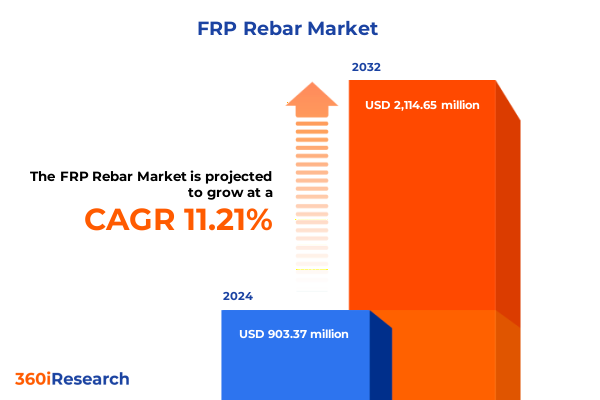

The FRP Rebar Market size was estimated at USD 999.13 million in 2025 and expected to reach USD 1,106.94 million in 2026, at a CAGR of 11.30% to reach USD 2,114.65 million by 2032.

How fiber-reinforced polymer rebar transitioned from specialty use to an essential engineering choice driven by service-life economics and material innovation

Fiber-reinforced polymer rebar has shifted from a niche specification to a mainstream alternative where corrosion resistance, weight reduction, and electromagnetic neutrality materially change design and maintenance paradigms. Across bridge decks, coastal structures, and specialty industrial applications, engineers and specifiers now consider FRP alongside traditional reinforcing steel when lifecycle performance, long-term maintenance budgets, and corrosive exposure are primary constraints. This evolution reflects a convergence of material advances, broader acceptance of nonmetallic reinforcement in codes and standards, and the pragmatic reality that service-life economics often outweigh higher upfront material cost.

As adoption increases, parallel developments have accelerated: manufacturers refined resin chemistries for greater UV and alkali resistance; fiber producers scaled continuous-manufacturing techniques to improve homogeneity and reduce defects; and fabricators developed bend and anchorage solutions adapted to nonmetallic modulus and ductility. These technical refinements have reduced barriers to entry for projects that previously rejected FRP because of perceived constructability or long-term uncertainty. Consequently, procurement conversations that once focused narrowly on unit price now routinely integrate whole-life maintenance models, risk allocation for repair cycles, and compatibility with specialized concrete mixes.

Material innovation, supply-chain realignment, and evolving standards are driving decisive shifts that accelerate real-world adoption of FRP rebar across infrastructure use cases

The landscape for FRP rebar and composite reinforcement is undergoing transformative shifts driven by material innovation, supply-chain realignment, and changing regulatory emphasis on durability and embodied carbon. New fiber and resin combinations have improved mechanical performance while enabling forms that better integrate with conventional construction workflows, thereby shortening the learning curve for contractors and owners. At the same time, supply-chain reconfiguration-prompted by geopolitical tension, nearshoring incentives, and capital investment in domestic manufacturing-has reduced single-source risk for critical fiber types even as it increased the complexity of procurement specifications.

Regulatory and design standards are moving in parallel; code committees and infrastructure owners are increasingly comfortable accepting documentation and long-term test programs in lieu of decades of field history, which shortens the approval cycle for innovative products. This regulatory pragmatism, combined with a growing emphasis on resilience and reduced maintenance budgets, is shifting the procurement calculus toward solutions whose total cost of ownership outperforms traditional steel in corrosive or magnetically sensitive environments. Consequently, early adopters are repositioning their value propositions to emphasize lifecycle savings, reduced downtime, and lower environmental maintenance burdens rather than purely first-cost comparisons.

In practice, contractors and asset owners are adopting hybrid design approaches, applying FRP selectively in zones with the highest exposure risk, and reserving conventional reinforcement where ductility and in-field adjustment remain the overriding criteria. This hybridization accelerates learning at scale and creates a virtuous cycle: installed references validate performance claims, which in turn reduce perceived risk for next-generation projects. The net effect is a progressively deeper market penetration that is both technically defensible and commercially pragmatic.

A consolidated assessment of how 2025 U.S. tariff measures and proposed carbon-linked import fees have reshaped sourcing costs and strategic procurement decisions

The aggregate tariff actions and legislative proposals introduced in 2024–2025 have created a markedly different commercial backdrop for imported reinforcement materials, and their cumulative effect is reshaping sourcing decisions for FRP rebar. Broad-based administration measures implemented in early April 2025 established an across-the-board baseline tariff on many imports and introduced additional, country-specific reciprocal duties that raise effective landed costs for goods coming from targeted trading partners. These policy decisions have prompted a two-fold immediate response among buyers: accelerated pre-tariff sourcing from trusted suppliers and a rapid reassessment of domestic or nearshore options to insulate projects against further trade-policy volatility. The implementation and enforcement of the baseline tariff and differentiated country surcharges materially increased the unit landed cost profile for imported composite materials, thereby changing procurement thresholds and payback calculations for owners and contractors.

