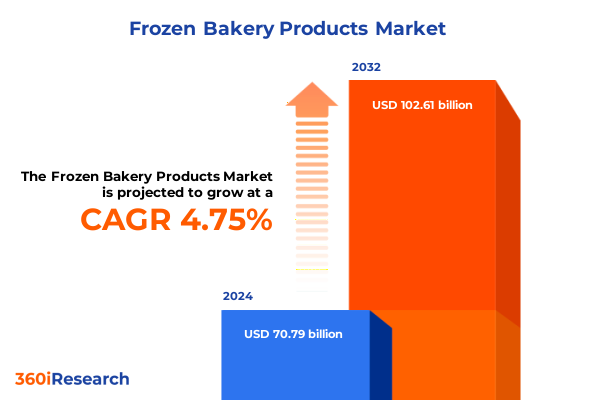

The Frozen Bakery Products Market size was estimated at USD 73.91 billion in 2025 and expected to reach USD 77.26 billion in 2026, at a CAGR of 4.79% to reach USD 102.61 billion by 2032.

Exploring the dynamic evolution and strategic significance of frozen bakery products in meeting modern consumer demands and driving industry innovation

The frozen bakery products sector has emerged as a vital pillar of the modern foodservice and retail landscape, offering unparalleled convenience and consistent quality for consumers worldwide. From artisan breads to ready-to-bake pastries, frozen bakery innovations cater to the evolving lifestyles of households seeking both time savings and enhanced culinary experiences. Over the past decade, advancements in freezing technologies have enabled manufacturers to deliver products that retain texture, flavor, and nutritional integrity, effectively blurring the line between fresh and frozen offerings. As a result, the sector has witnessed robust growth, driven by attributes such as extended shelf life, operational flexibility, and the ability to meet surging demand in both foodservice and home baking sectors.

Amid shifting demographics and urbanization trends, time-pressed consumers have increasingly turned to frozen solutions that promise restaurant-quality results with minimal preparation. This shift has spurred a wave of product diversification, including clean-label formulations, plant-based alternatives, and premium artisanal varieties. Concurrently, foodservice operators have leveraged frozen bakery items to streamline back-of-house operations, reduce waste, and ensure consistent output across multiple locations. Transitioning from a cost-saving commodity to a strategic ingredient, frozen bakery products now play a pivotal role in menu innovation and brand differentiation. In this context, understanding the underlying forces shaping the frozen bakery market is essential for industry stakeholders seeking to capitalize on emerging opportunities and navigate potential headwinds.

How shifting consumer preferences and advanced technologies are revolutionizing the frozen bakery product landscape across global markets

The landscape of frozen bakery products is undergoing a series of transformative shifts, propelled by stronger consumer preferences for transparency, authenticity, and personalization. Today’s shoppers demand ingredient integrity, prompting manufacturers to reformulate portfolios with clean-label and non-GMO claims. Furthermore, the surge in plant-based diets has challenged producers to develop innovative meatless pastry fillings and egg-free doughs that replicate traditional textures and flavors without compromise. As a consequence, collaborations between ingredient suppliers and R&D teams have intensified, yielding breakthrough solutions that blend plant proteins, functional fibers, and natural binders to deliver superior sensory attributes.

Simultaneously, digitalization and automation are redefining manufacturing footprints and supply-chain architectures. Sensor-driven quality control systems, AI-powered demand forecasting, and automated dough handling are enhancing throughput, reducing waste, and ensuring batch-to-batch consistency. These technological advancements support agile production models capable of rapid SKU changeovers, accommodating niche flavors or limited-edition releases that cater to local trends. In parallel, omnichannel distribution strategies are gaining momentum as producers integrate direct-to-consumer e-commerce platforms with traditional brick-and-mortar partnerships. By leveraging predictive analytics and last-mile logistics solutions, frozen bakery brands can offer subscription-based deliveries and personalized mix-and-match assortments, further tailoring their value proposition to discerning consumers. This convergence of innovation and consumer insight is reshaping the competitive playing field, compelling market participants to adapt or risk obsolescence.

