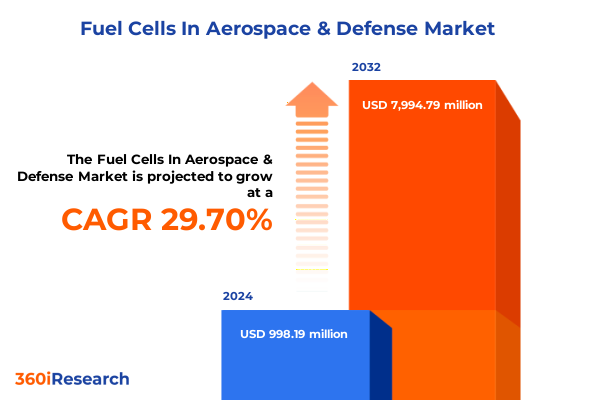

The Fuel Cells In Aerospace & Defense Market size was estimated at USD 1.28 billion in 2025 and expected to reach USD 1.65 billion in 2026, at a CAGR of 29.84% to reach USD 7.99 billion by 2032.

How Fuel Cell Innovations Are Revolutionizing Energy Systems in Aerospace and Defense with Sustainable High-Power Solutions

Fuel cell technologies are gaining increasing attention as sustainable power sources within aerospace and defense platforms, offering a pathway to lower emissions, greater energy resilience, and quieter operation. In an environment where mission success depends on uninterrupted, high-performance energy, fuel cells are emerging as a critical enabler of next-generation platforms. Leading innovators are advancing a range of chemistries and system architectures to address stringent safety requirements, thermal management challenges, and the need for rapid startup in both terrestrial and space applications.

These advances span across alkaline fuel cell, direct methanol fuel cell, phosphoric acid fuel cell, proton exchange membrane systems including high temperature and low temperature variants, as well as solid oxide configurations in both planar and tubular designs. Fuel cells are being evaluated for integration in defense vehicles, fixed wing aircraft, missiles, rotary wing platforms, satellites, and unmanned aerial vehicles. Their applications include auxiliary power units to support critical avionics, backup power for mission continuity, and even primary propulsion for stealthy or extended-duration operations. Adoption is driven by commercial aerospace stakeholders, military branches, and space agencies alike, each seeking to balance performance, weight, and lifecycle costs. Power demands within these environments range from under 10 kW modules for portable support to systems exceeding 200 kW for main propulsion roles, with intermediate ratings filling capability gaps. Various fuel choices including ammonia, hydrogen, and methanol feed into modular architectures comprising stacks, fuel processors, and balance of plant components to optimize efficiency and reliability.

In this executive summary, we examine the transformative shifts redefining the landscape, assess the cumulative impact of United States tariffs implemented in 2025, explore detailed segmentation insights, and present regional and competitive profiles. Finally, we offer actionable recommendations and a clear methodology underpinning the analysis, guiding decision-makers through an evolving market where performance, sustainability, and resilience converge.

Tracking the Transformative Shifts Redefining Aerospace and Defense Power Modules Through Cleaner Efficient Fuel Cell Integration

Over the past few years, the aerospace and defense sectors have experienced a shift from fossil-based auxiliary motors toward zero-emission power modules, driven by stringent decarbonization mandates and the pursuit of operational stealth. Industry partnerships are extending beyond traditional aerospace prime contractors to include advanced materials specialists and hydrogen infrastructure providers. This convergence of domain expertise has accelerated the transition from laboratory-scale demonstrations to field-ready prototypes, with several next-generation proton exchange membrane and solid oxide systems already completing successful flight tests and endurance trials.

At the heart of this transformation lies a renewed focus on modularity, digital integration, and lifecycle optimization. Digital twins and embedded diagnostics are enabling real-time monitoring of fuel cell stacks and balance of plant components, while additive manufacturing of bipolar plates and ceramic cells is reducing weight and improving thermal performance. Commercial aerospace operators are collaborating with defense primes to explore hybrid energy architectures that combine fuel cells with batteries, enhancing power density during takeoff and maximizing runtime during loiter phases. Concurrently, space agencies are investigating high-temperature fuel cell variants for reliable surface power on lunar and planetary missions.

As these advancements mature, the industry is witnessing a progressive shift from proving concepts to establishing supply chains that align with defense procurement standards and commercial aviation certification requirements. This evolution sets the stage for mainstream adoption, positioning fuel cells as a transformative force within a broader ecosystem of clean energy solutions.

