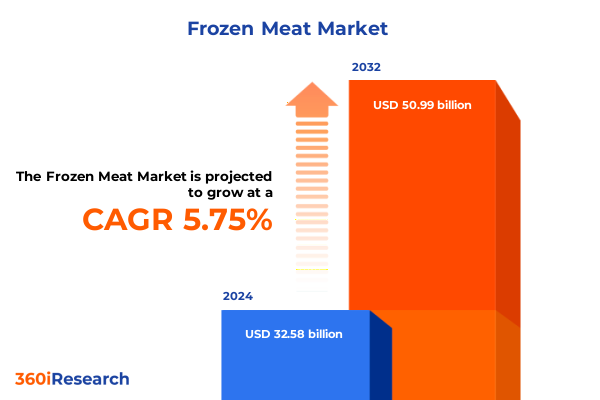

The Frozen Meat Market size was estimated at USD 34.41 billion in 2025 and expected to reach USD 36.35 billion in 2026, at a CAGR of 5.77% to reach USD 50.99 billion by 2032.

Exploring the evolving dynamics of the frozen meat industry and emerging opportunities in a changing global food ecosystem

The frozen meat industry stands at a pivotal crossroads where shifts in consumer behavior, technological advancements and global supply dynamics converge to reshape the competitive environment. Rising demand for convenience-driven food solutions has propelled frozen meat products from a secondary offering to a cornerstone of modern foodservice menus and at-home meal planning. Moreover, heightened awareness around food safety, traceability and sustainability has elevated quality expectations, prompting producers to invest in advanced processing techniques and transparent sourcing practices.

As generational cohorts seek balanced lifestyles that integrate health-conscious choices with time-saving options, the frozen meat market has adapted by broadening its product portfolio to include leaner cuts, value-added processed meats and globally inspired flavors. Concurrently, supply chain resilience has evolved into a strategic imperative, driving stakeholders to diversify sourcing regions and streamline cold chain logistics. These developments underscore a renewed focus on efficiency without sacrificing the integrity of meat quality.

Unveiling how preservation breakthroughs digital distribution innovations and sustainability initiatives are revolutionizing frozen meat supply chains

Over the past decade, the frozen meat landscape has been transformed by technological breakthroughs in packaging and preservation. Innovations such as high-pressure processing and modified atmosphere packaging have significantly extended shelf life while maintaining texture, flavor and nutritional value. These advancements have reduced waste, minimized quality degradation and enhanced consumer confidence in frozen offerings.

Parallel to preservation technologies, digital platforms and data analytics have disrupted traditional distribution frameworks. Real-time temperature monitoring and predictive maintenance for cold storage facilities have emerged as critical enablers of uninterrupted supply. E-commerce channels now offer direct-to-consumer frozen meat deliveries with customized subscription models, challenging conventional wholesale and retail paradigms. This digital shift is further characterized by interactive mobile applications that provide product origins, cooking suggestions and traceability credentials, reinforcing brand trust and driving repeat purchases.

Sustainability considerations have also redefined operational priorities. Leading producers are adopting renewable energy solutions for cold storage warehouses, while exploring circular economy initiatives that upcycle organic byproducts into animal feed or energy. As environmental, social and governance frameworks become integral to corporate strategy, these sustainability efforts not only mitigate regulatory risk but also resonate with eco-conscious consumers, thereby catalyzing brand differentiation in saturated markets.

Examining the multifaceted repercussions of United States tariff realignments on frozen meat trade dynamics and supply chain agility

In 2025, the imposition of new tariff structures by the United States has reconfigured cost equations across both imports and domestic pricing of frozen meat products. Tariffs on key protein imports have pressured global suppliers to reassess their export strategies, prompting shifts in trade flows as exporters seek more tariff-favorable markets. Meanwhile, domestic producers have experienced a competitive reprieve, enabling reinvestment in capacity expansion and modernization of processing lines to meet growing homegrown demand.

However, the tariff adjustments have not been without complex ripple effects. Upstream suppliers in producing regions have encountered unpredictable order volumes, compelling them to explore long-term contracts to stabilize revenue. Concurrently, importers have accelerated diversification efforts, engaging with alternate sourcing locations that offer lower tariff burdens or bilateral trade agreements. These strategic recalibrations have introduced new logistics corridors, redefined partnerships and spotlighted the need for agile procurement models that can swiftly adapt to evolving tariff landscapes.

Taken together, these dynamics underscore the interdependence of trade policy, supply chain agility and corporate planning. Stakeholders attuned to tariff fluctuations and proactive in revisiting sourcing matrices are best positioned to harness emerging advantages while mitigating exposure to trade policy volatility in an increasingly fragmented global marketplace.

Illuminating how consumer end uses packaging variations distribution avenues and source preferences shape frozen meat market dynamics

End user demand in the frozen meat domain spans from extensive commercial operations to individual households, each driving unique product preferences and volume requirements. Commercial clients such as catering services, hotels and restaurants command consistent, large-scale orders that emphasize reliability, uniformity and food safety compliance, whereas household consumers prioritize smaller package formats, convenient preparation and an expanding array of value-added options.

