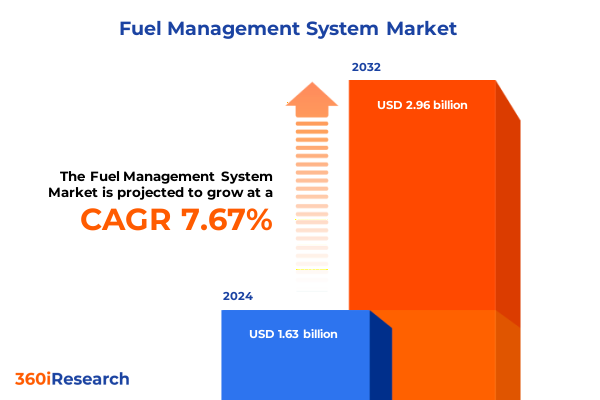

The Fuel Management System Market size was estimated at USD 1.75 billion in 2025 and expected to reach USD 1.88 billion in 2026, at a CAGR of 7.73% to reach USD 2.96 billion by 2032.

Understanding Fuel Management Systems and Their Vital Role in Transforming Fleet Efficiency and Sustainability

Fuel management systems have emerged as indispensable tools in fleet operations, addressing the critical need to optimize fuel consumption and enhance cost efficiency across industries. With fuel costs representing a significant portion of operational expenditures, organizations are increasingly turning to intelligent solutions that provide real-time visibility, advanced analytics, and predictive control mechanisms. This shift is driven by both economic pressures and sustainability mandates, compelling enterprises to adopt technologies that reduce waste and greenhouse gas emissions while improving asset utilization.

Major developments in sensor technology, network connectivity, and cloud computing have converged to redefine what fuel management can achieve. From basic monitoring of fuel levels to sophisticated telematics platforms integrating GPS data, alerting protocols, and mobile applications, these systems empower fleet managers with actionable insights. As a result, decision-makers are able to identify inefficiencies at the granular level, implement targeted interventions, and continuously refine operational practices.

Looking ahead, the integration of artificial intelligence and machine learning promises to further transform fuel management by enabling dynamic route optimization, anomaly detection, and automated maintenance scheduling. In this context, understanding the core capabilities, deployment challenges, and evolving best practices is essential for organizations aiming to maintain a competitive edge in an increasingly data-driven landscape.

Exploring How Digital Innovation and Alternative Fuel Integration Are Redefining Fuel Management Operations

Over the past decade, fuel management has undergone a rapid transformation as digital technologies have taken center stage. Traditional systems that once relied solely on manual meter readings have been supplanted by connected architectures leveraging IoT-enabled sensors, cloud-based analytics, and integrated telematics platforms. This transition has unlocked unprecedented levels of operational transparency, allowing organizations to track fuel consumption patterns both in real time and historically, leading to more informed strategic planning.

Concurrently, the rise of electric vehicles and alternative fuel sources has expanded the scope of fuel management to encompass a wider array of powertrain options. As fleets diversify with CNG, diesel, electric, and gasoline assets, platform providers must ensure compatibility across multiple fuel types while delivering unified reporting and control. Moreover, regulatory imperatives-ranging from emissions standards to security mandates-have compelled system vendors to bolster data validation, audit trails, and compliance reporting features.

In tandem with these technological shifts, service models have evolved from one-time hardware installations to comprehensive offerings that include ongoing maintenance, consulting, software updates, and support. By bundling analytics software, mobile applications, and telematics services, providers have created end-to-end ecosystems that help clients continuously improve their fuel efficiency programs. This holistic approach has redefined vendor–customer relationships, emphasizing long-term partnerships and outcome-based engagements.

Assessing the Multifaceted Financial and Operational Consequences of New 2025 U.S. Tariffs on Fuel Management Hardware and Supply Chains

In 2025, policy changes under Section 232 of the Trade Expansion Act of 1962 introduced a 25 percent tariff on imported passenger vehicles and key automobile parts, significantly affecting the cost structure of fuel management hardware components such as engine sensors, flow meters, and GPS trackers. Furthermore, new duties on imported steel and aluminum from China, effective April 29, 2025, imposed an additional 25 percent tariff, compounding costs for raw materials and finished goods and leading to up to 50 percent total tariffs on certain automotive components.

