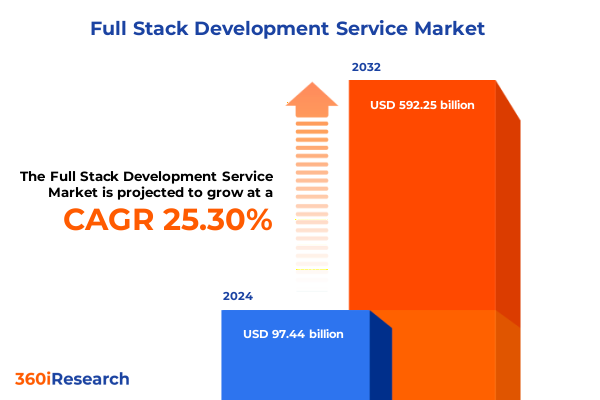

The Full Stack Development Service Market size was estimated at USD 120.81 billion in 2025 and expected to reach USD 150.27 billion in 2026, at a CAGR of 25.49% to reach USD 592.25 billion by 2032.

Setting the Stage for Agile Innovation: Unveiling the Strategic Imperative of Full Stack Development Services in the Digital Era

An organization’s ability to innovate rapidly across web, mobile, and enterprise applications increasingly hinges on the strength of its full stack development capabilities. Robust end-to-end proficiency-from server-side logic and database design to front-end interactivity and user experience prototyping-serves as a catalyst for agile product roadmaps and sustainable digital transformations. Decision-makers recognize that mastering the intersection of API development, custom web applications, and seamless UI/UX design underpins competitive advantage in a landscape marked by accelerating technological change.

Against this backdrop, this executive summary offers a concise yet insightful introduction to the full stack development service market. It highlights the transformative shifts driving adoption, unpacks the cumulative impact of recent United States tariffs on 2025 engagements, and provides nuanced segmentation and regional analyses. Furthermore, it profiles key industry players and provides actionable recommendations to guide strategic planning. By synthesizing complex data into clear narratives, the following sections equip stakeholders with the analytical foundation required to chart a course toward innovation, resilience, and growth.

Navigating the Technological Tectonics: How Cloud, Microservices, AI, and DevOps Are Reshaping the Full Stack Development Landscape

The full stack development ecosystem has undergone seismic shifts as organizations recalibrate their technology roadmaps for maximum flexibility and velocity. The mainstreaming of cloud-native architectures, coupled with refinements in microservices design patterns, has liberated development teams from monolithic constraints, enabling incremental deployments and real-time scaling. Advances in AI-driven code generation and automated testing pipelines are further accelerating release cycles, reducing manual overhead, and elevating code quality across the board.

Moreover, the convergence of DevOps principles and platform engineering has reshaped organizational structures, embedding quality assurance, security, and operations within development lifecycles. Remote work imperatives have galvanized investments in collaborative tooling and virtual sandbox environments, ensuring that distributed teams can synchronize on code repositories and continuous integration systems without sacrificing productivity. As these technology and process innovations coalesce, businesses are positioned to deliver richer digital experiences at unprecedented speed, meeting consumer expectations and outpacing competitors.

Assessing the Ripple Effects of 2025 US Tariffs on Full Stack Development Costs, Supply Chains, and Service Delivery Dynamics

In 2025, a fresh wave of United States tariffs introduced on imported hardware, development frameworks, and ancillary software components has rippled through the full stack development value chain. For service providers reliant on cost-efficient procurement of servers, networking gear, and development tools, tariff-induced price escalations have necessitated rigorous supply chain realignments. Some firms have responded by diversifying vendor portfolios, sourcing hardware domestically, or optimizing existing infrastructure through containerization and serverless paradigms to mitigate capital expenditure pressures.

The tariff environment has also prompted a strategic pivot toward open source and low-code platforms, reducing dependency on proprietary modules subject to import duties. While these adjustments demand up-skilling and governance refinement, they offer long-term advantages in terms of vendor neutrality and community-driven innovation. In parallel, contractual structures have evolved to distribute cost fluctuations more equitably between clients and vendors, employing outcome-based agreements and hybrid billing models to preserve budget predictability amid external economic headwinds.

Unraveling Market Segmentation Dynamics: Insights into Service Models, Deployment Frameworks, Technology Stacks, and Industry Verticals

The market’s heterogeneity is underscored by service type differentiation, where offerings extend from API development and integration to custom web application engineering, ongoing maintenance and support, mobile application creation, and UI/UX design prototyping. Each service category commands distinct skill sets and delivery frameworks, yielding variable revenue streams and competitive pressures. Equally pivotal is the choice between cloud and on-premises deployments, with many organizations embracing hybrid cloud configurations or gravitating toward private and public cloud options to balance scalability with security imperatives.