Complementing the baseline tariff changes, targeted adjustments under existing trade instruments further altered dynamics for specialized inputs. The Office of the United States Trade Representative concluded statutory reviews and raised duties on specific high-tech and strategic imports at the start of 2025, a move that signaled willingness to expand tariff coverage where supply-chain resilience and domestic industrial priorities intersect. At the same time, legislative proposals introduced in the spring of 2025 propose fees tied to the carbon intensity of imported goods, which-if enacted in any form-would add an emissions-linked premium that disproportionately affects energy-intensive fiber and precursor production in jurisdictions with coal-heavy energy systems. These layered policy shifts not only increase short-term landed costs but also change the risk calculus for multi-year sourcing agreements and capital investment decisions for domestic production capacity.

Taken together, these developments have produced predictable market reactions: upstream suppliers are accelerating investments in alternative supply corridors, importers are renegotiating terms that previously assumed stable tariff schedules, and owners are requiring more granular total-cost-of-ownership analysis from vendors. For composite rebar specifically, tariffs on derivative products and broad metal tariffs that encompass derivative manufacturing have created substitution and specification arbitrage in certain applications, pushing designers to explicitly evaluate FRP alternatives where tariffs make steel or aluminum-based reinforcement more expensive or less available. These cumulative effects will continue to restructure procurement practices and incentive architectures across public- and private-sector projects.

Segmented insight into how product type, material chemistry, form factor, application environment, and end-user needs collectively shape FRP rebar selection and specification

The market for FRP rebar is best understood through a layered segmentation that highlights where product innovation, material choice, form factor, application environment, and end-user priorities intersect. Within product types, aramid, basalt, carbon, glass, and sand-coated variants each serve distinct technical niches: aramid fibers excel where impact resistance is prioritized; basalt offers an attractive balance between cost and environmental resistance and is available in both fabric-based strands and monofilament formats; carbon fiber is reserved for high-modulus, demanding structural situations and is delivered through pultruded sections or woven fabric compositions; while glass fiber systems, offered as chopped strand or continuous filament, remain the default where cost-effective corrosion resistance is required. These product-layer distinctions determine compatibility with resin systems, anchorage details, and handling protocols, and thereby influence adoption across project types.

Material-type segmentation distinguishes thermoplastic systems from thermosetting solutions; thermoplastics, including polyethylene terephthalate and polypropylene variants, enable welding and recyclability pathways that appeal to certain circularity-minded projects, while thermosets such as epoxy and polyester prioritize structural bonding, thermal stability, and established curing workflows. Shape and form create a parallel axis of differentiation: straight bars simplify scheduling and field insertion, bent and shaped rebars address anchorage and lap splice requirements, spiral forms provide improved confinement for specialized columns, and customized profiles enable prefabricated elements that reduce on-site labor. These form-factor choices are inseparable from application demands.

Application segmentation links the technical and commercial dimensions to real-world project requirements. Commercial buildings-particularly industrial warehouses and multi-story office structures-value noncorrosive reinforcement for long-span decks and electromagnetic neutrality. Infrastructure projects, encompassing bridges, ports and harbors, and tunnels, are among the most compelling use cases for FRP because exposure to deicing salts and marine environments accelerates steel corrosion and lifecycle costs. Marine structures such as docks and mooring systems benefit from the material’s resistance to saline degradation, while residential adoption is growing in both detached family houses and high-rise apartments where reduced maintenance and lighter elements can lower construction complexity. Utilities and heavy industrial facilities, including power plants and water treatment facilities, prize the insulation and nonconductive properties of FRP in environments where stray currents or cathodic protection systems complicate design. End users-spanning private construction firms, government bodies, infrastructure agencies, marine operators, and oil and gas firms-frame specifications differently, but all increasingly require documented durability, traceable material provenance, and demonstrable constructability evidence.

