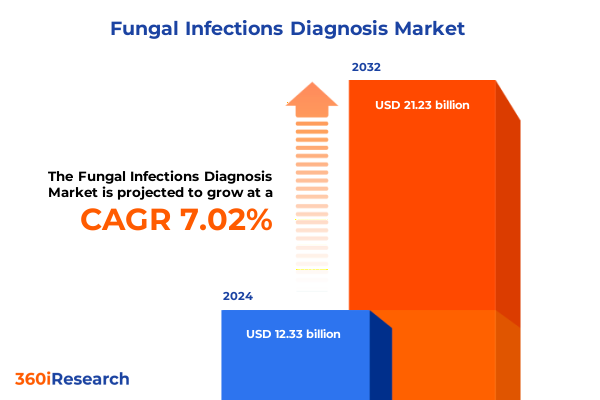

The Fungal Infections Diagnosis Market size was estimated at USD 9.84 billion in 2025 and expected to reach USD 10.52 billion in 2026, at a CAGR of 7.04% to reach USD 15.85 billion by 2032.

Unveiling the Critical Role of Innovative Diagnostic Approaches in Transforming Fungal Infection Management and Patient Outcomes Worldwide

In recent years, the global healthcare landscape has witnessed a pronounced rise in the incidence and complexity of fungal infections, prompting an urgent need for more accurate and timely diagnostic solutions. Growing immunocompromised populations, including patients undergoing chemotherapy, organ transplantation, and intensive care, have heightened the demand for diagnostics that can rapidly distinguish invasive fungal pathogens from bacterial and viral agents. Concurrently, the emergence of antifungal resistance has underscored the necessity of early detection technologies that can guide targeted therapy and reduce morbidity and mortality. As a result, the diagnostic community has rallied to develop platforms that balance sensitivity, specificity, and speed to address these clinical challenges.

Amid this backdrop, stakeholders across the diagnostic value chain are evaluating novel approaches ranging from traditional culture methods to advanced molecular and proteomic assays. The combination of technological innovation and shifting clinical priorities has established fungal diagnostics as a critical focal point within infectious disease management. This introduction outlines the imperative for innovative diagnostic tools that not only meet rigorous performance criteria but also integrate seamlessly into laboratory workflows and point-of-care settings. By setting the stage for a deeper exploration of transformative trends, regulatory developments, and market dynamics, this section primes readers to understand the strategic landscape shaping the future of fungal infection diagnostics.

Exploring the Pivotal Technological and Clinical Shifts Reshaping the Fungal Infection Diagnostic Landscape in the Modern Healthcare Ecosystem

The last decade has witnessed a cascade of transformative shifts that are redefining the fungal diagnostics landscape through technological breakthroughs and evolving clinical paradigms. Traditional culture-based methods, long hailed for their proven reliability, are now complemented by matrix-assisted laser desorption/ionization time-of-flight mass spectrometry platforms that deliver rapid species identification directly from clinical specimens. Concurrently, immunoassays employing lateral flow devices and enzyme-linked systems have matured to offer point-of-care options that dramatically reduce time to result. This diversification of diagnostic modes underscores the industry’s pivot toward decentralized and patient-centric testing solutions.

In parallel, molecular diagnostics have surged ahead, harnessing polymerase chain reaction innovations and next-generation sequencing to achieve unprecedented levels of sensitivity and specificity. These modalities provide comprehensive pathogen profiling and resistance gene detection, unlocking new avenues for precision therapy. The integration of digital health tools, including laboratory information systems and cloud-based analytics, further amplifies the impact of these diagnostic advances, enabling real-time surveillance and cross-institutional data sharing. As these shifts converge, the fungal diagnostics landscape is being reshaped by a synergy of speed, accuracy, and connectivity that promises to elevate clinical decision-making and patient outcomes.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Policies on Fungal Diagnostic Supply Chains and Clinical Accessibility

The United States’ tariff adjustments enacted in early 2025 have reverberated through the supply chain for fungal diagnostics, influencing both the cost structure and availability of critical reagents and instrumentation. Tariffs imposed on imported culture media components and specialized molecular reagents have incrementally eroded the tight margins that diagnostic laboratories typically operate under. In response, many laboratories have had to renegotiate reagent contracts or seek domestic suppliers to mitigate cost pressures. This recalibration has led to localized manufacturing initiatives and strategic partnerships aimed at reducing dependence on affected import channels.

