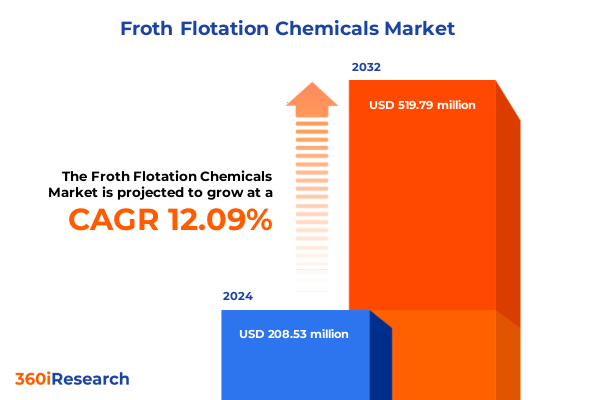

The Froth Flotation Chemicals Market size was estimated at USD 231.31 million in 2025 and expected to reach USD 260.86 million in 2026, at a CAGR of 12.26% to reach USD 519.79 million by 2032.

Understanding the Critical Role of Froth Flotation Chemicals in Optimizing Mineral Concentration Processes across Diverse Mining Operations Globally

Froth flotation chemicals have become indispensable in the modern mineral processing landscape, serving as the cornerstone for separating valuable ores from gangue materials. These specialized reagents interact at the molecular level to alter surface properties, enabling selective attachment of target mineral particles to air bubbles and subsequent recovery. As mining operations intensify their focus on efficiency, yield improvement, and environmental stewardship, the role of collectors, frothers, and modifiers has grown more strategic than ever before.

Collectors are engineered to selectively bind to mineral surfaces, with subclasses such as dithiocarbamates, dithiophosphates, and xanthates each demonstrating distinct affinities and selectivity profiles. Frothers, encompassing alcohols, pine oil, and polyglycols, fine-tune bubble stability and froth characteristics, directly influencing recovery rates and concentrate grade. Modifiers, ranging from activators and depressants to pH regulators, refine reagent action and process robustness under diverse ore chemistries and operating conditions.

The intricate interplay among these reagent families underscores the necessity for rigorous formulation science and precise dosing control. As mining enterprises contend with increasingly complex ore bodies and stricter environmental regulations, the demand for higher-performance, more sustainable reagents is propelling innovation in green chemistry and digital monitoring solutions. Against this backdrop, an informed understanding of froth flotation chemical dynamics is crucial for stakeholders committed to maximizing resource efficiency and maintaining competitive advantage.

Identifying Key Transformative Shifts Reshaping the Froth Flotation Chemicals Landscape Driven by Innovation, Sustainability, and Evolving Industry Demands

The froth flotation chemicals market is experiencing transformative shifts driven by innovation, sustainability imperatives, and evolving demand patterns. First, the imperative for eco-friendly reagents has accelerated the development of biodegradable collectors and frothers that minimize downstream wastewater treatment burdens. This shift toward green chemistry is reshaping product portfolios and compelling suppliers to invest in novel surfactants derived from renewable feedstocks.

Simultaneously, digitalization is redefining process control, with real-time monitoring platforms and AI-driven dosing algorithms enabling superior reagent management and yield optimization. These intelligent systems facilitate adaptive reagent blending, reducing excess consumption and enhancing metallurgical performance. Furthermore, collaborative partnerships between specialty chemical providers and equipment manufacturers are fostering integrated solutions that streamline reagent delivery and automate flotation circuit adjustments.

Another key transformation lies in the diversification of supply chains, as companies seek to mitigate risks associated with raw material volatility and geopolitical uncertainties. Strategic alliances and localized manufacturing initiatives are emerging to strengthen supply resilience and manage costs more effectively. Together, these shifts-sustainable reagent innovation, digital process optimization, and supply chain reconfiguration-are redefining competitive dynamics and presenting new pathways for value creation in froth flotation operations.

