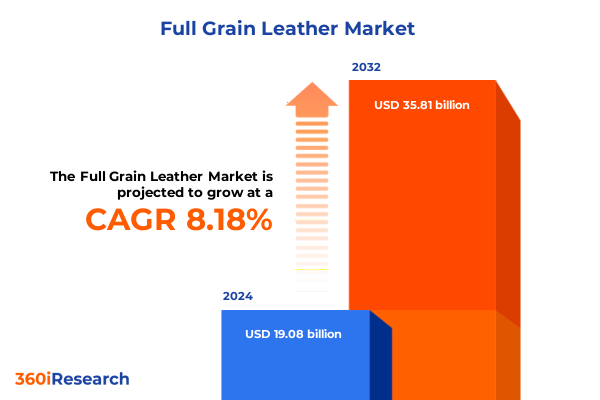

The Full Grain Leather Market size was estimated at USD 20.58 billion in 2025 and expected to reach USD 22.19 billion in 2026, at a CAGR of 8.23% to reach USD 35.81 billion by 2032.

Setting the Stage for Full Grain Leather’s Evolution Amidst Intensifying Sustainability Demands Digital Innovations Shifting Consumer Preferences and Global Market Dynamics

Full grain leather stands at the intersection of tradition and innovation, where artisanal craftsmanship meets evolving consumer and regulatory demands. As the most premium and durable type of leather, it has long been the benchmark for quality in industries ranging from luxury goods to automotive interiors. Yet the underlying dynamics-shifts in raw material availability, rising sustainability expectations, and the advent of digital traceability tools-are redefining how this material is sourced, processed, and marketed.

In recent years, pressure from integrated supply chains and end consumers has accelerated demand for greater transparency in tanning processes and animal welfare practices. These developments coincide with advancements in manufacturing automation and digital inspection systems, which are streamlining defect detection and resource allocation. Consequently, stakeholders across the value chain must balance the heritage of full grain leather with strategic investments in modern technology and eco-friendly operations.

Looking ahead, the full grain leather market will be shaped by a convergence of factors: regulatory scrutiny on chemical use, breakthroughs in bio-based tanning agents, and potential tariff fluctuations that affect international flows of hides and skins. An informed understanding of these elements is essential for decision-makers who aim to harness the inherent strengths of full grain leather while adapting to a rapidly transforming global market landscape.

Navigating Transformative Shifts as New Tanning Technologies Circular Economy Practices Sustainable Sourcing and Evolving Consumer Expectations Reshape the Full Grain Leather Landscape

The full grain leather sector is experiencing transformative shifts that extend far beyond incremental process improvements. New tanning technologies leveraging plant-based extracts and enzymatic treatments have emerged, reducing the environmental footprint of chemical tanning agents while maintaining or enhancing hide strength and aesthetic qualities. Parallel developments in blockchain-enabled traceability systems are providing verifiable supply chain transparency, enabling brands to substantiate responsible sourcing claims and comply with stringent regulatory reporting requirements.

Circular economy principles are reshaping waste management and by-product utilization within tanneries. Innovations in upcycling leather scraps into composite materials for footwear soles and accessories illustrate how closed-loop strategies can generate new revenue streams while minimizing landfill contributions. Meanwhile, cultured and biofabricated leather prototypes are gaining traction among environmentally conscious consumers, prompting traditional players to rethink long-term R&D investments and collaborative ventures with biotech startups.

Moreover, evolving consumer expectations around personalization and premium craftsmanship are driving demand for small-batch and bespoke leather goods. These niche segments rely on agile production models that integrate digital pattern-making tools and just-in-time inventory management, a stark contrast to legacy mass-production frameworks. As a result, companies must strategically align their talent, technology, and sustainability agendas to thrive amidst these rapid industry realignments.

Unpacking the Cumulative Effects of 2025 United States Tariffs on Full Grain Leather Imports Supply Chains and Cost Structures Across Key Industry Segments

The United States has maintained tariff measures on imported leather goods for decades, but recent adjustments in 2025 have amplified their cumulative impact on full grain leather supply chains. Tariffs under the Section 301 framework and longstanding Harmonized Tariff Schedule provisions have collectively raised duties on specific categories of hides and finished leather by up to 25 percent. These elevated import costs have reverberated through downstream manufacturing sectors, particularly in automotive upholstery and luxury fashion accessories.

