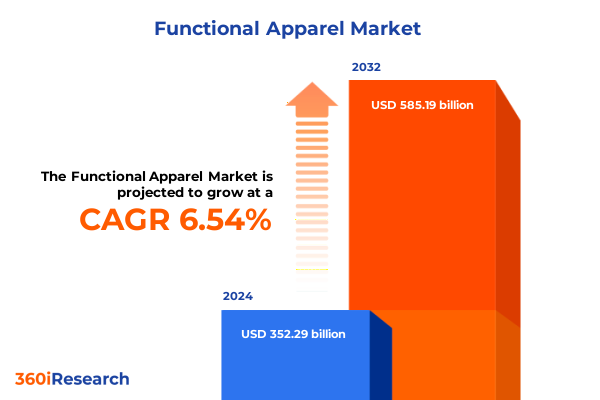

The Functional Apparel Market size was estimated at USD 375.20 billion in 2025 and expected to reach USD 399.60 billion in 2026, at a CAGR of 6.55% to reach USD 585.19 billion by 2032.

Unveiling the Multifaceted Landscape of Functional Apparel Where Innovation Meets Evolving Consumer and Regulatory Expectations

In today’s competitive landscape of functional apparel, brands and manufacturers are facing unprecedented pressure to innovate while meeting evolving consumer demands for performance, safety, and style. This segment of the textile industry, which bridges advanced materials science and the practical needs of healthcare professionals, athletes, industrial workers, and outdoor enthusiasts, is transforming at a rapid pace. New performance fabrics endowed with moisture-wicking, antimicrobial, and thermoregulatory properties have become table stakes, driving a wave of R&D investment and collaboration between technology providers and apparel brands.

At the same time, regulators and end users are imposing stricter standards for protective clothing in medical, industrial, and defense applications, fueling demand for garments that combine compliance with comfort. Beyond technical performance, sustainability has emerged as a cornerstone of brand differentiation, as companies adopt circular design principles and bio-based fibers to satisfy both regulatory mandates and consumer expectations. As a result, supply chains have grown more complex, requiring seamless coordination among raw material suppliers, textile engineers, and contract manufacturers. Against this backdrop, organizations that can swiftly translate the latest material innovations into scalable production processes, while maintaining cost and environmental efficiencies, will be best positioned to capture market share.

Charting the Confluence of Sensor-Driven Smart Apparel, Sustainable Materials, and Agile Manufacturing Models Reshaping the Industry

The functional apparel market is experiencing transformative shifts driven by convergence of digital technologies, sustainability imperatives, and personalized consumer experiences. Smart clothing embedded with sensors and wearable electronics is no longer a futuristic concept but an emerging reality, enabling real-time biometric monitoring for athletes, patients, and industrial workers. These garments integrate seamlessly with mobile applications and cloud platforms, providing data-driven feedback loops that inform product design enhancements and unlock new service-based revenue streams.

Concurrently, the proliferation of on-demand manufacturing and digital textile printing is redefining the production paradigm. Brands are leveraging these capabilities to offer customized fit, style, and functional attributes at scale, reducing waste and accelerating time-to-market. Alongside these technological advances, heightened scrutiny of environmental and social governance has compelled industry leaders to invest in recycled synthetic fibers, phase change materials derived from bio-based sources, and manufacturing processes powered by renewable energy. These strategies are not merely marketing talking points but essential levers for long-term viability, as consumers and corporate buyers increasingly evaluate suppliers based on transparent sustainability metrics.

Examining How 2025 Tariff Measures on Imported Textiles Are Redefining Supply Chains, Cost Structures, and Strategic Sourcing Decisions

In 2025, the cumulative impact of newly implemented United States tariffs on imported textiles and functional fabrics has created ripple effects throughout the functional apparel ecosystem. Companies sourcing chemical-resistant and flame-retardant textiles from traditional manufacturing hubs have encountered elevated input costs, prompting many to reevaluate supplier portfolios. This shift has accelerated investment in domestic production capacity, leading to strategic partnerships with regional mills and textile engineering startups that specialize in high-performance materials.

At the same time, end users such as hospitals and construction firms are facing higher procurement prices, which in some cases has driven demand toward mid-tier protective clothing offerings with modular safety features. In response, leading brands have diversified their product lines, blending premium sensor-integrated textiles with more cost-effective synthetic fiber blends to maintain competitive price points. These evolving supply chain dynamics have underscored the importance of vertical integration and transparent supplier audits, as organizations strive to balance regulatory compliance, product performance, and margin preservation in a tariff-influenced market environment.

Integrating Performance, Protection, and Personalization Across a Diverse Array of Functional Apparel Subcategories and Market Pathways

The functional apparel landscape encompasses a wide array of product types, each tailored to specific performance requirements. Within medical apparel, isolation gowns, scrubs, and surgical gowns offer varying degrees of fluid protection and breathability, catering to ambulatory care settings, hospitals, and home care scenarios. Performance wear spans activewear and sportswear, where gym wear and yoga wear demand moisture management and stretch recovery, while cycling, running, and team sports apparel require aerodynamic design, enhanced durability, and reinforced high-stress zones.