Assessing the cumulative impact of newly imposed United States tariffs on frozen bakery products and supply chains throughout 2025

Beginning in early 2025, the United States government enacted a series of tariffs targeting key trading partners-Canada, Mexico, and China-that have exerted substantial pressure on the frozen bakery products supply chain. These measures include a 25% levy on most imports from Canada and Mexico and a 10% duty on Chinese goods, effective March 4, 2025, as stipulated under the International Emergency Economic Powers Act, with limited carve-outs for de minimis entries prior to February 1, 2025. While initial implementation paused some tariff actions pending stakeholder consultations, the eventual resumption of duties has underscored the critical dependence of U.S. bakers on cost-effective cross-border sourcing.

According to the American Bakers Association, the cumulative financial impact of these tariffs on the U.S. baking industry is projected to reach approximately $454 million in 2025. Specifically, 2024 imports of $977 million in Canadian goods-spanning ingredients, packaging, and equipment-face an additional $244 million in costs under a 25% duty, while $679 million worth of Mexican imports incurs roughly $170 million in added expenses. Chinese shipments valued at $395 million yield an extra $40 million after a 10% tariff is applied. These incremental outlays translate into higher input costs for flour blends, specialty fats, chocolate, and other critical components used in frozen bakery formulations.

Beyond direct price impacts, the tariff regime has triggered secondary effects across logistics and procurement strategies. Many manufacturers report lengthening lead times as suppliers seek to reroute shipments through non-tariff jurisdictions, while some are pursuing nearshoring options to mitigate exposure. However, reallocating production capacity domestically entails significant capital expenditures and extended ramp-up periods. In the interim, margin compression and price pass-through to foodservice operators and retailers are straining customer relationships, potentially dampening volume growth. Looking ahead, market participants will need to reassess supplier contracts, explore alternate ingredient formulations, and engage with policymakers to advocate for more nuanced trade remedies.

Revealing segmentation insights on product diversity, flavour preferences, dietary choices, shelf life categories, distribution networks, end-use scenarios

The frozen bakery products market can be dissected through multiple segmentation lenses, each revealing unique patterns of demand and innovation. Examining product type differentiation uncovers the dominance of bread offerings-such as artisan, multigrain, and gluten-free variants-alongside high-growth categories including pastries, frozen doughs, and specialty pizza crusts. Regional palettes and meal occasions drive flavor segmentation, where Savory profiles led by cheese, herb, and vegetable notes coexist with Sweet expressions ranging from caramel and chocolate to seasonal fruit essences. This interplay between global taste trends and local preferences has prompted manufacturers to expand limited-edition lines while maintaining core SKUs that resonate across demographics.

Dietary preference segmentation underscores the rising importance of gluten-free, keto, and plant-based formulations, as health-oriented consumers seek bakery indulgences that align with restrictive eating patterns. The bifurcation of the keto segment into high-protein and standard formulations highlights the growing emphasis on functional nutrition. Shelf life segmentation further delineates the market, contrasting ultra-convenient, long-shelf-life offerings exceeding 12 months with freshly oriented short-term frozen solutions designed for rapid turnover. Distribution channels form another critical axis; offline sales through bakery stores and supermarkets remain foundational, yet online platforms-from branded websites to major e-commerce marketplaces-are gaining traction as digital grocery adoption accelerates. Finally, end-use applications distinguish commercial kitchens-cafes, catering services, and full-service restaurants-from residential usage, where single-serve convenience and family-size packs support diverse consumption scenarios.

This comprehensive research report categorizes the Frozen Bakery Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Flavours

- Shelf Life

- Distribution Channel

- End Use

Highlighting regional dynamics and emerging opportunities across the Americas, Europe Middle East & Africa, and Asia-Pacific frozen bakery markets

Across the Americas, frozen bakery products benefit from well-established cold chain networks and a mature retail ecosystem that embraces both value-oriented products and premium artisanal offerings. North American consumers have shown particular enthusiasm for clean-label breads and indulgent pastries, while Latin American markets demonstrate strong growth potential in frozen pizza crusts and dough segments, driven by urbanization and rising disposable incomes. Transitioning eastward, the Europe, Middle East & Africa region is characterized by diverse eating traditions and regulatory frameworks emphasizing food safety and ingredient transparency. Western European markets gravitate toward whole grain and specialty breads, whereas the Middle East’s café culture underpins demand for sweet and savory pastries. In Africa, expanding foodservice infrastructure is creating nascent opportunities, albeit tempered by logistical challenges.

