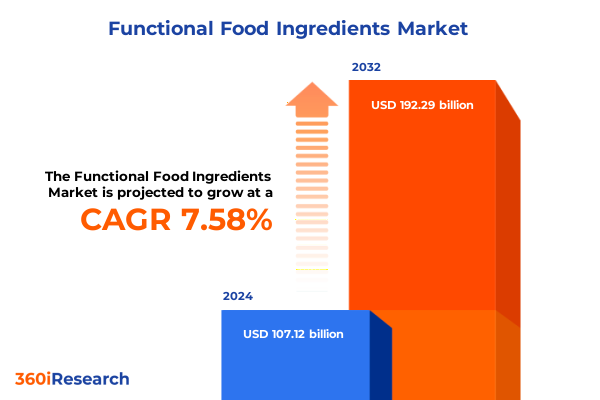

The Functional Food Ingredients Market size was estimated at USD 114.73 billion in 2025 and expected to reach USD 123.04 billion in 2026, at a CAGR of 7.65% to reach USD 192.29 billion by 2032.

Unveiling the Strategic Foundations and Market Dynamics Driving Rapid Evolution in Functional Food Ingredients for Modern Health-Focused Consumers

The landscape of functional food ingredients is evolving at an unprecedented pace, driven by growing consumer demands for health-optimizing foods that deliver tangible nutritional benefits. As lifestyle diseases and wellness aspirations gain prominence, manufacturers are compelled to innovate beyond traditional fortification, harnessing ingredients that support gut health, cognitive performance, immune resilience, and metabolic balance. This dynamic convergence of nutrition and science underscores the critical role that functional ingredients play in shaping both product development pipelines and consumer purchase decisions.

Amidst this transformative climate, stakeholders are navigating a complex matrix of regulatory frameworks, technological breakthroughs, and shifting retail paradigms. The strategic integration of novel proteins, bioactive fibers, targeted micronutrients, and probiotic strains is no longer a speculative endeavor but a core competency for market leadership. By understanding the forces that underpin this rapid evolution, industry participants can anticipate consumer needs, optimize supply chain efficiencies, and cultivate differentiated value propositions. Ultimately, the introduction of functional food ingredients represents not just a category expansion but a fundamental redefinition of how foods can contribute to holistic well-being.

Examining the Pivotal Technological Advancements and Regulatory Reforms Reshaping Functional Food Ingredients and Consumer Expectations Across Markets

Over the past few years, the functional food ingredients sector has witnessed a series of transformative shifts that have recalibrated market expectations and operational imperatives. Precision fermentation, for example, has emerged as a disruptive force, enabling the scalable production of high-purity proteins and bioactives without reliance on traditional agricultural inputs. Parallel advances in microencapsulation and nanotechnology have enhanced ingredient stability and bioavailability, unlocking new formulation possibilities for beverages, dairy analogues, and snack bars.

Regulatory ecosystems have also evolved in tandem, with agencies embracing frameworks that facilitate the approval of novel ingredients while ensuring consumer safety. Health claim substantiation requirements have become more rigorous, prompting companies to invest in clinical studies and biomarker analyses. Simultaneously, the rise of personalized nutrition platforms-powered by digital health apps and genetic profiling-has empowered consumers to demand hyper-targeted solutions. Consequently, manufacturers are forging collaborations with biotech firms and academic institutions to co-create next-generation ingredients that cater to individualized health goals.

Analyzing the Cumulative Effects of 2025 United States Tariffs on Supply Chains Innovation Investment and Competitive Positioning in Functional Food Ingredients

The introduction of new United States tariffs in 2025 has exerted a cumulative impact across supply chains, compelling ingredient producers to reassess procurement strategies and cost structures. Raw materials such as omega-3 fatty acids derived from marine sources and certain specialty proteins have experienced increased landed costs, driving businesses to explore alternative sourcing regions and to accelerate investments in domestic production capabilities.

In response, many organizations have embarked on strategic partnerships and joint ventures to secure raw material streams within tariff-exempt jurisdictions. These moves, combined with the adoption of advanced yield-enhancing cultivation techniques, have mitigated some of the cost pressures, while simultaneously fostering innovation in raw material differentiation. The tariff-induced cost escalations have also spurred the development of cost-efficient, high-yield microbial fermentation processes for compounds previously dependent on imported sources. Looking ahead, the necessity of supply chain resilience is reshaping decision-making priorities, as companies balance the trade-off between near-term cost fluctuations and long-term investment in local capacity to ensure stable ingredient availability.

