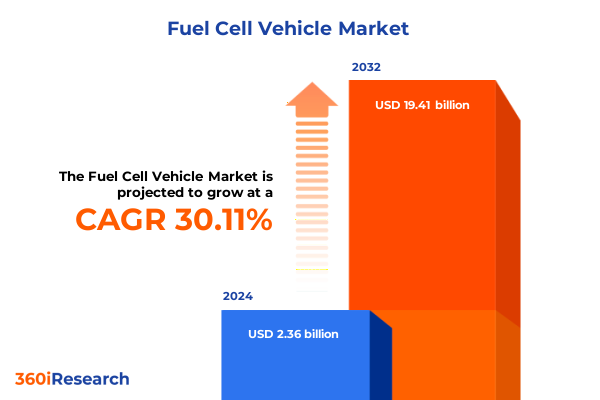

The Fuel Cell Vehicle Market size was estimated at USD 3.05 billion in 2025 and expected to reach USD 3.94 billion in 2026, at a CAGR of 30.64% to reach USD 19.81 billion by 2032.

Discover the Emerging Dynamics and Strategic Imperatives Shaping the Global Fuel Cell Vehicle Industry Landscape for Sustainable Mobility

In recent years, the automotive industry has witnessed a paradigm shift with the emergence of hydrogen fuel cell vehicles (FCVs) as a credible and sustainable alternative to traditional internal combustion engines. Unlike battery electric vehicles, which rely on large lithium-ion batteries, FCVs generate electricity on board through an electrochemical reaction between hydrogen and oxygen, emitting only water vapor as exhaust. This process not only offers a zero-emission solution but also boasts the potential for rapid refueling and extended driving ranges comparable to conventional vehicles. According to the International Energy Agency, under favorable conditions, hydrogen fuel cell vehicles poised to enter markets around 2025 could account for nearly 30 percent of global vehicle stock by 2050, substantially reducing oil demand and greenhouse gas emissions.

Against this backdrop, the hydrogen mobility sector is propelled by advancements in fuel cell technology, growing policy support, and evolving consumer preferences centered on sustainable transportation. While challenges related to hydrogen production, distribution infrastructure, and cost reduction remain, collaborative efforts among automakers, technology providers, and governments are steadily addressing these barriers. This executive summary synthesizes key developments shaping the FCV landscape, offering senior executives and decision-makers a concise yet comprehensive overview of transformative industry trends, policy impacts, market segmentation nuances, regional dynamics, and competitive strategies. By distilling critical insights without resorting to market forecasts or numerical estimates, this report equips stakeholders with a strategic framework to navigate the complexities of hydrogen fuel cell vehicle adoption and capitalize on emerging opportunities.

Uncover the Game-Changing Technological Advancements and Policy Shifts Transforming the Hydrogen Fuel Cell Vehicle Market Ecosystem Worldwide

Over the past few years, the hydrogen fuel cell vehicle sector has undergone transformative shifts driven by advances in technology, evolving policy frameworks, and strategic industry alliances. In the policy arena, the United States has reinforced its pro-hydrogen stance through legislative measures that preserve and expand incentives for hydrogen production and fuel cell installations, marking a departure from earlier concerns about reduced support under broader energy bills. Concurrently, major automakers have intensified research and development efforts, unveiling third-generation fuel cell systems that promise improved durability, enhanced performance, and lower costs to meet the stringent demands of both passenger and commercial vehicle applications.

Technological breakthroughs in membrane materials, catalyst formulations, and system integration have enabled fuel cell powertrains to achieve higher efficiencies and power densities. At the same time, strategic collaborations and joint ventures are forging new pathways to scale production, optimize supply chains, and facilitate global deployments. However, despite these strides, projects in regions like Europe have faced setbacks as companies reassess investments in green hydrogen amid cost pressures and delayed demand commitments, underscoring the need for resilient business models that can adapt to fluctuating market conditions.

As the industry transitions from pilot programs to early commercial rollouts, competitive dynamics are intensifying. OEMs and Tier-1 suppliers are forging partnerships with electrolyte and stack manufacturers, while governments continue to refine regulatory and financial support to accelerate infrastructure buildout. Ultimately, these combined forces are reshaping the hydrogen mobility landscape, setting the stage for a new era of zero-emission transportation.