Procurement teams are responding to these cost pressures by diversifying sourcing bases away from traditional exporters subject to higher tariffs. Some brands are shifting orders toward regions with preferential trade agreements or lower duty burdens, while others are negotiating long-term contracts with domestic tanneries to stabilize input costs. However, increased reliance on domestic or alternate suppliers has prompted concerns about capacity constraints, feedstock quality variations, and potential bottlenecks in logistics.

In parallel, margin erosion from higher duties has intensified conversations around vertical integration. Several forward-thinking companies are exploring strategic investments in raw hide processing facilities or forging joint ventures with upstream partners to capture value earlier in the value chain. These moves underscore a broader trend: firms are seeking to mitigate tariff volatility through enhanced control of critical supply nodes, positioning themselves to maintain product quality and competitive pricing in a fluid trade environment.

Unveiling the Key Segmentation Insights That Illuminate How Diverse Leather Types Product Forms Applications and Distribution Channels Drive Industry Dynamics

Analyzing market segmentation by type reveals a hierarchy of material characteristics and price points. Buffalo and cow hides serve as the backbone of full grain applications, prized for their robustness and availability. Meanwhile, the exotic category-encompassing crocodile and ostrich-commands premium valuations driven by unique grain patterns and exclusivity. In parallel, goat and sheep populations contribute distinct sub-tiers, with goat leather offering a supple hand feel and sheep providing a lighter, more flexible substrate for high-end garments.

Turning to the form in which leather enters the market, the differences among finished leather, half-cut, and wet blue are pivotal. Finished leather emerges fully treated and ready for end-use, appealing to brands seeking to minimize in-house processing. Wet blue represents a mid-stage product, chrome-tanned but awaiting further finishing steps, which permits customization according to specific aesthetic or performance requirements. Half-cut, typically half of a full hide split horizontally, occupies a niche that balances cost efficiency with functional versatility.

Applications further stratify the full grain leather market into distinct use cases. In automotive, commercial and passenger vehicle interiors demand stringent durability and colorfastness standards. Footwear manufacturers segment demand between men’s and women’s styles, each requiring tailored thickness and flexibility. Furniture and upholstery applications bifurcate into commercial and residential environments, where factors such as stain resistance and maintenance protocols vary significantly. Finally, the garments sector, divided into men’s and women’s lines, relies on diverse finishing techniques to meet fashion-driven color and texture trends.

Distribution channels complete the segmentation landscape. Direct sales arrangements enable manufacturers to foster deeper client relationships and capture greater margin, while e-commerce platforms provide scalability and consumer reach. Traditional retail outlets still play a critical role in brand discovery and tactile evaluation of leather quality, and wholesale partnerships remain indispensable for high-volume supply to large-scale industrial clients. Each channel demands distinct marketing strategies and logistical coordination, underscoring the importance of harmonized channel management for market participants.

This comprehensive research report categorizes the Full Grain Leather market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product Form

- Application

- Distribution Channel

Deriving Key Regional Insights by Examining Demand Drivers Regulatory Trends and Competitive Landscapes Across Americas EMEA and Asia-Pacific Markets

Regional dynamics in the Americas reflect a blend of mature markets in North America and emerging opportunities in Latin America. The United States continues to lead in design innovation and high-specification automotive upholstery, whereas Brazil and Argentina remain critical suppliers of raw hides and wet blue for global tanning hubs. Nevertheless, regulatory developments in environmental standards and wildlife protection measures have begun to reshape sourcing protocols in several Latin American jurisdictions, prompting closer scrutiny on traceability and compliance practices.

In Europe, Middle East, and Africa, stringent chemical use regulations and circular economy mandates drive investment in eco-friendly tanning processes and by-product valorization. Germany, Italy, and France exemplify advanced tanning clusters with deep heritage in luxury leather goods, while Turkey and Morocco have emerged as competitive producers of wet blue and half-cut due to favorable labor costs and tariff advantages within regional free-trade frameworks. Meanwhile, the Middle East market exhibits growing appetite for premium leather furnishings and bespoke automotive interiors, supported by rising consumer spending and infrastructure deployment.