The choice of packaging type-whether bulk shipments for high-volume users, consumer-friendly trays for supermarket shelves or vacuum packed single-serve portions-plays a central role in influencing purchasing decisions and logistical considerations. Bulk formats reduce cost per kilogram but require robust cold storage infrastructure, while tray and vacuum options cater to end users seeking minimal handling and extended shelf stability.

Distribution channels further segment the market landscape. Foodservice distributors remain vital for institutional buyers, yet modern trade outlets including hypermarkets and warehouse clubs have become important touchpoints for value-driven shoppers. Online retail platforms are disrupting traditional routes to market by offering convenience and direct delivery, and traditional trade networks persist in regions where digital penetration is nascent or consumer habits favor established brick-and-mortar relationships.

On the supply side, source segmentation delineates consumer attitudes toward beef, pork and poultry. Beef products convey premium positioning, pork serves as a versatile mid-tier offering and poultry commands attention for its perceived health benefits. Within product type, the contrast between minced meat, processed products and whole cuts illustrates the spectrum of consumer convenience demands and culinary applications. Processed categories such as burgers, nuggets and sausages address ready-to-cook expectations, and within sausages, the choice between fresh and smoked varieties enables producers to cater to distinct flavor profiles and regional palates.

This comprehensive research report categorizes the Frozen Meat market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Packaging Type

- End User

- Distribution Channel

Revealing the contrasting regional nuances from the Americas through EMEA to Asia Pacific that influence frozen meat product adoption

Across the Americas, a growing affinity for on-the-go protein consumption has fueled demand for innovative frozen meat offerings that align with evolving taste profiles and health considerations. North America leads in adoption of premium refrigerated logistics solutions, enabling rapid product rollouts and seasonal introductions. In Latin America, local processing hubs are gaining traction, supported by investments in cold storage expansion and targeted trade agreements that reduce cross-border friction.

The Europe Middle East & Africa region presents a tapestry of regulatory environments and culinary traditions. Western Europe prioritizes strict quality assurance protocols and organic certifications, whereas Eastern markets lean toward cost-effective formats. In the Middle East, high-income consumers seek halal-certified frozen meats with global flavor influences. Across Africa, emerging urban centers are driving gradual uptake, with modern retail penetration paving the way for refrigerated and frozen categories to gain a share of consumer wallets.

Asia-Pacific stands out for its dual characteristics of enormous volume potential and tremendous diversity. Southeast Asian markets exhibit growing preference for Western-style burgers and processed snack forms, while East Asian consumers maintain strong appetites for premium whole cuts and regionally inspired marinated offerings. Robust infrastructure investments in logistics corridors and cold chain networks are crucial enablers for the region’s long-term growth trajectory, as stakeholders aim to bridge rural production zones with metropolitan consumption hubs.

This comprehensive research report examines key regions that drive the evolution of the Frozen Meat market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing how differentiation through vertical integration innovation and sustainability credentials is shaping frozen meat industry frontrunners

Leading companies in the frozen meat sphere are carving out competitive advantages through differentiated strategies that combine product innovation with supply chain optimization. Some have centered their investments on vertical integration, cultivating proprietary livestock operations and in-house processing facilities to ensure end-to-end quality control. Others have focused on strategic alliances with logistics specialists to refine cold chain resiliency and unlock new market channels.

Innovation-driven players are launching premium and value-added ready-to-cook lines, integrating globally inspired flavor profiles and clean-label ingredients to capture both health-conscious and culinary-adventurous consumers. At the same time, several incumbents are forging partnerships with digital platforms to expand direct-to-consumer capabilities, leveraging data analytics to fine-tune assortment, forecasting and personalized promotions.

Sustainability leadership has emerged as a critical differentiator. Industry frontrunners are publicly reporting environmental impact metrics and pursuing certifications that validate humane animal husbandry, reduced water usage and carbon footprint optimization. Their emphasis on transparency and traceability resonates with institutional buyers and retail chains, enhancing long-term contract discussions and premium pricing potential.

This comprehensive research report delivers an in-depth overview of the principal market players in the Frozen Meat market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AdvancePierre Foods, Inc.

- BRF S.A.

- Cargill, Inc.

- Conagra Brands, Inc.

- Cremonini S.p.A.

- Danish Crown A/S

- Foster Farms, Inc.

- Hormel Foods Corporation

- JBS S.A.

- Kerry Group plc

- LDC S.A.

- Marfrig Global Foods S.A.

- National Beef Packing Company, LLC

- NH Foods Ltd.

- Nippon Meat Packers, Inc.

- Nomad Foods Limited

- OSI Group, LLC

- Perdue Farms, Inc.

- Pilgrim’s Pride Corporation

- Sanderson Farms, Inc.