Assessing the Cumulative Consequences of New United States Tariffs on Fuel Cell Vehicle Components and Supply Chain Realignment Strategies

In March 2025, the United States implemented a series of tariffs that have had far-reaching consequences for the hydrogen fuel cell vehicle supply chain. The presidential proclamation invoking Section 232 of the Trade Expansion Act imposed a 25 percent ad valorem tariff on imported passenger vehicles and light trucks, effective April 3, followed by a 25 percent tariff on key automobile parts-covering engines, transmissions, powertrain components, and electrical assemblies-scheduled to take effect by May 3. These measures, designed to protect national security and domestic manufacturing, have significantly elevated the cost basis for import-dependent automakers and suppliers.

Concurrently, under Section 301 of the Trade Act, tariff rates on electric vehicles imported from China-including those integrating fuel cell stacks manufactured abroad-were escalated to 102.5 percent, intensifying cost pressures for multinational manufacturers sourcing components from Chinese suppliers. Although these tariffs apply broadly across vehicle types, the hydrogen mobility sector, reliant on specialized fuel cell stacks, balance-of-plant components, and high-precision power electronics, faces pronounced headwinds as global supply chains adapt.

In response, industry participants have accelerated initiatives to diversify sourcing strategies, ramp up domestic content certification under USMCA, and invest in localized manufacturing hubs. At the same time, ongoing dialogue between trade associations and federal agencies aims to secure temporary exclusions and clarify compliance processes. While elevated import duties pose short-term cost challenges, they also incentivize near-shoring of critical component production, fostering supply chain resilience that could benefit long-term fuel cell vehicle deployment in North America.

Unlocking Critical Market Segmentation Insights to Navigate Diverse End Users Vehicle Types Fuel Cell Technologies and Application Demands

A nuanced understanding of market segmentation reveals critical pathways for tailored strategies and targeted value propositions. From an end-user perspective, the automotive segment dominates early hydrogen fuel cell vehicle adoption with leading OEMs prioritizing passenger mobility programs and strategic pilot fleets, while commercial deployments in stationary and portable applications highlight the technology’s versatility across backup power, material handling, and portable electronics markets. This end-user diversity underscores the need for adaptive business models that address sector-specific performance, reliability, and service requirements.

When examining vehicle types, the distinction between commercial vehicles and passenger cars informs development roadmaps, as commercial fleets often leverage modular fuel cell powertrains and shared infrastructure investments to achieve scale efficiencies. In contrast, passenger car initiatives emphasize consumer convenience, refined user interfaces, and extensive dealer networks to drive broader public acceptance. Equally important is the choice of fuel cell chemistry, spanning direct methanol, molten carbonate, phosphoric acid, proton exchange membrane, and solid oxide configurations, each presenting unique trade-offs in power density, operating temperature, and cost structure that guide technology roadmaps and strategic partnerships.

Power output classifications-ranging from systems up to 50 kilowatts for light duty and portable applications, through mid-range modules delivering 50 to 100 kilowatts, to heavy-duty assemblies exceeding 100 kilowatts-further delineate product architecture choices aligned with application demands. Finally, application-driven segmentation into backup power, residential combined heat and power, material handling, and portable electronics informs go-to-market sequencing and channel development strategies. By integrating these segmentation dimensions, stakeholders can optimize product portfolios, align R&D investments, and craft value propositions that resonate across distinct market niches.

This comprehensive research report categorizes the Fuel Cell Vehicle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Fuel Cell Type

- Power Output

- Application

- End User

Exploring Distinct Regional Dynamics Driving Hydrogen Fuel Cell Vehicle Adoption Across the Americas Europe Middle East Africa and Asia-Pacific Markets

Across the Americas, policy frameworks and infrastructure investments are converging to accelerate hydrogen mobility adoption. The United States has leveraged tax credits and production incentives to support the expansion of refueling networks, while Canada’s provincial green hydrogen strategies complement federal climate goals. Latin American countries, rich in renewable resources, are exploring export-oriented production hubs that could supply regional and international markets. The Americas’ expansive highways and established logistics corridors create favorable conditions for early commercial fleet deployments, particularly in short-haul and last-mile applications.

