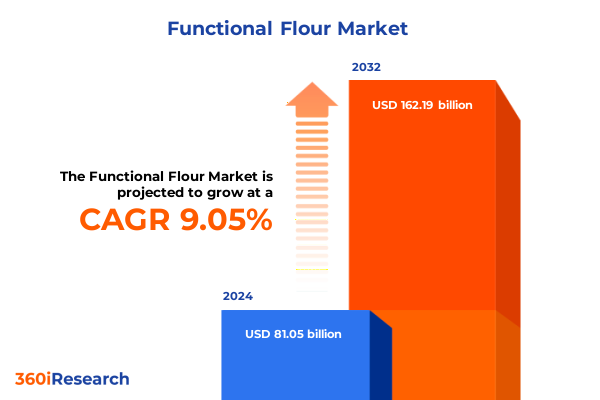

The Functional Flour Market size was estimated at USD 88.27 billion in 2025 and expected to reach USD 96.13 billion in 2026, at a CAGR of 9.07% to reach USD 162.19 billion by 2032.

Unveiling the Unprecedented Rise of Functional Flours Driven by Nutrition-Conscious Consumers and Technological Innovations

Functional flours have emerged as a transformative ingredient category, blending traditional grain-based components with novel nutritional properties to cater to health-conscious consumers. This evolution has been propelled by growing awareness of functional ingredients that support digestive health, sustained energy, and clean-label transparency. As consumers increasingly seek out food products that offer tangible wellness benefits while satisfying taste and texture expectations, ingredient manufacturers and food enterprises are accelerating innovation across the functional flour landscape.

This introduction outlines how shifting consumer preferences and advancements in processing technologies have converged to redefine the role of flour in modern product development. Where conventional wheat and rice flours once dominated the market purely on cost and versatility, a broader palette of sources-including cassava, pulses, and specialized wheat varieties-now provides opportunities for enhanced nutritional profiles and novel applications. The rapid integration of these new ingredients into bakery, beverage, and specialty formulations underscores a fundamental change in industry priorities.

Against this backdrop, the subsequent analysis delves into the transformative shifts shaping product innovation, examines the cumulative impact of U.S. trade policies, uncovers key segmentation and regional dynamics, and highlights leading companies driving growth. By weaving together these insights, this executive summary equips decision-makers with a comprehensive understanding of the functional flour market’s current state and its trajectory.

Exploring the Paradigm-Altering Shifts Redefining Functional Flour Production and Consumption in a Rapidly Evolving Global Food Ecosystem

The functional flour sector is undergoing a paradigm shift fueled by advancements in biotechnology, sustainability imperatives, and evolving consumption patterns. Ingredient developers are harnessing enzyme-assisted processing and extrusion technologies to unlock bioactive compounds, enhance protein bioavailability, and create flours with tailored fiber profiles. These innovations are not only reshaping textural and sensory attributes, but also enabling precise nutritional claims that resonate with discerning consumers.

Simultaneously, sustainability considerations are driving the exploration of unconventional raw materials. Pulses, previously valued mainly for traditional cuisine, are now recognized for their protein content and low environmental footprint, while cassava is gaining attention as a gluten-free alternative sourced from tropical regions. At the same time, novel functional blends combining multiple grain types are redefining flavor and performance benchmarks in bakery, pasta, and snack applications.

Another key shift is digital traceability, whereby blockchain and IoT-enabled supply chain solutions provide end-to-end transparency. This capability addresses consumer demand for provenance and supports regulatory compliance in complex international trade environments. As ingredient and food manufacturers integrate these technologies, the sector is transitioning from a commodity-driven model to one defined by differentiated value propositions, demonstrating a move toward a more resilient, transparent, and innovation-led functional flour marketplace.

Analyzing the Far-Reaching Consequences of United States Tariff Adjustments on Functional Flour Trade Dynamics Throughout 2025

Throughout 2025, United States tariff adjustments have exerted a profound influence on functional flour supply chains and sourcing strategies. Policy measures targeting selected imported wheat and pulse derivatives have raised landed costs, prompting manufacturers to reassess existing supplier relationships. As duties increased, several food processors pivoted toward domestic producers of hard and soft wheat varieties, while others diversified into cassava and corn-based flours to hedge against price volatility and maintain uninterrupted production.

These trade dynamics have also triggered a broader reconfiguration of procurement models. Companies are leveraging forward purchase agreements and exploring alternative export markets to mitigate exposure to U.S. duties. Meanwhile, global suppliers that previously concentrated on U.S. distribution are intensifying efforts in regions less affected by trade barriers, reshaping competitive landscapes and regional trade flows. In parallel, ingredient innovators are investing in process efficiencies to absorb cost pressures without compromising on functional performance or clean-label positioning.

Overall, the cumulative impact of U.S. tariffs in 2025 has underscored the importance of adaptable supply strategies. By balancing domestic sourcing with selective international partnerships and prioritizing versatile ingredient portfolios, market participants are navigating a more complex trade environment while sustaining innovation and product differentiation.

