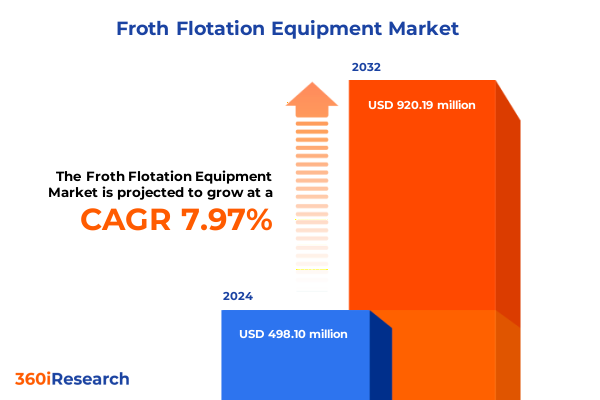

The Froth Flotation Equipment Market size was estimated at USD 537.14 million in 2025 and expected to reach USD 581.74 million in 2026, at a CAGR of 7.99% to reach USD 920.19 million by 2032.

Uncovering the Strategic Importance of Froth Flotation Equipment in Modern Mineral Processing and Environmental Management

Froth flotation has long been a cornerstone of mineral processing, driving the efficient separation of valuable resources from complex ore bodies. Originally conceived in the early 20th century, this method has evolved into one of the most versatile and widely applied techniques for recovering metals such as copper, lead, zinc, and gold. Beyond mining, flotation principles now underpin critical applications in wastewater treatment and recycling, underscoring the technology’s broad industrial relevance.

As environmental regulations intensify worldwide, froth flotation equipment has adapted rapidly to meet stringent standards on water usage, reagent toxicity, and energy consumption. Modern installations integrate advanced control systems to minimize waste and enhance resource recovery, reflecting an industry-wide commitment to sustainable practices. Simultaneously, the rise of digital transformation is reshaping process monitoring, enabling real-time adjustments that bolster both operational performance and safety across diverse processing plants.

Navigating Disruptive Technological and Sustainability-Driven Transformations Shaping the Future of Froth Flotation Systems

The froth flotation landscape is experiencing sweeping transformations driven by both technological innovation and sustainability mandates. Industry participants are now prioritizing eco-efficient designs that reduce water consumption and lower greenhouse gas emissions. Novel flotation cells featuring polymer-composite liners and bio-derived frothers are replacing legacy systems, cutting manufacturing emissions while extending service life.

Concurrently, digitalization has emerged as a critical catalyst for change. The integration of artificial intelligence and machine learning into flotation circuits enables real-time process optimization, predictive maintenance, and continuous metallurgical improvement. These smart systems can adjust air injection rates and reagent dosages on the fly, improving recovery rates and minimizing reagent usage.

Moreover, advanced automation platforms and digital twins are transitioning from pilot projects to mainstream deployment. Operators now leverage high-fidelity simulations and sensor arrays to forecast equipment performance under varying ore conditions, streamlining troubleshooting and reducing unplanned downtime. This convergence of data analytics and physical processes is reshaping procurement criteria and compelling stakeholders to re-evaluate capital investment strategies.

Assessing How Recent United States Tariff Measures Are Reshaping Equipment Costs Supply Chains and Strategic Sourcing in Froth Flotation

In 2025, newly imposed U.S. tariffs on imported mining machinery and components have significantly altered the cost structure of froth flotation equipment. Major mineral producers have reported supplier cost increases as they continue to rely on specialized parts from tariffed regions. For example, Freeport-McMoRan cautioned that these measures could raise supplier expenses by roughly five percent, prompting exploration of alternative sourcing strategies.

The broader machinery sector, including flotation equipment, faces average tariff rates of nearly twenty percent, expanding the impact beyond traditional U.S.–China trade tensions. According to a Federal Reserve analysis, manufacturing and mining industries exhibit the highest exposure under these measures, with a significant share of CFOs actively diversifying their supply chains and accelerating capital purchases in anticipation of further duties.

To mitigate these headwinds, equipment manufacturers and end users are pursuing reshoring initiatives, forging partnerships with domestic suppliers, and reclassifying equipment under alternative tariff categories. Nonetheless, for highly specialized cells and consumables that lack local equivalents, incumbent operations continue to absorb these incremental costs, affecting project economics and maintenance budgets.

