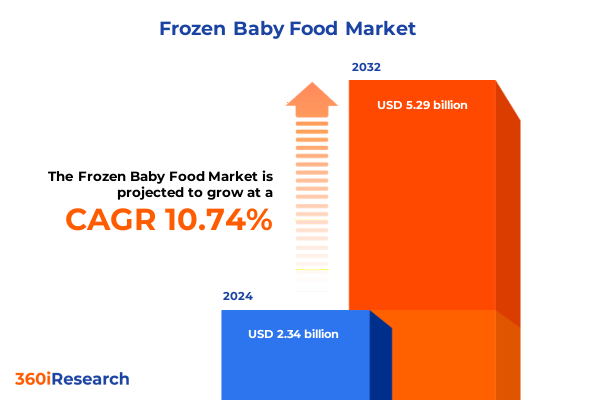

The Frozen Baby Food Market size was estimated at USD 2.59 billion in 2025 and expected to reach USD 2.88 billion in 2026, at a CAGR of 10.75% to reach USD 5.29 billion by 2032.

Unlocking the Essentials Behind the Growing Popularity and Nutritional Innovation Driving the Frozen Baby Food Market Forward in 2025

The frozen baby food arena is experiencing a wave of innovation as modern parents demand convenience without sacrificing nutritional integrity. Recent years have witnessed a marked shift toward products that deliver the freshness and vitamin retention of homemade meals with the ease of a ready-to-serve solution. This convergence of convenience and quality is reshaping retail assortments, elevating premium offerings alongside value-driven options. From a nutritional standpoint, the industry is under pressure to meet stringent guidelines and consumer expectations for clean-label ingredients, driving manufacturers to refine freezing technologies and preserve delicate flavors. Simultaneously, the rise of e-commerce platforms has broadened reach beyond traditional brick-and-mortar channels, enabling targeted direct-to-consumer strategies and subscription models that foster brand loyalty.

Dynamic demographic trends are further propelling market evolution. Urbanization and dual-income households create an accelerated consumption pattern, while heightened awareness of infant health and wellness prompts more discerning purchasing behavior. Parents now seek transparent sourcing, organic certifications, and clear labeling on everything from nutrient composition to allergen management. These factors collectively craft an environment where innovation, reliability, and consumer trust form the pillars of success. As frozen baby food transitions from a niche convenience offering to a mainstream pantry staple, the stage is set for new entrants and established players alike to capitalize on a rapidly maturing marketplace.

Tracing the Pivotal Technological Advances and Consumer Preferences That Are Reshaping the Landscape of Frozen Baby Food Consumption Globally

Technological breakthroughs and evolving consumer mindsets are catalyzing a transformative shift in the frozen baby food landscape. On the innovation front, advanced cryogenic freezing techniques and high-pressure processing have emerged as leading methods for locking in flavor, color, and nutrient profiles. These refined preservation processes not only extend shelf life but also create opportunities for more delicate formulations, such as probiotic-fortified blends and plant-powered protein alternatives. In parallel, digital endpoints are reshaping supply chain transparency, with blockchain and IoT-enabled cold chain sensors offering real-time tracking and quality assurance from farm to freezer.

Consumer preferences have undergone an equally dramatic evolution. There is a growing appetite for personalized nutrition, fueled by digital health platforms that help parents identify specific dietary needs and allergy considerations. Clean-label credentials, non-GMO verification, and sustainably sourced ingredients have become prerequisites for brand credibility. Moreover, the surge in meal customization-ranging from mixed-vegetable medleys to single-ingredient purees-reflects a broader trend toward modular eating experiences. Retailers and manufacturers are responding by co-developing exclusive ranges tailored to store formats and regional taste profiles. These concerted efforts in technology adoption and consumer-centric design underscore a decisive movement toward an industry defined by flexibility, transparency, and heightened quality standards.

Assessing How 2025 Tariff Adjustments on Key Raw Ingredients and Packaging Inputs Have Altered the Economic Viability of Frozen Baby Food in the United States

The United States’ tariff adjustments implemented in early 2025 have exerted a pronounced effect on the frozen baby food value chain. Crucial raw materials such as specialty fruits, vegetables, and packaging components experienced cost fluctuations in response to higher import duties. These elevated input costs have imposed pressure on manufacturers’ margins, prompting procurement teams to diversify sourcing strategies or renegotiate supplier contracts to mitigate financial impact. In certain instances, companies have opted to nearshore production facilities, capitalizing on lower labor rates and streamlined logistics to offset the cost burden associated with overseas imports.

Equally significant is the influence of tariffs on packaging supplies. Containers made of flexible film and molded trays, essential for portion control and convenience, have seen price escalations, leading to a reexamination of material choices and the exploration of recyclable or biodegradable alternatives. Downstream, trade dynamics have encouraged collaboration between frozen food producers and carriers to optimize cold chain routes, balancing tariff-induced costs against temperature-controlled shipping efficiencies. While the adjustments created short-term headwinds, they also spurred innovation around local ingredient sourcing and packaging reformulation, ultimately advancing the sector’s resilience and reinforcing the imperative for agile supply chain frameworks.