Asia-Pacific presents a dual narrative of rapid industrialization and evolving consumer sophistication. China and India remain dominant in raw hide procurement and basic wet blue processing, yet both countries are investing heavily in post-tanning R&D to ascend the value chain. Japan and South Korea continue to excel in high-precision finishing techniques, meeting the exacting requirements of luxury brands across footwear and accessories. Southeast Asian nations are also gaining prominence, leveraging competitive labor costs and government incentives to attract new tannery projects and downstream manufacturing facilities.

This comprehensive research report examines key regions that drive the evolution of the Full Grain Leather market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Company Insights to Understand How Market Leaders Are Innovating Differentiating and Strategizing to Capture Value in the Full Grain Leather Sector

Leading companies in the full grain leather sector are distinguished by their strategic emphasis on innovation, sustainability, and vertical integration. Established tanneries with global footprints are accelerating efforts to adopt greener tanning chemistries and water-efficient processes, while also expanding their digital traceability infrastructure to meet brand and regulatory expectations. These investments are complemented by partnerships with academic institutions and biotech firms exploring next-generation tanning agents and by-product upcycling.

A parallel group of mid-tier players is leveraging niche positioning in specialized segments, such as exotic skins or high-performance automotive grades, to capture premium margins. These firms typically emphasize craftsmanship credentials, tight quality control, and tailored finishing services that differentiate their offerings. At the same time, they often collaborate closely with design houses and OEMs to co-develop proprietary leather innovations aligned with brand identity and performance criteria.

Meanwhile, emerging entrants-particularly technology-driven startups-are challenging conventional paradigms with cultured leather prototypes and advanced materials engineering. They operate at the fringes of the mainstream market but command significant attention from investors and major brands keen to pilot sustainable alternatives. As these disruptive models gain traction, incumbent participants must determine whether to integrate similar approaches or pursue strategic alliances to safeguard their competitive positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Full Grain Leather market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Andrew Muirhead & Son Ltd.

- Conceria Pasubio S.p.A.

- Dalton Tanning Company, LLC

- DESA Deri Sanayi ve Ticaret A.Ş.

- Devon Leather Co.

- Ecco Leather A/S

- Garrett Leather Corporation

- Guangzhou Jiaye Leather Co., Ltd.

- H. L. Becker & Sons, Inc.

- Hein Gericke Leder GmbH

- Hermann Oak Leather Co.

- Horween Leather Company

- JBS Couros S.A.

- Kemin Leather Sourcing B.V.

- Manassé‑Block Tanning Company

- Red‑Dragon Leather, Ltd.

- Rosti Leather

- SB Foot Tanning Co.

- Shandong Jiaxin Leather Co., Ltd.

- Tasman Leather Group Pty Ltd

- W. J. Burke Tanners, Inc.

- Wickett & Craig of America

Crafting Actionable Recommendations to Empower Industry Leaders with Strategies for Operational Resilience Sustainable Growth and Competitive Advantage in Full Grain Leather

Industry leaders must prioritize a balanced approach that integrates sustainability, cost management, and technological innovation. First, strengthening supply chain resilience through diversified sourcing and strategic inventory buffers will help mitigate tariff-induced cost shocks and logistics disruptions. This includes establishing alternate procurement corridors in regions with favorable trade agreements and nurturing long-term partnerships with trusted tannery operators.

Second, investing in eco-efficient tanning processes and circular by-product initiatives will address growing regulatory scrutiny and consumer demand for responsible manufacturing practices. Companies should evaluate enzyme-based and vegetable tanning options alongside water recycling systems to minimize environmental impact. Complementary collaborations with research institutions can accelerate development of next-generation tanning formulations that reduce chemical usage without compromising quality.

Third, embracing digital tools-ranging from blockchain-backed traceability to AI-driven quality analytics-will enhance transparency, streamline defect detection, and optimize resource allocation. Leveraging data insights to refine production workflows can lower rework rates and bolster on-time delivery reliability, a critical competitive differentiator in sectors like automotive interiors and bespoke fashion.

Finally, fostering strategic partnerships with biotech startups and design houses will allow incumbent manufacturers to experiment with emerging materials and co-create differentiated products. Such collaboration pipelines can unlock new revenue streams in adjacent markets, from upholstery composites to premium accessories, positioning forward-thinking organizations at the forefront of full grain leather’s evolution.

