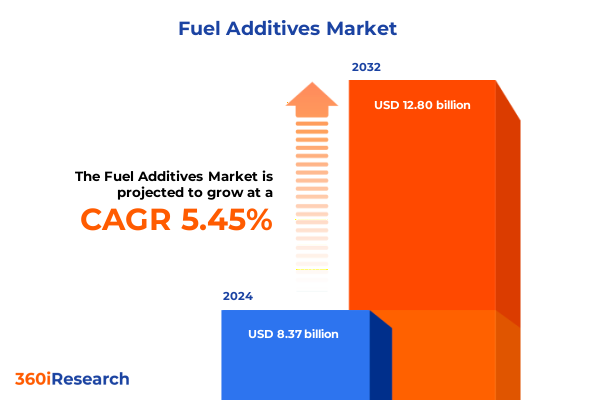

The Fuel Additives Market size was estimated at USD 8.84 billion in 2025 and expected to reach USD 9.26 billion in 2026, at a CAGR of 5.43% to reach USD 12.80 billion by 2032.

Unveiling the Vital Role of Fuel Additives in Driving Performance, Efficiency, and Environmental Compliance Across Fuel Industries

Fuel additives play a pivotal role in enhancing fuel quality, optimizing engine performance, and meeting stringent environmental regulations across global fuel markets. These specialized formulations, ranging from detergents and corrosion inhibitors to cetane improvers and lubricity boosters, are engineered to address the complex chemical and mechanical demands of modern powertrains. With end users requiring consistent reliability and efficiency, the landscape for fuel additives has expanded to support multiple grades of diesel, gasoline, biofuel blends, and high-performance jet fuel. This introduction explores the critical functions of additives in reducing emissions, improving combustion stability, and extending equipment life, while also setting the stage for how recent regulatory and technological shifts are reshaping the industry.

As governments worldwide tighten emissions standards and mandate reductions in sulfur content, additive technologies have become indispensable in bridging the gap between existing fuel infrastructures and next-generation clean energy targets. Simultaneously, rising consumer expectations for fuel economy and durability in both automotive and industrial applications underscore the need for advanced chemical solutions. The synergy between formulators, engine manufacturers, and fuel suppliers is increasingly important as stakeholders collaborate to innovate additive blends that comply with evolving norms and deliver measurable performance enhancements. This section lays the groundwork for understanding why additive chemistries are more essential than ever in driving sustainable growth and technological progress within the fuel sector.

Navigating the Transformation of Fuel Additives Amidst Stringent Emissions Standards, Biofuel Integration, and Advanced Engine Technologies

The fuel additives market is experiencing a paradigm shift driven by the convergence of stringent emissions regulations, rapid advancements in engine design, and the integration of renewable biofuels. As regulators impose tighter limits on greenhouse gases and particulate matter, formulators are compelled to develop next-generation pigments, surfactants, and metal-based catalysts that effectively reduce soot formation and optimize combustion profiles. At the same time, the push toward lightweight, high-compression engines has led to the adoption of tailored dispersant and detergent systems that prevent deposit buildup under extreme operating conditions.

Moreover, the rising incorporation of biodiesel and ethanol into conventional fuel streams demands specialized additive chemistries capable of stabilizing complex organic compounds and mitigating phase separation issues. This adoption has catalyzed significant research into corrosion inhibitors and cold-flow improvers to ensure reliable performance in diverse climates. Beyond regulatory and alternative fuel pressures, digitalization in the form of real-time fuel quality monitoring and smart blending platforms is transforming supply chain efficiencies. Data-driven blending allows suppliers to adjust additive concentrations dynamically, ensuring consistent fuel quality while minimizing excess chemical usage. Collectively, these transformative shifts underscore the industry’s commitment to innovation, sustainability, and collaboration across regulatory bodies, technology providers, and end-user communities.

