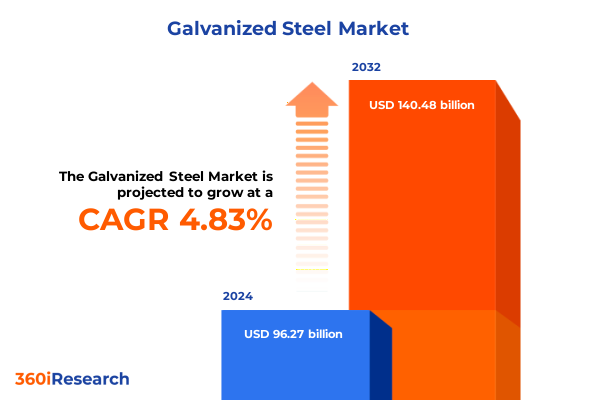

The Galvanized Steel Market size was estimated at USD 100.85 billion in 2025 and expected to reach USD 105.35 billion in 2026, at a CAGR of 4.84% to reach USD 140.48 billion by 2032.

Unveiling the Strategic Importance of Galvanized Steel in Modern Industrial Applications Amidst Evolving Manufacturing Dynamics

Galvanized steel has emerged as a cornerstone material in modern manufacturing and infrastructure, offering exceptional corrosion resistance and longevity that cater to a wide range of industrial applications. As global supply chains evolve and sustainability considerations take precedence, this versatile material enables manufacturers and engineers to achieve durability without compromising on performance. The protective zinc layer not only safeguards the structural integrity of steel components but also reduces lifecycle costs, making galvanized steel a preferred choice for organizations aiming to balance upfront investment with long-term operational efficiency.

In recent years, heightened demand for resilient infrastructure and energy-efficient systems has further elevated the profile of galvanized steel. From residential building frameworks to automotive exterior panels, its adaptability across diverse end-use segments underscores a growing recognition of its strategic value. Moreover, advances in coating technologies and process optimizations continue to enhance surface quality and uniformity, unlocking new possibilities for high-precision applications. As stakeholders navigate a complex landscape of regulatory requirements and environmental objectives, understanding the multifaceted advantages of galvanized steel becomes imperative for informed decision-making and competitive differentiation.

Against this backdrop, this executive summary synthesizes critical market dynamics, transformative shifts, and actionable insights, providing a comprehensive foundation for industry leaders seeking to capitalize on emerging opportunities within the galvanized steel sector.

Revolutionary Technological Advancements and Market Forces Dynamically Reshaping the Galvanized Steel Ecosystem Across Global Supply Chains

The galvanized steel landscape is undergoing transformative shifts driven by groundbreaking advancements in coating technologies, digital integration, and sustainability imperatives. Innovative processes such as advanced batch hot-dip techniques and continuous electrogalvanizing are redefining quality benchmarks, delivering tighter coating tolerances, and enabling manufacturers to meet stringent specifications for end-use applications. Simultaneously, the integration of Industry 4.0 tools-including real-time process monitoring, data analytics, and predictive maintenance-has enhanced operational agility, reduced downtime, and elevated overall production efficiency.

Another pivotal shift arises from the growing emphasis on circular economy principles. As regulatory bodies implement stricter carbon footprint requirements, recycled zinc utilization and eco-friendly passivation treatments are gaining traction. These developments not only mitigate environmental impact but also offer material cost advantages, fostering a competitive edge for early adopters. Furthermore, rising demand for lightweight yet durable materials in sectors such as mobility and renewable energy has propelled the adoption of tailored galvanization solutions, underscoring the need for strategic partnerships between steelmakers and coating technology providers.

Looking ahead, collaboration across the value chain will be essential to accelerate innovation and drive value creation. By embracing these transformative forces, stakeholders can anticipate shifts in market share distribution, capitalize on new application niches, and strengthen their resilience against evolving trade and regulatory landscapes.