Detailing the Comprehensive Research Methodology Underpinning Transparent Rigorous Analysis of Full Grain Leather Market Trends Data Collection and Validation Processes

This study employs a multi-method research approach, combining primary interviews, secondary data aggregation, and rigorous validation processes. Expert interviews were conducted with senior executives across tanning, manufacturing, and brand management functions to capture firsthand perspectives on market drivers, technological adoption, and regulatory impacts. These qualitative insights were triangulated with publicly available industry data, company reports, and trade association publications to ensure comprehensiveness.

Secondary research also encompassed supply chain mapping, trade flow analysis, and review of tariff schedules to quantify the impact of trade measures on cost structures. Historical pricing data and contract terms were examined to identify long-term trends in raw hide and finished leather procurement. Additionally, emerging science and technology literature was evaluated to gauge the maturity of next-generation tanning agents and cultured leather prototypes.

Data validation involved cross-referencing findings with industry benchmarks and consulting with independent subject matter experts. Market segmentation logic was tested through scenario modeling to assess sensitivity across types, product forms, applications, and distribution channels. Regional analyses were aligned with macroeconomic indicators and trade policy shifts to ensure relevance. Finally, the research framework underwent peer review to confirm methodological rigor and mitigate potential biases.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Full Grain Leather market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Full Grain Leather Market, by Type

- Full Grain Leather Market, by Product Form

- Full Grain Leather Market, by Application

- Full Grain Leather Market, by Distribution Channel

- Full Grain Leather Market, by Region

- Full Grain Leather Market, by Group

- Full Grain Leather Market, by Country

- United States Full Grain Leather Market

- China Full Grain Leather Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Observations on the Full Grain Leather Market’s Present State Future Trajectories and Strategic Imperatives for Stakeholders Seeking Growth Opportunities

The full grain leather market stands poised at a crossroads of tradition and transformation. Time-tested tanning practices and artisanal techniques continue to underpin its prestige, while sustainability imperatives and digital innovations drive rapid evolution. As tariffs reshape cost dynamics, and consumer preferences tilt toward traceable, eco-friendly materials, stakeholders must adopt forward-looking strategies that leverage both legacy expertise and technological advancements.

Segmentation insights reveal that while buffalo and cow hides remain foundational, high-growth pockets exist in exotic and goat-sheep subsegments. Demand across automotive, footwear, furniture, and garment applications is diversifying, necessitating agile supply chain orchestration and channel differentiation. Regionally, mature markets in North America and Europe coexist alongside burgeoning opportunities in Asia-Pacific, each presenting distinct regulatory and competitive landscapes.

Success in this milieu will hinge on the ability of companies to integrate sustainable tanning methods, digital traceability platforms, and collaborative innovation models into their core operations. By aligning these initiatives with strategic supply chain diversification and data-driven decision-making, industry participants can chart a resilient path forward, capturing value across the entire full grain leather ecosystem.

Engage with Ketan Rohom to Unlock In-Depth Market Research Intelligence That Drives Strategic Decisions and Fuels Growth in the Full Grain Leather Market

If your strategic roadmap demands data-driven clarity and actionable market insights, engage with Ketan Rohom to access a comprehensive market research report specifically tailored to the full grain leather industry. Leveraging deep expertise in sales and marketing dynamics, Ketan Rohom will guide you through the research findings, ensuring granular understanding of segmentation shifts, regional growth nuances, and competitive landscapes that directly inform your business decisions.

By partnering with Ketan, you gain direct access to analysts who can contextualize complex data sets into strategic recommendations, whether you are evaluating new supply chain partnerships, exploring emerging applications, or refining your go-to-market approach. This personalized consultation will demystify tariff implications, technological advancements, and sustainability mandates that shape cost structures and consumer expectations across global markets.

Take the next step toward market leadership by scheduling a briefing with Ketan Rohom. Unlock unparalleled depth of analysis and forward-looking perspectives that fuel innovation and drive growth in the full grain leather sector. Propel your organization toward informed decision-making and tangible results by securing your copy of the definitive market research report today.

- How big is the Full Grain Leather Market?

- What is the Full Grain Leather Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?