Unearthing Crucial Segmentation Insights Revealing How Product Type, Application, End User, and Distribution Channel Shape the Functional Flour Market

A nuanced analysis of market segmentation reveals distinctive growth patterns across ingredient types, application categories, end-user groups, and distribution channels. Derived from cassava, corn, pulses, rice subcategorized into brown and white, and wheat divided into hard and soft varieties, product types demonstrate diverse functional attributes. Pulse-based flours have surged in protein-focused formulations, while rice flours continue to meet gluten-free demands in both brown and white forms. Hard wheat flours remain favored for high-volume bakery operations, whereas soft wheat imparts delicate texture enhancements in specialty pastries.

Application-driven insights indicate that bakery-from artisan bread and cakes to cookies, biscuits, muffins, and rusk-remains the largest segment, yet beverages such as functional drinks and smoothies are experiencing rapid upticks as consumers seek nutrient-dense refreshment. Confectionery innovations, spanning candies, gums, chocolates, toffees, and caramels, showcase how functional flour blends can elevate indulgence with added fiber or protein. Meat analog developers are experimenting with insect protein and plant-based meat alternatives to create textured, protein-rich formats. Meanwhile, pasta manufacturers blend dried and fresh variants with functional flours for improved nutrition, and snack producers are formulating baked, extruded, and popped products that meet clean-label criteria.

End-user analysis highlights industrial processing hubs as primary volume drivers, yet institutional channels-including hospitals, schools, and workplace canteens-are adopting functional formulations to support health and wellness initiatives. Retail demand is growing for consumer-ready packages that communicate clear benefits. Distribution channel trends show direct sales relationships with manufacturers continuing to deepen, while food service outlets, both full-service and quick-service, integrate functional flours into menu innovations. Online platforms, spanning direct-to-consumer and e-commerce channels, are accelerating growth, complemented by specialty stores and supermarket hypermarkets catering to discerning shoppers.

This comprehensive research report categorizes the Functional Flour market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- End User

- Distribution Channel

Deciphering Regional Nuances in the Functional Flour Market with Focus on Americas, Europe Middle East Africa, and Asia-Pacific Growth Drivers

Regional dynamics play a pivotal role in shaping the functional flour landscape. In the Americas, health and wellness trends converge with robust agricultural capabilities to create a market environment defined by clean-label transparency and innovation. North American consumers are increasingly demanding functional breads and snacks with clear nutritional claims, prompting manufacturers to collaborate with local grain producers to ensure traceability and compliance with stringent quality standards.

Europe, Middle East & Africa present a complex regulatory tapestry that both challenges and stimulates ingredient innovation. European markets emphasize nutrient profiling and labeling requirements, pushing suppliers to develop flours enriched with specific bioactives and fibers that satisfy rigorous health claims. Meanwhile, Middle Eastern and African regions are experiencing rising demand for shelf-stable, nutrient-dense ingredients to address food security concerns, thereby elevating the strategic importance of rice, cassava, and pulse-based functional flours.

Asia-Pacific continues to lead in the application of traditional staples reimagined with enhanced functionality. Markets such as Japan and Australia are early adopters of functional beverages and baked goods, while large-scale processors in India and China integrate protein-enriched cereal blends into established product lines. Across the region, rapid urbanization and expanding retail networks drive consumption, supporting a competitive landscape where innovation and local adaptation are key to success.

This comprehensive research report examines key regions that drive the evolution of the Functional Flour market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Firms Driving Innovation Strategic Partnerships and Competitive Differentiation in the Global Functional Flour Sector

Leading companies in the functional flour sector are distinguished by their commitment to research and development, strategic collaborations, and sustainability initiatives. Multinational ingredient suppliers are investing heavily in pilot plants and innovation centers to test novel processing techniques that boost protein content, reduce antinutritional factors, and engineer tailored fiber matrices. These efforts are often conducted in partnership with academic institutions and biotechnology firms to accelerate commercialization and intellectual property development.

At the same time, specialized startups are emerging with proprietary blends that combine multiple grain sources for targeted health benefits. By leveraging agile production models and direct-to-manufacturer relationships, these agile entrants are securing pilot contracts with major food brands. Regional processors are also forging alliances with large-scale distributors and foodservice operators to scale up production of functional flours designed for specific end markets, such as institutional kitchens and artisanal bakeries.

Furthermore, several companies have announced acquisitions and joint ventures aimed at expanding geographical reach and diversifying portfolios. Emphasis on sustainable sourcing has led to partnerships with farming cooperatives, ensuring responsible cultivation practices and supply chain transparency. Through these multifaceted strategies, market leaders are strengthening their competitive edge and shaping the trajectory of the functional flour industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Functional Flour market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agrana Beteiligungs-AG

- Archer Daniels Midland Company

- Bay State Milling Company

- Bunge Limited

- Cargill, Incorporated

- Conagra Brands, Inc.

- Foodchem International Corporation

- Gemef Industries SA

- General Mills, Inc.

- Grain Millers, Inc. by Richardson International

- Great River Organic Milling by Columbia Grain International

- Gruma, S.A.B. de C.V.