Examining the Cumulative Impact of 2025 United States Tariffs on Supply Chains, Pricing Strategies, and Competitive Dynamics in Froth Flotation Chemicals

The imposition of United States tariffs on select chemical imports in 2025 has introduced considerable operational challenges and strategic recalibrations within the froth flotation supply chain. Elevated duties on critical surfactants and specialty reagents have led to immediate increases in procurement costs for downstream processors. In response, many stakeholders have accelerated efforts to qualify domestic suppliers, fostering a more localized supply base while mitigating exposure to tariff-related price spikes.

These trade measures have also prompted a reassessment of pricing strategies, with many producers passing incremental costs through to end users. Concurrently, companies are optimizing reagent formulations to reduce dosage requirements and enhance performance per unit of chemical consumed. Some industry players have opted to reformulate products around tariff-exempt precursors, illustrating how regulatory shifts catalyze innovation in reagent chemistry.

On a strategic level, the tariffs have encouraged a diversification of sourcing channels, including new partnerships in Latin America and Asia-Pacific markets outside the US jurisdiction. This realignment is gradually reshaping competitive dynamics, as non-US producers expand their market share by offering compelling value propositions in regions unaffected by tariffs. Ultimately, the cumulative impact of these measures underscores the critical importance of supply chain agility and regulatory foresight in sustaining operational resilience.

Unveiling Deep Insights into Froth Flotation Chemicals Segmentation to Illuminate Strategic Opportunities across Chemical Type, Mineral, Industry, Reagent, and Process

A granular examination of market segmentation reveals nuanced strategic opportunities across five distinct dimensions. Based on chemical type, the domain is categorized into collectors, frothers, and modifiers. Within the collector segment, dithiocarbamates, dithiophosphates, and xanthates each present varying selectivity profiles and operational cost structures, enabling operators to tailor reagent suites to specific ore mineralogies. The frother category encompasses alcohols, pine oil, and polyglycols, with each subcategory offering different froth stability characteristics suited to diverse flotation circuit designs. Modifier reagents, including activators, depressants, and pH regulators, are essential for refining separation kinetics and maintaining process consistency amid fluctuating feed compositions.

In terms of mineral type, the market is subdivided into copper, gold, lead, and zinc applications, reflecting the unique flotation behaviors and surface chemistries associated with each base and precious metal ore. End use industry segmentation distinguishes between metal mining and non-metal mining operations. Within metal mining, base metal extraction and precious metal recovery each leverage tailored reagent strategies to optimize concentrate grade and recovery yield.

Reagent form segmentation considers the physical state of these chemicals as either liquid or powder, impacting storage, handling, and dosing methodologies across plant operations. Finally, process type delineation between batch and continuous protocols underlines differing operational approaches, where batch flotation systems prioritize flexibility and manual control, while continuous circuits focus on throughput consistency and automated regulation.

This comprehensive research report categorizes the Froth Flotation Chemicals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Chemical Type

- Mineral Type

- Reagent Form

- Process Type

- End Use Industry

Delving into Regional Dynamics to Highlight Distinct Growth Drivers, Regulatory Trends, and Technology Adoption within Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exert considerable influence over reagent selection, regulatory compliance, and technology adoption in froth flotation. Within the Americas, stringent environmental standards in jurisdictions across North and South America have elevated the adoption of low-impact, biodegradable reagents. This regulatory environment, coupled with mature mining infrastructure in the United States and Canada, fosters an emphasis on digitalized process control to optimize reagent consumption and minimize effluent treatment costs. Latin American producers, contending with evolving local regulations and high-value ore deposits, are increasingly seeking turnkey reagent solutions that blend performance with compliance.

Europe, the Middle East, and Africa present a diverse regulatory tapestry. In Europe, chemical registration frameworks and eco-design mandates are driving suppliers toward greener formulations and full life-cycle assessments. Middle Eastern mining hubs are investing in large-scale copper and gold projects, creating demand for robust reagent chemistries in challenging arid conditions. Africa, with its rich base metal and precious metal reserves, is witnessing heightened collaboration between reagent specialists and mining operators to navigate logistical constraints and ensure consistent supply under complex geopolitical climates.