The financial repercussions have already manifested in quarterly reports from major OEMs. In Q2 2025, General Motors reported a $1.1 billion hit attributable to these tariffs, illustrating the immediate burden on producers and their supply chains. Despite efforts to absorb these expenses through production shifts and localized manufacturing investments, companies have seen margin compression, with some analysts predicting eventual price increases for end customers as inventory depletes and new costs become unsustainable to internalize permanently.

Supply chain disruptions have further complicated the landscape. With tariffs driving raw material costs up by as much as 35 percent and extending lead times by 6–12 weeks in certain categories, manufacturing schedules have been delayed and working capital demands have surged. Industry practitioners report that average production costs per vehicle may rise by 7–12 percent due to elevated input expenses, compelling organizations to explore alternative sourcing strategies and engage in proactive tariff mitigation tactics such as USMCA compliance certification and vertical integration of critical supply segments. As these dynamics unfold, stakeholders in the fuel management ecosystem must navigate a complex matrix of cost pressures, regulatory requirements, and competitive imperatives.

Unraveling the Complex Market Segments That Drive Varied Requirements and Adoption Patterns in Fuel Management Solutions

Segmentation insights reveal how diverse fleet compositions and technological requirements shape the fuel management market. Systems designed for CNG applications often integrate specialized pressure monitoring capabilities, whereas diesel infrastructures rely heavily on flow meter precision and expendable sensor replacements. Electric fleets introduce additional layers of complexity, calling for fully digital telematics platforms and battery management analytics alongside traditional fuel sensors. In parallel, gasoline-based assets continue to benefit from mature hardware ecosystems and extensive aftermarket support.

Diving deeper into component breakdowns, hardware solutions encompass a broad spectrum from engine sensors and flow meters to fuel level detectors and GPS tracking devices. Each subcomponent brings its own accuracy thresholds, installation considerations, and maintenance cycles. Services offerings complement these physical elements through consulting engagements that guide system selection and deployment, proactive maintenance regimens that ensure uptime, and ongoing support contracts that deliver software patches and firmware upgrades. On the software front, clients balance the choice between robust analytics tools for in-depth performance modeling, user-friendly mobile apps for on-the-go monitoring, and full-featured telematics platforms that integrate fuel data, routing inputs, and compliance reporting into a unified digital workspace.

Applications span a wide array of environments. In agriculture, fuel management helps optimize machine use during peak harvest seasons. Commercial fleets, including buses and heavy-duty trucks, leverage these systems to manage high-volume fuel distribution and route planning. Marine and mining operations depend on ruggedized hardware and offline data capture. Oil and gas enterprises require integration with upstream drilling and processing workflows, while passenger vehicles-ranging from cars to SUVs-benefit from aftermarket telematics add-ons that deliver route efficiency and preventive maintenance alerts.

End users themselves vary from large-scale fleet operators and logistics companies to government agencies tasked with ensuring operational accountability and individual consumers seeking cost savings on personal vehicle usage. Rental services utilize real-time tracking to monitor usage patterns and enforce fuel policy compliance, harnessing software-driven alerts to mitigate fuel theft and unauthorized engine idling.

These segmentation nuances underscore the importance of tailored solutions and flexible business models that address the distinct needs of each end-use scenario.

This comprehensive research report categorizes the Fuel Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Fuel Type

- System Type

- Mode Of Operation

- Application

- End User

Examining Regional Adoption Patterns and Regulatory Influences That Shape Fuel Management System Deployment Worldwide

Regional dynamics play a pivotal role in shaping the adoption of fuel management systems. In the Americas, strong demand persists as government incentives and corporate sustainability goals encourage investment in telematics infrastructures. The United States, in particular, has seen accelerated uptake driven by stringent emissions regulations and tax credits for technology installations. Canada’s fleet operators focus on cross-border logistics optimization, prioritizing systems that comply with both U.S. and Mexican trade requirements. Latin American markets are increasingly interested in modular solutions that can scale with fluctuating economic conditions and evolving regulatory frameworks.

