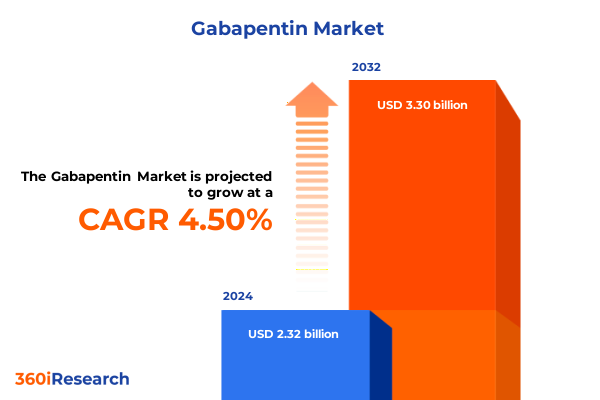

The Gabapentin Market size was estimated at USD 2.43 billion in 2025 and expected to reach USD 2.53 billion in 2026, at a CAGR of 4.50% to reach USD 3.30 billion by 2032.

Setting the Stage for Gabapentin Market Dynamics Through a Comprehensive Overview of Therapeutic Roles, Industry Drivers, and Competitive Context

Gabapentin has evolved into a cornerstone in the management of neurological disorders and chronic pain, initially introduced as an anticonvulsant and subsequently gaining widespread adoption for neuropathic pain and restless leg syndrome. Its mechanism of action, which modulates calcium channels to inhibit excitatory neurotransmission, underpins its therapeutic versatility across diverse patient populations. As a result, clinicians and payers have increasingly relied on gabapentin as a cost-effective intervention with a well-established safety profile.

Moreover, the product life cycle of gabapentin has transitioned dramatically following patent expiration, ushering in an era defined by generic competition and strategic price management. Healthcare systems have leveraged formulary optimization to drive volume-based procurement, while manufacturers have focused on differentiation through novel formulations and extended-release profiles. This dynamic interplay between clinical efficacy, cost containment pressures, and innovation has set the stage for heightened competitive intensity.

In addition, patient adherence and real-world evidence have emerged as critical determinants of market performance, prompting stakeholders to explore digital health integrations, patient support programs, and value-based contracting models. Consequently, a holistic understanding of these therapeutic, commercial, and patient-centric drivers is essential to navigate the evolving gabapentin landscape and capitalize on emerging opportunities.

Exploring Transformative Technological and Regulatory Shifts Reshaping Gabapentin Market Trajectories in Innovation, Patient Accessibility, and Therapeutic Application

The gabapentin market is experiencing transformative shifts driven by advancements in drug delivery technologies and evolving regulatory frameworks. Injectable parenteral formulations have gained traction in acute care settings, while oral extended-release platforms are redefining chronic therapy adherence. These formulation innovations have been propelled by enhanced pharmacokinetic profiles, offering smoother plasma concentration curves and reduced dosing frequency, thereby improving patient experience and engagement.

Concurrently, regulators are streamlining approval pathways for generics and novel formulations, with abbreviated new drug applications and adaptive licensing frameworks accelerating market entry. This regulatory agility has incentivized contract development and manufacturing organizations to expand capacity and diversify formulation pipelines. In addition, digital health solutions, such as smart pill dispensers and remote monitoring applications, are converging with pharmaceutical strategies to bolster adherence and demonstrate real-world outcomes, thereby reinforcing the value proposition to payers and providers.

Furthermore, payers are adopting outcomes-based reimbursement models, aligning payment with demonstrated clinical benefit and patient-reported outcomes. This shift has compelled manufacturers to establish robust evidence generation programs and patient engagement initiatives. By integrating clinical innovation with regulatory and commercial strategies, the gabapentin market is poised for sustainable growth and differentiation through value-driven approaches.

Assessing the Cumulative Impact of 2025 United States Tariff Policies on Gabapentin Supply Chains, Pricing Structures, and Industry Resilience Strategies

In early 2025, United States tariff adjustments placed additional levies on active pharmaceutical ingredients imported from select global suppliers, impacting gabapentin production costs and supply chain resilience. Manufacturers reliant on international API sourcing encountered increased landed costs, necessitating strategic repricing discussions with key payers and wholesalers. As a result, many organizations rebalanced inventory levels and pursued nearshoring initiatives to mitigate exposure to tariff volatility and maintain uninterrupted supply for critical patient populations.

Moreover, the imposition of tariffs triggered a ripple effect across contract manufacturing networks, compelling stakeholders to diversify their supplier base and negotiate longer-term API contracts. In doing so, industry players have moved to secure alternative feedstock from emerging markets with preferential trade agreements, thus alleviating cost pressures and fostering supply chain agility. Underpinning these strategic pivots is an emphasis on robust risk management frameworks designed to anticipate policy shifts and ensure continuity of production.