Assessing the Far-Reaching Consequences of 2025 US Tariff Adjustments on the Galvanized Steel Industry’s Trade Dynamics and Value Chains

The introduction of new tariffs by the United States in 2025 has reshaped trade dynamics for galvanized steel imports and exports, influencing procurement strategies and cost structures across the industry. With higher levies on selected steel variants, domestic producers have gained a relative price advantage, prompting international suppliers to reassess market access and recalibrate their supply networks. Consequently, this shift has encouraged end users to explore domestic sourcing options and reinforced strategic alliances between U.S. steelmakers and key fabricators.

In light of these tariff adjustments, advanced planning and contractual agility have become paramount. Buy-side organizations now emphasize flexible agreements that allow for volume adjustments and alternative sourcing scenarios in response to evolving trade policies. This approach helps mitigate the risk of sudden price spikes and supply disruptions, while ensuring continuity for downstream manufacturing processes. Moreover, enhanced transparency in cost pass-through mechanisms supports more accurate budgeting and financial forecasting, even as tariff levels undergo periodic review.

Furthermore, stakeholders are actively monitoring legislative developments and participating in industry advocacy to influence future policy directions. By engaging with trade associations and leveraging tariff suspension filings where applicable, companies aim to secure more predictable trade frameworks. These strategies, when combined with investment in domestic galvanization capacity, offer a robust pathway to navigate the cumulative impact of 2025 tariffs and to sustain competitiveness in a complex global market.

In-Depth Insights into Sectoral and Product-Based Segmentation Trends Influencing the Landscape of the Global Galvanized Steel Market

An in-depth examination of segmentation in the galvanized steel domain reveals nuanced insights that are crucial to unlocking market potential. When viewed through the prism of end-use industry, galvanized steel demonstrates its versatility across appliances, automotive, construction, and machinery sectors. In the appliance realm, components range from consumer electronics casings to HVAC equipment and white goods, each demanding specific corrosion resistance and finish standards. The automotive segment spans commercial vehicles, electric vehicles, and passenger cars, with each subsegment driving tailored coating specifications to meet durability and aesthetic requirements. In construction, galvanized steel supports commercial buildings, infrastructure projects, and residential development, underpinning structural stability and weather resistance. Machinery applications, including agricultural machinery, industrial equipment, and mining systems, further highlight the material’s adaptability to heavy-duty operational environments.

Exploring product types deepens our understanding of performance differentiation. Electrogalvanized offerings, whether barrel or rack-coated, deliver precise thickness control, while hot-dip variants, produced via batch or continuous methods, offer robust protective layers. Pre-galvanized solutions, either batch or mill-galvanized, cater to high-volume manufacturing contexts. In terms of form, coil, sheets and plates, and wire formats each align with distinct fabrication processes and end-user assembly requirements, ensuring optimal material utilization. Meanwhile, coating types such as dual zinc iron, pure zinc, zinc alloys, and zinc aluminum blends present a spectrum of corrosion resistance profiles. Variations in coating weight-from 40 to 80 grams per square meter up to above 120 grams-allow for tailored performance balancing durability with material efficiency. Thickness categories of up to 0.4 millimeters, 0.4 to 1 millimeter, and above 1 millimeter further refine application suitability, while distribution channels encompassing direct sales, distributors, and OEM partnerships shape go-to-market strategies and customer engagement models.

Collectively, these segmentation insights offer a multidimensional view of market dynamics, revealing growth levers and guiding product development, production planning, and strategic positioning across the galvanized steel value chain.

This comprehensive research report categorizes the Galvanized Steel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Coating Type

- Thickness

- End Use Industry

- Distribution Channel

Comprehensive Regional Perspectives Revealing Distinct Growth Drivers and Challenges Affecting Galvanized Steel Demand in Key Global Markets

Regional dynamics play an instrumental role in shaping galvanized steel demand and supply realities, driven by distinct economic, regulatory, and infrastructural factors. In the Americas, demand is fueled by robust infrastructure investments and a resurgence in automotive production, supported by government incentives for electric vehicle adoption. North America’s emphasis on domestic manufacturing has led to capacity expansions and collaborative ventures to meet localized requirements, while South American markets show strong potential in agricultural and construction applications.