The Asia-Pacific region encompasses heterogenous dynamics, from price-sensitive markets in Southeast Asia to discerning consumers in Japan and South Korea, where premium frozen bakery innovations-such as dorayaki-style pancakes and matcha-infused pastries-find eager audiences. Australia and New Zealand blend Western and Asian influences, fostering a competitive landscape for both multinational and domestic players. Rapid digital transformation throughout APAC has elevated direct-to-consumer channels, enabling smaller producers to reach urban millennials with niche flavors and subscription-based models. Together, these regional distinctions underscore the necessity for tailored strategies that account for local supply chain realities, regulatory environments, and evolving consumer expectations.

This comprehensive research report examines key regions that drive the evolution of the Frozen Bakery Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating competitive strategies and innovation approaches driving leading companies in the global frozen bakery products sector

The competitive arena of frozen bakery goods is anchored by established multinationals and agile regional specialists. Companies such as Grupo Bimbo and Flowers Foods leverage expansive manufacturing footprints and broad product portfolios to maintain cost efficiencies and ensure rapid distribution across key markets. These incumbents invest heavily in R&D, forging partnerships with ingredient innovators to introduce next-generation dough systems and functional bakery mixes. Meanwhile, midsized players like Dawn Foods differentiate through customization capabilities, offering co-packing solutions and localized flavor development to serve both artisanal bakeries and large-scale foodservice accounts.

In parallel, niche brands and private-label operators are carving out positions by targeting underserved segments, such as plant-based laminated pastries or diabetic-friendly cookies. Their agility allows for swift product launches and iterative reformulations, often in response to real-time consumer feedback harvested from digital channels. Some have adopted sustainable packaging innovations and carbon-neutral production standards to appeal to environmentally conscious purchasers. Collaboration between retail chains and in-house frozen bakery brands further intensifies competition, as retailers seek exclusive items that foster customer loyalty. This multiplicity of strategies highlights an industry at the nexus of scale-driven efficiency and targeted differentiation, where success hinges on aligning portfolio optimization with evolving consumer and customer needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Frozen Bakery Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amy’s Kitchen, Inc.

- ARYZTA AG

- Bakers Circle

- Bakers Delight Holdings Limited

- Bikaji Foods International Limited

- Bimbo Bakeries USA, Inc.

- Conagra Brands, Inc.

- Dr. Oetker

- EUROPASTRY, S.A.

- Flowers Foods, Inc.

- General Mills, Inc.

- Hostess Brands, Inc.

- Kellanova

- Krispy Kreme Doughnut Corp.

- La Lorraine Bakery Group

- Lantmännen Unibake International

- McCain Foods USA, Inc.

- McKee Foods Corporation

- Mondelēz International, Inc.

- Nestlé S.A.

- New York Bakery Co.

- Otis Spunkmeyer, Inc

- Pepperidge Farm Incorporated

- Rich Products Corporation

- Rise Baking Company

- Schwan's Food Service, Inc.

- The Hain Celestial Group, Inc.

- The Original Cakerie Co.

- Vandemoortele NV

- VIVESCIA

- Yamazaki Baking Co., Ltd.

Providing actionable strategic recommendations to help industry leaders navigate challenges and capitalize on growth prospects in frozen bakery products

To thrive amid escalating raw material costs and trade uncertainties, industry leaders should prioritize resilience and adaptability across their value chains. First, diversifying supplier bases and evaluating nearshore manufacturing options can mitigate tariff risks while preserving supply continuity. Engaging in collaborative forecasting and inventory sharing with key trading partners will enhance visibility and reduce lead time volatility. Second, accelerating R&D investments in alternative ingredients-such as high-performance flour substitutes, stabilizer blends, and plant-based fat systems-can offset cost pressures and expand dietary-friendly offerings, thereby capitalizing on emerging health and wellness trends.