- Seaboard Corporation

- Smithfield Foods, Inc.

- Tyson Foods, Inc.

- Vion Food Group

- WH Group Limited

Empowering frozen meat stakeholders with partnership strategies digital modernization and sustainability integration for enduring competitiveness

To stay ahead in a landscape marked by regulatory flux and shifting consumer priorities, frozen meat leaders must pursue strategic partnerships that broaden their sourcing footprint and accelerate innovation cycles. Engaging with specialized cold chain technology providers can enhance real-time monitoring capabilities and reduce spoilage losses, while collaborations with flavor development experts offer a pipeline of on-trend product extensions that satisfy evolving palates.

Furthermore, embracing digital transformation is imperative. Investments in advanced analytics platforms can streamline demand forecasting, optimize inventory levels and personalize consumer engagement across e-commerce channels. Equally important is the adoption of agile procurement frameworks that incorporate scenario planning for tariff changes and sustainability criteria, ensuring procurement teams can pivot swiftly under uncertain trade conditions.

Finally, embedding sustainability into the core operating model will reinforce brand equity and unlock preferential access to key partnerships. Initiatives such as renewable energy adoption for cold storage, circular waste management and transparent supply chain reporting not only meet escalating stakeholder expectations but also drive operational efficiencies that contribute to the bottom line.

Outlining a robust mixed methods research framework combining qualitative expert interviews data triangulation and scenario analysis for dependable insights

Our research framework integrates primary and secondary data sources to construct a multidimensional perspective on the frozen meat sector. Key primary research interviews with procurement officers, supply chain managers and foodservice operators provide firsthand insights into operational challenges and strategic priorities. These qualitative engagements are complemented by secondary data obtained from reputable trade associations, government publications and proprietary industry databases that track trade flows, product launches and regulatory developments.

Analytical rigor is maintained through data triangulation, cross-validating findings across multiple sources to ensure reliability and identify emerging patterns. Advanced statistical techniques are employed to dissect shipment records and consumption trends, while scenario analyses simulate the impact of tariff adjustments and technological adoption on supply chain resilience. Expert peer review rounds refine the interpretation of results, ensuring that conclusions and recommendations reflect practical realities and strategic relevance for decision-makers.

Throughout the process, ethical research standards guide data collection and reporting. Confidentiality protocols protect sensitive contributor information, and transparency measures document methodology steps to facilitate reproducibility and foster trust in the insights delivered. This robust approach ensures that stakeholders receive a credible, actionable intelligence asset tailored to the evolving challenges and opportunities within the frozen meat market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Frozen Meat market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Frozen Meat Market, by Product Type

- Frozen Meat Market, by Source

- Frozen Meat Market, by Packaging Type

- Frozen Meat Market, by End User

- Frozen Meat Market, by Distribution Channel

- Frozen Meat Market, by Region

- Frozen Meat Market, by Group

- Frozen Meat Market, by Country

- United States Frozen Meat Market

- China Frozen Meat Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing critical insights on trend convergence operational segmentation and strategic imperatives to chart the future course of frozen meat

In an era where consumer demands, technological progress and regulatory frameworks continuously reshape the frozen meat industry, strategic agility has become a nonnegotiable competitive asset. Stakeholders equipped with a deep understanding of transformative trends-from advanced preservation methods to tariff-driven supply chain realignments-are positioned to drive sustainable growth and innovation.

The segmentation lenses of end use, packaging options, distribution channels, source preferences and product types offer a granular vantage point for customizing offerings and prioritizing investments. Regional nuances further underscore the importance of localized strategies that resonate with distinct consumer expectations and infrastructure capacities. Companies championing integration of digital tools, sustainability metrics and collaborative partnerships consistently emerge as frontrunners in market share expansion and brand loyalty.

Ultimately, the path forward demands a balanced synthesis of data-driven foresight, operational excellence and proactive engagement with evolving trade and regulatory landscapes. By internalizing the insights and recommendations presented, industry leaders can confidently navigate complexity, anticipate disruptions and capture emerging opportunities that define the future trajectory of the frozen meat sector.

Empower strategic decision making in the frozen meat sector by unlocking comprehensive insights through a direct engagement with our Associate Director

Deciding to deepen your understanding of the complex and rapidly evolving frozen meat industry can define your strategic edge in one of the most dynamic food sectors today. Ketan Rohom, Associate Director of Sales & Marketing, invites industry leaders, procurement executives and market strategists to secure the comprehensive research report that unpacks critical trends, competitive landscapes and future-oriented insights. This extensive analysis will equip your organization with the clarity and foresight necessary to navigate regulatory challenges, capitalize on shifting consumer tastes and harness supply chain innovations.

Reach out to Ketan Rohom to acquire the full report and align your next strategic moves with robust, data-driven intelligence. Empower your decision-making with the nuanced analysis and expert recommendations tailored to your business objectives in the frozen meat sector.

- How big is the Frozen Meat Market?

- What is the Frozen Meat Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?