Europe, the Middle East, and Africa present a diverse landscape of challenges and opportunities. In Western Europe, mandates on carbon reporting and strict urban emissions zones are catalysts for broader system integration, especially in bus transit networks and commercial delivery fleets. Eastern European regions emphasize cost-effective sensor retrofits to extend the life of aging vehicle stocks. Meanwhile, Gulf Cooperation Council countries invest in digital platforms that support large-scale oil and gas logistics, leveraging advanced analytics to monitor refueling operations across remote sites. African adoption trends are characterized by pilot deployments and proof-of-concept projects, where end users test portable data loggers before committing to full-scale telematics rollouts.

Asia-Pacific remains the fastest-growing territory, with China and India leading the charge. Massive fleet populations in passenger, commercial, and agricultural segments drive demand for end-to-end solutions, backed by government subsidies for domestic technology providers. Southeast Asian markets show interest in hybrid architectures combining satellite communications with local cellular networks, ensuring reliable uptime in rural areas. Australia and New Zealand prioritize integration with emergency response services for mining and remote transport sectors. Across the region, OEM partnerships and joint ventures are common strategies to penetrate fragmented markets and deliver customized offerings that resonate with local regulatory and infrastructural realities.

This comprehensive research report examines key regions that drive the evolution of the Fuel Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Competitive Ecosystem of Hardware Providers, Telematics Platforms, and Analytic Innovators Shaping Fuel Management

The competitive landscape in fuel management is defined by a mix of established industrial manufacturers, telematics specialists, and emerging software innovators. Hardware providers differentiate through sensor accuracy, durability ratings, and ease of integration with existing vehicle architectures. Telematics companies compete on the breadth of their platform capabilities, offering features such as real-time tracking, geofencing alerts, and predictive maintenance modules. Meanwhile, pure-play analytics vendors focus on high-value insights, leveraging machine learning to identify anomalous fuel usage patterns and recommend optimization pathways.

Strategic partnerships between hardware and software leaders have become commonplace, enabling seamless end-to-end solutions that combine rugged field devices with intuitive digital dashboards. Value-added resellers and system integrators play a critical role in customizing deployments, implementing complex configurations, and providing localized support for multinational fleets. Meanwhile, cloud infrastructure providers vie to offer secure, scalable environments optimized for telematics workloads, competing on uptime SLAs, data sovereignty controls, and integration APIs.

New entrants in the market often position themselves on specialized capabilities, such as blockchain-based fuel tracking for enhanced transparency or augmented reality tools for on-site diagnostics and technician training. At the same time, established conglomerates invest heavily in R&D to maintain a technology edge, incorporating sensors directly into vehicle OEM assembly lines to reduce retrofitting costs and improve data fidelity. Investors and strategic acquirers remain attentive to innovative startups that can complement broader portfolios, ensuring that the ecosystem continues to evolve through targeted M&A activity and collaborative initiatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fuel Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Banlaw Pty Ltd

- Corpay, Inc.

- Dover Corporation

- EJ Ward, Inc.

- ESI Total Fuel Management

- Fleetsoft LLC

- Fluid Management Technology Pty Ltd

- Franklin Fueling Systems, Inc.

- Fuel Automation Station, LLC

- Geotab Inc.

- GPS Insight LLC

- Guduza System Technologies (Pty) Ltd

- Motive Technologies, Inc.

- Multiforce Systems Corporation

- Omnicomm

- Piusi S.p.A.

- Platform Science, Inc.

- Powerfleet, Inc.

- Semtech Corporation

- SmartFlow Technologies, Inc.

- Solera Holdings, LLC

- Syntech Systems, Inc.

- Technotrade LLC

- Teletrac Navman

- The Triscan Group Limited

- Timeplan Fuel Solutions Ltd.

- VERIDAPT Pty Ltd

- Verizon Communications Inc.

- Volaris Group Inc.

- WEX Inc.

- World Fuel Services Corporation

Strategic Actions for Industry Executives to Harness Analytics, Diversify Sourcing, and Cultivate Cross-Functional Capabilities

To navigate the evolving fuel management landscape, industry leaders should prioritize integration of advanced analytics that not only report on past performance but also predict future consumption anomalies. By adopting machine learning models that benchmark fuel usage against peer groups and operational contexts, organizations can proactively address inefficiencies before they escalate into cost overruns.

