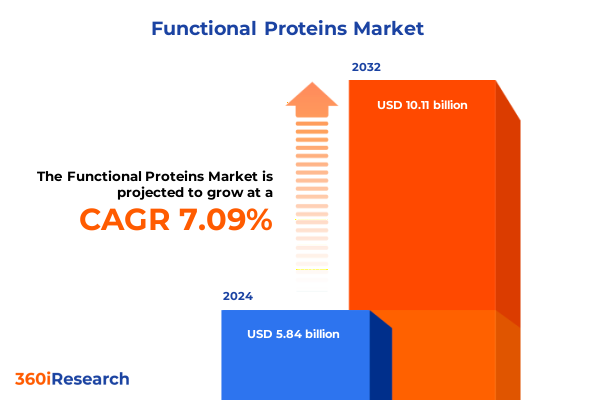

The Functional Proteins Market size was estimated at USD 6.25 billion in 2025 and expected to reach USD 6.70 billion in 2026, at a CAGR of 7.09% to reach USD 10.11 billion by 2032.

Exploring the Growing Demand for Functional Proteins Across Diverse Industries Fueled by Health Trends, Sustainability Goals, and Biotechnological Breakthroughs

In recent years, functional proteins have emerged as a cornerstone ingredient for manufacturers addressing consumer demand for health and wellness. The growing interest in high-protein snacks and supplements underscores a shift towards proactive nutritional choices, with interest in plant-based protein rising by 41% since 2023 and protein powder interest growing by 58% over the same period. This trend extends beyond traditional sports nutrition into broader product portfolios, including beverages, baked goods, and ready-to-drink formats, driving innovation across the food and beverage landscape.

Additionally, sustainability concerns and personalized nutrition have fueled developments in functional protein formulations. Companies are leveraging biotechnological breakthroughs such as precision fermentation to introduce animal-free alternatives, exemplified by a collaboration on vegan lactoferrin that binds iron and supports red blood cell production without reliance on animal sources. This confluence of health orientation and environmental consciousness has spurred investments in alternative sourcing methods, transparent labeling practices, and clean‐label claims, aligning with consumer expectations for traceable, eco-friendly solutions.

As a result, the functional proteins market now spans diverse industrial segments-from food and beverage applications targeting muscle recovery and immune support to cosmetic formulations promoting skin health and pharmaceutical excipients enabling targeted delivery. These cross‐sector integrations underscore the versatility of functional proteins and set the stage for accelerated R&D collaboration among ingredient suppliers, contract manufacturers, and end‐user brands poised to capitalize on evolving consumer preferences.

Unpacking the Global Technological, Regulatory, and Consumer-Driven Shifts Reshaping the Functional Proteins Market Ecosystem

Technological advancements are rapidly transforming the functional proteins landscape, with precision fermentation and AI‐driven design enabling the development of proteins tailored for enhanced efficacy and stability. Regulatory approval of precision fermentation platforms, exemplified by a landmark collaboration establishing fermentation facilities for animal‐free proteins in India, has validated production scalability and opened pathways for next‐generation bioactive ingredients. Concurrently, digital modeling tools and machine learning algorithms are accelerating the discovery of novel enzymatic functions, shortening innovation cycles and reducing time to market.

Regulatory modernization is also reshaping market entry strategies. Recent changes to the U.S. tariff framework, coupled with the FDA’s phased elimination of the self‐affirmed GRAS pathway, have heightened compliance requirements for novel proteins and prompted suppliers to engage early with authorities to secure clearances. In parallel, new EU labeling rules for partially hydrolyzed barley and rice proteins underscore the importance of proactive dossier preparation and stakeholder collaboration across the supply chain to mitigate approval delays.

Finally, evolving consumer behaviors are driving shifts toward customization and sustainability. Personalized nutrition platforms leveraging wearable devices and AI‐enabled health analytics are creating demand for tailored protein blends suited to individual metabolic profiles and lifestyle goals. Moreover, the surge in plant‐based diets is catalyzing product line extensions focused on pea, hemp, and other non‐animal proteins, reinforcing the sector’s responsiveness to ethical and environmental imperatives.

Analyzing the Cumulative Impact of the 2025 United States Reciprocal and Sector-Specific Tariffs on Functional Protein Imports

In April 2025, the U.S. government implemented a sweeping reciprocal tariff policy to rebalance trade imbalances and bolster domestic manufacturing. All imported goods faced an additional baseline ad valorem duty of 10% beginning April 5, with country‐specific duties rolling out on April 9 per the published Annex I schedule. This order applied uniformly across product categories unless explicitly exempted, signaling a strategic pivot toward tariff‐driven supply chain realignment.

Pharmaceutical imports, including specialized protein ingredients for drug formulations and nutraceutical applications, underwent layered tariff adjustments. An initial 10% duty applied to all pharmaceutical commodities for the first ninety days, after which rates were subject to escalation up to 25% or more based on sector reviews. Certain nations saw markedly higher levies-for example, China faced tariffs in the 104–245% range, while European Union exports encountered a 20% duty and India‐sourced goods bore 27%. These measures aim to stimulate onshore production but have introduced cost‐push factors for import‐dependent manufacturers.

