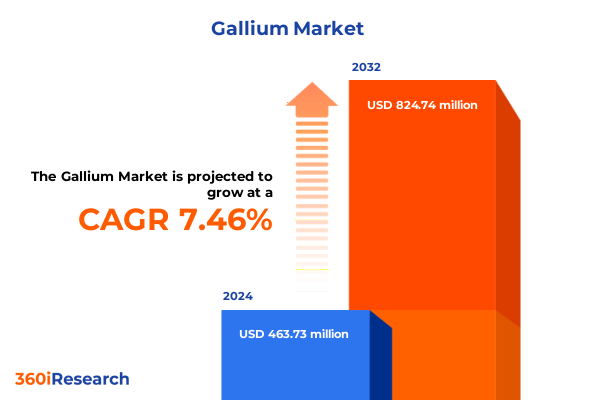

The Gallium Market size was estimated at USD 496.65 million in 2025 and expected to reach USD 532.46 million in 2026, at a CAGR of 7.51% to reach USD 824.74 million by 2032.

Exploring the Critical Role of Gallium in Advanced Technologies Across Semiconductor, Renewable Energy, and Defense Applications

Gallium, a soft metal prized for its unique semiconducting properties, has moved from a niche chemical curiosity to a linchpin of advanced technology sectors. Its two primary incarnations-gallium arsenide (GaAs) and gallium nitride (GaN)-serve as the foundation for powerful new applications, from high-efficiency power electronics to next-generation wireless communication. In GaAs form, gallium enables the lasers and photodetectors at the heart of fiber optics and optical sensors, while GaN’s wide band gap and thermal resilience underpin breakthroughs in electric vehicle charging and 5G infrastructure. Moreover, gallium’s role in LED lighting, spanning automotive headlights to industrial general illumination, underscores its cross-cutting relevance across consumer and industrial domains.

Historically, global gallium production has been concentrated in China, representing over 60 percent of refined output and shaping pricing dynamics worldwide. This concentration has prompted concerted efforts to diversify supply chains, exemplified by pioneering extraction projects at Missouri University of Science and Technology that repurpose zinc leach residue into secondary gallium sources, potentially bolstering domestic availability and reducing import reliance. Simultaneously, leading semiconductor firms have invested in high-purity gallium processing to meet the stringent demands of power electronics and defense applications, further elevating the metal’s strategic importance.

As the technological landscape shifts toward electrification, connectivity, and sustainability, gallium’s malleability, thermal stability, and performance under extreme conditions have rendered it indispensable. These factors, coupled with evolving regulatory and trade policies, set the stage for a rapidly complexifying market that demands careful navigation and proactive strategy.

Uncovering the Technological Advancements Driving Gallium Adoption from Power Electronics to High-Speed Communication and Enhanced Extraction Techniques

Recent developments have dramatically reshaped the gallium landscape, driven by both technological breakthroughs and geopolitical tensions. On the technology side, a landmark achievement occurred when a leading European semiconductor manufacturer successfully produced GaN chips on 300 mm wafers-an innovation that more than doubled chip yield per wafer and markedly reduced production costs, bringing GaN devices closer in price to legacy silicon alternatives. This milestone accelerates the adoption of GaN in electric vehicle inverters, data center power supplies, and high-frequency amplifiers for 5G networks, reinforcing gallium’s trajectory beyond laboratory curiosity to mainstream industrial material.

Simultaneously, geopolitical factors have introduced transformative supply-chain shifts. China’s restrictions on gallium exports, implemented in late 2024 in response to U.S. trade measures, have underscored the metal’s strategic value and spurred allied efforts to secure alternative sources. The prohibition compelled semiconductor manufacturers to fast-track domestic secondary recovery initiatives and intensified international collaboration to develop new mining and refining capacity. Moreover, purity grades have evolved, with high-purity gallium-meeting the 7N standard and above-becoming essential for defense photonics and semiconductor production, while lower-grade variants continue to serve LED lighting and photovoltaic applications with less stringent tolerances.

This convergence of innovation and regulation is redefining industry norms: vertical integration by chipmakers seeking to control their supply, partnerships between material specialists and OEMs to co-develop tailored gallium alloys, and a growing emphasis on sustainable extraction techniques. These shifts are forging a new paradigm in which gallium’s supply security and material performance move in lockstep, compelling stakeholders to reevaluate sourcing strategies and accelerate technology investments.

