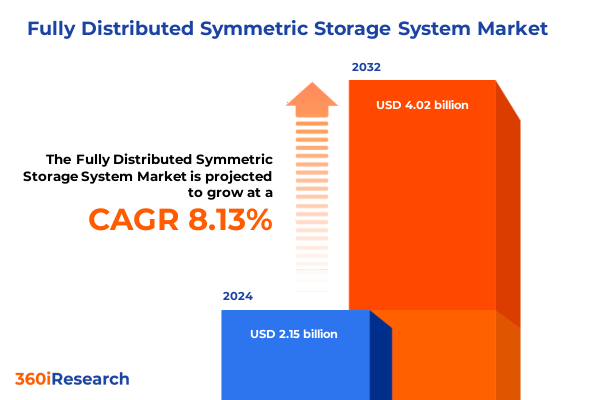

The Fully Distributed Symmetric Storage System Market size was estimated at USD 2.27 billion in 2025 and expected to reach USD 2.46 billion in 2026, at a CAGR of 8.48% to reach USD 4.02 billion by 2032.

Initiating a New Era of Fully Distributed Symmetric Storage Architectures to Empower Scalable, Resilient, and High-Performance Data Environments

The digital landscape is evolving at an unprecedented pace, fueled by an explosion of data generated by cloud-native applications, edge computing deployments, and the relentless advancement of artificial intelligence and machine learning workloads. Against this backdrop, fully distributed symmetric storage systems emerge as a foundational architecture designed to distribute compute and storage resources evenly across nodes, ensuring consistent performance and eliminating bottlenecks inherent in legacy centralized approaches.

This section sets the stage for understanding the transformative potential of these systems by defining their core principles and contrasting them with conventional clustered, scale-out, and hyper-converged topologies. It outlines the critical business drivers propelling adoption, including the demand for sub-millisecond latency, seamless scalability to petabyte and exabyte workloads, and resilient architectures that uphold high availability across multi-site and edge environments. By establishing this context, the introduction offers readers a clear vision of why fully distributed symmetric storage is becoming indispensable for organizations striving to support complex, data-intensive applications at scale.

Unveiling the Pivotal Technological and Operational Shifts Redefining Storage Infrastructure for Modern Data-Driven Enterprises

Organizations globally are witnessing a fundamental shift in storage infrastructure driven by the demands of modern workloads and evolving operational priorities. Artificial intelligence and machine learning training pipelines now require parallel I/O performance at massive scale, prompting a move toward architectures that spread data and compute workloads uniformly across all nodes to maintain consistent throughput under intense analytic loads. This paradigm shift is complemented by the rise of edge computing, where real-time insights at retail outlets, manufacturing sites, and remote research stations necessitate low-latency, localized storage clusters that can operate seamlessly both on-premises and at the network edge.

Meanwhile, sustainability considerations are becoming central to infrastructure planning, as data center operators seek to reduce power consumption per I/O and minimize carbon footprints through energy-efficient hardware and advanced data tiering techniques. Simultaneously, the proliferation of containerized microservices architectures has created an imperative for storage systems that can scale elastically, integrate naturally with orchestration platforms, and support dynamic provisioning workflows. These converging forces underscore the necessity for software-defined innovations-such as autonomous tiering, inline compression, and policy-driven data placement-that balance performance demands with operational simplicity.

Examining the Far-Reaching Implications of 2025 United States Tariffs on Storage Infrastructure Supply Chains and Cost Structures

The cumulative impact of U.S. tariff measures implemented in 2025 has introduced significant complexities into storage infrastructure supply chains. A 25 percent levy on imported steel and aluminum has increased the cost of critical storage hardware components, such as rack enclosures, interconnect frames, and power distribution units, eroding projected cost efficiencies for expansion projects and new availability zones. At the same time, tariffs on semiconductors and memory modules have disrupted vendor roadmaps for high-throughput flash and NVMe-based arrays, leading to extended lead times and supply shortages that threaten deployment timelines for hyperscale and edge clusters alike.

Compounding these challenges, tariffs targeting lithium-ion battery imports have reverberated through the market for UPS and energy storage systems, driving up prices for backup power solutions that are integral to resilient symmetric storage designs. The result is a recalibration of total cost of ownership assumptions, with organizations forced to absorb higher hardware expenses or seek alternative suppliers in regions less affected by levies. Moreover, the uncertainty created by potential future tariff escalations has accelerated efforts to diversify supply chains, invest in localized manufacturing partnerships, and enhance software-centric capabilities that reduce dependency on specialized hardware.