Across Europe, the Middle East, and Africa, stringent environmental regulations and sustainability mandates are driving innovation in coating processes and recycled zinc usage. European markets emphasize circular economy principles, prompting investments in eco-friendly galvanization technologies. The Middle East’s infrastructure boom and large-scale construction projects are creating significant pull for corrosion-resistant structural materials, while African markets, though emerging, present opportunities in mining equipment and residential development as urbanization accelerates.

In the Asia-Pacific region, rapidly growing infrastructure networks and expanding automotive and appliance industries sustain high volumes of galvanized steel consumption. China remains a central hub with extensive production capabilities, whereas Southeast Asian economies are increasing capacity to serve both domestic and export markets. Japan and South Korea focus on high-precision coatings for electronics and automotive components, underpinned by continuous process improvement and technological leadership.

Collectively, these regional insights underscore the importance of tailored market strategies that align with localized drivers, regulatory landscapes, and application trends, guiding stakeholders toward targeted investments and collaborative initiatives.

This comprehensive research report examines key regions that drive the evolution of the Galvanized Steel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Analysis of Leading Industry Participants Driving Innovation and Competitive Dynamics in the Global Galvanized Steel Sector

The competitive landscape of galvanized steel is characterized by a blend of legacy producers and emerging innovators, each leveraging distinct capabilities to capture market share. Established steelmakers continue investing in capacity expansions and vertical integration, securing raw material supply while enhancing downstream coating operations. Their scale advantages support cost leadership, enabling competitive pricing in high-volume segments.

Simultaneously, specialized galvanizers focus on niche applications and advanced coating technologies, differentiating through surface quality, precision thickness control, and tailor-made corrosion resistance profiles. These firms often collaborate closely with OEM customers in automotive and electronics to co-develop solutions that meet exacting performance criteria. Strategic mergers and acquisitions have emerged as a key tactic, allowing companies to broaden geographic reach and integrate complementary technology portfolios.

Innovation partnerships between steel producers, chemical suppliers, and research institutions are accelerating the deployment of next-generation coating chemistries and environmentally benign treatment processes. Such collaboration enhances product offerings and aligns with global sustainability goals, appealing to environmentally conscious end users. Competitive dynamics also reflect a shift toward digitalization, as leading players adopt advanced analytics and automation to optimize yield, minimize waste, and improve quality consistency.

As a result, companies that strike the right balance between scale efficiency, technological differentiation, and customer intimacy are poised to lead the market. Understanding the strategies and capabilities of these key participants provides a roadmap for navigating competitive pressures and forging strategic alliances.

This comprehensive research report delivers an in-depth overview of the principal market players in the Galvanized Steel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AK Steel Holding Corporation

- Ansteel Group

- ArcelorMittal S.A.

- Baoshan Iron & Steel Co., Ltd.

- BlueScope Steel Limited

- China Steel Corporation

- Evraz Group

- Gerdau

- HBIS Group Co., Ltd

- Hyundai Steel Co., Ltd.

- JFE Holdings, Inc.

- Jindal Steel and Power Ltd.

- JSW Steel Ltd.

- Liberty Steel Group

- Nippon Steel Corporation

- Nucor Corporation

- POSCO

- SSAB AB

- Steel Dynamics, Inc.

- Tata Steel Limited

- thyssenkrupp Steel Europe AG

- United States Steel Corporation

- Voestalpine AG

Actionable Strategic Recommendations to Empower Industry Leaders in Enhancing Operational Efficiency and Market Competitiveness

To thrive amidst evolving market conditions and intensifying competition, industry leaders must pursue a multifaceted strategic agenda that emphasizes technological investment, supply chain resilience, and customer-centric solutions. It is imperative to allocate resources toward advanced galvanization processes that enhance coating uniformity and environmental compliance, thereby meeting stringent regulatory requirements and end-user expectations. Equally important is the integration of digital tools, such as process monitoring systems and data analytics platforms, to preemptively identify inefficiencies and streamline production workflows.

Moreover, forging deeper partnerships throughout the value chain can unlock cost synergies and foster collaborative innovation. By aligning closely with raw material suppliers, chemical providers, and OEM customers, companies can co-create tailored offerings, share risk, and accelerate time-to-market for new products. Concurrently, diversifying sourcing strategies and expanding domestic capacity will mitigate exposure to trade policy fluctuations, ensuring consistent supply and stable pricing.