Assessing the Compound Effects of Recent U.S. Tariff Policies and Export Restrictions on Gallium Supply Chains and Domestic Production Initiatives

The U.S. government’s 2025 trade policies have cumulatively affected gallium supply dynamics by layering tariffs, revoking preferential entry terms, and prompting reciprocal export controls. In early 2025, a ten-percent tariff on imports from China, combined with the suspension of the de minimis exemption for Chinese goods, removed a longstanding relief measure for low-value shipments, directly raising the landed cost of gallium materials and components sourced from Asia. Shortly thereafter, broader proposals signaled the potential for universal tariffs of twenty percent on all imports, inciting industry concerns that gallium could lose its exemption under certain trade statutes and face levies if security reviews deem it critical.

In response to these measures, Chinese authorities in December 2024 officially banned direct exports of gallium to the United States, triggering a pronounced supply squeeze. An analysis by a prominent policy institute estimated that gallium prices could surge by more than one hundred fifty percent under a comprehensive export ban, sharply constricting availability for U.S. manufacturers and defense contractors alike. While back-channel routes through intermediary countries have partially mitigated shortages, this approach adds logistical complexity and elevates transactional risk.

As a consequence, domestic stakeholders have accelerated secondary production trials-exemplified by a zinc residue recovery project in the Midwest-and advanced new exploration efforts targeting both primary ores and mining waste. These initiatives aim to offset the tariff-driven supply constraints and realign the domestic value chain, yet they require significant capital and regulatory support to scale effectively. The interplay between policy-induced price pressures and emergent production ventures underscores a critical juncture: stakeholders must adapt to a more fragmented and politically influenced gallium ecosystem.

Deciphering Material, Purity, and Application Dimensions to Illuminate the Multifaceted Segmentation of the Gallium Landscape

The gallium ecosystem can be understood through interlocking material, quality, and application tiers that define how this metal is produced, processed, and deployed. At its core, the dichotomy between gallium arsenide and gallium nitride materials shapes the strategic direction of research and investment, with GaAs maintaining its stronghold in optoelectronics while GaN accelerates into power conversion and radio frequency amplification. This bifurcation directs suppliers to tailor their refining and crystal-growth processes to the distinct lattice structures and impurity thresholds demanded by each chemistry.

Complementing material distinctions, purity grade segmentation further delineates gallium’s commercial pathways. High-purity gallium-purified to six or more nines-serves the most exacting semiconductor, military, and aerospace applications, where even trace contaminants can compromise device performance. In contrast, lower-grade gallium remains adequate for mass-market LED lighting and thin-film photovoltaics, where cost sensitivity outweighs extreme purity requirements.

Application layers interweave these segments across a spectrum of end uses. In LED lighting, gallium’s luminescent properties enable automotive headlights, display backlighting, and broad general illumination. Optoelectronic systems leverage GaAs-based laser diodes, optical sensors, and photodetectors for precision instrumentation. Photovoltaic applications split between high-concentration solar cells-where gallium enhances conversion efficiency-and thin-film cells that promise lower manufacturing overhead. Meanwhile, the semiconductor domain spans discrete devices, integrated circuits, and power electronics, with the latter branching into power transistors and RF modules that drive next-generation wireless infrastructure.

Finally, the end-use industry matrix-ranging from aerospace and defense to telecommunications-determines demand profiles and risk tolerances. Each segment calls for customized supply strategies, whether ensuring long-term contracts for strategic military systems or optimizing cost-performance ratios for consumer electronics. Together, these interconnected groupings reveal the multifaceted nature of the gallium market and spotlight the nuanced approaches required for sustainable growth.

This comprehensive research report categorizes the Gallium market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Purity Grade

- Product Type

- Form

- Application

- End-Use Industry

- Distribution Channel

Analyzing Regional Dynamics as Americas, EMEA, and Asia-Pacific Respond to Shifting Gallium Supply Chains and Industrial Demand Drivers

Gallium’s journey through global supply chains manifests differently across the Americas, Europe-Middle East & Africa, and Asia-Pacific regions, each responding to local supply realities and demand drivers. In the Americas, recent domestic initiatives underscore a strategic pivot toward self-reliance; pioneering recovery projects in the Midwest and emerging explorations in mining-waste repositories aim to diminish historical dependence on imported gallium. Concurrently, U.S. federal investments in critical minerals and pilot production facilities are ramping up capacity, signaling government resolve to secure essential materials for high-tech and defense ecosystems.