Revealing In-Depth Market Segmentation Insights That Illuminate Strategic Priorities Across Components, Deployment Models, End Users, Applications, and Organization Sizes

Insight into market segmentation reveals distinct opportunities and priorities across each dimension of the fully distributed symmetric storage landscape. When viewed from the component perspective, hardware remains the backbone, yet services-encompassing both maintenance and support as well as professional services-are increasingly vital, ensuring seamless integration, ongoing optimization, and rapid issue resolution. In parallel, software platforms that orchestrate data distribution, tiering, and metadata management have become differentiators, shaping how organizations derive value from their storage estates.

Deployment choices further illuminate buyer strategies. Hybrid cloud environments are prized for blending on-premises control with cloud elasticity, while many large enterprises retain dedicated private cloud clusters for mission-critical workloads. At the same time, public cloud offerings continue to draw organizations seeking pay-as-you-go scale, and traditional on-premises deployments sustain environments where sovereign control or ultra-low latency remain paramount.

From an end-user standpoint, the financial services sector drives early adoption thanks to its tolerance for high-performance, low-latency systems underpinned by stringent regulatory requirements, while healthcare providers emphasize robust security and data resiliency to protect sensitive patient records. The IT and telecom vertical demands platforms capable of supporting distributed network functions, and retail enterprises focus on agile storage to accommodate fluctuating seasonal workloads and real-time inventory analytics.

Application analysis highlights backup and recovery as foundational use cases, with data analytics and high-performance media and entertainment pipelines leveraging symmetric topologies to accelerate workloads. Virtualization initiatives have also evolved, as hypervisor-driven architectures now interface directly with distributed storage fabrics for greater efficiency.

Finally, organizational scale influences purchasing behavior, with large enterprises engaging in multiyear strategic partnerships and small and medium enterprises prioritizing turnkey solutions that offer rapid time-to-value and simplified management.

This comprehensive research report categorizes the Fully Distributed Symmetric Storage System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Model

- Organization Size

- End User

- Application

Highlighting Key Regional Dynamics That Drive Adoption Patterns and Strategic Priorities Across Americas, Europe, Middle East & Africa, and Asia-Pacific

Regional dynamics play a crucial role in shaping adoption patterns and go-to-market strategies for fully distributed symmetric storage systems. In the Americas, demand is propelled by hyperscale cloud providers and large financial institutions pursuing advanced analytics platforms, while Latin American organizations focus on resilience, cost efficiency, and compliance with evolving data sovereignty regulations. Early adopters in this region often prioritize integrated analytics capabilities tightly coupled with storage infrastructures to glean real-time business intelligence.

Across Europe, the Middle East & Africa, stringent data protection regulations such as GDPR have led governments and healthcare organizations to deploy localized clusters that ensure regulatory alignment and robust disaster recovery. Concurrently, investments in smart city initiatives and national defense programs in Gulf Cooperation Council countries are driving growth in distributed storage platforms designed for high-availability and secure remote operations.

In the Asia-Pacific region, rapid digital transformation efforts in China, India, and Southeast Asia have triggered massive data center expansions. Local cloud and telecom operators leverage edge deployments to support latency-sensitive 5G applications, while manufacturing hubs in East Asia adopt symmetric storage clusters to enhance automation and yield optimization. In Australia and New Zealand, hybrid approaches dominate, reflecting a balance between public cloud partnerships and on-premises investments that address data sovereignty and operational flexibility.

This comprehensive research report examines key regions that drive the evolution of the Fully Distributed Symmetric Storage System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Competitive Differentiators and Strategic Initiatives Among Key Providers and Emerging Innovators in the Fully Distributed Symmetric Storage Landscape

Several leading technology vendors and emerging innovators are defining the fully distributed symmetric storage market through differentiated strategies and partnerships. Pure Storage has positioned its FlashBlade//E platform as an enterprise-grade solution delivering sub-millisecond latency and seamless scale-out capabilities, enabling premier clients to tackle deep learning and analytics datasets exceeding petabytes. Dell Technologies, with its integrated storage software and hardware offerings, emphasizes hybrid cloud compatibility and orchestration with leading public cloud providers. IBM continues to evolve its Spectrum Scale software-defined storage suite, focusing on advanced data placement policies and integration with high-performance computing environments.

Alongside these established players, open-source and cloud-native companies such as MinIO and Scality have captured attention by offering Kubernetes-native object storage platforms optimized for microservices architectures and containerized workflows. These vendors underscore the industry’s move toward software-centric models that abstract underlying hardware dependencies and enable seamless portability across private data centers and public cloud regions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fully Distributed Symmetric Storage System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services Inc.

- Backblaze Inc.

- Box Inc.

- Cisco Systems, Inc

- Cloudian

- Cohesity

- Commvault Systems Inc.