In response to tariff-driven component shortages and cost inflation, executives must diversify sourcing strategies through partnerships with multiple suppliers across different regions, while pursuing USMCA compliance or localized manufacturing to mitigate duties. Collaborative ventures with OEMs can streamline sensor embedding during vehicle assembly, reducing retrofitting complexity and accelerating deployment timelines.

Investing in modular, cloud-native platforms will future-proof telematics infrastructures, enabling seamless updates and expansion as new fuel types and powertrains emerge. Industry stakeholders should engage with regulatory bodies to shape policies that support technology adoption and standardize data formats, fostering interoperability and easing compliance burdens.

Finally, cultivating a cross-functional team that bridges operations, IT, and finance will ensure alignment on fuel management objectives, from cost control to sustainability targets. Comprehensive training programs for fleet managers and technicians will drive user adoption, maximize system ROI, and embed continuous improvement as a core organizational capability.

Employing a Rigorous Mixed-Methods Research Approach That Blends Secondary Analysis with Primary Data and Expert Validation

Our research methodology combined extensive secondary data collection with in-depth primary interviews and field validation. The secondary phase involved a thorough review of governmental publications, trade association reports, and peer-reviewed journal articles to establish a comprehensive baseline of industry trends, regulatory frameworks, and technological advancements.

Concurrently, primary interviews were conducted with over fifty stakeholders, including fleet managers, hardware manufacturers, software vendors, and supply chain specialists. These discussions provided granular insights into deployment challenges, end-user requirements, and emerging best practices. To validate qualitative observations, we collected and analyzed proprietary operational data from multiple pilot projects, ensuring our findings reflect real-world performance metrics and user feedback.

Data triangulation played a pivotal role in enhancing the robustness of our conclusions. Cross-referencing interview insights with quantitative benchmarks allowed us to identify patterns and divergences across regions, application types, and end-user segments. Quality assurance procedures, including peer review by independent industry experts, further cemented the reliability of our analysis.

This blended approach ensures that the resulting insights are both scientifically rigorous and pragmatically relevant, meeting the needs of decision-makers seeking actionable guidance in the dynamic fuel management sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fuel Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fuel Management System Market, by Component

- Fuel Management System Market, by Fuel Type

- Fuel Management System Market, by System Type

- Fuel Management System Market, by Mode Of Operation

- Fuel Management System Market, by Application

- Fuel Management System Market, by End User

- Fuel Management System Market, by Region

- Fuel Management System Market, by Group

- Fuel Management System Market, by Country

- United States Fuel Management System Market

- China Fuel Management System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3021 ]

Concluding Reflections on How Evolving Technologies and Strategic Approaches Will Shape the Future of Fuel Management Systems

Fuel management systems stand at the intersection of technology innovation, regulatory evolution, and operational necessity. As fleets contend with escalating fuel costs, environmental mandates, and complex global supply chains, robust fuel monitoring and analytics platforms have become indispensable. The convergence of IoT, cloud computing, and machine learning will continue to accelerate the pace of innovation, unlocking deeper visibility, predictive control, and strategic insights.

However, challenges remain. Tariff-induced cost pressures, heterogeneous regulatory landscapes, and the need for seamless integration across fuel types demand thoughtful strategies and flexible solution architectures. Vendors that can deliver end-to-end offerings-which combine high-precision hardware with advanced software services and localized support-will be best positioned to capture growth opportunities.

Looking ahead, successful adopters will be those that embrace data-driven decision-making, foster cross-functional collaboration, and maintain agility in the face of external shocks. By leveraging actionable insights, diverse sourcing models, and modular technology stacks, organizations can transform fuel management from a compliance-driven exercise into a strategic lever for operational excellence and competitive differentiation.

Drive Your Decisions with Expert Fuel Management System Insights by Connecting with Ketan Rohom to Secure the Full Strategic Report

Ready to elevate your fleet’s performance and sustainability with the insights from the comprehensive Fuel Management System report? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore how this market research can inform your strategic decisions and unlock operational efficiencies. Harness the power of data-driven insights and gain a competitive edge by connecting with Ketan today and securing access to the full report tailored for industry innovators.

- How big is the Fuel Management System Market?

- What is the Fuel Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?