- Harinas Polo

- Hodgson Mill

- Ingredion Incorporated

- ITC Limited

- King Arthur Baking Company.

- LifeLine Foods, LLC

- Mennel Milling Company

- PHM Brands, LLC

- Siemer Milling Company

- Stern-Wywiol Gruppe GmbH & Co. KG

- SunOpta Inc.

- The Hain Celestial Group, Inc.

- The Scoular Company

- Wilmar Group

Formulating Actionable Strategies for Industry Leaders to Harness Emerging Opportunities and Navigate Challenges in the Functional Flour Arena

To thrive in this dynamic landscape, industry leaders should adopt proactive strategies that capitalize on emerging opportunities while mitigating risks. Prioritizing investment in advanced milling and enzymatic processes will enable the creation of functionally superior products that command premium positioning. Equally important is the diversification of raw material sourcing to include both domestic producers and alternative global suppliers, which can safeguard against trade-induced disruptions.

Strengthening collaborations with research institutions and technology partners can accelerate the development of next-generation functional flour blends and foster the emergence of proprietary solutions. At the same time, embracing digital traceability across supply chains will enhance consumer trust and simplify compliance with evolving regulatory frameworks. Marketing efforts should emphasize clear, evidence-backed health claims and clean-label transparency to resonate with a wide spectrum of consumers, from wellness enthusiasts to institutional purchasing managers.

Finally, an agile distribution strategy that balances direct sales relationships, partnerships with foodservice outlets, and robust online presence will help capture diverse end-user segments. By integrating these actionable recommendations into strategic planning, companies can position themselves at the forefront of innovation, resilience, and sustainable growth in the functional flour arena.

Illuminating Robust Research Methodology Underpinning Comprehensive Analysis of Functional Flour Market Trends Segmentation and Regional Insights

This study employs a rigorous research methodology designed to deliver a holistic understanding of the functional flour market. Primary research comprised in-depth interviews with key stakeholders, including ingredient manufacturers, food processors, distributors, and regulatory experts. These qualitative insights were complemented by secondary sources such as industry publications, peer-reviewed journals, and trade association reports.

Data triangulation was applied to validate findings, ensuring consistency across diverse information streams. Segment mapping leveraged detailed criteria for product type, application, end user, and distribution channel, enabling granular analysis of market drivers and constraints. The regional assessment incorporated both macroeconomic indicators and local consumption patterns to highlight nuanced growth opportunities and regulatory influences.

Furthermore, the methodology integrated supply chain evaluation, examining raw material availability, logistics considerations, and trade policy impacts. Expert panels reviewed preliminary conclusions, providing constructive feedback to refine analysis and recommendations. This comprehensive approach ensures that the conclusions presented are robust, actionable, and grounded in the latest industry intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Functional Flour market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Functional Flour Market, by Type

- Functional Flour Market, by Application

- Functional Flour Market, by End User

- Functional Flour Market, by Distribution Channel

- Functional Flour Market, by Region

- Functional Flour Market, by Group

- Functional Flour Market, by Country

- United States Functional Flour Market

- China Functional Flour Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Drawing Comprehensive Conclusions on the Evolution of Functional Flour Landscape and Future Growth Pathways for Industry Stakeholders

The evolution of functional flours reflects a broader transformation in the food industry-one where health, sustainability, and technological prowess converge to redefine ingredient paradigms. From the expanding array of grain and pulse sources to the integration of digital traceability, this market is characterized by rapid innovation and strategic adaptation. Trade policies and regional nuances further shape competitive dynamics, underscoring the need for agility in sourcing and product development.

Segmentation insights reveal that while traditional bakery applications maintain significant volume, high-growth potential lies in beverage formulations, meat analogs, and snack innovations that leverage functional attributes. Regional analyses highlight diverse regulatory landscapes and consumer preferences, with each geography presenting unique opportunities and challenges. Leading companies are differentiating through partnerships, proprietary technologies, and sustainability commitments, setting new benchmarks for performance and trust.

As the functional flour sector continues to mature, stakeholders must embrace a multifaceted approach-combining advanced processing, market-specific product design, and resilient supply strategies-to capture value in a competitive environment. This synthesis of insights provides a clear pathway for industry participants to navigate complexity and drive sustainable growth.

Engaging Decision-Makers with a Direct Invitation to Connect with Ketan Rohom for Exclusive Access to the Comprehensive Functional Flour Market Report

To gain a competitive edge and unlock the full potential of functional flour innovations, we invite leaders and decision-makers to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in market dynamics and customer needs can help tailor insights from the report to your strategic priorities. Reach out to initiate a customized briefing that highlights the most relevant findings, actionable recommendations, and partnership opportunities to drive growth and differentiation. Let Ketan guide your team toward smarter sourcing strategies, optimized product portfolios, and enhanced market positioning through an exclusive consultation tailored to your organization’s goals. Connect today to secure priority access to this comprehensive analysis and position your business at the forefront of the functional flour revolution.

- How big is the Functional Flour Market?

- What is the Functional Flour Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?