This comprehensive research report categorizes the FRP Rebar market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Diameter Range

- Manufacturing Process

- Surface Profile

- Application

- End User

How regional policy, manufacturing footprint, and infrastructure priorities across the Americas, EMEA, and Asia-Pacific shape FRP rebar sourcing, specification, and adoption

Regional dynamics exert a strong influence on supply-chain choices, technical acceptance, and regulatory drivers for FRP rebar. In the Americas, demand is concentrated where corrosion-prone infrastructure and coastal assets are prioritized, public procurement increasingly weights lifecycle costs, and nearshoring incentives have encouraged investment in North American fiber conversion and pultrusion capacity. These dynamics favor suppliers that can provide rapid lead times, robust install guidance, and warranty-backed performance metrics tailored to U.S. and Canadian codes.

Across Europe, the Middle East, and Africa, regulatory emphasis on sustainability and resilience is a dominant theme. European specification environments place significant weight on embodied carbon and recyclability, while Middle Eastern coastal and offshore projects require hybrid material solutions that withstand severe saline exposure and high temperatures. Africa’s infrastructure programs present a mix of opportunity and constraint: where capital programs focus on port and bridge upgrades, FRP offers durable alternatives, but supply-chain limitations and local procurement practices can slow adoption. In the Asia-Pacific region, large-scale manufacturing capacity, especially for glass and carbon precursors, supports competitive pricing and technical depth, but geopolitical tensions and logistics constraints have pushed buyers to seek regionalized redundancy and certified performance records. These regional variations create differentiated strategic priorities for manufacturers and distributors aiming to tailor product portfolios and commercial terms to local procurement cultures.

This comprehensive research report examines key regions that drive the evolution of the FRP Rebar market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive positioning and strategic behaviors among manufacturers and fabricators that determine which suppliers win specification-driven infrastructure projects

Company strategies within the FRP rebar ecosystem are bifurcated between vertically integrated manufacturers that control fiber-to-bar value chains and specialized fabricators that focus on niche forms, pultrusion quality, and installation solutions. Leading players differentiate on several fronts: breadth of fiber and resin portfolios; demonstrated durability through accelerated and field-exposure testing; depth of engineering support for anchorage and splice systems; and commercial models that offer bundled warranties, installation training, and extended technical documentation. Strategic partnerships between fiber producers and formers have accelerated product qualification and reduced time-to-spec for major infrastructure contractors.

Across the competitive set, innovation is as important as scale. Companies that can rapidly certify performance for specific use cases-such as tunnel linings or prestressed elements-and that can provide HTS-aligned trade documentation and supply-traceability reports hold a competitive advantage for public tenders. Conversely, smaller specialists that offer customized bar shapes, proprietary sand coatings, or service bundles tailored to marine and oil-and-gas environments capture opportunities where bespoke performance or rapid turnaround is required. The net effect is a marketplace where both large integrated suppliers and nimble specialists coexist, and where collaboration across the value chain accelerates acceptance for technically challenging or heavily regulated projects.

This comprehensive research report delivers an in-depth overview of the principal market players in the FRP Rebar market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agni Fiber Boards Pvt. Ltd.

- ARC Insulations & Insulators Pvt. Ltd.

- Armastek

- Composite Technology by Casa Perfecta

- Dextra Group

- Fibrolux GmbH

- FiReP Rebar Technology GmbH

- Galen Panamerica LLC

- Jiangsu Chemlead New Material Co., Ltd.

- Kodiak Fiberglass Rebar

- Marshall Composite Technologies, LLC

- Mateenbar Limited

- MRG Composites

- MST Rebar Inc.

- Neuvokas Corp.

- Owens Corning

- Pultrall Inc.

- Pultron Composites Ltd.

- Sanfield India Limited

- Sanskriti Composites Private Limited

- Sireg Geotech S.r.l.

- TUF-BAR Inc.

- Unique Fiberglass & Composites LLC

- Viva & Co Ghana Limited

Actionable steps for manufacturers, specifiers, and procurement teams to mitigate tariff risk, secure supply, and accelerate adoption of FRP rebar through operational and commercial changes

Industry leaders must act decisively to protect margin and accelerate adoption in this changing environment. First, prioritize contractual language and procurement templates that account for tariff volatility and embodied-carbon surcharges by including indexed price adjustments, longer-term hedging options, and clear material-provenance obligations so that owners and contractors share risk equitably. Second, invest in regional manufacturing or conversion capacity near high-demand corridors to shorten lead times and reduce exposure to cross-border tariff shifts; strategic capital investment in pultrusion lines or resin-compounding capability can convert uncertain import flows into predictable local supply with higher margin control.