Operationally, companies should harness data analytics to optimize production schedules, minimize waste through real-time quality controls, and fine-tune batch sizes to align with latest demand signals. Digital transformation of order-to-cash processes and integration of predictive logistics platforms will streamline distribution networks and improve fill rates across offline and online channels. From a commercial standpoint, developing dynamic pricing models and value-added packaging solutions-such as multipacks and heat-and-serve formats-can enhance brand agility in retail environments facing margin compression. Finally, fostering proactive policy engagement and tracking regulatory developments will position organizations to anticipate potential trade actions. By embracing a dual focus on strategic innovation and supply chain fortification, frozen bakery manufacturers and distributors can safeguard profitability and propel sustainable growth.

Detailing the robust research methodology encompassing primary interviews, secondary data analysis, and validation processes behind the frozen bakery products study

This study’s findings are grounded in a rigorous, multi-stage research methodology designed to ensure accuracy, relevance, and depth of analysis. Secondary research formed the initial framework, encompassing a review of industry publications, trade association reports, regulatory filings, and company disclosures. This phase provided critical context on market dynamics, technology trends, and competitive landscapes. In parallel, tariff data and supply chain impacts were corroborated through government notices and legal analyses, ensuring a granular understanding of trade measures affecting frozen bakery imports.

Primary research involved structured interviews with executive-level stakeholders across the frozen bakery ecosystem, including R&D directors, procurement managers, foodservice operators, and retail category buyers. Discussions probed product development priorities, margin pressures, and channel strategies. Quantitative data collected from these interviews was triangulated with secondary sources to validate key insights and uncover divergent viewpoints. A proprietary scoring model evaluated companies based on innovation capabilities, financial resilience, and supply chain flexibility, while regional market potential was assessed through demographic and consumption pattern analyses. Finally, a review panel of subject-matter experts provided critical feedback on draft conclusions, ensuring methodological rigor and practical applicability for industry decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Frozen Bakery Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Frozen Bakery Products Market, by Product Type

- Frozen Bakery Products Market, by Flavours

- Frozen Bakery Products Market, by Shelf Life

- Frozen Bakery Products Market, by Distribution Channel

- Frozen Bakery Products Market, by End Use

- Frozen Bakery Products Market, by Region

- Frozen Bakery Products Market, by Group

- Frozen Bakery Products Market, by Country

- United States Frozen Bakery Products Market

- China Frozen Bakery Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Summarizing essential takeaways and the strategic importance of insights for stakeholders in the frozen bakery products market

The frozen bakery products sector is at an inflection point defined by consumer-driven innovation, supply chain realignment, and geopolitical factors reshaping cost structures. As tariff pressures challenge traditional procurement models, manufacturers must embrace strategic pivots that balance efficiency with agility. Segmentation analyses reveal distinct growth pathways, from gluten-free breads and keto-friendly doughs to regionally inspired pastries and emerging e-commerce channels. Regional insights highlight the necessity of localized approaches, while competitive assessments underscore the value of scale coupled with targeted differentiation.

By synthesizing these insights, industry stakeholders can make informed decisions that align product portfolios with evolving demand, optimize operations in the face of trade volatility, and differentiate their offerings through innovation. The collective findings reinforce a central theme: the ability to anticipate change and proactively adapt will distinguish the market leaders of tomorrow. With a comprehensive understanding of segment dynamics, regional nuances, and competitive strategies, organizations are well-positioned to harness growth opportunities and mitigate risks in the dynamic frozen bakery landscape.

Empowering decision makers with a compelling call-to-action to connect with Ketan Rohom for comprehensive market insights and purchasing next steps

For organizations looking to deepen their understanding of frozen bakery market dynamics and translate insights into actionable strategies, the next step is clear. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to discuss tailoring the report to your unique business objectives. Ketan’s expertise in baked goods trends and market intelligence will guide you through the data, helping you identify high-impact opportunities and competitive advantages. Engage in a detailed consultation to explore customized analyses, bulk purchasing options, and enterprise licensing arrangements that align with your growth roadmap. By securing full access to the comprehensive market report, you empower your team with the strategic intelligence needed to drive innovation, optimize supply chains, and enhance profitability. Connect with Ketan today to unlock the full potential of frozen bakery insights and ensure you stay ahead in a market defined by rapid transformation and evolving consumer preferences.

- How big is the Frozen Bakery Products Market?

- What is the Frozen Bakery Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?