In the Asia-Pacific region, rapid growth in copper and zinc output, particularly in nations like Australia, Indonesia, and newly emerging mining markets, is underpinning strong reagent demand. These producers emphasize cost efficiency and supply security, leading to partnerships with local manufacturers and strategic stockpiling initiatives. Across the region, the integration of advanced process analytics and remote monitoring is gaining traction, enabling more precise reagent dosing and real-time performance insights.

This comprehensive research report examines key regions that drive the evolution of the Froth Flotation Chemicals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Froth Flotation Chemicals Companies to Reveal Competitive Strategies, Innovation Portfolios, and Collaborative Partnerships Shaping Industry Progress

The competitive frontier of froth flotation chemicals is defined by companies that continuously refine their product portfolios, forge strategic partnerships, and harness emerging technologies. Leading specialty chemical producers have concentrated R&D investments on next-generation surfactants, focusing on enhancing selectivity and reducing environmental footprints. Collaborative ventures with academic institutions and pilot test sites are accelerating innovation cycles, validating new reagent chemistries under realistic plant conditions.

Supply chain integration serves as another hallmark of industry leaders. By establishing regional manufacturing hubs, top-tier companies are reducing lead times, managing inventory more effectively, and tailoring reagent formulations to local ore characteristics and regulatory requirements. Strategic alliances with reagent handling equipment manufacturers have given rise to bundled solutions that streamline dosing accuracy and reduce operational variability.

Beyond product innovation and supply optimization, the most successful players are diversifying their service portfolios to include digital process advisory services. These offerings leverage AI-powered analytics to recommend reagent dosage adjustments, predict maintenance intervals, and benchmark performance against peer operations. By converging chemical expertise with data science, these companies are creating high-value consultative propositions that deepen customer engagement and foster long-term partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Froth Flotation Chemicals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema group

- BASF SE

- Beijing Hengju Chemical Group Co., Ltd.

- Borregaard AS

- Chevron Phillips Chemical Company LLC

- Clariant AG

- Ecolab

- Evonik Industries AG

- Fardad Mining Chem

- Kao Corporation

- Kemcore

- Kemira Oyj

- Nasaco International Ltd.

- Nouryon Chemicals Holding B.V.

- Orica Limited

- Qingdao Bright Chemical Co., Limited

- Solvay SA

- The Dow Chemical Company

- Y&X Beijing Technology Co., Ltd.

- Yantai Humon Chemical Auxiliary Co., Ltd.

Actionable Recommendations for Industry Leaders to Navigate Market Complexities, Enhance Operational Resilience, and Leverage Emerging Opportunities in Froth Flotation Chemicals

Industry leaders are advised to pursue a multi-pronged strategy that balances operational agility with forward-looking innovation. First, diversifying the supplier base through regional partnerships and backward integration can mitigate supply chain disruptions and tariff exposures, ensuring continuity of critical reagent deliveries. Such diversification should be complemented by rigorous vendor qualification processes and dual-sourcing protocols.

Concurrently, investing in green chemistry initiatives will be paramount as regulatory landscapes tighten and sustainability becomes a decisive differentiator. Companies should allocate R&D resources toward developing biodegradable collectors and frothers, while also conducting comprehensive life-cycle assessments to validate environmental benefits. Pilot programs at representative flotation circuits can hasten market entry and demonstrate performance advantages to key customers.

On the digital front, implementing advanced process monitoring and AI-driven control systems will yield immediate benefits in reagent utilization efficiency and recovery optimization. Leaders should explore integrated hardware-software solutions that automate dosing based on real-time mineralogical and process feedback. Training and change-management programs will ensure that operations teams fully leverage these digital tools.

Finally, proactive engagement with regulatory stakeholders and participation in industry consortia will provide early insights into forthcoming policy changes and emerging best practices. By combining supply chain resilience, sustainable product development, digital transformation, and regulatory foresight, companies can secure competitive advantage and drive long-term growth in the froth flotation chemicals sector.

