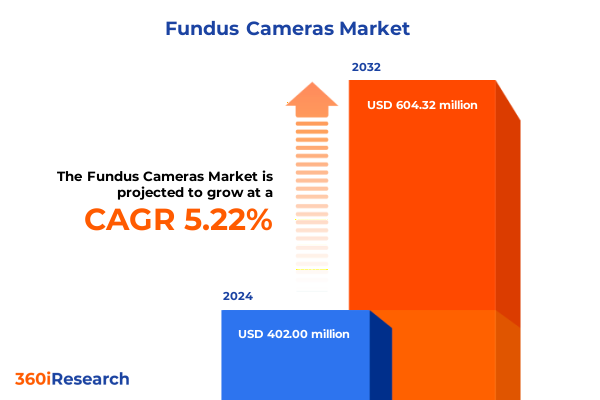

The Fundus Cameras Market size was estimated at USD 422.66 million in 2025 and expected to reach USD 446.45 million in 2026, at a CAGR of 5.24% to reach USD 604.32 million by 2032.

Unveiling the Critical Role and Rising Importance of Advanced Fundus Cameras in Modern Ophthalmic Diagnostics and Vision Care Improvements Worldwide

Fundus cameras have emerged as indispensable instruments in ophthalmology, underpinning early detection and management of retinal diseases that can lead to irreversible vision loss. By capturing high-resolution images of the interior surface of the eye, these devices enable clinicians to diagnose conditions ranging from diabetic retinopathy to age-related macular degeneration with unparalleled precision. Over the past decade, technological advancements have accelerated the evolution of fundus imaging, broadening its clinical applications and enhancing diagnostic workflows. As a result, eye care providers can now deliver more comprehensive patient care, informed by detailed visualization of retinal structures.

Against this backdrop, stakeholders across the value chain-from device manufacturers to healthcare providers-are navigating a dynamic landscape shaped by regulatory shifts, technological breakthroughs, and evolving patient needs. This section introduces the critical role of fundus cameras in modern ophthalmic practice, setting the stage for a deeper examination of the forces that are redefining the market. Through a survey of recent innovations and the growing emphasis on precision medicine, we highlight why fundus imaging stands at the forefront of vision care transformation and how it continues to drive both clinical and commercial opportunities.

Transformative Technological Advances Including Artificial Intelligence Integration and Telehealth Platforms Reshaping the Fundus Camera Landscape Globally

Rapid digitalization in healthcare has catalyzed transformative shifts in the fundus camera sector, as emerging technologies converge to enhance imaging capabilities and streamline diagnostic procedures. Artificial intelligence, for instance, has moved from theoretical application to real-world deployment, enabling automated image analysis that flags early disease markers, quantifies lesion severity, and supports decision-making. This integration of machine learning algorithms not only reduces clinician workload but also improves diagnostic consistency across care settings.

Simultaneously, telehealth platforms are fostering remote ophthalmic consultations, allowing specialists to evaluate retinal images captured in disparate locations. This trend is further amplified by the proliferation of smartphone-based fundus cameras, which leverage mobile devices to extend screening services to underserved communities. As these disruptive innovations gain traction, they are reshaping competitive dynamics and prompting established players to adopt new business models focused on software-as-a-service offerings and strategic partnerships with digital health vendors.

Assessing the Aggregate Effects of United States Tariff Policy Adjustments in 2025 on the Supply Chain Cost Structures and Pricing of Imported Fundus Cameras

In 2025, revisions to the United States tariff regime have exerted a cumulative impact on the supply chain economics of imported fundus cameras. Components such as specialized optics, high-resolution sensors, and embedded software modules that originate from overseas suppliers have faced increased duties, driving up landed costs. For manufacturers dependent on global sourcing, these additional levies have translated into tighter margins and higher end-user prices, potentially dampening adoption rates among cost-sensitive diagnostic and screening centers.

However, the tariff adjustments have also precipitated a strategic pivot toward domestic production and vertical integration. Several original equipment manufacturers have accelerated investments in local assembly capabilities and forged partnerships with US-based distributors to mitigate exposure to import duties. In parallel, device developers are exploring alternative sourcing strategies in tariff-exempt regions and consolidating component procurement to achieve economies of scale. As a result, the 2025 tariff landscape has induced both short-term pricing pressures and long-term realignment of manufacturing footprints within the fundus camera industry.