Third, scale engineering and field-service capabilities to remove technical acceptance barriers: provide extended site trials, instrumented pilot installations, and owner-facing lifecycle models that translate mechanical performance into maintenance budgets and resilience metrics. Fourth, strengthen supplier alliances and multi-sourcing strategies for critical fiber inputs and precursors to avoid single-vendor exposure; where possible, diversify across fiber types to offer form-and-performance equivalence that meets design intent without forcing unnecessary specification lock-in. Finally, accelerate product qualification against evolving regulatory drivers-specifically embodied-carbon reporting and acceptance criteria-so that sales cycles align with procurement windows and public-sector grant timelines. By operationalizing these recommendations, leaders can defend existing opportunities, capture accelerated specification wins, and resynchronize product roadmaps with buyer risk appetites.

Clear explanation of the mixed-method research approach combining primary stakeholder interviews, field observations, trade records, and standardized material testing

This research synthesizes primary interviews with technical leads, procurement officers, and project owners, combined with a comprehensive review of publicly available policy instruments and industry technical literature. Primary inputs include structured interviews with practicing structural engineers, specification writers, and materials scientists, supported by in-field observations of installed pilot projects and accelerated laboratory exposure testing that validates durability claims. Secondary sources comprise trade filings, HTS-mapped import records, technical white papers on fiber and resin behavior, and regulatory texts relevant to procurement and embodied-carbon disclosure.

To ensure analytical rigor, the study triangulates interview-derived qualitative insights against procurement documents and trade flows, tests material-performance assertions using standardized accelerated aging protocols, and maps product attributes to application-specific acceptance criteria. The methodology applies a consistent evidence hierarchy: documented field performance and certifiable test data take precedence over manufacturer claims, which are then contextualized by buyer interviews that describe actual procurement behaviour. Finally, sensitivity assessments were performed to evaluate how tariff scenarios, regional supply disruptions, and resin-formulation shifts could influence sourcing decisions and price negotiation dynamics over multi-year contracting horizons.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our FRP Rebar market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- FRP Rebar Market, by Product Type

- FRP Rebar Market, by Material Type

- FRP Rebar Market, by Diameter Range

- FRP Rebar Market, by Manufacturing Process

- FRP Rebar Market, by Surface Profile

- FRP Rebar Market, by Application

- FRP Rebar Market, by End User

- FRP Rebar Market, by Region

- FRP Rebar Market, by Group

- FRP Rebar Market, by Country

- United States FRP Rebar Market

- China FRP Rebar Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Concluding assessment that technical maturity and commercial discipline together determine who captures long-term opportunity in the evolving FRP rebar market

The FRP rebar sector is at an inflection point where technical maturity, shifting procurement logic, and geopolitically driven trade policy converge to create both risk and opportunity. Durability-led specification, improvements in form and handling, and the emergence of validated pilot installations have jointly lowered the technical barriers that once limited adoption. Yet the policy environment in 2025 has introduced new cost and risk vectors-tariff layers and proposed carbon-linked fees-that alter the comparative economics of reinforcement choices and reward manufacturers that can guarantee supply, documentation, and service at scale.

Decision-makers should therefore pursue a balanced approach: accelerate specification in applications where FRP’s performance advantage is unambiguous, while simultaneously pursuing supply-chain resilience through nearshoring, diversified sourcing, and contractual protections against policy-driven cost shocks. Firms that align engineering rigor with commercial agility-delivering documented durability, responsive logistics, and creative contracting-will capture the greatest share of infrastructure and specialty construction opportunities in the coming procurement cycles. In short, FRP rebar’s technical value proposition is intact; the winners will be those who pair it with strategic supply-chain and commercial discipline.

Purchase the full FRP rebar market report and arrange a tailored briefing with Ketan Rohom to translate research into strategic commercial decisions

For executives ready to convert insight into decisive action, purchasing the full market research report and speaking directly with our commercial lead is the fastest path to immediate, tailored value. Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, is available to walk through the report’s primary findings, explain how the research aligns with your project timelines, and propose licensing and custom advisory options that map to operational priorities and procurement cycles.

Contacting Ketan will expedite access to the full dataset, detailed company profiles, HTS-linked trade tables, and the technical annex that underpins material-performance comparisons and lifecycle cost models. He can also arrange a short briefing that highlights the most relevant sections for procurement, engineering, or strategic sourcing teams and coordinate a tailor-made extract of data for internal stakeholders.

If you are evaluating sourcing strategy, capital allocation for production lines, or partnering with material suppliers, a direct conversation will clarify which datasets and service bundles best address your near-term decisions. Reach out to speak with Ketan to secure the report and begin translating research insight into immediate commercial outcomes.

- How big is the FRP Rebar Market?

- What is the FRP Rebar Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?