- DDN Storage

- Dell Technologies Inc.

- Dropbox Inc.

- Fujitsu Limited

- Google LLC

- Hewlett Packard Enterprise Company

- Hitachi Vantara Corp.

- Huawei Technologies Co Ltd

- IBM Corporation

- Infinidat

- Microsoft Corporation

- NetApp Inc.

- Nutanix

- Oracle Corporation

- Pure Storage Inc.

- Qumulo

- Veritas Technologies LLC

- Wasabi Technologies

Offering Targeted Strategic Recommendations That Enable Industry Leaders to Harness the Full Potential of Distributed Symmetric Storage Systems

To capitalize on the evolving storage paradigm, industry leaders should prioritize the integration of machine learning and AI-driven management capabilities that automate data placement, predictive tiering, and real-time performance tuning. Investing in partnerships with green data center operators and specialized hardware vendors can address sustainability goals through energy-efficient infrastructure and carbon-aware data routing. Furthermore, organizations must diversify supply chains to mitigate the impact of tariff-related disruptions by forging relationships with multiple hardware suppliers across differing geographies and by encouraging localized component production where feasible.

Adopting container-native storage solutions and collaborating with orchestration platform providers will enable more agile deployments, reduce operational overhead, and facilitate smoother integration with microservices-driven applications. Finally, embedding security and compliance controls at every layer-from encryption at rest and in transit to policy-driven access governance-will safeguard data assets and foster trust with regulators and end customers.

Detailing a Rigorous Mixed-Methods Research Methodology Integrating Expert Interviews, Proprietary Databases, and Quantitative Validation

This research combines comprehensive primary and secondary methodologies to deliver an authoritative analysis of the fully distributed symmetric storage market. Primary inputs include in-depth interviews with storage architects, chief information officers, and procurement decision-makers across key verticals, ensuring real-world perspectives on deployment challenges and value drivers. These insights are augmented by surveys conducted with data center operators and service providers to quantify infrastructure priorities and technology adoption patterns.

Secondary research encompasses an extensive review of industry publications, patents, white papers, and regulatory filings. Proprietary proprietary databases and vendor briefings were leveraged to map product roadmaps, partnership ecosystems, and investment trends. Data triangulation methods ensure the findings are robust; qualitative feedback from expert panels is validated against publicly available company announcements, technology benchmarks, and supply chain analyses to confirm accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fully Distributed Symmetric Storage System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fully Distributed Symmetric Storage System Market, by Component

- Fully Distributed Symmetric Storage System Market, by Deployment Model

- Fully Distributed Symmetric Storage System Market, by Organization Size

- Fully Distributed Symmetric Storage System Market, by End User

- Fully Distributed Symmetric Storage System Market, by Application

- Fully Distributed Symmetric Storage System Market, by Region

- Fully Distributed Symmetric Storage System Market, by Group

- Fully Distributed Symmetric Storage System Market, by Country

- United States Fully Distributed Symmetric Storage System Market

- China Fully Distributed Symmetric Storage System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Perspectives That Reinforce the Strategic Imperative of Embracing Fully Distributed Symmetric Storage Architectures for Future-Ready Data Infrastructure

Fully distributed symmetric storage systems represent a critical evolution in enterprise infrastructure, offering unparalleled performance consistency, fault tolerance, and scalability to meet the demands of today’s data-driven world. As artificial intelligence, edge computing, and sustainability imperatives continue to reshape storage requirements, organizations that embrace these architectures will unlock new efficiencies, accelerate innovation, and strengthen resilience against supply chain disruptions.

By understanding the nuanced lessons across tariffs, segmentation, regional dynamics, and competitive landscapes, decision-makers can craft data strategies that not only address current challenges but also anticipate future requirements. The insights and recommendations presented here serve as a strategic blueprint for navigating an increasingly complex ecosystem and securing a competitive advantage in the era of fully distributed symmetric storage.

Unlock Strategic Advantages Today by Contacting Ketan Rohom to Acquire the Fully Distributed Symmetric Storage System Market Research Report Now

For inquiries and to gain immediate access to comprehensive insights that can guide strategic infrastructure decisions, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He can walk you through the detailed findings, answer your questions, and facilitate a seamless procurement process that ensures your organization captures the competitive advantages revealed in this report.

Take the next step toward future-proofing your data strategy by securing the Fully Distributed Symmetric Storage System market research report today. Connect with Ketan Rohom to explore tailored licensing options, customizable deliverables, and value-added services designed to maximize the impact of this analysis within your organization.

- How big is the Fully Distributed Symmetric Storage System Market?

- What is the Fully Distributed Symmetric Storage System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?