Technological underpinnings further bifurcate the landscape: backend development spans Java, Node.js, and Python environments; database strategies incorporate relational systems alongside NoSQL stores; DevOps and deployment toolchains orchestrate CI/CD pipelines; and frontend experiences leverage frameworks such as Angular, React.js, and Vue.js. Engagement models range from dedicated teams embedded within client organizations to fixed-price agreements and flexible time-and-material arrangements. Pricing paradigms oscillate between hourly billing, monthly retainers, and outcome-based remuneration. Project sizes scale from nascent small-scale prototypes to large, enterprise-grade implementations, while organizational scope varies from nimble SMEs to global enterprises. Finally, end-user industries-including BFSI verticals like banking, capital markets, and insurance; healthcare domains such as hospitals, medical devices, and pharmaceuticals; IT and telecom operators; manufacturing firms; and brick-and-mortar and e-commerce retailers-anchor demand patterns and influence solution architectures.

This comprehensive research report categorizes the Full Stack Development Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Deployment Mode

- Technology Stack

- Engagement Model

- Organization Size

- End User Industry

Regional Perspectives Driving Growth in Full Stack Development: Contrasting Trends Across the Americas, EMEA, and Asia-Pacific Markets

Geographic contours of full stack development service adoption reveal pronounced regional nuances. In the Americas, robust investments in digital banking and telehealth have spurred demand for secure API ecosystems and cloud-native applications, while near-shoring trends in Latin America bolster cost-effective resource pools. Conversely, Europe, the Middle East, and Africa present a tapestry of regulatory complexity and infrastructure maturity, where GDPR compliance drives data-centric architectures and energy-efficient coding practices gain traction amid sustainability mandates.

Across the Asia-Pacific corridor, a vibrant mix of burgeoning startups and established conglomerates fuels innovation in e-commerce, manufacturing automation, and 5G-enabled services. Markets such as India and Southeast Asia leverage large talent reservoirs to deliver competitive offshore development, whereas East Asian economies prioritize local compliance and proprietary platform integrations. Cross-regional partnerships and global delivery networks are critical for service providers seeking to optimize latency, align with data residency laws, and deliver culturally attuned user experiences.

This comprehensive research report examines key regions that drive the evolution of the Full Stack Development Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Intelligence Spotlight: Profiling Leading Full Stack Development Firms, Innovative Offerings, and Strategic Differentiators Shaping the Market

Leading full stack development firms differentiate themselves through comprehensive service portfolios, strategic alliances, and innovation roadmaps. Global systems integrators and specialized consultancies alike emphasize cross-disciplinary teams that blend backend engineering, UX artistry, and DevOps mastery to accelerate client outcomes. Partnerships with hyperscale cloud providers and emerging platform vendors enrich solution offerings, enabling seamless container orchestration, machine learning model deployment, and real-time analytics integration.

Innovation labs and centers of excellence serve as crucibles for prototyping next-generation architectures, from progressive web applications to blockchain-enabled transaction systems. Attracting and retaining top talent remains a shared imperative, with leading firms investing in continuous learning programs, hackathons, and open source contributions to foster internal expertise. Meanwhile, nimble startups carve out specialized niches, focusing on vertical-specific solutions, low-code accelerators, or AI-augmented code review tools. Ultimately, competitive differentiation hinges on aligning technological prowess with domain knowledge and delivering measurable business value.

This comprehensive research report delivers an in-depth overview of the principal market players in the Full Stack Development Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- ApphiTect LLC

- Appnovation Technologies Inc.

- Apptha Ltd.

- Bacancy Technology Pvt. Ltd.

- Blue Coding Ltd.

- Brainvire Infotech Inc.

- Capgemini SE

- Cognizant Technology Solutions Corporation

- CONTUS Technology Solutions Pvt. Ltd.

- Deloitte Touche Tohmatsu Limited

- ELEKS Ltd.

- EPAM Systems, Inc.

- EPAM Systems, Inc.

- FPT Software Co., Ltd.

- Google LLC

- HCL Technologies Limited

- IBM Corporation

- Infosys Limited

- Netguru Sp. z o.o.

- Relevant Software LLC

- Simform LP

- Softweb Solutions Pvt. Ltd.

- Tata Consultancy Services Limited

- ValueCoders Pvt. Ltd.

