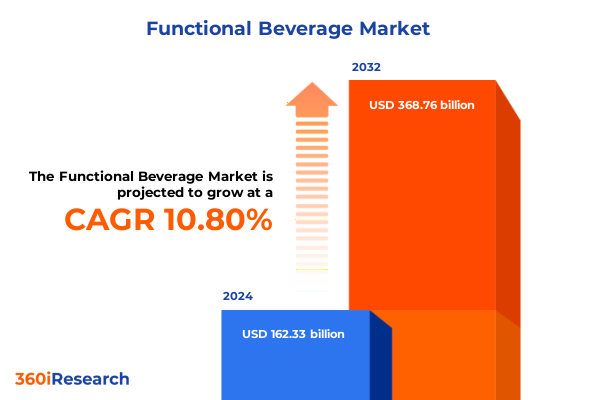

The Functional Beverage Market size was estimated at USD 179.91 billion in 2025 and expected to reach USD 198.12 billion in 2026, at a CAGR of 10.79% to reach USD 368.76 billion by 2032.

Setting the Stage for a Health-First Beverage Revolution by Exploring How Functional Drinks Are Redefining Consumer Wellness and Convenience Trends

As consumer preferences rapidly pivot toward wellness, convenience, and scientifically backed nutritional claims, functional beverages have emerged as a frontier for innovation across the global beverage landscape. Modern consumers view drinks not simply as thirst quenchers but as purposeful solutions that deliver hydration, energy, digestive support, and cognitive benefits in formats that suit busy, on-the-go lifestyles. Fueled by a growing desire for transparent ingredient lists, clean labels, and targeted health outcomes, beverage manufacturers are reimagining classic categories-from waters and teas to sodas and coffees-through a functional lens.

Against this backdrop of evolving demand, industry participants are challenged to blend brand heritage with cutting-edge science, crafting products that resonate with diverse audiences seeking energy boosts, gut-health support, or recovery solutions. Meanwhile, retail innovators and e-commerce platforms are reshaping distribution channels, creating new touchpoints for discovery and direct-to-consumer engagement. This introductory overview lays the foundation for exploring how functional beverages are redefining the interplay between nutrition, technology, and consumer experience in the years ahead.

Charting Transformative Shifts in Beverage Innovation by Harnessing Advanced Functional Ingredients and Digital Manufacturing Excellence

The functional beverage category is undergoing a profound transformation as brands pivot toward ingredients that transcend mere hydration. Performance-enhancing components such as amino acids, creatine, and specialized electrolyte blends have evolved into table stakes, while adaptogenic botanicals and nootropics are now mainstream in products designed to mitigate stress and sharpen focus. Consumer appetite for gut-targeted solutions has driven prebiotic and probiotic formulations into beverages ranging from sodas to flavored waters, reflecting the industry’s commitment to addressing digestive wellness beyond traditional yogurt and supplement formats. These shifts are emblematic of an innovation cycle where beverage developers harness both ancient herbal wisdom and modern clinical research to forge novel formulations.

Simultaneously, technological enablers are reshaping product development and production efficiencies. Artificial intelligence and advanced data analytics support real-time quality control, demand forecasting, and agile ingredient selection, while the Industrial Internet of Things (IIoT) drives smart manufacturing ecosystems that optimize energy use and streamline traceability. Digital tools such as virtual reality are being deployed for workforce training, accelerating the uptake of aseptic packaging and precision dosing systems that ensure both shelf-life stability and ingredient integrity. This confluence of ingredient innovation and tech-driven operational excellence is setting a new benchmark for functional beverage quality and consistency.

Assessing the 2025 U.S. Tariff Wave’s Cumulative Impact on the Functional Beverage Supply Chain, Packaging Mix and Cost Structures

In 2025, the U.S. administration’s decision to raise steel and aluminum tariffs to as high as 50 percent has reverberated through the functional beverage industry, particularly in aluminum can and glass container supply chains. Major can producers have pointed to their reliance on domestically sourced recycled aluminum as a buffer, yet beverage companies that depend on imported primary aluminum for cans and keg components face elevated input costs. These higher raw-material prices could alter packaging mixes, prompting some firms to shift toward PET bottles or cartons when aluminum expenses rise substantially.

Despite these headwinds, domestic recycling initiatives are mitigating some of the cost impact. Over 70 percent of the aluminum used in U.S. beverage cans originates from recycled content, insulating manufacturers from the worst tariff effects. Industry stakeholders are also leveraging multi-source procurement strategies, combining domestic recycled feedstock with select primary imports to manage overall cost structures and supply security. Even major brewers and energy drink producers, including global leaders with expansive U.S. operations, have reported only modest increases in container costs for 2025, with more pronounced tariff effects anticipated in subsequent years unless policy adjustments occur.

At the consumer level, economists project that the amplified costs associated with aluminum tariffs will translate into marginal price increases-on the order of a few cents per six-pack of canned beverages. Beverage giant executives emphasize their capacity to absorb small input cost changes within existing profit margins, but acknowledge that sustained tariff pressures could eventually necessitate adjustments in retail pricing strategies. Concurrent research underscores that producers have shouldered over two billion dollars in tariff‐related fees over the past half‐decade, reinforcing the need for dynamic sourcing and packaging resilience to safeguard product affordability and competitive positioning.