Beyond immediate cost implications, the tariff policies have catalyzed a broader industry reassessment of supply chain resilience and procurement strategies. Diagnostic manufacturers are accelerating investments in regional production facilities to safeguard against future trade policy disruptions, while laboratories are exploring collaborative procurement networks to maintain consistent access to essential diagnostic inputs. Although these shifts present operational challenges in the short term, they also offer opportunities to strengthen domestic capabilities and foster innovation ecosystems that support sustainable growth in fungal infection diagnostics.

Demystifying Diagnostic Market Segmentation by Technology, End User, Specimen, Pathogen, and Testing Mode to Illuminate Growth Levers

A nuanced understanding of market segmentation reveals critical drivers and opportunities across diagnostic technologies, end user environments, specimen types, pathogen categories, and testing modes. Within diagnostic technologies, culture-based methods continue to serve as the backbone for many laboratories, yet are increasingly complemented by liquid broth and solid media variations that optimize growth parameters. Immunoassays have progressed from conventional enzyme-linked approaches to rapid lateral flow assays that empower decentralized testing. In microscopy, high-resolution imaging systems enhance morphological confirmation, while matrix-assisted analysis provides more rapid identification without extended incubation periods. Molecular diagnostics stand at the forefront, combining polymerase chain reaction and next-generation sequencing innovations-whether Illumina or Ion Torrent platforms-to deliver comprehensive genomic insights. Each of these subdomains reflects a maturation of technology aimed at accelerating turnaround times and expanding diagnostic reach.

End users ranging from specialized diagnostic laboratories to hospitals, clinics, and research institutes each demand tailored solutions that align with their operational workflows and clinical objectives. Blood, cerebrospinal fluid, sputum, tissue, and urine specimens each present distinct analytical challenges, driving the development of assays optimized for sensitivity and stability in varying biological matrices. Pathogen-specific diagnostics targeting Aspergillosis, Candidiasis, Cryptococcosis, Dermatophytosis, and Mucormycosis are refined to detect unique biomarkers, ensuring precise identification. Finally, the delineation between laboratory testing, point-of-care diagnostics, and research-use-only applications underscores the industry’s commitment to delivering the right level of complexity and regulatory compliance for each use case.

This comprehensive research report categorizes the Fungal Infections Diagnosis market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Diagnostic Technology

- Pathogen Type

- Specimen Type

- Infection Type

- Offerings

- Testing Mode

- End User

Unearthing Regional Dynamics and Adoption Patterns across the Americas, EMEA, and Asia-Pacific in Fungal Diagnostics

Regional dynamics play a pivotal role in shaping adoption patterns for fungal diagnostics across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, robust healthcare infrastructure and reimbursement frameworks support rapid uptake of advanced molecular platforms and mass spectrometry solutions. Clinical laboratories in the United States and Canada often serve as early adopters for novel diagnostics, leveraging economies of scale and established distribution networks to integrate new assays with minimal barriers.

In the Europe, Middle East & Africa region, disparities in regulatory pathways and healthcare funding dictate varied adoption timelines. Western European markets benefit from streamlined approval processes and centralized procurement mechanisms, whereas emerging economies in Eastern Europe, the Middle East, and Africa face budget constraints that prioritize cost-effective culture-based and lateral flow diagnostics. Meanwhile, Asia-Pacific demonstrates a dual dynamic of mature markets in Japan and Australia embracing next-generation sequencing innovations, alongside rapidly developing healthcare systems in Southeast Asia and India focusing on scalable and affordable diagnostic frameworks. This juxtaposition of market maturity and growth potential underscores the necessity of region-specific strategies to maximize market penetration.