Deriving Actionable Insights from Machine Type Capacity Mobility Driving Mechanism and Application-Based Segmentations in Flotation Markets

Analyzing the market through a type-based lens reveals that column flotation cells are increasingly favored for fine particle recovery due to their enhanced separation efficiency, while Jameson cells maintain a strong position where rapid flotation kinetics and compact footprints are paramount. Mechanical agitation cells continue to serve legacy operations requiring robust mixing capabilities, and pneumatic flotation units are carving out niches in applications demanding low energy consumption and simplified maintenance.

Capacity segmentation further delineates market dynamics, with large-scale installations dominating high-throughput operations in established mining complexes, medium-capacity units finding broad application in diversified mineral processing facilities, and small, pilot-scale systems facilitating research, development, and specialized processing tasks. Mobility considerations also play a pivotal role: stationary units underpin permanent plant installations with optimized flow sheets, whereas portable flotation systems enable rapid deployment for modular plants and remote sites.

Driving mechanisms underpin equipment performance, as air suction–driven cells offer precise aeration control for delicate separations, impeller-driven units deliver high mixing intensities suited to coarse particle recovery, and jet pump–driven systems excel in fine mineral liberation with reduced mechanical complexity. Finally, the landscape of applications spans coal processing-where both coking and thermal coal benefit from flotation-based impurity removal-mineral processing of base metals, industrial minerals, and precious metals, and wastewater treatment, encompassing both industrial effluents and municipal sludge streams.

This comprehensive research report categorizes the Froth Flotation Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Capacity

- Mobility

- Driving Mechanism

- Application

Examining Regional Dynamics across the Americas Europe Middle East Africa and Asia-Pacific That Are Influencing Froth Flotation Equipment Adoption

Regional dynamics are playing an increasingly strategic role in shaping equipment deployment and technological priorities. In the Americas, mining operations across the United States, Canada, and Latin America are driving demand for water-efficient flotation systems, spurred by stringent regulatory frameworks governing effluent quality and resource stewardship. Emerging projects targeting copper and lithium are prioritizing modular solutions to accelerate commissioning timelines.

Across Europe, the Middle East, and Africa, operators are navigating diverse geological deposits and regulatory regimes. In Southern Africa, large-scale gold and PGM producers are investing in high-capacity flotation cells engineered for robust performance in remote locations, while European refiners are focusing on retrofits that enhance energy efficiency and integrate with broader digital mine initiatives.

In Asia-Pacific, a combination of rapid industrial growth and resource nationalism is fueling expansive mineral processing programs. Australia’s nickel, copper, and iron ore sectors are adopting advanced flotation narratives that leverage integrated sensor networks and AI-enabled control loops. Regulatory reforms in countries such as Chile have catalyzed investments in smart cells designed to drastically reduce water usage and enhance process reliability.

This comprehensive research report examines key regions that drive the evolution of the Froth Flotation Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Innovations and Strategic Moves Driving Competition in the Froth Flotation Equipment Landscape

Leading suppliers are differentiating through a blend of product innovation and strategic alliances. Metso has expanded its flotation portfolio with solutions such as the Spider Crowder upgrade, which optimizes froth management in large cells and drives metallurgical performance improvements. FLSmidth’s introduction of the REFLUX Flotation Cell leverages enhanced aeration and rotor designs to cut energy consumption while maintaining throughput, reflecting a broader industry pivot toward eco-efficient technologies.

In the reagents arena, BASF’s Luprofroth and Luproset brands exemplify next-generation chemistries designed for high selectivity, lower toxicity, and reduced ecological footprints, addressing the dual imperatives of performance and compliance. Meanwhile, emerging contenders are entering the market with specialized microbubble flotation columns and modular cell architectures that facilitate rapid scaling and minimize capital expenditure risk.

This comprehensive research report delivers an in-depth overview of the principal market players in the Froth Flotation Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ANDRITZ AG

- Eriez Manufacturing Co.

- FLSmidth & Co. A/S

- Gekko Systems Pty Ltd

- JXSC Mining Machinery Co., Ltd.