Assessing the Ripple Effects of 2025 United States Tariff Measures on Fuel Additive Supply Chains, Costs, and Global Trade Dynamics

In 2025, a wave of U.S. tariff measures targeting imported chemical intermediates and catalyst substrates has significantly influenced the fuel additives sector. Tariffs levied under Section 301 on key raw materials sourced from select regions have escalated input costs for manufacturers relying on specialty metal oxides and phosphorous-based compounds. Simultaneously, duties imposed on packaging resins and transport equipment have increased logistical expenses, reshaping cost structures for additive producers and distributors.

These cumulative measures have prompted industry participants to re-evaluate sourcing strategies, driving a trend toward regional supply chain diversification. Formulators are increasingly partnering with domestic chemical producers to mitigate exposure to import duties, accelerating investment in local production capabilities. However, the shift has not been without challenges, as capacity constraints among U.S. intermediate suppliers and the lead times required to qualify new vendors have created intermittent supply gaps. As a result, stakeholders are collaborating more closely with customs brokers and trade compliance experts to navigate complex tariff schedules while exploring tariff engineering strategies such as process modifications to reclassify material origins. This evolving tariff landscape underscores the importance of agile procurement, supply chain resilience, and proactive risk management for firms operating in the additive value chain.

Delivering Deep Insights Through Comprehensive Segmentation by Product Type, Application, End User, and Distribution Channels

A granular understanding of the fuel additives market emerges when viewing it through the lens of product type, application, end user, and distribution channel. Product type segmentation highlights the role of anti-foam additives in preventing air entrainment, anti-icing chemistries in cold-weather operability, cetane improver compounds in enhancing ignition quality, corrosion inhibitors in safeguarding fuel infrastructure, detergents and dispersants in maintaining engine cleanliness, and lubricity additives in reducing friction under high-pressure conditions. These distinct chemical solutions each address unique performance attributes, emphasizing the necessity for formulators to fine-tune blends based on precise engine and fuel profiles.

Diving deeper, applications span the gamut from conventional diesel powered by renewable biodiesel blends and gasoline requiring stringent volatility control to specialized jet fuels engineered for high-altitude thermal stability. The end-use landscape comprises automotive sectors-both passenger and commercial vehicles with divergent performance needs-alongside aviation applications demanding rigorous certification, industrial sectors such as construction, manufacturing, and mining that operate under heavy-duty conditions, marine engines subject to variable sulfur regulations, and stationary power generation facilities prioritizing fuel reliability and emissions compliance. Complementing these segments is a multi-channel distribution network, where direct sales models facilitate custom blending partnerships, global and local distributors extend market reach, and e-commerce platforms enable rapid, small-batch deliveries. Understanding these interconnected segments sheds light on where innovation, strategic investments, and targeted marketing efforts can unlock the greatest value.

This comprehensive research report categorizes the Fuel Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Distribution Channel

Exploring Regional Dynamics Shaping Fuel Additive Demand and Innovation Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a decisive role in shaping demand patterns, regulatory compliance strategies, and technological adoption rates. In the Americas, robust diesel and gasoline consumption driven by transportation and power generation sectors, coupled with biofuel mandates in the United States and Brazil, fuels demand for advanced detergents, cold-flow improvers, and cetane enhancers. The push for renewable diesel and B20/B100 blends in North and South America is intensifying formulators’ focus on compatibility with vegetable- and animal-based feedstocks under varying temperature profiles.

Across Europe, Middle East, and Africa, stringent Euro VI emission norms and sulfur caps in shipping fuels are compelling end users to adopt premium corrosion inhibitors, ashless dispersants, and aftermarket deposit control additives. Meanwhile, the Middle East’s refining expansions, geared toward high-octane gasoline and low-sulfur gasoil, are creating localized opportunities for additive manufacturers to embed blending units adjacent to refinery complexes. In Africa, emerging markets present growth potential, albeit with fragmented distribution networks and price sensitivities that require flexible packaging and competitive logistics.