Unveiling Key Consumer and Product Segments Shaping Functional Beverage Demand Across Types, Ingredients, Packaging, Channels, and Demographics

A nuanced analysis of functional beverage segmentation reveals that product type variations-from carbonated energy drinks to niche categories like plant-based waters and probiotic sodas-are each carving out unique value propositions. Energy drinks have bifurcated into high-caffeine carbonated formulations and milder non-carbonated options, while enhanced waters span from alkaline to toxin-detox variants, reflecting consumer appetites for both functional benefits and pure hydration. Nutritional beverages, including meal-replacement shakes and medical nutrition solutions, emphasize macronutrient balance and targeted health outcomes, whereas ready-to-drink teas and coffees leverage familiar flavor profiles enriched with vitamins and antioxidants.

Equally, ingredient-based segmentation underscores the strategic importance of components such as amino acids-particularly BCAAs and L-glutamine-for recovery, along with antioxidants from green tea extract and resveratrol for cellular support. Hydration-focused products continue to feature sodium, magnesium, and potassium blends, while vitamin-fortified beverages harness B-complex, vitamin C, and vitamin D to address immune and metabolic demands. Probiotic drinks, especially non-dairy formulations, have gained traction among gut-health enthusiasts seeking dairy-free options.

Packaging formats range across bottles, cans, cartons, pouches, and sachets, each chosen for mobility, preservation needs, or brand differentiation. Moreover, distribution channels split between traditional brick-and-mortar outlets and digital platforms, with e-commerce sites and direct-to-consumer models powering niche launches and smaller brands’ rapid scale-up efforts. Finally, end-user segmentation spans adults, athletes, children, and seniors, guiding formulation decisions that balance taste preferences with functional mandates-whether delivering cognitive focus, post-exercise recovery, or nutritional support for aging populations.

This comprehensive research report categorizes the Functional Beverage market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient

- Packaging Type

- Distribution Channel

- End User

Comparative Regional Dynamics Driving Functional Beverage Adoption: Insights for Growth in the Americas, EMEA, and Asia-Pacific Markets

In the Americas, North American consumers are driving functional beverage innovation through a dual focus on performance and wellness. U.S. trends reveal heightened interest in customized cold drinks-from electrolyte-enhanced “loaded waters” to stress-relief tonics-often propelled by Gen Z’s demand for personalization and social media shareability of vibrant flavors and novel ingredients. Fast-food chains and coffeehouses are responding with limited-edition menu items, while major food and beverage conglomerates are launching prebiotic sodas and zero-sugar options under legacy brands to capture health-minded cohorts.

Across Europe, the Middle East, and Africa, regional diversity informs product portfolios and positioning. Western European markets show robust uptake of probiotic and vitamin-fortified drinks, supported by stringent clean-label and flavor innovation standards. In the Middle East and North Africa, non-alcoholic beer variants and fortified juices resonate in culturally tailored marketing initiatives, as local producers partner with global players to adapt formulations to regional tastes. Meanwhile, sustainability imperatives are driving a pivot toward plant-based and lactose-free offerings, aligning with broader consumer awareness around natural ingredients and eco-friendly packaging.

Asia-Pacific stands as the fastest-growing region for functional beverages, propelled by rising disposable incomes, urbanization, and health-centric lifestyles. Markets in China, India, Japan, and South Korea have welcomed energy drinks with reduced sugar content, plant-based dairy alternatives, and hydration-plus waters enriched with vitamins. Inflationary pressures have spurred value-added formulations that justify premium pricing, while digital commerce channels accelerate product discovery among tech-savvy millennials and Gen Z consumers.

This comprehensive research report examines key regions that drive the evolution of the Functional Beverage market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Inside the Competitive Arena of Functional Beverages by Profiling Strategic Moves, Acquisitions, and Innovations from Industry Leaders

Leading multinationals are reinforcing their stakes in functional beverages through strategic acquisitions and product innovations. Keurig Dr. Pepper’s U.S. refreshment segment delivered a double-digit lift in beverage volume thanks to its 2024 majority acquisition of Ghost Energy, which has fueled its portfolio of carbonated and non-carbonated energy variants. PepsiCo, intent on expanding its better-for-you offerings, closed on its $1.65 billion acquisition of the prebiotic soda brand poppi in March 2025, and is set to launch Pepsi Prebiotic Cola in both Original and Cherry Vanilla under legacy branding in late 2025. The Coca-Cola Company, responding to probiotic and antioxidant trends, introduced Simply Pop-its first prebiotic soda-while evaluating a shift in packaging mix to favor PET bottles amid tariff-induced aluminum price volatility.