This comprehensive research report examines key regions that drive the evolution of the Fungal Infections Diagnosis market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Moves and Competitive Positioning of Leading Players Driving Innovation in Fungal Infection Diagnostic Solutions

Leading diagnostic manufacturers are executing a variety of strategic initiatives to maintain and expand their foothold in the fungal diagnostics arena. Some have broadened their portfolios through acquisitions of niche molecular diagnostics firms, integrating specialized assays into comprehensive testing platforms. Others invest in research collaborations with academic and clinical institutions to co-develop advanced biomarker panels and digital workflows that streamline laboratory operations. Major players are also forming joint ventures with reagent suppliers to guarantee uninterrupted access to proprietary culture media and molecular reagents, thereby reducing vulnerability to supply chain disruptions.

Beyond product development, competitive positioning increasingly hinges on value-added services such as remote technical support, integrated informatics solutions, and bundled reagent–instrument contracts. Strategic alliances with distributors and systems integrators enhance market reach, particularly in regions where direct sales channels are underdeveloped. In parallel, several companies are piloting subscription-based models for diagnostic platforms, offering laboratories flexible payment structures that align capital expenditures with utilization rates. These multifaceted approaches reflect an industry-wide recognition that success in fungal infection diagnostics depends as much on ecosystem partnerships and service excellence as on core technological capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fungal Infections Diagnosis market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BioMérieux SA

- Becton, Dickinson and Company

- Hologic, Inc.

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche AG

- Bruker Corporation

- Danaher Corporation

- Laboratory Corporation of America Holdings

- Bio-Rad Laboratories, Inc.

- Qiagen N.V.

- Merck KGaA

- Siemens Healthineers AG

- Revvity, Inc.

- Associates of Cape COD, Inc. by Seikagaku Group company

- DiaSorin S.p.A.

- Dynamiker Biotechnology (Tianjin) Co., Ltd.

- Eurofins Viracor, LLC

- FUJIFILM Wako Pure Chemical Corporation

- Genobio Pharmaceutical Co., Ltd.

- IMMY

- MicroGenDX Europe GmbH

- MiraVista Diagnostics, LLC

- Norgen Biotek Corp.

- PathoNostics B.V.

- Polysciences, Inc.

- Seegene Inc.

- T2 Biosystems, Inc.

- Tianjin Era Biology Technology Co., Ltd.

- Vircell, S.L.

- Xiamen Bioendo Technology Co., Ltd.

- Zhuhai DL Biotech Co., Ltd.

Empowering Industry Leaders with Strategic Recommendations to Capitalize on Emerging Opportunities in Fungal Infection Diagnostics

Industry leaders should prioritize investments that align with the maturation of molecular and proteomic diagnostics while simultaneously strengthening resilience to trade policy shifts. Allocating resources toward modular platforms capable of accommodating both polymerase chain reaction assays and next-generation sequencing tests will provide laboratories with the versatility required to respond to emerging fungal threats. Equally important is forging partnerships with domestic reagent manufacturers to hedge against tariff-related cost escalation and to cultivate local innovation hubs that can accelerate assay development.

In parallel, organizations must engage payers and regulatory bodies early in the product life cycle to secure favorable reimbursement codes and streamline approval processes. Developing robust clinical validation studies that demonstrate clear improvements in patient outcomes will facilitate uptake among hospitals, clinics, and public health laboratories. Finally, incorporating digital analytics and remote data management into diagnostic offerings can create new revenue streams while enhancing service delivery, enabling providers to deliver real-time insights and predictive trends to their customers.

