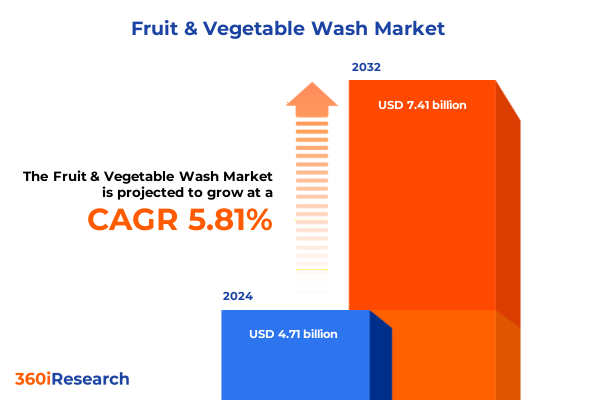

The Fruit & Vegetable Wash Market size was estimated at USD 4.97 billion in 2025 and expected to reach USD 5.25 billion in 2026, at a CAGR of 5.87% to reach USD 7.41 billion by 2032.

Navigating the Rising Demand for Fruit & Vegetable Wash Amidst Evolving Food Safety Standards and Innovative Clean-Tech Developments

The integrity of fresh produce is a non-negotiable priority for consumers and industry stakeholders alike, as even minimal contamination can have severe public health and economic repercussions. A wave of high-profile foodborne illness outbreaks has intensified scrutiny on post-harvest handling, underscoring the vital role of specialized fruit & vegetable wash formulations in mitigating microbial hazards and reducing chemical residues. In parallel, estimates suggest that foodborne pathogens afflict tens of millions of Americans annually, prompting renewed emphasis on washing protocols to support produce safety and extend shelf life.

Amidst this heightened vigilance, consumer perceptions have shifted dramatically. Shoppers now actively seek products that promise no aftertaste, water-efficient cleaning, and transparent ingredient profiles. This divergence of demand has fostered a dynamic subsegment of specialized wash solutions, encompassing both industrial-scale sanitizers designed for foodservice operations and consumer-oriented sprays and soak formulations. The market’s maturation is evident in a growing array of certified no-rinse treatments, emphasizing ease of use alongside regulatory compliance.

Industry participants have responded by aligning their innovation pipelines with emerging guidance and voluntary standards, integrating natural antimicrobial extracts and refining dosing technologies to meet diverse application settings. This convergence of public health imperatives, consumer expectations, and technical advances sets the stage for accelerated growth and competitive differentiation in the fruit & vegetable wash domain.

Mapping the Transformative Shifts in Consumer Preferences and Technological Innovations That Are Redefining the Fruit & Vegetable Wash Market Landscape

The fruit & vegetable wash market is undergoing fundamental transformation driven by consumer values and technological breakthroughs. Heightened awareness of the health and environmental implications of synthetic cleaning agents has catalyzed a shift toward plant-based and biodegradable formulations. As consumers increasingly eschew harsh chemicals like ammonia and chlorine, manufacturers are integrating essential oils, citrus extracts, and vinegar-based alternatives into their product offerings.

In tandem, regulatory bodies in key regions are reinforcing industry accountability by tightening permissible limits for residual chemicals on produce surfaces. This regulatory momentum is accelerating research into novel sanitization approaches such as peracetic acid dosing systems and ultraviolet irradiation technologies. The emerging emphasis on sustainable packaging further underscores industry commitment to minimizing plastic waste and optimizing transport efficiencies, as seen in compact tablet-based dosing formats that reduce storage footprint and plastic usage by up to 98%.

Simultaneously, digital engagement and omnichannel distribution have emerged as pivotal growth levers. E-commerce platforms are capitalizing on subscription models and targeted social media campaigns to educate consumers on product efficacy, leveraging user-generated content and influencer partnerships. This digital pivot has not only expanded market reach but also enriched consumer data streams, enabling precise segmentation and personalized marketing strategies that enhance brand loyalty and accelerate adoption.