As a result, companies that proactively adapted to the 2025 tariff environment have strengthened their competitive positioning and demonstrated resilience in cost management. Looking ahead, maintaining stakeholder collaboration across customs authorities, logistics providers, and procurement teams will remain paramount to navigate future trade policy changes while preserving patient access to affordable gabapentin therapies.

Unveiling Critical Segmentation Insights Highlighting Route of Administration, Formulation Nuances, Dosage Variations, Distribution Channels, and End-User Profiles

An in-depth segmentation analysis reveals that oral administration accounts for the majority of gabapentin prescriptions, driven by patient and provider preferences for ease of dosing and proven safety in ambulatory care. In contrast, parenteral delivery retains a niche role in hospital settings, particularly for post-operative pain management and instances requiring rapid onset of action. This dichotomy underscores the importance of route-specific development strategies to address distinct clinical scenarios.

Turning to formulation, generic gabapentin continues to dominate market volumes due to cost efficacy, while branded extended-release versions maintain a presence through differentiated release mechanisms and targeted marketing to specialist clinics. In addition, dosage form segmentation highlights the robustness of tablets and capsules, with hard gelatin capsules appreciated for rapid dissolution and soft gelatin variants offering versatility in compounding bespoke doses. Oral solutions cater to pediatric and geriatric populations, ensuring dose flexibility for sensitive patient groups.

Distribution channels exhibit evolution as hospital pharmacies serve as primary hubs for acute care, while retail pharmacies underpin broad outpatient access. Online pharmacies are rapidly gaining traction among chronically treated patients seeking convenience and home delivery options. In parallel, end-user segmentation illustrates that hospitals remain the largest volume purchasers, with home care and clinics driving growth as self-administration models proliferate. Indication-specific analysis points to epilepsy as a foundational segment, with neuropathic pain-particularly diabetic neuropathy and postherpetic neuralgia-leading expansion, and restless leg syndrome representing a high-value niche opportunity.

This comprehensive research report categorizes the Gabapentin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Route Of Administration

- Formulation

- Dosage Form

- Distribution Channel

- End User

- Indication

Identifying Key Regional Insights Across Americas, Europe Middle East Africa, and Asia-Pacific to Illuminate Diverse Market Dynamics and Growth Potential in Gabapentin Consumption

Regional analysis of the gabapentin market reveals distinct trends across the Americas, Europe Middle East & Africa, and Asia-Pacific regions, each shaped by regulatory, economic, and demographic nuances. In the Americas, the United States remains the largest single-country market, where progressive reimbursement policies and robust healthcare infrastructure drive comprehensive coverage for neurological and pain indications. Meanwhile, Canada’s provincial formulary negotiations emphasize cost containment, stimulating generic competition and fostering value-based procurement approaches.

Transitioning to Europe Middle East & Africa, nation-specific regulatory harmonization under the European Medicines Agency streamlines generics approvals, yet individual countries maintain divergent pricing and reimbursement frameworks. Markets in Western Europe prioritize innovative delivery systems and patient support services, whereas emerging Middle Eastern and African economies face access barriers related to import regulations and distribution inefficiencies. Consequently, strategic partnerships with local distributors and tailored market entry models are imperative to unlock growth in these regions.

In Asia-Pacific, India and China serve as primary manufacturing hubs for active pharmaceutical ingredients and generics, benefiting from established contract manufacturing ecosystems and government incentives. Concurrently, expanding middle-class populations in Southeast Asia and Australasia are increasing demand for effective chronic pain and neurological treatments. Regulatory agencies in key markets such as Japan and Australia are progressively adopting international guidelines, further facilitating product launches and cross-border collaboration.

This comprehensive research report examines key regions that drive the evolution of the Gabapentin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Stakeholders and Emerging Innovators Shaping the Gabapentin Landscape Through Strategic Alliances, Pipeline Developments, and Market Positioning

Leading pharmaceutical companies and contract manufacturers have strategically positioned themselves within the gabapentin landscape by forging collaborative alliances and advancing formulation pipelines. Prominent generic producers leverage scale efficiencies and integrated supply networks to secure cost advantages, while branded developers focus on extended-release technologies and targeted patient support programs to differentiate offerings. This dual approach underscores a competitive ecosystem where cost leadership and innovation coalesce.

Furthermore, specialized CDMOs have expanded capacity for semi-solid and liquid formulation lines, responding to the growing demand for soft gelatin capsules and oral solutions. These organizations also invest in continuous manufacturing platforms to enhance process efficiency and regulatory compliance. In parallel, technology-driven entrants are exploring subcutaneous delivery systems and formulation partnerships to address emerging clinical niches, signaling an evolving market driven by both established incumbents and agile innovators.

Finally, strategic pipelines feature novel gabapentin analogs and prodrug candidates designed to optimize pharmacokinetics and reduce off-target adverse events. Partnerships with academic institutions and biotech firms are accelerating early-stage research, while licensing agreements enable rapid scale-up and commercialization. Collectively, these activities reflect a dynamic corporate landscape that balances generics volume with targeted therapeutic differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gabapentin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alkem Laboratories Ltd.

