-environmental factors, segmentation matrices to dissect market drivers, and scenario planning to anticipate regulatory and trade policy shifts. Findings were validated through cross-referencing interview insights with secondary sources, ensuring consistency and reliability. This multi-pronged approach underpins the report’s strategic recommendations and regional assessments, delivering a robust foundation for decision-making in the fresh meat packaging sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fresh Meat Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fresh Meat Packaging Market, by Packaging Type

- Fresh Meat Packaging Market, by Material Type

- Fresh Meat Packaging Market, by Meat Type

- Fresh Meat Packaging Market, by Application

- Fresh Meat Packaging Market, by End User

- Fresh Meat Packaging Market, by Region

- Fresh Meat Packaging Market, by Group

- Fresh Meat Packaging Market, by Country

- United States Fresh Meat Packaging Market

- China Fresh Meat Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of Critical Findings Emphasizing Strategic Imperatives and Future Outlook for Stakeholders in the Fresh Meat Packaging Sector

The fresh meat packaging industry stands at a pivotal juncture where innovation and sustainability converge with regulatory pressure and global trade complexities. Critical findings underscore the imperative to integrate advanced packaging functionalities-such as active barrier systems and smart traceability features-with eco-efficient materials that meet tightening environmental standards. Stakeholders must also navigate the financial and operational impacts of cumulative tariffs by diversifying supply chains and investing in domestic capabilities.

Segmentation analysis highlights the value of tailoring packaging formats to distinct product applications, material properties, and consumer preferences across channels. Regional insights point to divergent growth trajectories, demanding bespoke strategies for the Americas, EMEA, and Asia-Pacific markets. Finally, leading companies demonstrate that strategic collaborations, vertical integration, and digital platform adoption are key enablers of competitive advantage.

Looking ahead, the ability to synthesize these multidimensional insights into cohesive action plans will determine market leadership. Organizations that proactively embrace packaging innovations, leverage data-driven decision frameworks, and build resilient supply networks will be best positioned to capture emerging opportunities and deliver sustained value.

Secure In-Depth Fresh Meat Packaging Market Intelligence and Collaborate with Associate Director Sales & Marketing to Empower Strategic Decision Making Today

Unlock unparalleled market intelligence by securing the comprehensive fresh meat packaging research report today. Tailored to executives seeking actionable insights, this report offers an in-depth examination of key trends, regulatory shifts, and technological innovations shaping the future of fresh meat packaging. Engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to customize your research needs, explore bespoke data points, and receive expert guidance on strategic adoption of sustainable materials, tariff mitigation strategies, and regional growth opportunities. Accelerate your decision-making with a robust understanding of segmentation dynamics across packaging types, materials, meat categories, applications, and end users. Whether navigating evolving U.S. tariff landscapes, optimizing supply chains, or pioneering new packaging technologies, this report empowers your organization with the knowledge to drive market differentiation and long-term profitability. Reach out now to elevate your competitive positioning, harness emerging innovations, and future-proof your operations in the rapidly evolving fresh meat packaging industry. Your strategic advantage begins with this essential intelligence-secure your copy and collaborate with Ketan Rohom to transform insights into impactful action.

- How big is the Fresh Meat Packaging Market?

- What is the Fresh Meat Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?