Assessing the Impact of United States Tariff Policies on Fuel Cell Technology Adoption and Supply Chains Across the Aviation and Defense Sectors

In 2025, the United States implemented a series of tariffs aimed at safeguarding domestic fuel cell component manufacturing, encompassing critical inputs such as membrane electrode assemblies, catalyst-coated membranes, and specialized bipolar plates. While intended to bolster local supply chains and reduce strategic dependency, these measures have introduced heightened procurement complexity for system integrators relying on global production hubs. As a result, program budgets have been realigned to accommodate higher landed costs of imported components, prompting several aerospace and defense organizations to explore localized assembly and testing facilities within the United States.

The tariff landscape has catalyzed domestic partnerships between component specialists and prime integrators, with a particular emphasis on developing scalable production lines for high temperature proton exchange membrane and planar solid oxide fuel cell variants. Defense programs subject to Buy American Act requirements have accelerated qualification processes for homegrown suppliers, fostering a pipeline of small- to mid-tier manufacturers. Meanwhile, some international original equipment manufacturers are negotiating duty exemptions for research and development imports, seeking to maintain continuity in collaborative innovation projects.

Looking ahead, industry stakeholders are closely monitoring adjustments in tariff codes and potential reciprocal duties from trading partners. These dynamics are influencing strategic decisions such as dual sourcing arrangements and regional redistribution of manufacturing footprints. Navigating this complex policy environment will remain a critical factor shaping investment priorities, supply resilience, and the pace of fuel cell adoption across both commercial aviation and defense applications.

Key Insights into Market Segmentation Revealing Technology Platforms Applications and User Dynamics Driving Fuel Cell Deployments

Understanding the market landscape requires a granular view of multiple segmentation dimensions, each uncovering specific application and performance considerations. From a technology standpoint, alkaline configurations offer robustness for low-power stationary roles, whereas direct methanol and phosphoric acid systems demonstrate compelling thermal stability for extended-duration operations. Proton exchange membranes are bifurcated into high temperature variants optimized for heavy-duty propulsion scenarios and low temperature designs suited to rapid start auxiliary power units. Likewise, solid oxide architectures, whether in planar form factors or tubular cells, cater to high efficiency requirements in spaceborne and remote defense installations.

Examining platform-level distinctions highlights that defense vehicles demand compact footprints and rapid mobility support, while fixed wing and rotary aircraft impose stringent weight targets and integration constraints. Missiles and unmanned aerial vehicles prioritize stealthy operation and minimal acoustic signature, whereas satellites emphasize long-duration reliability under extreme thermal cycling. Across these platforms, applications vary from auxiliary power feeding mission-critical sensors, to backup systems ensuring safe returns, to primary propulsion enabling silent or electric lift capabilities.

Market participants are also attuning strategies to end-user priorities. Commercial aerospace stakeholders focus on lifecycle cost reduction and regulatory compliance, military entities emphasize mission assurance and interoperability, and space agencies prioritize radiation resistance and autonomous operation. Power rating selections range from portable modules below 10 kW to midrange systems in the 10 to 50 kW bracket for vehicular support, through 50 to 200 kW units for medium-lift aircraft, up to over 200 kW installations for primary propulsion. Fuel considerations-spanning hydrogen’s high energy density, ammonia’s storage advantages, and methanol’s logistical convenience-guide system architecture, while component-level focus on stacks, fuel processors, and balance of plant elements ensures optimized performance and maintainability.

This comprehensive research report categorizes the Fuel Cells In Aerospace & Defense market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Platform

- Power Rating

- Fuel Type

- Component

- Application

- End User

Regional Perspectives Unveiling the Unique Drivers Opportunities and Challenges Shaping Fuel Cell Adoption in Americas EMEA and AsiaPacific Zones

Regional dynamics play an essential role in shaping adoption pathways, as policy frameworks, infrastructure availability, and defense priorities diverge across the globe. In the Americas, supportive legislation and robust R&D funding have fostered vibrant collaborations between national labs, major aerospace OEMs, and emerging clean tech entrants. This region has become a proving ground for hybrid propulsion demonstrations and modular APU installations, with several programs targeting commercial certification under evolving environmental mandates.

Moving eastward, Europe, Middle East & Africa exhibit a varied landscape where European Union regulations emphasize hydrogen corridors and strategic defense initiatives support collaborative development of solid oxide solutions for high-altitude and space-based platforms. The Middle East’s investments in sustainable aviation fuels and defense modernization are creating opportunities for early-stage trials, whereas Africa’s nascent regulatory frameworks present both challenges and potential for leapfrogging conventional energy systems in aerospace logistics.