Deep Dive into Distinct Segmentation Dimensions Highlighting Technology, Product Type, Distribution Channel, Applications, and End User Variations

A nuanced understanding of market segmentation is essential to decipher growth trajectories within the fundus camera domain. By technology, devices are distinguished between mydriatic systems, which require pupil dilation, and non-mydriatic alternatives that facilitate imaging without pharmacological intervention. Among mydriatic options, single-field cameras capture a concentrated retinal area, whereas wide-field systems encompass a broader view, enabling comprehensive assessments. In contrast, non-mydriatic instruments are available in multi-field configurations that stitch together multiple images for expanded coverage, along with single-field models optimized for rapid, targeted examinations.

Examining product type reveals additional layers of diversity. Handheld fundus cameras, offered in both wired and wireless designs, deliver portability for point-of-care settings, while tabletop variants provide stability and advanced imaging features suited for specialized clinics. Meanwhile, the smartphone-based category bifurcates into Android-based and iOS-based attachments, each leveraging the unique hardware and software ecosystems of their host platforms to democratize access to retinal screening.

Distribution channel analysis highlights the coexistence of established offline networks-comprising medical equipment distributors and clinical supply chains-and burgeoning online marketplaces that facilitate direct-to-provider transactions. This dual channel environment underscores the necessity for manufacturers to balance traditional sales relationships with digital engagement strategies.

Finally, application-driven segmentation encompasses diagnostic imaging, research-grade data acquisition, mass screening initiatives, and teleophthalmology services. Teleophthalmology itself divides into real-time imaging for synchronous virtual consultations and store-and-forward workflows that permit asynchronous expert review. End users span diagnostic centers, including mobile screening units and stationary facilities, hospitals with dedicated ophthalmology departments, research institutes focused on clinical trials and epidemiological studies, and specialty clinics segregated into multispecialty establishments and dedicated ophthalmology practices.

This comprehensive research report categorizes the Fundus Cameras market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product Type

- Distribution Channel

- Application

- End User

Comprehensive Regional Perspectives Showcasing the Americas, EMEA and Asia-Pacific Market Dynamics, Adoption Trends, and Operational Opportunities

Regional dynamics play a pivotal role in shaping the fundus camera marketplace, as each geographic zone exhibits unique drivers and barriers to adoption. In the Americas, robust healthcare infrastructure and established reimbursement frameworks have fostered widespread integration of advanced retinal imaging systems across hospitals and diagnostic networks. Meanwhile, demand for portable, point-of-care devices has surged within mobile screening programs designed to reach remote and underserved populations.

Across Europe, the Middle East & Africa, diverse regulatory environments and varying levels of healthcare investment result in a heterogeneous landscape. Western Europe’s stringent medical device standards and consolidated procurement processes contrast with the Middle East’s strategic investments in telemedicine hubs and the African region’s reliance on cost-effective, non-mydriatic solutions for large-scale vision screening campaigns.

In the Asia-Pacific region, rapid growth is being driven by expanding health insurance coverage, heightened awareness of diabetic retinopathy screenings, and government-led initiatives to combat preventable blindness. Markets such as China and India are witnessing accelerating adoption of smartphone-based fundus cameras, propelled by substantial smartphone penetration and the drive to decentralize eye care services.

This comprehensive research report examines key regions that drive the evolution of the Fundus Cameras market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Compelling Company Profiles and Strategic Initiatives Highlighting Market Leaders Innovation, Partnerships, and Competitive Positioning in Fundus Camera Industry

Leading companies in the fundus camera domain are pursuing differentiated strategies to solidify their market positioning and capitalize on emerging trends. Established optical and imaging conglomerates have intensified research and development investments, focusing on integrating artificial intelligence modules that automate retinal pathology detection and quantification. Strategic collaborations with cloud platform providers are facilitating the rollout of subscription-based analytics suites that augment hardware offerings with real-time diagnostic support.

In parallel, innovative medical technology startups are challenging traditional business models by introducing cost-effective handheld and smartphone-based devices. These disruptors often leverage agile manufacturing approaches and digital-first marketing channels to accelerate market penetration, particularly in emerging economies. Many of these entrants have forged alliances with local distributors and telehealth service providers to ensure seamless integration into existing clinical workflows.

To maintain competitive differentiation, industry leaders are also expanding their geographic presence through targeted acquisitions and joint ventures that bolster local service networks and regulatory compliance capabilities. By combining global R&D expertise with region-specific go-to-market strategies, these companies aim to deliver comprehensive solutions that cater to the full spectrum of stakeholder needs-from large hospital systems to community-based screening initiatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fundus Cameras market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acon Laboratories, Inc.

- Canon Inc.

- Carl Zeiss Meditec AG

- CenterVue SpA

- Clarity Medical Systems, Inc.

- CSO Costruzione Strumenti Oftalmici S.r.l.

- Haag-Streit AG

- Heidelberg Engineering GmbH

- iCare Finland Oy

- Kowa Company, Ltd.

- Kreativ, Inc.