In Europe, Middle East, and Africa, the European Commission’s REPowerEU initiative has set ambitious targets for domestic renewable hydrogen production and strategic imports by 2030, supported by dedicated funding for electrolyser capacity and hydrogen valleys to link industrial demand centers with clean supply. Despite some recent project delays fueled by high production costs, major hydrogen corridors are taking shape in Germany, France, and the Benelux region, while Middle Eastern nations are positioning themselves as hydrogen exporters through large-scale solar and wind-to-hydrogen schemes. African markets, although nascent, offer opportunities for off-grid power, disaster relief, and remote industrial applications.

In the Asia-Pacific region, Japan’s Ministry of Economy, Trade and Industry has designated priority regions to stimulate commercial vehicle deployments through fixed and variable cost subsidies, aiming to close the price gap with diesel and catalyze local demand. South Korea continues to expand fuel cell bus and truck fleets under its hydrogen economy roadmap, while Australia is advancing export facilities connecting renewable energy with overseas markets. Together, these regional dynamics illustrate a mosaic of policy instruments, infrastructure commitments, and market development trajectories that shape hydrogen mobility’s global rollout.

This comprehensive research report examines key regions that drive the evolution of the Fuel Cell Vehicle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Surveying Leading Industry Players and Their Strategic Initiatives Driving Innovation Partnerships and Market Expansion in Fuel Cell Vehicles Globally

Leading original equipment manufacturers are charting distinct strategic pathways to commercialize hydrogen fuel cell vehicles. Toyota has secured government support for its domestic supply chain under Japan’s GX Promotion Act, partnering with local suppliers and establishing a Hydrogen Factory unit to scale fuel cell stack production and water electrolysis systems, aiming to capture significant volumes in commercial truck markets by 2030. Simultaneously, the company is piloting Class 8 heavy-duty trucks in Southern California and debuting its Gen 3 fuel cell system to demonstrate North American capabilities.

Canadian innovator Ballard Power Systems has solidified its position as a key supplier of fuel cell engines through long-term agreements with bus manufacturers. A recent multi-year contract with Egypt’s Manufacturing Commercial Vehicles will deliver 50 HD+ engines to support intercity bus deployments in Europe , while a purchase order to supply 200 engines to New Flyer underscores North American transit agencies’ confidence in Ballard’s FCmove modules for next-generation hydrogen buses.

Other notable participants, including Cummins, Hyundai, and Plug Power, are advancing system integration, electrolyser scale-up, and modular fuel cell platforms to diversify market reach. Through joint ventures, cross-sector collaborations, and targeted investments in R&D facilities, these companies are intensifying competition, fostering innovation, and creating ecosystem synergies essential for hydrogen mobility’s mass deployment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fuel Cell Vehicle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BMW AG

- Daimler AG

- Doosan Group

- General Motors company

- Honda Motor Co., Ltd.

- Hydrogen Vehicle Systems Limited

- Hyperion Motors

- Hyster-Yale Group, Inc. by NACCO Industries, Inc.

- Hyundai Motor Group

- Hyzon Motors Inc.

- MAN Truck & Bus SE by Traton SE

- Mazda Motor Corporation

- Nikola Corporation

- Nissan Motor Co. Ltd.

- Renault Group

- Riversimple

- Tata Motors Limited

- Toyota Motor Corporation

- Volvo AB

Strategic Roadmap Recommendations Empowering Industry Leaders to Capitalize on Hydrogen Fuel Cell Vehicle Opportunities Amidst Tariff and Infrastructure Challenges

To navigate the evolving hydrogen fuel cell vehicle landscape and mitigate tariff-induced cost pressures, industry leaders should prioritize strategic investments in domestic manufacturing capabilities. By establishing localized production hubs for fuel cell stacks and balance-of-plant components, organizations can reduce dependency on imports, streamline logistics, and benefit from regional content incentives. Moreover, proactive engagement with policymakers to secure favorable exclusion processes and certification pathways under trade agreements can safeguard profitability and ensure supply chain continuity.

Innovation remains paramount; therefore, allocating R&D resources towards advanced materials, next-generation catalysts, and integrated system architectures will yield performance and cost advantages. Collaborations with electrolyser manufacturers, energy utilities, and fleet operators can facilitate seamless value chain integration, while joint ventures in emerging markets can distribute development risks and accelerate network expansion. Complementing these efforts with workforce training programs and partnerships with academic institutions will cultivate a skilled talent pool capable of sustaining long-term growth.