Across Asia-Pacific, expanding defense budgets and national ambitions in space exploration are driving demand for reliable, high-power modules. Governments are prioritizing indigenization of fuel cell stacks and digitalized manufacturing practices. Partnerships between local conglomerates and global technology leaders are focused on scaling planar solid oxide installations for remote base power, while low temperature proton exchange membrane APUs are piloted on export-focused rotary wing platforms. Each regional cluster exhibits distinct momentum, yet all share a common imperative: integrating sustainable, resilient power solutions to meet evolving mission requirements.

This comprehensive research report examines key regions that drive the evolution of the Fuel Cells In Aerospace & Defense market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Players Shaping the Future of Fuel Cell Solutions in Aerospace Mobility and Defense Applications

Leading industry participants are forging the competitive contours of this emerging sector, each leveraging unique strengths to gain strategic advantage. Established fuel cell specialists are collaborating with prime aerospace contractors to co-develop integrated power units, combining proprietary membrane technologies with advanced thermal management systems. Technology newcomers are focusing on modular, scalable designs that facilitate rapid qualification cycles and cost-effective maintenance for military platforms. Concurrently, defense OEMs are incubating in-house capabilities, securing intellectual property around stack assembly and hybrid energy management software.

Cross-industry alliances are accelerating the pace of innovation; partnerships between battery storage providers and fuel cell integrators are yielding hybrid prototypes that balance peak power demands with extended endurance. Space agencies are selecting suppliers based on proven track records in extreme environment testing, performance under vacuum, and resilience to radiation. Joint ventures between local system integrators and global component manufacturers are emerging in key regional markets to satisfy offset requirements while strengthening supply chain transparency.

As the competitive landscape continues to evolve, companies are differentiating through demonstrable lifecycle reliability, certification roadmaps, and service networks tailored to the aerospace and defense ecosystem. Those that can harmonize advanced stack chemistries, fuel processing expertise, and digital diagnostic platforms will be best positioned to lead the transition toward zero-emission, high-performance power solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fuel Cells In Aerospace & Defense market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advent Technologies Holdings, Inc.

- AeroVironment, Inc.

- AFC Energy PLC

- Airbus SE

- Australian Fuel Cells Pty Ltd.

- Ballard Power Systems Inc.

- Bramble Energy Ltd.

- Ceres Power Holdings PLC

- Cummins, Inc.

- Doosan Fuel Cell Co., Ltd.

- Edge Autonomy

- GenCell Ltd.

- General Motors Company

- GKN Aerospace Services Limited

- Honeywell International, Inc.

- Horizon Fuel Cell Technologies

- Infinity Fuel Cell and Hydrogen, Inc.

- Intelligent Energy Limited

- ITM Power PLC

- Leonardo S.p.A.

- Loop Energy, Inc.

- Nedstack Fuel Cell Technology BV

- Nuvera Fuel Cells, LLC

- Plug Power Inc.

- Raytheon Technologies Corporation

- Siemens AG

- Snam S.p.A.

- Thales Group

- Toyota Motor Corporation

- ZeroAvia, Inc.

Actionable Strategies and Roadmap Recommendations for Industry Leaders to Drive Adoption and Integration of Fuel Cell Systems in HighStakes Environments

To capitalize on growth opportunities and navigate a complex regulatory and supply environment, industry leaders should prioritize several strategic imperatives. First, accelerating R&D investment in high temperature proton exchange membrane and planar solid oxide systems will unlock pathways for both propulsion and auxiliary power modules, supporting extended mission profiles across air, land, and space. Concurrently, establishing collaborative frameworks with fuel suppliers and infrastructure developers will ensure access to hydrogen, ammonia, and methanol at scale, mitigating logistical constraints and feedstock cost fluctuations.

Next, organizations must deepen engagement with defense procurement authorities and aviation certification bodies to co-create standards for durable, safety-certified fuel cell integration. By participating in early-stage qualification efforts, companies can influence technical criteria around vibration tolerance, thermal cycling, and fault management. Parallel to these efforts, digitization of manufacturing and the deployment of smart diagnostics in the field will enhance predictive maintenance capabilities and reduce lifecycle costs.

Finally, fostering dual sourcing strategies and regional manufacturing partnerships will build resilience against trade disruptions and tariff impacts. Leaders should leverage flexible production platforms that can pivot between planar and tubular designs or shift between membrane types in response to changing performance requirements. By executing on these recommendations, industry champions will be well positioned to lead the transition to sustainable, high-reliability energy systems within aerospace and defense domains.