Assessing the Cumulative Impact of US Section 301 Tariff Increases on Fruit & Vegetable Wash Industry Supply Chains and Cost Structures Throughout 2025

In 2025, the United States Trade Representative finalized a series of Section 301 tariff increases targeting a broad spectrum of imported chemical intermediates and sanitation agents, including surfactants, chlorine and oxidizing agents, and antimicrobial compounds used in produce wash formulations. The new duties, effective January 1, 2025, have raised tariffs on covered imports to levels as high as 25% to 50%, prompting suppliers to reassess sourcing strategies and absorb additional cost pressures.

These punitive measures have had a cascading effect on supply chain configurations. Manufacturers reliant on Chinese-origin chemical inputs are actively diversifying procurement, exploring regional alternatives in Southeast Asia and Latin America to mitigate duty burdens and logistical disruptions. Concurrently, the USTR’s extension of select tariff exclusions through August 31, 2025 has provided temporary relief for certain processing equipment and packaging materials, underscoring the ongoing volatility and need for agile supply management.

As a result, product portfolios are adapting to reflect input cost variability; formulators are optimizing ingredient concentrations, while investing in in-house blending capabilities to retain margin integrity. The convergence of elevated tariffs, shifting trade policies, and dynamic exclusion regimes necessitates proactive scenario planning and robust supplier diversification to safeguard continuity and maintain competitive pricing.

Unveiling Key Segmentation Insights Across Product Types, Ingredient Variants, Packaging Solutions, Functionality Preferences, Channels, and End User Applications in Fruit & Vegetable Wash Market

Diverse product forms offer tailored solutions across cleaning contexts, as foam washes excel in high-viscosity applications that demand contact time for wax and residue removal, while liquid washes provide rapid spray-and-rinse functionality suited to both household and foodservice use, and powder washes deliver concentrated, low-volume dosing that reduces packaging waste.

Ingredient selection underpins both performance and market positioning. Chemical-based formulations leverage antibacterial agents for broad-spectrum pathogen control, supported by chlorine and oxidizing agents in centralized wash water, complemented by surfactants that enhance soil dispersion; in parallel, natural and organic variants utilize citrus extracts for their inherent solvent properties, essential oils for antimicrobial synergy, and vinegar-based acids to disrupt adhesion of wax and synthetic coatings.

Packaging formats cater to application scale and convenience, with single-serve bags and sachets enabling precise pre-measured dosing, bulk packaging serving high-volume institutional operations, and spray bottles offering direct-to-consumer ease-of-use for quick surface treatments.

Functional attributes drive purchase behavior, as solutions validated for bacteria and pathogen elimination deliver critical food safety assurances, pesticide and residue removal address consumer perceptions of chemical risk, and wax and chemical removal restores produce appearance and texture.

Distribution channels continue to evolve, with offline retail encompassing pharmacies and drugstores for health-focused offerings, specialty stores for curated organic lines, and supermarkets & hypermarkets for broad visibility; online retail thrives through brand websites and e-commerce marketplaces, facilitating subscription models and direct-to-consumer engagement.

End users span commercial uses-where catering services, hotels, restaurants, and cafes demand regulatory compliance and operational efficiency-households seeking at-home food preparation safety, and industrial/institutional applications in airline and railway catering units, food processing facilities, healthcare environments, and school and corporate cafeterias, each requiring customized formulation, dosing, and delivery systems.

This comprehensive research report categorizes the Fruit & Vegetable Wash market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient Type

- Packaging

- Functionality

- Distribution Channel

- End User

Highlighting Regional Dynamics and Unique Growth Drivers Across the Americas, EMEA, and Asia-Pacific Fruit & Vegetable Wash Markets

The Americas region remains a cornerstone of demand, driven by robust foodservice infrastructure and consumer sensitivity to food safety following high-visibility recalls and E. coli outbreaks. North American market participants emphasize clean-label credentials and sustainable packaging to align with tightening federal and state regulatory expectations, while Latin American producers increasingly adopt small-format dosing and natural ingredient platforms to address local market access and price sensitivity.