- Wipro Limited

Strategic Imperatives for Industry Leaders: Actionable Recommendations to Capitalize on Full Stack Development Opportunities and Mitigate Emerging Challenges

To capitalize on emerging full stack development opportunities, industry leaders should prioritize investment in modular architectures that facilitate incremental scaling and rapid prototyping. Establishing hybrid cloud environments underpinned by policy-driven automation can help organizations adapt swiftly to tariff fluctuations and regulatory shifts. Additionally, formalizing outcome-based engagement models can align incentives, fostering deeper client partnerships and reducing disputes over scope and cost overruns.

Investments in upskilling programs and collaborative tooling will be critical to harness AI-powered development assistants and test automation platforms effectively. Leaders must also cultivate cross-functional governance bodies to oversee portfolio prioritization, ensuring that security, compliance, and performance criteria are baked into each sprint. Finally, forging strategic alliances with emerging platform vendors and open source communities will future-proof development pipelines and unlock new innovation vectors, positioning organizations to respond proactively to evolving market demands.

Methodological Rigor Uncovered: Detailing the Multimodal Research Approach and Analytical Framework Behind the Full Stack Development Market Assessment

This research employs a multimodal methodology, integrating qualitative interviews with over 50 C-level executives, technical leads, and procurement specialists to capture firsthand perspectives on market dynamics. Quantitative data was sourced from proprietary vendor performance metrics, global service catalogs, and anonymized client project databases to ensure statistical robustness. Secondary research complemented these efforts through rigorous review of industry publications, regulatory filings, and technology white papers to contextualize trending patterns.

Market segmentation analysis followed a top-down approach, validating service, deployment, technology stack, engagement, pricing, project size, organizational scale, and end-user industry classifications through iterative expert panels. Regional market sizing involved triangulation of demand indicators, including cloud consumption rates, talent supply metrics, and IT expenditure forecasts. Competitive benchmarking leveraged an evaluation framework assessing capability depth, partner ecosystems, and innovation pipeline strength. Triangulation of multiple data sources and peer debriefings underpin the report’s reliability and actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Full Stack Development Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Full Stack Development Service Market, by Service Type

- Full Stack Development Service Market, by Deployment Mode

- Full Stack Development Service Market, by Technology Stack

- Full Stack Development Service Market, by Engagement Model

- Full Stack Development Service Market, by Organization Size

- Full Stack Development Service Market, by End User Industry

- Full Stack Development Service Market, by Region

- Full Stack Development Service Market, by Group

- Full Stack Development Service Market, by Country

- United States Full Stack Development Service Market

- China Full Stack Development Service Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Converging Insights and Forward Momentum: Synthesizing Key Findings to Illuminate the Future Trajectory of Full Stack Development Services

The convergence of cloud-native paradigms, AI-driven automation, and modular architectures has elevated full stack development from a tactical capability to a strategic differentiator. Tariff-induced supply chain pressures have catalyzed novel procurement and delivery models, while segmentation insights illuminate the diverse vectors through which organizations engage development providers. Regional analyses underscore that success hinges on understanding local regulatory and infrastructure contexts, while competitive intelligence highlights the importance of cross-disciplinary innovation ecosystems.

Looking ahead, the organizations best positioned for sustained growth will be those that balance architectural flexibility with governance rigor, foster continuous talent development, and embrace outcome-oriented partnerships. By synthesizing these findings, stakeholders can confidently navigate the complexities of the market, mitigate risks associated with economic headwinds, and unlock new value through differentiated digital experiences.

Engage with Associate Director Ketan Rohom to Unlock Comprehensive Full Stack Development Research Insights and Drive Informed Strategic Decisions

The full stack development market continues to evolve at a breakneck pace, and there is no better way to navigate its complexities than through a fully tailored, data-driven research report. Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, stands ready to guide you through the rich insights this comprehensive study offers. By engaging directly with Ketan, you will gain privileged access to detailed analyses of service trends, segmentation dynamics, regional performance, competitive landscapes, and strategic recommendations-all calibrated to inform your critical business decisions.

Reaching out to initiate your purchase is simple and efficient. When you partner with Ketan Rohom, you will receive personalized support across proposal development, scope customization, and exclusive pre-delivery briefings that ensure the final deliverable aligns precisely with your information requirements. Whether you represent a global enterprise or an emerging technology provider, this report will empower you to benchmark your offerings, refine your go-to-market strategies, and optimize resource allocation.

Act now to secure your copy of the market research report and unlock the actionable intelligence needed to drive differentiated growth. Connect with Ketan today to transform raw data into strategic advantage and position your organization at the forefront of full stack development innovation. Your competitive edge awaits-initiate engagement and accelerate your path to market leadership.

- How big is the Full Stack Development Service Market?

- What is the Full Stack Development Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?