To mitigate undue burden on critical life science materials and research samples, the administration carved out commodity‐specific exemptions for key Harmonized System codes covering pharmaceuticals, laboratory reagents, and biotech inputs. While these exemptions preserve access to essential goods, firms have had to recalibrate procurement strategies and inventory buffers to adapt to shifting duty landscapes. Many are accelerating qualified domestic supplier development and revisiting global sourcing matrices to safeguard product continuity.

Deriving Strategic Insights from Type, Source, Form, and End-User Segmentation to Unlock Growth Opportunities in Functional Proteins

Insight into the functional proteins market is sharpened through a multifaceted segmentation framework reflecting product characteristics and end‐use contexts. When analyzed by type, functional proteins break down into enzymes, hormones, regulatory proteins, storage proteins, structural proteins, and transport proteins, each category presenting unique performance attributes and formulation opportunities within food, pharma, and cosmetic matrices. Enzymes, for example, are prized for targeted catalytic reactions in processing, while transport proteins like albumin offer solubility enhancements in drug delivery.

Source‐based segmentation further delineates the market by animal, microbial, plant, and synthetic origins, underscoring the strategic balancing of cost efficiency, regulatory compliance, and sustainability imperatives. Animal‐derived proteins often command premium positioning, whereas microbial and plant sources facilitate scalable production and align with vegan and allergen‐free product strategies.

The form factor segmentation-ranging from capsules and granules to liquid concentrates and powders-reflects diverse manufacturing and application requirements, influencing solubility profiles, dosage precision, and shelf‐life stability. Powdered proteins remain dominant where dry blending is paramount, while liquids and encapsulated formats are gaining traction for rapid dissolution and precision delivery in nutraceuticals.

End‐user segmentation identifies five primary customer groups-cosmetic manufacturers, food manufacturers, nutraceutical producers, pharmaceutical companies, and research institutes-each with distinct performance benchmarks and regulatory pathways. Cosmetic brands leverage collagen and peptides for skin health, food producers integrate hydrolysates for texture and nutrition, and research entities drive innovation through custom enzyme libraries, cumulatively shaping a dynamic demand ecosystem.

This comprehensive research report categorizes the Functional Proteins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Source

- Form

- End User

Highlighting Regional Dynamics in Americas, Europe Middle East & Africa, and Asia-Pacific That Shape Functional Proteins Demand Patterns

Across the Americas, functional proteins benefit from a mature manufacturing base and high consumer purchasing power. Strong demand in North America for personalized nutrition solutions is propelled by robust healthcare infrastructure and widespread adoption of digital health platforms, reinforcing the region’s leadership in high‐protein launches and premium ingredient sourcing. U.S. and Canadian producers are at the forefront of formulating innovative blends that cater to sports nutrition, immune support, and general wellness segments.

In Europe, Middle East & Africa, stringent regulatory frameworks have elevated safety and transparency standards for novel proteins. The EU’s novel foods regime-updated through Implementing Regulation (EU) 2024/2046-mandates specific labeling for partially hydrolyzed proteins from spent barley and rice, reinforcing investor focus on regulatory compliance and early engagement with EFSA processes. This environment incentivizes collaborative partnerships between ingredient innovators and regulatory experts to expedite market approvals and secure consumer trust.

Asia‐Pacific stands out as the fastest‐growing region, driven by expanding middle‐class consumption and government support for biotechnology. In 2024, Strive Nutrition’s partnership with a precision fermentation innovator introduced an animal‐free lactoferrin, exemplifying the region’s appetite for sustainable protein alternatives and precision nutrition solutions. Rapid digitalization of supply chains and investments in local fermentation capacity underscore the region’s evolving role from contract manufacturing hub to innovation epicenter.

This comprehensive research report examines key regions that drive the evolution of the Functional Proteins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Positioning and Innovation Trajectories of Leading Functional Protein Providers Driving Industry Competition

The competitive landscape of functional proteins is anchored by global leaders and agile specialists driving innovation. dsm-firmenich, born from a 2023 merger of Royal DSM and Firmenich, has emerged as a powerhouse across Health, Nutrition & Care, Taste, Texture & Health, Perfumery & Beauty, and Animal Nutrition units. The company reported €12.8 billion in revenue in 2024 and leverages integrated R&D platforms to serve diverse sectors with bespoke protein solutions.

Novonesis, the 2024 merger of Novozymes and Chr. Hansen, solidified its position in industrial enzymes and microbial fermentation technologies. This entity focuses on scalable enzyme pipelines and proprietary microbial strains for bioactive peptide production, reinforcing leadership in sustainable biomanufacturing and advanced enzyme applications.

Mid‐tier players such as DuPont Nutrition & Biosciences, AB Enzymes, Amano Enzyme, Kerry Group, Advanced Enzymes Technologies, and Biocatalysts Ltd. maintain strong footholds through targeted application expertise-from digestive and baking enzymes to specialty hydrolases for cosmetic and pharmaceutical formulations. A fragmented innovation tail comprising startups in synthetic biology, AI‐assisted enzyme design, and bespoke fermentation services continues to influence pricing, speed of new product introductions, and regional growth dynamics, particularly throughout Asia‐Pacific and Latin America.