In Europe, Middle East & Africa, stringent EU regulations on maximum residue levels and VOC emissions have accelerated adoption of chlorine-free wash systems and concentrated powder formats that reduce transport carbon footprint. In the Middle East, a burgeoning hospitality sector and investment in food safety accreditation programs are catalyzing institutional demand, while African markets are emerging through partnership-driven entry models and distributed manufacturing hubs that localize production.

Asia-Pacific reflects a dichotomy between mature markets such as Japan and Australia, where advanced peracetic acid and ozone-based sanitization systems are prevalent in processing plants, and high-growth economies like India and Southeast Asia, where rising middle-class consumption of fresh-cut produce and expanding modern retail networks spur demand for affordable spray and soak wash variants formulated with indigenous botanical extracts.

This comprehensive research report examines key regions that drive the evolution of the Fruit & Vegetable Wash market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Strategies and Innovations Driving Success Among Leading Players in the Fruit & Vegetable Wash Industry

Leading industry players are optimizing differentiated portfolios to capture expanding market segments. Ecolab has reinforced its commercial positioning through the launch of integrated processing solutions such as the Tsunami™ Produce Processing Wash and Process Water Tracker, which deliver proportional dosing of peracetic acid to drive consistent pathogen reduction and operational throughput improvements. Concurrently, major household brands are strengthening their clean-label propositions: ECOS has introduced a USDA-certified organic fruit + veggie wash made with plant-powered formulas and eco-friendly refill models , while ATTITUDE Living has scaled distribution of its vegan, 94% naturally derived wash, leveraging subscription and specialty retail channels.

Emerging entrants are harnessing technology-driven formats, exemplified by electrolysis-based purifiers that convert tap water into reactive cleaning solutions, tapping wellness and IoT integration trends. Established consumer goods conglomerates are consolidating their foothold through targeted acquisitions of niche brands, expanding their footprint in organic and natural segments and leveraging extensive distribution networks.

Across the board, players are investing in sustainability certifications, digital traceability platforms, and end-to-end service offerings that bundle equipment, chemical supply, and regulatory compliance support, underscoring an evolution from single-product sales to holistic food safety solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fruit & Vegetable Wash market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amway International Inc.

- Beaumont Products Inc.

- Belshaw Limited

- BioSafe Systems, LLC

- Branch Basics LLC

- Dr Bronner's Magic Soaps Inc

- Dr Kleenz Laboratories Private Limited

- Fit Organic

- Happy Herbal Care

- HERBAL STRATEGI HOMECARE PRIVATE LIMITED.

- iHerb, LLC

- ITC Limited

- Mygaga Consumer Pvt. Ltd.

- Nellie’s All‑Natural

- Nikole Kozmetics Pvt. Ltd.

- Novozymes A/S.

- Procter & Gamble Company (P&G)

- SANOSIL MENA LLC

- Seventh Generation Inc.

- Solenis LLC

- Tazo Home

- Tersano Inc.

- Weiman Products

- Wipro Limited

- Zep Inc.

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends and Navigate Regulatory and Trade Challenges in Fruit & Vegetable Wash Market

Industry leaders should pursue diversified ingredient strategies that balance high-efficacy synthetic actives with naturally derived antimicrobials, enabling flexible product tiers that align with varied consumer segments. Investing in R&D to expand the pipeline of botanical extracts and enzymatic agents will foster new clean-label claims and mitigate reliance on tariff-impacted imports.

Optimizing digital channels is imperative; brands must bolster e-commerce capabilities with subscription offerings, data-driven personalization, and educational content to articulate product benefits, build trust, and reduce acquisition costs. Strategic partnerships with foodservice operators and produce distributors can facilitate pilot programs that demonstrate efficacy at scale and accelerate institutional adoption.