Asia-Pacific stands out with its scale and diversity, where China’s decarbonization targets drive demand for advanced anti-foam and surfactant technologies, India’s diesel fleet modernization spurs lubricity and cetane improvement solutions, and Southeast Asia’s maritime trade corridors demand high-performance marine fuel additives. Japan and South Korea continue to lead in jet fuel optimization, integrating proprietary antioxidants and thermal stability enhancers. Across all these regions, the interplay of local regulations, feedstock availability, and infrastructure maturity determines where market entrants should prioritize resource allocation and collaborative partnerships.

This comprehensive research report examines key regions that drive the evolution of the Fuel Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Players Driving Innovation, Strategic Partnerships, and Competitive Positioning in the Global Fuel Additives Industry

The competitive landscape is characterized by a blend of global chemical conglomerates, specialty additive manufacturers, and regional innovators. Established multinationals leverage vast R&D investments to develop next-generation catalyst supports and deposit control technologies, while strategic acquisitions bolster regional footprints and broaden product portfolios. For instance, leading European and North American firms have executed joint ventures to establish specialty blending terminals near major refinery clusters, ensuring rapid response times and customer intimacy.

Concurrently, niche players with deep expertise in biodegradable or bio-based surfactants are carving out specialized segments, particularly within biodiesel and ethanol applications. Several companies have introduced plant-derived corrosion inhibitors that align with sustainability mandates, tapping into growing preferences for eco-friendly solutions. Strategic partnerships between additive formulators and engine OEMs are also on the rise, enabling co-development of tailor-made chemistries that optimize next-generation combustion systems. Moreover, distributors and ecommerce platforms are enhancing value by offering digital portals for inventory tracking and predictive order alerts, further differentiating service offerings in a highly competitive arena.

Behind each success story lies a nuanced approach to talent acquisition, process innovation, and client collaboration. Whether through targeted venture investments, capacity expansion projects, or proprietary catalyst licensing agreements, market leaders continue to seek new avenues to solidify their positions and anticipate future shifts. Smaller firms, in turn, find opportunities in agility and specialization, often focusing on under-penetrated regions or emerging fuel technologies to drive incremental growth and strategic relevance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fuel Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Afton Chemical Corporation

- Baker Hughes Company

- BASF SE

- BG Products, Inc.

- Cerion, LLC

- Clariant AG

- Cummins Inc.

- Dorf Ketal Chemicals India Pvt. Ltd.

- Evonik Industries AG

- Gold Eagle Co.

- Infineum International Limited

- Innospec Inc.

- Lucas Oil Products, Inc.

- NITRO GmbH

- OLI Systems, Inc.

- Royal Purple, LLC

- Rymax B.V.

- STP Products Company

- The Lubrizol Corporation

- TotalEnergies SE

Empowering Industry Leaders with Strategic Recommendations to Capitalize on Emerging Opportunities and Overcome Key Challenges

Industry leaders should prioritize investment in next-generation additive R&D, focusing on bio-based chemistries, recyclable carrier solvents, and multifunctional blends that can satisfy multiple performance attributes simultaneously. Emphasizing green chemistry principles not only aligns with global decarbonization goals but also unlocks premium pricing in sustainability-focused segments. Collaborative innovation with engine manufacturers and refinery operators will accelerate time to market, ensuring new formulations are validated under real-world conditions before widespread release.

Supply chain resilience must become a strategic imperative. Firms are advised to diversify sourcing of critical raw materials by qualifying alternate vendors across multiple geographies and to explore nearshoring opportunities to mitigate tariff exposure. Implementing digital procurement platforms, coupled with advanced analytics for demand forecasting, will further enhance agility and reduce stock-out risks. In parallel, distributors and e-commerce operators should enrich customer offerings with digital tools such as API-driven order tracking, predictive maintenance alerts, and customized formulation calculators, fostering deeper customer engagement and loyalty.