This comprehensive research report delivers an in-depth overview of the principal market players in the Functional Proteins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Ajinomoto Co., Inc.

- Archer-Daniels-Midland Company

- Cargill, Incorporated

- Fonterra Co-operative Group Limited

- Glanbia plc

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Koninklijke DSM N.V.

- Roquette Frères S.A.

- Royal FrieslandCampina N.V.

- Tate & Lyle PLC

Delivering Actionable Strategic Recommendations to Enhance Competitiveness, Resilience, and Market Penetration for Functional Protein Industry Leaders

Leverage agile sourcing strategies to offset elevated tariff pressures by mapping your supplier base against country‐specific duties that range from a 10% baseline to peaks of 245% on certain imports. Prioritize near‐shoring and qualification of domestic manufacturers to secure uninterrupted protein supply while maintaining cost discipline.

Capitalize on the sustainability imperative by expanding your plant-based and precision-fermented protein portfolios. Invest in collaborations with biotech innovators to accelerate launch of animal-free functional proteins, aligning new offerings with consumer expectations for ethical, low-carbon ingredients.

Enhance competitive differentiation through personalization. Integrate AI-driven formulation platforms and real-time consumer data streams to deliver bespoke protein blends addressing immunity, muscle recovery, or skin health. Develop modular product architectures that facilitate rapid customization across end-user segments.

Drive regulatory resilience by embedding compliance expertise early in product development. Engage with authorities to preempt evolving GRAS and novel food requirements, and implement robust labeling and traceability systems to expedite market access in the U.S. and EU.

Outlining the Comprehensive Mixed-Methods Research Methodology Underpinning Robust and Reliable Functional Protein Market Insights

This research integrates a mixed‐methods approach balancing quantitative and qualitative insights. Secondary data were gathered from industry publications, regulatory filings, and scientific journals to map market dynamics, tariff policies, and technological advances. Primary research involved in-depth interviews with C-suite executives, R&D leaders, and procurement heads across the supply chain to validate emerging trends and segment priorities.

A data triangulation framework was employed, cross‐referencing information from public sources, subscription databases, and expert consultations to ensure consistency and identify discrepancies. Key findings were further corroborated through workshops with technical specialists and external advisors, whose feedback refined the analysis of segmentation, regional drivers, and competitive positioning.

All quantitative inputs, including tariff schedules, regulatory milestones, and corporate financial indicators, were subjected to a rigorous validation protocol leveraging official government notices and audited company reports. This methodology underpins the actionable insights presented, offering market participants a robust, defensible foundation for strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Functional Proteins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Functional Proteins Market, by Type

- Functional Proteins Market, by Source

- Functional Proteins Market, by Form

- Functional Proteins Market, by End User

- Functional Proteins Market, by Region

- Functional Proteins Market, by Group

- Functional Proteins Market, by Country

- United States Functional Proteins Market

- China Functional Proteins Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Strategic Perspectives Summarizing Key Insights and Anticipated Developments Shaping the Future Trajectory of the Functional Proteins Market

As functional proteins command expanding roles across food, beverage, pharmaceutical, and personal care sectors, their market architecture has grown increasingly sophisticated. Health and wellness trends, coupled with sustainability and personalization imperatives, are converging to drive both product innovation and supply chain transformation. The introduction of reciprocal U.S. tariffs and evolving EU novel food requirements have underscored the necessity for flexible sourcing and proactive regulatory engagement.

Segmentation by type, source, form, and end‐use continues to inform targeted R&D investments, enabling companies to tailor offerings from high‐purity enzymes for industrial processes to encapsulated peptides for premium nutritional supplements. Regional dynamics in the Americas, EMEA, and APAC reveal varied growth accelerators-from North American digital health platforms to European regulatory rigor and Asia‐Pacific’s biotechnology expansion.

Against this backdrop, leading providers are differentiating through integrated biomanufacturing capabilities, strategic mergers, and agile partnerships, while startups inject fresh innovation via synthetic biology and AI‐driven enzyme design. To navigate this complex environment, industry stakeholders must embrace cross‐functional collaboration, deepen regulatory intelligence, and harness data analytics to anticipate market shifts. These collective actions will shape the competitive landscape and define the trajectory of the functional proteins market in the years ahead.

Connect with Ketan Rohom to Unlock Customized Functional Proteins Research Insights and Secure Your Comprehensive Market Intelligence Report Today

To explore how tailored insights into functional proteins can advance your strategic priorities, connect directly with Ketan Rohom, Associate Director, Sales & Marketing. He can guide you through the comprehensive scope of this market research report, share customized intelligence on emerging product categories, regional dynamics, and regulatory shifts, and outline flexible licensing options to meet your organization’s unique needs. Engage in a consultative discussion today to secure unparalleled visibility into competitive landscapes, technology roadmaps, and actionable market entry strategies. Reach out now to gain the critical data and expert interpretation necessary for decisive investments and sustained growth in the evolving functional proteins sector.

- How big is the Functional Proteins Market?

- What is the Functional Proteins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?