- Amneal Pharmaceuticals Inc.

- Apotex Inc.

- Ascend Laboratories LLC

- Aurobindo Pharma Limited

- Cadila Healthcare Ltd.

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- Emcure Pharmaceuticals Ltd.

- Endo International plc

- Glenmark Pharmaceuticals Ltd.

- Granules India Limited

- Hikma Pharmaceuticals PLC

- Intas Pharmaceuticals Ltd.

- Lupin Limited

- Pfizer Inc.

- Sandoz (a Novartis division)

- Strides Pharma Science Ltd

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Torrent Pharmaceuticals Ltd.

- Viatris Inc.

- Zydus Lifesciences Limited

Delivering Actionable Strategic Recommendations for Industry Leaders to Optimize Gabapentin Portfolio Performance, Enhance Market Penetration, and Navigate Regulatory Complexities

Industry leaders should prioritize the diversification of their supply chains by establishing multi-regional API procurement strategies and securing long-term partnerships with both established and alternative suppliers. Such resilience measures will mitigate the impact of potential trade policy changes and raw material shortages. Furthermore, investing in extended-release and parenteral formulation capabilities will capture emerging clinical segments and differentiate portfolios in a generic-dominated environment.

Moreover, integrating digital health solutions to monitor adherence and real-world outcomes will support value-based contracting discussions with payers and healthcare systems. By deploying smart packaging and patient engagement platforms, manufacturers can substantiate therapeutic benefits while enhancing brand loyalty. In addition, addressing the growing home care segment through customized patient support services and targeted educational initiatives will unlock new avenues for market penetration.

Finally, fostering collaborative research partnerships with biotech innovators and academic centers will catalyze the development of next-generation gabapentin analogs and prodrug approaches. These alliances should be coupled with proactive regulatory engagement to optimize approval timelines. By executing these strategic initiatives, industry leaders will strengthen competitive advantage and deliver sustained value to stakeholders across the gabapentin ecosystem.

Defining Rigorous Research Methodology Combining Primary Interviews, Secondary Data Triangulation, and Robust Analytical Frameworks to Ensure Unbiased Gabapentin Market Insights

The research methodology underpinning this analysis combines qualitative and quantitative approaches to ensure comprehensive and unbiased insights. Primary data was collected through in-depth interviews with key opinion leaders, including neurologists, pain specialists, pharmacy directors, and regulatory experts. These conversations illuminated real-world prescribing behaviors, payer dynamics, and emerging clinical preferences.

In parallel, secondary data was systematically gathered from publicly available sources such as regulatory databases, clinical trial registries, industry publications, and company financial reports. This information was triangulated to validate market trends, competitive landscapes, and regulatory developments. Quantitative models were then applied to historical sales trajectories and adoption rates, enhancing the robustness of segmentation and regional analyses.

Finally, an expert review panel comprising market access consultants, pharmacoeconomists, and manufacturing specialists conducted a thorough validation of findings. This multi-step framework ensures that the insights presented are grounded in empirical evidence and industry best practices, offering stakeholders a reliable foundation for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gabapentin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gabapentin Market, by Route Of Administration

- Gabapentin Market, by Formulation

- Gabapentin Market, by Dosage Form

- Gabapentin Market, by Distribution Channel

- Gabapentin Market, by End User

- Gabapentin Market, by Indication

- Gabapentin Market, by Region

- Gabapentin Market, by Group

- Gabapentin Market, by Country

- United States Gabapentin Market

- China Gabapentin Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Concluding Insights Emphasizing Market Maturation, Strategic Imperatives, and Future Outlook for Gabapentin Stakeholders in an Evolving Competitive Environment

In conclusion, the gabapentin market stands at a pivotal juncture characterized by sustained generic dominance, emerging formulation innovations, and evolving regulatory landscapes. As payers shift toward value-based models and digital health integration becomes mainstream, manufacturers are challenged to differentiate through advanced delivery systems and evidence-driven support programs. Moreover, supply chain resilience remains critical in the face of geopolitical and tariff-related pressures.

Moving forward, success will hinge on the ability to anticipate policy shifts, invest in patient-centric technologies, and cultivate strategic partnerships across the ecosystem. Companies that adapt their operational, clinical, and commercial strategies to this multifaceted environment will be best positioned to capitalize on growing demand for neurological and pain therapies. Ultimately, a balanced approach combining cost efficiency with targeted innovation will define the next phase of competitive advantage in the gabapentin sector.

Empowering Decision Makers with Direct Access to Tailored Gabapentin Market Research through Strategic Engagement Opportunities

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive gabapentin market research report and empower your strategic decision making with unrivaled insights and tailored data solutions

- How big is the Gabapentin Market?

- What is the Gabapentin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?