Comprehensive Overview of Methodologies and Analytical Frameworks Employed to Examine Fuel Cell Market Dynamics and Technology Trends

This research employs a multi-tiered methodology combining primary interviews, secondary data analysis, and case study validation to construct a comprehensive view of fuel cell trajectories in aerospace and defense. Primary efforts included structured discussions with technology developers, prime contractors, defense acquisition officials, and end users across commercial airlines, military branches, and space agencies. These insights provided firsthand perspectives on performance requirements, certification challenges, and long-term operational strategies.

Secondary research encompassed a thorough review of technical papers, regulatory filings, patent databases, and public procurement announcements. Segmentation analysis leveraged seven key dimensions-technology, platform, application, end user, power rating, fuel type, and component-to dissect performance trade-offs and adoption drivers. Regional mapping was informed by government policy directives, infrastructure investments, and multinational defense collaboration agreements within the Americas, Europe Middle East & Africa, and Asia-Pacific.

Finally, all findings were triangulated through expert panels and scenario modeling to test the resilience of identified trends against potential policy shifts, supply chain disruptions, and technological breakthroughs. This robust framework ensures that the conclusions and recommendations reflect a balanced synthesis of qualitative insights and empirical evidence, equipping stakeholders with actionable intelligence to guide strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fuel Cells In Aerospace & Defense market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fuel Cells In Aerospace & Defense Market, by Technology

- Fuel Cells In Aerospace & Defense Market, by Platform

- Fuel Cells In Aerospace & Defense Market, by Power Rating

- Fuel Cells In Aerospace & Defense Market, by Fuel Type

- Fuel Cells In Aerospace & Defense Market, by Component

- Fuel Cells In Aerospace & Defense Market, by Application

- Fuel Cells In Aerospace & Defense Market, by End User

- Fuel Cells In Aerospace & Defense Market, by Region

- Fuel Cells In Aerospace & Defense Market, by Group

- Fuel Cells In Aerospace & Defense Market, by Country

- United States Fuel Cells In Aerospace & Defense Market

- China Fuel Cells In Aerospace & Defense Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Summarizing Critical Findings and Future Outlook for Fuel Cells in Aerospace and Defense Pointing Toward Sustainable and Collaborative Innovations

The convergence of decarbonization mandates, digital innovations, and strategic supply chain realignment is propelling fuel cells from experimental curiosity to core components of aerospace and defense power architectures. As regulatory landscapes evolve and tariffs reshape supplier networks, system integrators and end users alike are adjusting procurement strategies, co-investing in manufacturing ecosystems, and co-developing standards to ensure mission success.

Segmentation analysis has highlighted the nuanced performance requirements across technology types-from low temperature proton exchange membranes for rapid startup to high temperature solid oxide cells for sustained operation in extreme environments. Platform considerations reveal unique design imperatives for defense vehicles, aircraft of varying classes, and satellite systems, while application and end user distinctions underscore the importance of customizing solutions for auxiliary power, backup resilience, and primary propulsion. Regional perspectives point to differentiated adoption trajectories shaped by infrastructure maturity, policy incentives, and defense modernization agendas.

Looking forward, success will hinge on collaborative innovation that bridges component expertise, digital capabilities, and regulatory alignment. Organizations that invest in flexible architectures-capable of accommodating multiple fuel types, power ratings, and modular designs-will be best equipped to navigate evolving mission profiles. By leveraging the insights and recommendations presented herein, stakeholders can confidently advance sustainable, resilient power systems that meet the rigorous demands of aerospace and defense operations.

Connect with Ketan Rohom to Unlock In-Depth Fuel Cell Market Insights Tailored for Executive Decision-Making and Strategic Growth Initiatives

For a comprehensive examination of how fuel cell innovations are reshaping aerospace and defense capabilities, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360i, to discuss tailored insights and next steps. He can guide you through the report’s core findings, highlight custom areas of interest aligned with your strategic goals, and arrange a personalized briefing to dive deeper into advanced technologies, market drivers, and regional dynamics. By partnering with Ketan, executives and technical leaders will gain access to nuanced analysis, proprietary perspectives on supply chain resilience, and actionable roadmaps designed to accelerate adoption.

Secure your copy of the full research report today to unlock detailed profiles of leading players, explore segmented intelligence by technology, platform, application, end user, power rating, fuel type, and component, and leverage expert recommendations for scaling fuel cell deployments. Connect with Ketan Rohom to ensure your organization is positioned at the forefront of sustainable, high-performance power solutions within aerospace and defense.

- How big is the Fuel Cells In Aerospace & Defense Market?

- What is the Fuel Cells In Aerospace & Defense Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?