Protective clothing segments such as chemical-resistant, cut-resistant, flame-resistant, and high-visibility garments serve industrial and defense end uses, necessitating materials engineered for barrier protection, thermal stability, and visibility compliance. Smart clothing has emerged as a distinct category, integrating sensor-integrated textiles and wearable electronics to monitor vital signs, posture, and environmental exposures across healthcare, military training, and outdoor recreation applications. Meanwhile, workwear for corporate attire, industrial coveralls, and uniforms balances professional aesthetics with durability and functional enhancements.

The distribution ecosystem spans brand outlets, mass retailers, online channels, and specialty stores, each influencing consumer access and brand perception. Material choice plays a pivotal role, with cotton and wool offering natural fiber benefits, synthetic fibers such as nylon, polyester, and spandex delivering performance and cost efficiencies, and smart textiles like phase change materials and sensor-embedded fabrics unlocking next-generation capabilities. Gender-focused product strategies address men’s, women’s, and unisex designs, ensuring functional fit and performance tailoring.

This comprehensive research report categorizes the Functional Apparel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Gender

- End Use

- Distribution Channel

Uncovering Distinct Drivers and Adoption Patterns in the Americas, EMEA, and Asia-Pacific Functional Apparel Ecosystems

Regional dynamics in the functional apparel market reveal distinct growth drivers and adoption patterns across major geographies. In the Americas, strong investment in domestic textile engineering and expanded healthcare infrastructure has underpinned demand for medical gowns, antimicrobial scrubs, and smart sensor-enabled clothing for sports and labor-intensive industries. North American end users value rapid product innovation cycles and transparent supply chains, fueling growth for brands that prioritize traceability and collaborative R&D initiatives.

Across the Europe, Middle East, and Africa region, stringent safety regulations in industrial and defense sectors have driven uptake of chemical-resistant and flame-resistant workwear. The region’s focus on sustainability and circular economy principles has accelerated initiatives to incorporate recycled synthetic fibers and phase change materials into protective garments. Furthermore, specialty outdoor recreation markets in Europe have spurred demand for high-performance cycling and skiing apparel designed for extreme weather resilience.

In Asia-Pacific, the convergence of large-scale manufacturing infrastructure and rising disposable incomes has created a robust market for performance wear and protective clothing. China and India have emerged as both production powerhouses and key consumer markets, with accelerated adoption of smart textiles in healthcare monitoring and athletic training. Regional government investments in defense modernization have further boosted demand for advanced combat and training apparel, elevating local R&D capabilities and cross-border collaborations.

This comprehensive research report examines key regions that drive the evolution of the Functional Apparel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing How Innovative Alliances and Strategic Vertical Integration Are Driving Differentiation in Functional Apparel

Leading companies in the functional apparel domain are forging strategic alliances and investing heavily in proprietary material technologies to differentiate their offerings. Major textile innovators have partnered with electronics specialists to refine sensor integration techniques, ensuring data accuracy and garment durability through rigorous validation processes. At the same time, established apparel brands have expanded R&D centers focused on bio-based phase change materials and next-generation moisture management fibers to address both performance and sustainability mandates.

Several market players have embraced vertical integration, acquiring specialty mills and launching in-house testing laboratories to streamline product development cycles and safeguard quality control. Others have pursued joint ventures with industrial conglomerates to co-develop flame-resistant and chemical barrier fabrics, leveraging cross-industry expertise to meet evolving regulatory requirements. In addition, a growing number of enterprise software providers are collaborating with apparel manufacturers to deploy digital twin and supply chain visibility platforms, enabling real-time inventory management and predictive maintenance of production assets.

Innovation in distribution is also apparent, with select brands piloting direct-to-consumer platforms that offer virtual fit trials and subscription-based replenishment for high-turnover segments like scrubs and industrial uniforms. These approaches not only enhance customer engagement but also generate recurring revenue streams and deepen insights into usage patterns and garment lifecycles.

This comprehensive research report delivers an in-depth overview of the principal market players in the Functional Apparel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 1. Gap Inc.

- 10. Mizuno Corporation

- 11. 361 Degrees International Limited

- 12. Patagonia, Inc.

- 13. Perry Ellis International, Inc.

- 14. Brooks Sports, Inc.

- 15. Salomon Group

- 16. Peak Sport Products Co., Limited

- 17. Gymshark Ltd

- 18. Odlo International AG

- 19. Yonex Co., Ltd.

- 2. Skechers U.S.A., Inc.

- 20. Lotto Sport Italia S.p.A.

- 3. PVH Corp.

- 4. New Balance Athletics, Inc.

- 5. Ralph Lauren Corporation

- 6. Hanesbrands Inc.

- 7. Li Ning Company Limited

- 8. Fila Holdings Corp.

- 9. Xtep International Holdings Limited

- adidas AG

- Anta Sports Products Limited

- ASICS Corporation

- Columbia Sportswear Company

- Decathlon S.A.

- Lululemon Athletica Inc.

- Nike, Inc.

- Puma SE

- Under Armour, Inc.