Supply chain resilience should be enhanced through multi-sourcing agreements, regional production facilities, and forward contracts for critical inputs, offsetting tariff-induced cost volatility. Concurrently, continuous monitoring of trade policy developments and proactive engagement with policymakers will inform advocacy efforts and shape favorable exclusion regimes.

Finally, embedding sustainability throughout the value chain-from biodegradable packaging design to circular refill programs-will resonate with corporate ESG mandates and eco-conscious consumers, generating long-term brand differentiation and regulatory goodwill.

Detailing a Robust Research Methodology Combining Primary Interviews, Secondary Data Sources, and Advanced Analytical Frameworks to Deliver Actionable Market Insights

Our research framework commenced with a comprehensive review of publicly available regulatory guidelines, technical standards, and scientific literature pertaining to produce sanitization, supplemented by an analysis of recent trade policy announcements to assess tariff impacts. This formed the basis for identifying key market drivers and constraints.

Primary research comprised structured interviews with senior executives across leading chemical suppliers, equipment manufacturers, produce processors, and foodservice operators to validate emerging trends, gauge innovation priorities, and capture real-world application insights. Surveys with procurement and operations managers quantified preferences across formulation attributes and delivery formats.

Data triangulation integrated import/export statistics, corporate press releases, patent filings, and e-commerce analytics to ensure consistency and reliability. Advanced analytical models were deployed to segment demand profiles and simulate tariff scenario outcomes, while expert panels provided peer review to enhance objectivity and refine strategic interpretations.

Throughout the research process, rigorous quality checks and standardized methodologies upheld transparency, enabling stakeholders to confidently leverage the findings for product development, market entry decisions, and investment planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fruit & Vegetable Wash market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fruit & Vegetable Wash Market, by Product Type

- Fruit & Vegetable Wash Market, by Ingredient Type

- Fruit & Vegetable Wash Market, by Packaging

- Fruit & Vegetable Wash Market, by Functionality

- Fruit & Vegetable Wash Market, by Distribution Channel

- Fruit & Vegetable Wash Market, by End User

- Fruit & Vegetable Wash Market, by Region

- Fruit & Vegetable Wash Market, by Group

- Fruit & Vegetable Wash Market, by Country

- United States Fruit & Vegetable Wash Market

- China Fruit & Vegetable Wash Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding Insights on Market Opportunities, Challenges, and Strategic Imperatives Shaping the Future of the Fruit & Vegetable Wash Industry

The fruit & vegetable wash market sits at the nexus of food safety imperatives, environmental stewardship, and consumer-driven expectations for transparency and efficacy. A confluence of tariff adjustments, evolving regulations, and breakthrough technologies is reshaping supply chains, competitive positioning, and product innovation pathways. Stakeholders that adeptly navigate these multidimensional shifts will secure lasting advantage.

Key drivers such as health-conscious consumption, sustainability mandates, and digital commerce expansion offer compelling growth avenues, while challenges including input cost volatility, regulatory complexity, and shifting import regimes necessitate dynamic risk management and strategic agility. By harnessing the insights presented herein-ranging from nuanced segmentation analysis to region-specific growth catalysts and competitive benchmarking-industry participants can chart informed pathways to expand in established markets, penetrate emerging geographies, and fortify operational resilience.

As the landscape continues to evolve, iterative market intelligence and collaborative innovation will be critical for delivering differentiated value, maintaining compliance, and sustaining profitable growth in a highly competitive environment.

Engage with Associate Director Ketan Rohom to Gain Comprehensive Market Intelligence and Propel Strategic Growth in the Fruit & Vegetable Wash Sector

For organizations seeking to deepen their strategic understanding of evolving dynamics, regulatory shifts, and competitive benchmarks in the fruit & vegetable wash market, a comprehensive market research report is indispensable. Engaging with Associate Director Ketan Rohom will provide you with tailored insights, proprietary analysis, and in-depth data to drive decisive actions. Reach out today to secure your copy of the full report and establish a forward-looking roadmap for success in this rapidly transforming space

- How big is the Fruit & Vegetable Wash Market?

- What is the Fruit & Vegetable Wash Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?