Detailing a Robust Research Methodology Integrating Multi-Source Data and Expert Validation to Ensure Comprehensive Diagnostic Market Analysis

The research underpinning this analysis combined extensive secondary and primary data collection to ensure a comprehensive view of the fungal infection diagnostic market. Secondary research entailed a thorough review of regulatory filings, peer-reviewed publications, and public financial disclosures to map technological advancements and corporate strategies. Complementing this, primary research involved in-depth interviews with key opinion leaders, laboratory directors, and R&D heads across diagnostic manufacturers, hospitals, and academic centers. Input from these stakeholders validated emerging trends and clarified real-world adoption barriers.

Data triangulation formed a core element of the methodology, reconciling quantitative insights from sales databases and reagent consumption statistics with qualitative feedback from expert panels. Regional market dynamics were assessed through localized surveys and consultations with distributors to capture nuanced variations in procurement and regulatory landscapes. Segmentation analyses were rigorously applied to diagnostic technologies, end users, specimen types, pathogen targets, and testing modes to reveal strategic growth levers and unmet clinical needs. This robust approach underpins the credibility and depth of the report’s findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fungal Infections Diagnosis market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fungal Infections Diagnosis Market, by Diagnostic Technology

- Fungal Infections Diagnosis Market, by Pathogen Type

- Fungal Infections Diagnosis Market, by Specimen Type

- Fungal Infections Diagnosis Market, by Infection Type

- Fungal Infections Diagnosis Market, by Offerings

- Fungal Infections Diagnosis Market, by Testing Mode

- Fungal Infections Diagnosis Market, by End User

- Fungal Infections Diagnosis Market, by Region

- Fungal Infections Diagnosis Market, by Group

- Fungal Infections Diagnosis Market, by Country

- United States Fungal Infections Diagnosis Market

- China Fungal Infections Diagnosis Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Synthesizing Core Findings and Strategic Imperatives to Navigate the Complex Landscape of Fungal Infection Diagnostics with Confidence

The collective evidence underscores a clear trajectory toward faster, more precise, and decentralized fungal diagnostics. Culture-based and immunoassay techniques remain essential for foundational testing, while molecular and proteomic platforms are driving the next wave of innovation. Tariff policies in 2025 have prompted a reevaluation of supply chain strategies and accelerated domestic production initiatives, offering both challenges and strategic opportunities. Insights from segmentation analyses highlight the critical need for tailored solutions that reflect the diverse requirements of laboratories, hospitals, and research institutes dealing with a range of specimens and pathogen categories. Regional differences further emphasize the importance of adaptive market entry and commercialization strategies.

As leading companies refine their competitive positioning through partnerships, acquisitions, and service enhancements, industry stakeholders are well-positioned to leverage these developments for improved patient care and operational efficiency. By aligning technological investments with regulatory and reimbursement imperatives, and by proactively addressing supply chain vulnerabilities, decision-makers can navigate the evolving landscape with confidence. This conclusion distills the report’s core findings into a clear call for strategic action, ensuring that fungal infection diagnostics continue to advance in step with clinical needs and global health priorities.

Engage with Our Associate Director to Secure the Definitive Market Research Report on Fungal Infection Diagnostics for Strategic Insights

To acquire the comprehensive market research report and gain in-depth insights into the diagnostic fungal infections space, connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan can provide a tailored overview of the report’s robust findings and guide you through the rich data, competitive analysis, and actionable intelligence that your organization needs to make strategic decisions. By partnering with Ketan, you will unlock priority access to specialized segments, detailed regional breakdowns, and an executive-level summary that supports both C-suite deliberations and operational planning.

Engaging with Ketan ensures that you benefit from a personalized consultation that clarifies how the report’s content aligns with your specific goals. Whether you seek to optimize supply chain strategies amid evolving tariff pressures, explore technological adoption roadmaps, or benchmark against leading competitors, Ketan stands ready to facilitate a seamless purchase experience. Reach out today to secure your copy and elevate your decision-making with the definitive global perspective on fungal infection diagnostics.

- How big is the Fungal Infections Diagnosis Market?

- What is the Fungal Infections Diagnosis Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?