- Metso Outotec Oyj

- Multotec (Pty) Ltd.

- Tenova SpA

- The Weir Group PLC

- Xinhai Mining Technology & Equipment Inc.

Implementing Strategic Initiatives and Best Practices to Strengthen Market Position and Operational Excellence in Flotation Equipment

Industry leaders should prioritize the integration of digital twins and AI-driven process control to enhance real-time decision-making and predictive maintenance capabilities. By embedding sensor networks within flotation circuits and leveraging advanced analytics, operators can reduce unplanned downtime and optimize reagent consumption.

To navigate tariff-induced uncertainties, companies are advised to evaluate domestic manufacturing partnerships and nearshoring opportunities for critical equipment components. Cultivating relationships with local fabricators can not only alleviate duty burdens but also strengthen supply chain resilience and shorten lead times.

Investing in sustainable reagent formulations and low-energy driving mechanisms will be essential to align with evolving environmental regulations and corporate decarbonization goals. Collaborative development programs between equipment OEMs and chemical suppliers can yield tailored solutions that balance metallurgical performance with ecological stewardship.

Finally, industry players should commit to continuous capability development through cross-functional training and digital literacy programs. Equipping technical teams with the skills to interpret complex data streams and manage integrated automation systems will be a key differentiator in achieving operational excellence.

Detailing Rigorous Research Approaches Data Sources and Validation Techniques Underpinning the Comprehensive Flotation Equipment Analysis

This analysis synthesizes intelligence from a multi-stage research process combining exhaustive secondary and primary investigations. Secondary research involved reviewing corporate disclosures, peer-reviewed engineering journals, patent filings, and regulatory publications to map technological advancements and environmental imperatives.

Primary research encompassed in-depth interviews with equipment OEM executives, process engineers, and procurement specialists, providing firsthand perspectives on adoption drivers and emerging challenges. Data triangulation techniques were employed to cross-validate qualitative insights with industry case studies and macroeconomic reports.

Segmentation frameworks were developed through an iterative approach, aligning machine types, capacity classes, mobility options, driving mechanisms, and application domains with operational use cases and regional market characteristics. Throughout, rigorous data validation protocols ensured consistency and objectivity, underpinning the credibility of the findings presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Froth Flotation Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Froth Flotation Equipment Market, by Type

- Froth Flotation Equipment Market, by Capacity

- Froth Flotation Equipment Market, by Mobility

- Froth Flotation Equipment Market, by Driving Mechanism

- Froth Flotation Equipment Market, by Application

- Froth Flotation Equipment Market, by Region

- Froth Flotation Equipment Market, by Group

- Froth Flotation Equipment Market, by Country

- United States Froth Flotation Equipment Market

- China Froth Flotation Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Key Findings and Strategic Imperatives Highlighting the Pivotal Role of Advanced Froth Flotation Technologies in Resource Recovery

The convergence of sustainability mandates, digital innovation, and evolving trade policies is reshaping the froth flotation equipment sector at an unprecedented pace. Advances in eco-efficient cell designs and reagent chemistries promise to reduce environmental impact while enhancing recovery performance across diverse mineral processing contexts.

Tariff-induced cost pressures are prompting a strategic reevaluation of supply chain configurations, with reshoring and nearshoring emerging as viable pathways to mitigate duty burdens and bolster operational resilience. In parallel, the proliferation of AI-enabled process controls and digital twins is setting new benchmarks for performance optimization and maintenance efficiency.

For stakeholders across the value chain-from OEMs and reagent suppliers to mining operators and environmental regulators-these trends underscore the importance of agile adaptation and collaborative innovation in securing competitive advantage and achieving long-term sustainability.

Connect with Ketan Rohom to unlock in-depth insights and secure your comprehensive strategic froth flotation equipment report today

For tailored guidance on leveraging these insights and securing a detailed market research report, please connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He can provide comprehensive information on how this analysis applies to your strategic objectives and arrange access to the full suite of findings to help drive your organization’s success in the evolving froth flotation equipment landscape.

- How big is the Froth Flotation Equipment Market?

- What is the Froth Flotation Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?