Finally, organizations should establish clear sustainability roadmaps that integrate life-cycle assessments, carbon footprint metrics, and circular economy principles. By publishing annual impact reports and setting science-based targets, companies will not only demonstrate environmental stewardship but also differentiate their brands in increasingly transparent markets. These actionable strategies will enable industry participants to capitalize on emerging trends, address regulatory challenges, and maintain competitive advantage in a transforming landscape.

Ensuring Robustness of Findings Through a Rigorous Blend of Primary Interviews, Secondary Research, and Quantitative Data Analysis

This analysis leverages a rigorous methodology that combines in-depth primary research, comprehensive secondary data collection, and advanced quantitative modeling. Primary research involved structured interviews with senior executives, R&D directors, supply chain specialists, and key account managers across additive manufacturers, engine OEMs, and fuel distributors. These insights were validated through roundtable discussions and peer benchmarking sessions, ensuring that qualitative perspectives align with broader market realities.

Secondary research encompassed an exhaustive review of industry journals, regulatory publications, patent filings, and financial disclosures, supplemented by proprietary databases tracking trade flows and chemical price indices. Data triangulation methods were employed to cross-verify statistical outputs, while sensitivity analyses tested the robustness of key findings under various scenario assumptions, including tariff volatility and feedstock price fluctuations.

Quantitative components integrated time-series analyses and regression modeling to identify leading indicators influencing additive demand, such as fuel consumption trends, emissions standards timelines, and engine fleet compositions. Geographic information system (GIS) mapping highlighted regional infrastructure densities and transport corridors. All findings underwent rigorous quality assurance protocols, including peer review by external industry consultants and validation against publicly available government data sets, to ensure accuracy and reliability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fuel Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fuel Additives Market, by Product Type

- Fuel Additives Market, by Application

- Fuel Additives Market, by End User

- Fuel Additives Market, by Distribution Channel

- Fuel Additives Market, by Region

- Fuel Additives Market, by Group

- Fuel Additives Market, by Country

- United States Fuel Additives Market

- China Fuel Additives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Critical Insights to Illuminate the Future Trajectory and Strategic Imperatives of the Fuel Additives Market

The fuel additives market is evolving at the intersection of regulatory imperatives, technological innovation, and shifting supply chain dynamics. As emissions standards become more complex and biofuel adoption accelerates, formulators must stay ahead by delivering multifunctional, sustainable solutions. Tariff policies in 2025 have underscored the necessity of agile procurement strategies and local manufacturing investments, compelling industry participants to enhance supply chain resilience and cost competitiveness.

Segmentation insights reveal that targeted product development for specific applications-whether for high-speed diesel engines, high-altitude jet turbines, or marine propulsion systems-will continue to yield performance gains and differentiation opportunities. Regional analysis highlights the potential for rapid expansion in emerging markets, balanced against the maturity and regulatory rigor of established geographies. Leading companies are distinguished by their ability to integrate digital platforms, forge strategic partnerships, and champion eco-friendly chemistries, reflecting a broader industry shift toward transparency and sustainability.

Ultimately, decision-makers equipped with a nuanced understanding of market drivers, competitive dynamics, and technical innovations will be best positioned to capture growth and navigate uncertainties. This report’s insights serve as a roadmap for both established players and new entrants aiming to contribute to cleaner, more efficient fuel ecosystems worldwide.

Take the Next Step Toward Informed Decision-Making by Securing Your Comprehensive Fuel Additives Market Research Report Today

To access in-depth insights, detailed segment analyses, and exclusive market strategies, be sure to secure the complete fuel additives market research report. Reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, to request a personalized sample of the report, explore bespoke consultancy opportunities, and finalize your purchase. Partnering with an expert who understands evolving regulatory landscapes, technological advancements, and regional dynamics will position your organization for strategic growth. Don’t miss this chance to harness rigorous research and actionable intelligence tailored to your business objectives. Contact Ketan today to accelerate your competitive edge and drive sustainable value in the global fuel additives arena

- How big is the Fuel Additives Market?

- What is the Fuel Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?