Across the Europe-Middle East & Africa corridor, industrial powerhouses have intensified efforts to foster vertically integrated supply chains. With stringent environmental regulations and ambitious emissions targets, several European nations are co-funding gallium-refinement ventures that prioritize sustainable practices. In parallel, defense consortia in NATO framework countries view gallium as a strategic material for avionics and radar systems, prompting consortium agreements to underwrite high-purity production capacities.

Meanwhile, the Asia-Pacific region remains both the primary source and a voracious consumer of gallium-based technologies. China’s dominant refining operations continue to support a vast domestic semiconductor fabrication ecosystem, even as export curbs inject uncertainty into global trade flows. Japan and South Korea bolster research into next-generation GaN production techniques, while Southeast Asian nations cultivate partnerships to develop downstream applications. In each of these markets, the interplay of regulatory policies, industrial priorities, and technology roadmaps shapes the regional outlook and informs how stakeholders allocate investment to manage risk and opportunity.

This comprehensive research report examines key regions that drive the evolution of the Gallium market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Steering Innovation, Strategic Partnerships, and Capacity Expansion in the Global Gallium Ecosystem

A cadre of leading firms now defines the competitive dynamics of gallium supply and technology innovation. A preeminent European chipmaker has captured industry headlines by scaling GaN wafer production to 300 mm platforms, claiming a world-first that promises to reduce unit costs and accelerate deployment in power electronics. Across the Atlantic, entrepreneurial ventures at the university level are pioneering secondary recovery techniques, with pilot plants demonstrating the viability of extracting gallium from zinc processing residues, thereby laying groundwork for new sources of domestic supply.

Meanwhile, an integrated materials group in Kazakhstan has committed substantial capital to establish greenfield gallium refining operations by 2026, aiming to supply OECD markets and mitigate the concentration of global refining capacity. In the United States, semiconductor component specialists have deepened partnerships with automotive OEMs to co-develop GaN-based inverters, aligning resource procurement with long-term off-take agreements.

Technology providers in the North American and European markets are also forming alliances focused on enhancing purity-grade processes and recycling effluents to recover gallium byproducts. These collaborations blend proprietary crystal-growth expertise with rigorous quality metrics and reflect a broader trend toward vertical integration. Collectively, these company-level strategies reveal an industry pivoting from fragmented supply chains to cohesive, innovation-driven ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gallium market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALB Materials Inc.

- Aldon Corporation

- Aluminum Corporation of China Limited

- American Elements, Inc.

- AXT, Inc.

- BELMONT METALS INC.

- Cathay Advanced Materials Limited

- Chengdu Fufu Technology Co., Ltd.

- Dowa Holdings Co., Ltd.

- ESPI Metals

- Furukawa Co., Ltd.

- Gelest Inc.

- Indium Corporation

- IQE PLC

- Merck KGaA

- Mitsubishi Chemical Corp

- Nanoshel LLC

- Neo Performance Materials

- Noah Chemicals

- Noah Chemicals

- Otto Chemie Pvt. Ltd.

- RusAL

- Shenma Industrial Co., Ltd

- Shin-Etsu Chemical Co., Ltd.

- Solar Applied Materials Technology Corporation

- Strategic Metal Investments Ltd.

- Strategic Metal Investments Ltd.

- Sumitomo Electric Industries, Ltd.

- Thermo Fisher Scientific Inc.

- Umicore SA

- Vital Materials Co., Limited

- Vizag chemical international

- Zhuzhou Keneng New Material Co., Ltd.