- Lumenis Ltd.

- M&S Technologies Inc.

- Marco Ophthalmic, Inc.

- Microclear Medical Technology Co., Ltd.

- Nidek Co., Ltd.

- Nobel Biocare Services AG

- Ocular Instruments, Inc.

- Optos plc (a Nikon company)

- Rheon USA, Inc.

- Shanghai New Eyes Medical Inc.

- Topcon Corporation

Pragmatic and Actionable Strategic Recommendations Empowering Industry Stakeholders to Leverage Technological Advances and Market Trends for Sustainable Growth

Industry stakeholders can leverage several strategic imperatives to navigate the complexities of the fundus camera market and seize growth opportunities. First, prioritizing integration of advanced analytics and machine learning into imaging platforms will yield significant differentiation and create new value-added services. By embedding AI-driven triage and referral recommendations within the imaging device, providers can offer a seamless, end-to-end solution that enhances clinical efficiency and patient outcomes.

Second, diversifying product portfolios to include both mydriatic and non-mydriatic variants-alongside portable and smartphone-based configurations-can broaden addressable markets and mitigate dependency on any single user segment. Coupled with a dual channel distribution approach that balances established offline relationships with robust e-commerce capabilities, this strategy ensures market coverage across various care settings.

Third, building resilience against regulatory and trade headwinds requires adopting flexible manufacturing and sourcing frameworks. Establishing regional assembly hubs and cultivating local supplier networks not only reduces tariff exposure but also shortens lead times and strengthens alignment with country-specific compliance standards. Ultimately, a proactive stance on supply chain agility will be instrumental in maintaining competitiveness amidst evolving policy landscapes.

Rigorous Mixed Method Research Framework Illustrating Data Collection, Validation Processes, and Analytical Techniques Underpinning Market Intelligence

This research employs a rigorous mixed-method framework to ensure the credibility and relevance of its findings. Initially, a comprehensive secondary research phase involved extensive review of peer-reviewed journals, regulatory filings, clinical trial registries, and reputable industry publications to establish a foundational understanding of technological developments and market dynamics.

Building on this, in-depth primary interviews were conducted with a cross-section of stakeholders, including ophthalmologists, device manufacturers, distributors, and health policy experts. These discussions were designed to validate secondary research insights, gauge adoption barriers, and uncover emerging use cases within diverse care environments.

Data triangulation techniques were applied to reconcile information from multiple sources, while quantitative analysis of procurement and usage data provided empirical grounding for observed trends. Qualitative insights from expert panels and advisory workshops further enriched the analysis, ensuring that both macro-level dynamics and micro-level operational considerations are incorporated.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fundus Cameras market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fundus Cameras Market, by Technology

- Fundus Cameras Market, by Product Type

- Fundus Cameras Market, by Distribution Channel

- Fundus Cameras Market, by Application

- Fundus Cameras Market, by End User

- Fundus Cameras Market, by Region

- Fundus Cameras Market, by Group

- Fundus Cameras Market, by Country

- United States Fundus Cameras Market

- China Fundus Cameras Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summative Insights Emphasizing the Strategic Implications of Technological Evolution, Market Realities, and Policy Dynamics in Fundus Camera Markets

In summary, the fundus camera ecosystem is undergoing a period of profound transformation, driven by breakthroughs in artificial intelligence, the rise of telehealth-enabled service models, and shifting regulatory and trade environments. These dynamics are catalyzing a shift from traditional, clinic-based imaging to more accessible, portable, and interconnected solutions that address the full continuum of patient care. Moreover, the segmentation analysis underscores the critical importance of tailoring offerings by technology type, product configuration, distribution pathway, clinical application, and end-user profile.

Simultaneously, regional insights reveal that adoption patterns are influenced by local healthcare infrastructure maturity, reimbursement frameworks, and strategic public health initiatives. Leading companies are responding with multifaceted strategies that combine innovative product development, strategic partnerships, and manufacturing agility, positioning them for sustained success. As stakeholders navigate these complexities, the actionable recommendations presented herein offer a roadmap for leveraging market shifts, mitigating policy risks, and delivering enhanced clinical value.

Engage with Associate Director Ketan Rohom to Unlock Comprehensive Market Research Insights and Drive Strategic Decisions with Customized Report Access

To explore these insights in greater depth and to secure a tailored copy of the full market research report, we invite you to connect with Associate Director Ketan Rohom. His expertise in translating complex data into actionable guidance ensures that your organization can harness the latest market intelligence to inform strategic planning and investment decisions. Reach out today to unlock customized insights that address your unique objectives and gain a competitive edge in the rapidly evolving fundus camera domain.

- How big is the Fundus Cameras Market?

- What is the Fundus Cameras Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?