Unveiling Critical Segmentation Patterns Across Product Types Ingredients Packaging Formats and End Users to Illuminate Strategic Growth Opportunities

Diving beneath the surface of the frozen baby food market reveals distinct patterns when viewed through various lenses of consumer demand and product configuration. By product type, offerings span cereal blends, fruit puree, meat and vegetable blends, mixed meals, and vegetable puree, each catering to unique nutrition and taste preferences. Within the fruit puree category, further subdivisions include cup formats, pouches, and trays, presenting a tiered approach from on-the-go convenience to home-use presentation.

Ingredient-based segmentation further distinguishes the market between conventional and organic varieties. Conventional lines remain accessible to a broad consumer base seeking trusted reliability, while organic alternatives attract premium-focused parents who prioritize pesticide-free cultivation and non-GMO validation. Packaging format exerts additional influence on purchasing decisions: cups deliver single-serving simplicity, plastic trays ensure portion control in institutional settings, and pouches excel in mobility and spill-proof design. End-user channels such as daycare centers, healthcare institutions, households, and restaurants and catering services each possess distinct requirements for volume, nutritional compliance, and ease of handling. Households drive the greatest volume through e-commerce and retail outlets, while institutional users value standardization and streamlined preparation processes. This layered segmentation mapping uncovers niche opportunities and guides targeted innovation strategies.

This comprehensive research report categorizes the Frozen Baby Food market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient

- Packaging Type

- End User

Illuminating Regional Performance Trends and Market Dynamics Spanning the Americas Europe Middle East Africa and Asia Pacific Territories

Geographic dynamics play a pivotal role in defining strategic priorities and innovation trajectories across the frozen baby food domain. Within the Americas, market leaders continue to harness robust retail networks and advanced cold chain infrastructure, enabling widespread distribution and rapid fulfillment for both mature urban centers and underserved rural areas. North American consumers’ preference for nutritional transparency has accelerated premium product launches, whereas Latin American regions exhibit growing curiosity for affordable yet wholesome alternatives.

Across Europe, Middle East and Africa, the market is characterized by complex regulatory requirements and diverse cultural palates. European markets emphasize stringent quality certifications and eco-friendly packaging, while the Middle East and parts of Africa are witnessing nascent development in centralized cold storage facilities that support product availability. Tailored flavor profiles and halal certification have become critical for regional acceptance.

In the Asia Pacific sphere, rapid urbanization and rising disposable incomes are driving accelerated demand for frozen baby food. Consumers in metropolitan hubs prioritize health and convenience, prompting manufacturers to localize offerings with regionally favored ingredients and flavor combinations. Simultaneously, expanding e-commerce penetration and improved logistics networks facilitate wider market access, closing the gap between production centers and end consumers across a vast and varied geography.

This comprehensive research report examines key regions that drive the evolution of the Frozen Baby Food market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Industry Players and Their Innovative Strategies to Gain Competitive Advantage in the Evolving Frozen Baby Food Marketplace

A handful of principal players are defining the competitive contours of the frozen baby food industry through a blend of innovation, strategic partnerships, and brand equity. Well-established international conglomerates leverage their scale to invest heavily in research and development, refining proprietary freezing technologies and extending product portfolios to capture premium segments. Mid-sized specialists are differentiating through organic certifications, clean-label claims, and direct-to-consumer subscription platforms that build recurring revenue streams and foster loyalty.

Emerging brands are carving out niche positions by collaborating with local farmers to secure traceable ingredient sources, spotlighting farm-to-freezer narratives that resonate with sustainability-minded parents. Several companies have accelerated alliances with packaging innovators to trial compostable films and temperature-sensitive indicators, thereby enhancing both environmental credentials and consumer confidence. Distribution partnerships with major grocers and digital marketplaces have become essential for scale, enabling tailored promotional campaigns and broad shelf visibility. These strategic maneuvers underscore a transition from traditional commodity competition to a more nuanced battleground defined by brand trust, technological prowess, and consumer engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Frozen Baby Food market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Ajinomoto Co Inc

- Amy's Kitchen Inc

- Ausnutria Dairy Corporation Ltd

- Bambinos Baby Food

- Beech-Nut Nutrition Company

- Bubs Australia Limited

- Cerebelly Inc

- Conagra Brands Inc

- Danone SA

- Feihe International Inc

- General Mills Inc

- Hero Group

- HiPP GmbH & Co Vertrieb KG

- Kewpie Corporation

- Little Spoon Inc

- McCain Foods Limited

- Nestlé SA

- Nomad Foods Ltd

- Once Upon a Farm LLC

- Perrigo Company plc

- Reckitt Benckiser Group PLC

- The Hain Celestial Group Inc

- The Kraft Heinz Company

Proactive Strategies for Industry Leaders to Capitalize on Emerging Trends and Mitigate Risks in the Frozen Baby Food Sector

To thrive in the rapidly evolving frozen baby food sector, industry leaders should adopt a multifaceted approach that blends sustainability, agility, and consumer-centricity. Prioritizing investment in recyclable and compostable packaging materials will not only address environmental expectations but also differentiate brands in a crowded market. Cultivating diversified sourcing networks-balancing regional farms with international suppliers-can mitigate tariff exposure and supply chain disruptions while ensuring consistent quality standards.