- VF Corporation

Strategic Imperatives for Enhancing R&D Collaboration, Supply Chain Resilience, and Sustainable Business Models

Industry leaders seeking to capitalize on the functional apparel opportunity must prioritize several key strategic imperatives. First, investing in co-development partnerships with material science experts and wearable technology firms can accelerate time-to-market for sensor-enabled garments and advanced protective fabrics. By establishing collaborative R&D frameworks, companies can unlock specialized expertise in phase change materials, antimicrobial coatings, and embedded electronics.

Second, organizations should explore vertical integration or strategic minority investments in regional textile manufacturers to mitigate tariff-related risks and enhance supply chain resilience. Localized production hubs not only shorten lead times but also facilitate compliance with evolving safety standards and environmental regulations. Third, embracing digital platforms for direct-to-consumer interactions and omnichannel fulfillment can deepen customer loyalty, provide invaluable data on wear patterns, and support predictive warranty and maintenance services.

Finally, embedding circular design principles and rigorous supplier auditing into every stage of the value chain will be critical to meeting stakeholder demands for sustainability and corporate responsibility. By adopting recyclable synthetic fibers, designing for disassembly, and implementing take-back programs, companies can differentiate their brand and reduce environmental footprints while maintaining compliance with emerging global mandates.

Detailed Multi-Modal Research Approach Integrating Stakeholder Interviews, Secondary Analysis, and Methodological Triangulation

The research underpinning this analysis combined primary interviews with key stakeholders, including textile engineers, brand managers, healthcare procurement officers, and defense procurement specialists, to capture firsthand perspectives on performance requirements and innovation priorities. In parallel, an extensive review of patent filings, industry white papers, regulatory frameworks, and sustainability reports provided context for emerging material technologies and compliance trajectories.

Secondary research drew upon reputable industry journals, conference proceedings, and trusted trade association publications to validate market trends and benchmark best practices. Quantitative data on production capacities, geographic export-import balances, and investment flows were triangulated with qualitative insights to ensure robust findings. Throughout the study, data integrity checks and methodological triangulation were applied to reconcile any discrepancies and minimize bias.

The research scope encompassed multiple functional apparel categories, end-use sectors, distribution channels, material substrates, and gender-focused design considerations. Analytical frameworks were tailored to highlight cross-segment synergies, regulatory impacts, and regional variances, enabling organizations to make informed decisions across product development, supply chain optimization, and go-to-market strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Functional Apparel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Functional Apparel Market, by Product Type

- Functional Apparel Market, by Material

- Functional Apparel Market, by Gender

- Functional Apparel Market, by End Use

- Functional Apparel Market, by Distribution Channel

- Functional Apparel Market, by Region

- Functional Apparel Market, by Group

- Functional Apparel Market, by Country

- United States Functional Apparel Market

- China Functional Apparel Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3339 ]

Synthesis of Market Drivers, Regional Nuances, and Sustainability Imperatives Shaping the Future Trajectory of Functional Apparel

The functional apparel sector is poised for continued expansion as technological, regulatory, and sustainability drivers converge to reshape consumer and industrial demands. Organizations that successfully integrate smart textiles with advanced performance fabrics, while managing complex supply chain dynamics and tariff pressures, will unlock new revenue streams and foster enduring customer loyalty. This market is characterized by rapid innovation cycles, requiring agile development processes and strategic collaborations to stay ahead of competitors.

Moreover, the increasing emphasis on environmental responsibility presents both challenges and opportunities. Companies that adopt circular design, invest in recyclable materials, and maintain transparent supply chains will strengthen their brand reputation and align with stakeholder expectations. Regional growth pockets in North America, EMEA, and Asia-Pacific underscore the importance of tailored strategies that account for local regulations, consumer preferences, and manufacturing capabilities.

Ultimately, the successful players will be those that blend technical excellence in material science with customer-centric distribution models, delivering functional apparel solutions that meet the highest standards of safety, comfort, and sustainability. As end users become more discerning and regulations more stringent, the ability to anticipate and adapt to these evolving requirements will determine long-term success.

Secure Essential Functional Apparel Market Insights with Personalized Guidance from Our Associate Director to Propel Strategic Decision-Making

To gain a competitive advantage and harness the latest insights into the functional apparel market, reach out to Ketan Rohom, Associate Director of Sales & Marketing at our firm, who can provide a comprehensive market research report tailored to your strategic needs. This report is designed to guide your organization through the complexities of regulatory changes, emerging technologies, and evolving customer expectations across key product categories, end-use segments, and regional markets.

Engage with Ketan to explore in-depth analyses of how tariffs have reshaped supply chains, identify growth opportunities across healthcare, military, and performance wear sectors, and understand the nuances of distribution channel innovation. Whether you are seeking to refine your product development roadmap, optimize your distribution strategy, or deepen partnerships with material suppliers, this report delivers actionable intelligence and strategic recommendations.

Contact Ketan Rohom today to secure your copy of the market research report and chart a forward-looking path in the dynamic landscape of functional apparel. Empower your decision-making with data-driven insights and position your organization for sustainable growth in the years ahead.

- How big is the Functional Apparel Market?

- What is the Functional Apparel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?