Finally, adopting modular and scalable business models that incorporate battery-fuel cell hybrids, shared mobility platforms, and as-a-service offerings will enhance market responsiveness. By leveraging data analytics and predictive maintenance solutions, fleet operators can optimize uptime and total cost of ownership, strengthening the commercial value proposition of hydrogen fuel cell vehicles.

Comprehensive Research Methodology Detailing Rigorous Data Collection Analytical Frameworks and Expert Validation in Fuel Cell Vehicle Market Study

This market analysis integrates a rigorous multi-method research framework combining extensive secondary data collection, primary stakeholder interviews, and analytical modeling. Secondary research encompassed peer-reviewed journals, government white papers, regulatory filings, and credible news outlets to map policy developments, technological advancements, and competitive dynamics. Government reports and trade databases provided insights into tariff structures, incentive mechanisms, and infrastructure commitments. Technical specifications and patent databases facilitated the evaluation of fuel cell chemistry evolution and system performance benchmarks.

Primary research involved structured interviews and consultations with C-level executives, R&D leaders, supply chain managers, and regulatory authorities across key regions. Insights from these engagements enriched qualitative assessments and validated emerging trends. Data triangulation ensured that findings were cross-verified with multiple sources, enhancing reliability. Segmentation analysis was conducted by integrating end-user applications, vehicle types, fuel cell technologies, power output categories, and application sectors to generate multidimensional insights.

Regional dynamics were mapped through geopolitical risk assessments, policy scenario planning, and infrastructure deployment modeling. Competitive benchmarking analyzed strategic partnerships, capacity expansion plans, and product roadmaps of leading market players. Risk registers and sensitivity analyses were developed to evaluate the impact of tariff fluctuations, technology adoption rates, and regulatory shifts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fuel Cell Vehicle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fuel Cell Vehicle Market, by Vehicle Type

- Fuel Cell Vehicle Market, by Fuel Cell Type

- Fuel Cell Vehicle Market, by Power Output

- Fuel Cell Vehicle Market, by Application

- Fuel Cell Vehicle Market, by End User

- Fuel Cell Vehicle Market, by Region

- Fuel Cell Vehicle Market, by Group

- Fuel Cell Vehicle Market, by Country

- United States Fuel Cell Vehicle Market

- China Fuel Cell Vehicle Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Insights to Illuminate the Future Trajectory of the Hydrogen Fuel Cell Vehicle Sector Amid Evolving Policies Technology Advances and Market Forces

Throughout this executive summary, key themes have emerged that underscore the complexities and opportunities inherent in the hydrogen fuel cell vehicle sector. Technological breakthroughs and policy support are driving system efficiencies and infrastructure rollouts, yet the competitive landscape remains dynamic as automakers reassess strategies and project timelines. The introduction of substantial tariffs by the United States in 2025 has prompted a strategic recalibration of supply chain configurations, accelerating localization efforts and near-shoring initiatives.

Market segmentation insights reveal diverse end-user requirements, from automotive passenger mobility to portable electronics and stationary backup power, each necessitating tailored technology and service models. Regional analyses highlight differentiated trajectories across the Americas, EMEA, and Asia-Pacific, where policy frameworks, resource endowments, and infrastructure commitments shape adoption pathways. Meanwhile, leading companies are forging strategic alliances, scaling production capacity, and refining product portfolios to deliver differentiated solutions.

Collectively, these insights point to a future where hydrogen fuel cell vehicles co-exist with battery electric and hybrid platforms, fulfilling demand for long-range, rapid-refueling, and heavy-duty applications. By embracing collaborative innovation, adaptive business models, and proactive policy engagement, stakeholders can position themselves to capture long-term value in this transformative mobility ecosystem.

Engage with Associate Director Ketan Rohom Today to Secure Exclusive Access and Insights from the Definitive Fuel Cell Vehicle Market Research Report

Ready to elevate your strategic planning and gain a competitive edge in the rapidly evolving hydrogen fuel cell vehicle market? Contact Ketan Rohom, Associate Director of Sales & Marketing, to discover how our in-depth market research report can empower your organization with actionable insights, comprehensive analysis, and expert guidance. Secure your copy today and transform data-driven intelligence into impactful business decisions to accelerate growth and innovation in the hydrogen mobility landscape

- How big is the Fuel Cell Vehicle Market?

- What is the Fuel Cell Vehicle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?