Uncovering Segmentation Insights Across Product Origins Formats End Users Applications and Channels to Illuminate Functional Food Ingredients Market Diversity

Segmentation analysis reveals that the functional food ingredients landscape is defined by a spectrum of product types, each catering to distinct nutritional and formulation objectives. Among these, amino acids and proteins underpin sports nutrition and muscle health formulations, while antioxidants contribute to cellular protection and anti-aging applications. Dietary fiber manifests in both insoluble and soluble forms, offering digestive support and modulating glycemic response. Omega-3 fatty acids continue to attract interest for their cardiovascular and cognitive benefits. Meanwhile, prebiotic compounds such as fructooligosaccharides, galactooligosaccharides, inulin, and resistant starch serve as substrate for beneficial gut microbiota, and probiotic strains ranging from Bifidobacterium to Saccharomyces Boulardii promote microbial balance. Vitamins and minerals round out the portfolio, ensuring foundational micronutrient adequacy in fortified foods and beverages.

Beyond product typology, source differentiation plays a crucial role in market positioning. Animal-based origins span dairy derivatives, marine-extracted lipids, and meat hydrolysates, whereas microbial systems leverage both bacterial and yeast platforms for controlled biosynthesis of amino acids and organic acids. Plant-based sources, encompassing fruits, grains, and vegetables, have gained momentum for their clean-label appeal. The physical form of delivery-capsule, tablet, liquid, or powder-dictates application flexibility for both direct-to-consumer supplements and functional food formulations. Consumer segments bifurcate into adults, from young consumers seeking preventive wellness to middle-aged and older cohorts focused on health maintenance, as well as children, including infants, toddlers, and school-age individuals for whom dosage and safety parameters are critical. Application sectors extend from enriched baked goods, beverages, confectionery, and dairy products to nutraceutical formulations. Distribution channels span traditional brick-and-mortar outlets and burgeoning e-commerce platforms, enabling omnichannel reach and consumer engagement.

This comprehensive research report categorizes the Functional Food Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Form

- End User

- Application

- Distribution Channel

Illuminating Regional Variations in Consumer Preferences Regulatory Environments and Innovation Pathways Across Americas EMEA and Asia-Pacific Markets

Regional dynamics in the functional food ingredients market are shaped by diverse regulatory, consumer, and innovation ecosystems. In the Americas, regulatory clarity from agencies such as the Food and Drug Administration has facilitated expedited approvals of novel ingredients under Generally Recognized As Safe determinations, while consumer enthusiasm for digestive health and immune support has driven rapid retail uptake. North American manufacturers are increasingly focused on sports nutrition and gut-focused formulations, leveraging robust R&D collaborations with academic centers.

In Europe, Middle East, and Africa, the European Union’s Novel Foods regulation and the rise of eco-labeling initiatives have elevated standards for ingredient traceability and environmental sustainability. Consumers in Western Europe show strong affinity toward clean-label, plant-based extracts, while markets in the Gulf Cooperation Council countries are witnessing a surge in fortified dairy and beverage applications. Africa’s emerging markets are less saturated, offering a frontier for localized functional ingredient solutions.

Asia-Pacific remains a powerhouse of both traditional wisdom and modern innovation. Government incentives in China, India, and Southeast Asia have spurred investments in bioconversion technologies and specialty crop cultivation. Traditional dietary practices continue to inform consumer preferences, with botanical extracts and fermented ingredients maintaining high cultural resonance. This confluence of heritage and high-throughput manufacturing is positioning Asia-Pacific as a leading source of cost-competitive, novel functional ingredients.

This comprehensive research report examines key regions that drive the evolution of the Functional Food Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping Product Development Partnerships and Market Positioning in Functional Food Ingredients Industry

Leading players in the functional food ingredients arena are redefining value creation through strategic collaborations, targeted acquisitions, and diversified innovation pipelines. Global ingredient houses have expanded capabilities in precision fermentation and enzymatic synthesis, establishing joint ventures to secure proprietary strains and downstream processing expertise. Companies with established sensory science proficiencies are integrating flavor modulation technologies to enhance consumer acceptance of bioactive-rich formulations.

In parallel, niche innovators are emerging with specialized portfolios of clean-label extracts and fermented compounds that cater to highly targeted health claims. These agile entrants are partnering with contract manufacturers and co-packers to rapidly scale production while maintaining stringent quality and traceability standards. Major acquisitions have focused on bolt-on acquisitions of specialty startups, facilitating rapid incorporation of novel ingredient technologies and reinforcing pipelines with validated clinical data. As competitive intensity intensifies, forward-looking companies are investing in digital platforms for consumer feedback, enabling iterative product refinement and faster time to market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Functional Food Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aarkay Food Products Ltd.

- Actylis

- Ajinomoto Co., Inc.

- Akay Natural Ingredients Private Limited

- Amway Corporation

- Archer Daniels Midland Company

- Arla Foods Group

- Asahi Group Foods, Ltd.

- Associated British Foods PLC

- BASF SE

- Beneo GmbH

- Carbery Food Ingredients Limited

- Cargill, Incorporated

- Chr. Hansen Holding A/S by Novonesis Group

- Corbion N.V.

- DSM-Firmenich AG

- Evonik Industries AG

- Ginkgo Bioworks Holdings, Inc.

- Glanbia PLC

- ICL Group Ltd.

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Kao Corporation

- Kemin Industries, Inc.