Strategic Guidance for Executives to Navigate Supply Risks, Optimize Resource Allocation, and Advance Competitive Advantage in Gallium Technologies

To thrive amid gallium’s evolving landscape, industry leaders should pursue a diversified supply-chain strategy that balances primary mining, secondary recovery, and strategic partnerships. Securing long-term off-take agreements with refiners and OEMs can buffer against tariff volatility, while co-investment models with research institutions accelerate development of cost-effective extraction methods. Concurrently, it is essential to adopt advanced purity-control frameworks, leveraging in-line analytical techniques to ensure consistency and compliance with the most stringent application requirements.

Investing in joint ventures for fabrication capacity will enable companies to lock in favorable wafer pricing and capture scale-related efficiencies. Collaborative consortia can also engage policymakers to advocate for targeted trade exemptions and incentives that underwrite critical mineral projects. On the technology front, integrating GaAs and GaN platforms in hybrid designs may unlock new performance thresholds and broaden addressable markets.

Finally, executives should establish cross-functional task forces to monitor geopolitical developments and adapt sourcing strategies in near real time. By maintaining agile procurement processes and cultivating transparent supplier relationships, organizations can mitigate risk and capitalize on emerging regional opportunities, ensuring robust continuity of supply and sustained competitive advantage.

Detailing a Rigorous Multi-Source Methodological Framework Combining Primary Interviews, Public Data, and Expert Validation to Ensure Accuracy

This analysis draws upon a multi-layered research approach combining comprehensive secondary data collection, expert validation, and targeted primary inquiry. Publicly available documents-including government trade notices, industry press releases, and peer-reviewed technical studies-provided foundational details on production methods, material properties, and regulatory changes. To enrich the secondary insights, proprietary interviews were conducted with senior executives, materials scientists, and strategic procurement leads across major semiconductor and critical-minerals firms.

Information triangulation was achieved by cross-referencing official trade statistics, patent filings, and site-visit reports from extraction projects. Quality control measures included follow-up consultations with subject-matter experts to resolve data inconsistencies and to assess the practical implications of emerging technologies. Segmentation frameworks were applied to categorize gallium applications by material chemistry, purity grade, end-use industry, and geographical region, ensuring a structured analysis aligned with operational decision-making.

Finally, scenario planning workshops were held with industry stakeholders to evaluate the potential impacts of trade events and technology shifts. This rigorous methodology ensures that the insights presented here are robust, actionable, and reflective of the dynamic factors shaping the global gallium ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gallium market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gallium Market, by Purity Grade

- Gallium Market, by Product Type

- Gallium Market, by Form

- Gallium Market, by Application

- Gallium Market, by End-Use Industry

- Gallium Market, by Distribution Channel

- Gallium Market, by Region

- Gallium Market, by Group

- Gallium Market, by Country

- United States Gallium Market

- China Gallium Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesis of Key Insights Highlighting Gallium’s Strategic Imperatives, Emerging Opportunities, and Foundational Challenges Across Stakeholders

In conclusion, gallium has transformed from an obscure metalloid to a strategic commodity at the heart of global technology transitions. The interplay of material innovation-particularly in GaN wafer scaling and purity enhancements-and geopolitical currents has created both challenge and opportunity for stakeholders. Trade measures have exposed supply vulnerabilities, catalyzing a wave of domestic recovery projects and alternative sourcing alliances that will reshape the industry’s structure.

Meanwhile, segmentation by chemistry, purity, application, and industry end use underscores the diverse pathways through which gallium drives innovation, from high-efficiency lighting to advanced power electronics and secure communications. Regional responses-from North American pilot plants to European sustainability mandates and Asia-Pacific production dominance-further illustrate the sector’s complexity and the imperative for localized strategies.

As the gallium ecosystem continues to evolve, collaboration among technology providers, materials refiners, and policymakers will be critical to balance supply security with technological advancement. The insights herein illuminate the foundational trends and strategic considerations that will guide corporate, government, and research agendas in the years ahead.

Secure Your Insightful Gallium Market Report Today by Connecting with Ketan Rohom, the Expert Associate Director Leading Sales and Marketing Outreach

If you are poised to deepen your strategic understanding of gallium’s evolving role and capitalize on emerging opportunities, don’t hesitate to reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He can guide you through our comprehensive report, address any questions, and facilitate immediate access to the in-depth analysis and proprietary insights you need to inform critical business decisions and strengthen your competitive positioning in this dynamic market.

- How big is the Gallium Market?

- What is the Gallium Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?