In the energy drink arena, Monster Beverage has expanded its non-carbonated Rehab line with a Green Tea variant combining caffeine with electrolytes and B-vitamin blends to meet active consumer demands for hydration plus recovery. Red Bull North America entered 2025 with the U.S. rollout of Red Bull Zero-a monk fruit-sweetened, zero-sugar energy drink-that differentiates itself from existing sugar-free offerings and reinforces the brand’s innovation pipeline. Meanwhile, Nestlé, while pursuing a strategic review of its vitamins and supplements division, continues to manage indirect tariff impacts on its water and coffee capsule businesses and uphold its organic sales growth targets through agile pricing and localized manufacturing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Functional Beverage market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Celsius Holdings, Inc.

- Danone S.A.

- Glanbia plc

- GT’s Living Foods LLC

- Hint, Inc.

- Keurig Dr Pepper Inc.

- Lifeway Foods, Inc.

- Monster Beverage Corporation

- Nestlé S.A.

- Olipop, Inc.

- PepsiCo, Inc.

- POM Wonderful LLC

- Red Bull GmbH

- ROAR Beverages LLC

- Suja Life, LLC

- Suntory Holdings Limited

- The Coca-Cola Company

- The Vita Coco Company, Inc.

- Unilever PLC

Actionable Strategies for Industry Leaders to Thrive in the Functional Beverage Ecosystem Amid Shifting Consumer Expectations and Regulatory Changes

To capitalize on evolving consumer needs, industry leaders should prioritize agile product development that leverages emerging functional ingredients such as adaptogens, prebiotics, and recovery-enhancing amino acids. Formulation teams must maintain rigorous transparency-clearly communicating active ingredients and clinical backing-to build trust among health-conscious buyers. Concurrently, investing in flexible packaging solutions that allow rapid shifts between aluminum cans, PET bottles, and sustainable carton formats will mitigate raw-material cost volatility and tariff exposures.

Digital engagement strategies remain critical: brands should harness social media channels and direct-to-consumer platforms to cultivate niche communities, gather real-time feedback, and test new flavor and format concepts before full-scale launches. From a supply chain perspective, diversifying ingredient sourcing and fortifying relationships with domestic recycled materials providers could shield against geopolitical and tariff-related disruptions. Finally, sustainability frameworks-encompassing eco-friendly packaging, recycled content targets, and carbon footprint disclosures-should be integrated into every facet of operations to align with regulatory mandates and rising consumer environmental expectations.

Robust Multimethod Research Framework by Integrating Expert Interviews, Secondary Data Analysis, and Quantitative Modeling for Functional Beverage Intelligence

This research draws upon a rigorous multimethod approach combining primary and secondary data sources. Primary inputs included in-depth interviews with C-suite executives, R&D leaders, and channel partners across North America, EMEA, and Asia-Pacific. Secondary research encompassed analysis of industry press releases, earnings calls, government trade publications, and reputable news outlets to capture dynamic shifts in consumer behavior, policy, and competitive activity. Data triangulation techniques were employed to reconcile disparate estimates and validate emerging trends, while case reviews of strategic acquisitions and new product launches provided illustrative examples of successful market maneuvers.

Quantitative analyses leveraged trade and customs data for tariff impact modeling, alongside recycled material usage statistics from trade associations. Qualitative insights were enriched by expert panel workshops that evaluated ingredient efficacy, technology adoption, and regulatory scenarios. The methodology’s robustness ensures a comprehensive, fact-based understanding of the functional beverage landscape, empowering stakeholders to make informed decisions under evolving market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Functional Beverage market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Functional Beverage Market, by Product Type

- Functional Beverage Market, by Ingredient

- Functional Beverage Market, by Packaging Type

- Functional Beverage Market, by Distribution Channel

- Functional Beverage Market, by End User

- Functional Beverage Market, by Region

- Functional Beverage Market, by Group

- Functional Beverage Market, by Country

- United States Functional Beverage Market

- China Functional Beverage Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Concluding Insights on Seizing Opportunities in the Functional Beverage Sector Through Innovation, Partnership and Consumer-Centric Approaches

The functional beverage sector stands at an inflection point where consumer demand for health-driven experiences converges with transformative ingredient science and reshaped supply chains. Brands that embrace transparency, agility, and technological integration are poised to capture new consumer segments while reinforcing loyalty among existing audiences. By balancing innovation in formulations with resilient sourcing strategies, companies can navigate tariff pressures and packaging cost fluctuations, ensuring that functional benefits remain accessible and compelling.

As regional dynamics continue to diversify growth trajectories, market participants must align product development and go-to-market strategies with specific consumer sensibilities in the Americas, EMEA, and Asia-Pacific. Ultimately, success will hinge on a harmonious blend of consumer empathy, operational flexibility, and evidence-based innovation, driving the next wave of growth in this vibrant sector.

Unlock Comprehensive Functional Beverage Market Insights—Connect with Ketan Rohom to Secure the Full Research Report and Empower Your Strategic Decisions

To delve deeper into the trends, drivers, and strategic insights covered in this executive summary and to empower your organization with actionable market intelligence, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His guidance will help you secure the comprehensive functional beverage research report and tailor findings to your business objectives. Engage with Ketan to discuss custom data requests, licensing options, and exclusive advisory support that will enable you to navigate this dynamic market with confidence and foresight.

- How big is the Functional Beverage Market?

- What is the Functional Beverage Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?