Comprehensive Research Methodology Integrating Qualitative Insights, Primary Interviews, and Rigorous Secondary Data to Ensure Robust Analysis of Market Dynamics

The research underpinning this market analysis integrates a blend of qualitative interviews, primary surveys, and secondary data review to ensure comprehensive and balanced insights. Industry executives, plant metallurgists, and reagent specialists were engaged through structured discussions and in-depth interviews to capture firsthand accounts of operational challenges, innovation priorities, and procurement criteria. These primary engagements were supplemented by global surveys that quantified sentiment around key trends such as sustainability adoption and digitalization.

Secondary research drew on technical journals, whitepapers, and regulatory publications to contextualize reagent chemistries, process technologies, and trade policy impacts. Patent databases and company technical dossiers were examined to track novel formulation developments and intellectual property trends. Regional case studies provided further granularity by illustrating how local regulations and ore characteristics influence reagent selection and deployment strategies.

Data triangulation methods were applied to validate findings across sources, reconciling any discrepancies between reported trends and observed market behaviors. The result is a robust analytical framework that blends empirical evidence with expert judgment, delivering a nuanced understanding of market dynamics and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Froth Flotation Chemicals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Froth Flotation Chemicals Market, by Chemical Type

- Froth Flotation Chemicals Market, by Mineral Type

- Froth Flotation Chemicals Market, by Reagent Form

- Froth Flotation Chemicals Market, by Process Type

- Froth Flotation Chemicals Market, by End Use Industry

- Froth Flotation Chemicals Market, by Region

- Froth Flotation Chemicals Market, by Group

- Froth Flotation Chemicals Market, by Country

- United States Froth Flotation Chemicals Market

- China Froth Flotation Chemicals Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Perspectives on the Evolving Froth Flotation Chemicals Sector and Imperatives for Stakeholders to Sustain Growth and Drive Sustainable Mineral Processing Practices

The froth flotation chemicals landscape is at a strategic inflection point, driven by regulatory pressures, sustainability imperatives, and technological innovations. As environmental considerations become integral to reagent development, suppliers must refine product formulations to meet stringent eco-design criteria while preserving performance metrics. Simultaneously, digital transformation initiatives are enhancing process control, enabling adaptive dosing and reducing chemical waste across flotation circuits.

Regional disparities in regulatory regimes and infrastructure maturity underscore the need for localized strategies, where a one-size-fits-all approach will no longer suffice. Tariff-induced supply chain realignment further accentuates the importance of supplier diversification and domestic manufacturing capabilities. In this context, stakeholders equipped with granular segmentation insights-and an understanding of regional nuances-are best positioned to navigate market complexities.

Looking ahead, the convergence of green chemistry, AI-enabled process optimization, and flexible supply models will define competitive leadership. Companies that embrace a holistic approach-integrating sustainable reagent innovation, advanced analytics, and strategic alliances-will not only drive operational efficiency but also contribute to the broader goal of sustainable mineral processing. Through vigilant monitoring of policy shifts and emerging technologies, stakeholders can capitalize on new value pools and foster resilient, future-ready operations.

Connect with Ketan Rohom to Uncover In-Depth Market Intelligence and Empower Strategic Decision-Making with the Latest Froth Flotation Chemicals Report

If you’re seeking comprehensive insights into the latest developments, competitive strategies, and regulatory dynamics shaping froth flotation chemicals, you’re invited to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. Ketan combines deep industry expertise with strategic market intelligence to guide your decision-making process, ensuring you have the actionable data required to optimize reagent selection, manage supply chain risks, and seize emerging growth opportunities.

By engaging with Ketan, you gain access to tailored briefings that delve beyond surface-level analysis, providing a nuanced understanding of tariff implications, regional variances, and segmentation-driven strategies. This collaborative approach empowers your organization to refine product portfolios, enhance sustainability initiatives through next-generation reagent technologies, and strengthen competitive positioning in both established and frontier markets.

Reach out to Ketan Rohom today to secure your copy of the full froth flotation chemicals market research report. Elevate your strategic planning with a partnership that offers responsive support, bespoke market intelligence, and clear roadmaps for driving operational excellence amidst evolving industry challenges and opportunities.

- How big is the Froth Flotation Chemicals Market?

- What is the Froth Flotation Chemicals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?