Digital transformation is equally imperative. Brands must leverage data analytics to decode shifting consumer behaviors, optimize inventory management, and personalize marketing outreach. Direct-to-consumer subscription models, augmented by loyalty ecosystems and nutritional guidance apps, can foster deeper connections and recurring revenue streams. Strategic alliances with cold chain logistics providers will enhance distribution reliability, particularly in emerging regions where infrastructure gaps exist. Lastly, fostering transparent communication around ingredient provenance, nutritional benefits, and social responsibility commitments will solidify brand credibility and align with the values of today’s discerning parents.

Comprehensive Overview of the Research Framework Data Collection Techniques and Analytical Approaches Underpinning Our Insights into Frozen Baby Food

The research underpinning this analysis combined both primary and secondary methodologies to ensure a holistic understanding of the frozen baby food market. Primary research encompassed in-depth interviews with industry executives, procurement specialists, and culinary scientists to capture frontline perspectives on technology adoption, regulatory compliance, and consumer adoption trends. In parallel, structured surveys of parents and institutional foodservice operators provided quantitative insights into purchasing criteria, packaging preferences, and emerging nutritional priorities.

Secondary research involved a thorough review of publicly available information from trade associations, regulatory bodies, and reputable news sources to contextualize tariff impacts, regional developments, and competitive benchmarks. Data triangulation techniques were employed throughout to validate findings, cross-referencing insights from multiple sources to eliminate biases. Analytical frameworks such as SWOT and Porter’s Five Forces guided the evaluation of market competitiveness and supplier dynamics. This robust research design ensures that conclusions are grounded in credible evidence and reflect the multifaceted realities of the global frozen baby food ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Frozen Baby Food market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Frozen Baby Food Market, by Product Type

- Frozen Baby Food Market, by Ingredient

- Frozen Baby Food Market, by Packaging Type

- Frozen Baby Food Market, by End User

- Frozen Baby Food Market, by Region

- Frozen Baby Food Market, by Group

- Frozen Baby Food Market, by Country

- United States Frozen Baby Food Market

- China Frozen Baby Food Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Key Findings and Strategic Imperatives to Guide Stakeholders in Navigating the Future Trajectory of the Frozen Baby Food Market

Throughout this exploration, several key themes have crystallized: the convergence of nutrition and convenience, the imperative of sustainable packaging and sourcing, and the strategic importance of digital engagement. Technological advances in freezing and processing are enabling richer product differentiation, while demographic and cultural shifts are dictating more personalized and health-focused offerings. Tariff-induced cost pressures have catalyzed supply chain innovations and local sourcing initiatives, reinforcing resilience in the face of global trade disruptions.

Segmentation analysis highlights the nuanced needs of different consumer cohorts, from households that gravitate toward single-serve fruit purees in pouches to institutional users reliant on standardized trays. Regional insights underscore the varied pace of adoption and regulatory complexity spanning the Americas, Europe, Middle East, Africa, and Asia Pacific. Competitive dynamics show that while industry titans leverage scale for R&D investment, nimble challengers find traction through organic and farm-to-freezer positioning. Collectively, these insights illuminate a market at a pivotal juncture-one that rewards innovation, agility, and a relentless focus on trust and transparency.

Secure Personalized Market Intelligence and Unlock Strategic Growth Potential in Frozen Baby Food by Partnering Directly with an Industry Expert

To gain a competitive edge through deep analytics and tailored strategic guidance, secure your comprehensive market research report by connecting with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Ketan brings extensive expertise in the frozen baby food category and a keen understanding of evolving supply chain dynamics, consumer preferences, and regulatory landscapes. By partnering directly, you will unlock customized insights covering product innovation, tariff impact analysis, regional demand drivers, and actionable segmentation recommendations. Whether you seek clarity on ingredient sourcing strategies, packaging optimization, or emerging distribution channels, Ketan will help you navigate these complexities with confidence. Reach out to arrange a personalized consultation, explore bespoke market intelligence options, and access the latest findings that can inform your next strategic move. Empower your organization to stay ahead of disruptive shifts and capitalize on untapped opportunities. Take the first step toward informed decision-making and sustained growth by engaging with an expert who can translate data into decisive action for your frozen baby food initiatives

- How big is the Frozen Baby Food Market?

- What is the Frozen Baby Food Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?