- Kerry Group PLC

- Lacto Japan Co., Ltd.

- Maypro Group

- Nestlé S.A.

- Nuritas Ltd.

- Paleo B.V.

- Pellagic Food Ingredients Pvt. Ltd.

- Productos Aditivos, S.A.

- Sensient Technologies Corporation

- Shiru, Inc.

- Tate & Lyle PLC

- Teijin Limited

- The Every Company

Delivering Actionable Strategic Recommendations to Drive Innovation Competitive Resilience and Sustainable Growth for Functional Food Ingredients Stakeholders

To capitalize on emerging opportunities and fortify competitive positioning, industry leaders should prioritize the establishment of vertically integrated supply chains that combine raw material cultivation with in-house bioprocessing capabilities. By investing in proprietary fermentation technologies and high-throughput screening platforms, organizations can accelerate the identification and optimization of bioactive compounds suited for next-generation functional formulations. Moreover, forging cross-industry collaborations-spanning agri-processors, biotech firms, and academic research centers-will enhance innovation velocity and facilitate shared risk in product development.

In the realm of consumer engagement, leveraging digital ecosystems is imperative. Implementing data-driven personalized nutrition solutions, underpinned by real-time health monitoring, can strengthen brand loyalty and deliver measurable efficacy. Concurrently, companies must navigate evolving regulatory frameworks by engaging proactively with authorities to shape guidance on health claims and novel ingredient approvals. Sustainability should be woven into every stage-from feedstock selection to end-of-life packaging-to satisfy stakeholder expectations and mitigate supply chain vulnerabilities. Finally, developing robust consumer education campaigns that articulate the science behind functional ingredients will cultivate market trust and justify premium positioning.

Detailing Research Framework and Methodological Approaches Ensuring Data Integrity Comprehensive Coverage and Analytical Precision in Functional Food Studies

This analysis draws upon a multi-pronged research framework integrating both primary and secondary methodologies to ensure comprehensive and reliable insights. Primary research encompassed structured interviews and in-depth discussions with executives, R&D specialists, regulatory experts, and supply chain managers across major ingredient manufacturers and end-use companies. Quantitative surveys supplemented these qualitative inputs, capturing perspectives on innovation priorities, regulatory hurdles, and distribution strategies.

Secondary research involved rigorous review of scientific literature, patent filings, regulatory filings, and published standards. Industry white papers, trade association reports, and government publications provided contextual grounding for regional policy landscapes and emerging technological trends. All data sources underwent a systematic validation process involving cross-comparison, triangulation, and expert peer review. The methodological rigor implemented throughout this study ensures that findings and recommendations rest on a solid foundation of empirical evidence and industry consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Functional Food Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Functional Food Ingredients Market, by Product Type

- Functional Food Ingredients Market, by Source

- Functional Food Ingredients Market, by Form

- Functional Food Ingredients Market, by End User

- Functional Food Ingredients Market, by Application

- Functional Food Ingredients Market, by Distribution Channel

- Functional Food Ingredients Market, by Region

- Functional Food Ingredients Market, by Group

- Functional Food Ingredients Market, by Country

- United States Functional Food Ingredients Market

- China Functional Food Ingredients Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Synthesizing Key Findings and Strategic Implications to Illuminate Future Trajectories and Investment Priorities in the Functional Food Ingredients Landscape

Throughout this report, key themes have surfaced: the imperative of innovation through advanced bioprocesses, the strategic importance of supply chain resilience in the face of trade headwinds, and the necessity of segmentation-driven market strategies to address diverse consumer needs. Regional analyses underscored distinct regulatory and cultural drivers, illuminating pathways for market entry and expansion. Competitive profiling revealed that collaborative ecosystems and acquisitions remain potent mechanisms for rapid capability enhancement.

Looking ahead, the functional food ingredients domain will continue its trajectory toward precision-targeted formulations, personalized nutrition platforms, and sustainable sourcing models. Businesses that align R&D investment with consumer health trends, while proactively engaging regulatory bodies and forging strategic alliances, will lead the next wave of growth. By synthesizing these insights, stakeholders are equipped to navigate complex market dynamics, optimize innovation pipelines, and secure durable competitive advantage.

Inviting Decision Makers to Engage Directly with Associate Director Ketan Rohom for Tailored Insights and Acquisition of Comprehensive Market Intelligence Reports

To obtain the full-depth market intelligence and gain unparalleled strategic advantages, decision-makers are encouraged to connect with Ketan Rohom, Associate Director of Sales & Marketing, for a personalized consultation. Engaging directly will provide you with tailored insights addressing your organization’s unique growth challenges, as well as exclusive access to comprehensive data sets, regional analyses, and actionable industry trends. By partnering with Ketan, stakeholders can streamline the acquisition process, ensuring a seamless and efficient path to unlocking critical competitive intelligence. Secure your competitive edge today by reaching out for dedicated support and detailed guidance on how to leverage the market report for maximum impact

- How big is the Functional Food Ingredients Market?

- What is the Functional Food Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?