Finally, differentiating through service excellence and sustainable practices can strengthen brand reputation and customer loyalty. Offering end-to-end support-from materials consultation to technical application guidance-empowers clients to optimize product performance while reducing environmental impact. Collectively, these actionable recommendations form a robust blueprint for reinforcing competitive positioning and driving profitable growth in the galvanized steel industry.

Robust and Transparent Research Methodology Underpinning the Rigorous Analysis of Market Trends and Industry Insights in Galvanized Steel

The insights presented in this executive summary are grounded in a comprehensive research methodology designed to ensure accuracy, reliability, and transparency. Primary research involved structured interviews with a diverse cross-section of industry stakeholders, including steel producers, galvanization specialists, OEMs, and regulatory bodies. These dialogues provided firsthand perspectives on technology adoption, trade policy impacts, and end-use requirements. Concurrently, secondary research encompassed an extensive review of technical publications, industry reports, and regulatory filings, enabling triangulation of data and validation of emerging trends.

Quantitative analysis drew upon proprietary databases and historical shipment statistics to identify shifts in production volumes, capacity utilization, and trade flows. Data normalization and consistency checks were applied to reconcile discrepancies across sources. Qualitative evaluations examined technological roadmaps, joint ventures, and capital expenditure announcements to assess innovation trajectories and competitive positioning. Additionally, scenario analysis was conducted to explore potential outcomes of tariff policy adjustments and supply chain disruptions, highlighting strategic inflection points.

Throughout the research process, stringent quality control measures ensured methodological rigor. Findings were peer-reviewed by subject matter experts and underwent iterative refinement to eliminate bias and enhance clarity. This robust methodology underpins the actionable insights and recommendations offered, delivering a trusted foundation for stakeholders seeking informed decision-making within the galvanized steel landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Galvanized Steel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Galvanized Steel Market, by Product Type

- Galvanized Steel Market, by Form

- Galvanized Steel Market, by Coating Type

- Galvanized Steel Market, by Thickness

- Galvanized Steel Market, by End Use Industry

- Galvanized Steel Market, by Distribution Channel

- Galvanized Steel Market, by Region

- Galvanized Steel Market, by Group

- Galvanized Steel Market, by Country

- United States Galvanized Steel Market

- China Galvanized Steel Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Consolidated Perspectives on Galvanized Steel’s Evolutionary Trajectory and Its Implications for Industry Stakeholders and Decision Makers

In summary, galvanized steel remains a pivotal material that delivers unparalleled corrosion protection and lifecycle value across diverse industrial applications. The confluence of advanced coating technologies, digital integration, and sustainability imperatives is driving significant transformation within the sector. Stakeholders must navigate the cumulative impact of trade policy shifts, such as the 2025 U.S. tariffs, while capitalizing on segmentation, regional dynamics, and competitive strategies to maintain an edge.

By embracing a holistic approach that combines technological innovation, strategic partnerships, and operational excellence, industry players can unlock new avenues for growth and resilience. The multidimensional segmentation insights emphasize the importance of aligning product portfolios with specific end-use requirements, while regional analysis highlights tailored strategies for key markets. Competitive intelligence underscores the need for scale efficiency and customer intimacy, and actionable recommendations provide a clear pathway to bolstering market positioning.

Ultimately, decision makers who leverage these consolidated perspectives will be better equipped to respond to emerging challenges and seize opportunities in the galvanized steel value chain. With rigorous research as the bedrock, organizations can confidently formulate strategies that deliver sustainable success and long-term value.

Engaging Call to Collaborate with Ketan Rohom to Secure Comprehensive Galvanized Steel Market Intelligence and Drive Strategic Growth

To stay at the forefront of the galvanized steel market, industry stakeholders are invited to partner with Ketan Rohom, Associate Director of Sales & Marketing, who offers personalized consultations to address specific business challenges and growth objectives. Engaging directly with Ketan provides an opportunity to explore tailored solutions, receive in-depth insights, and gain access to proprietary data sets that illuminate emerging trends and competitive strategies.

By initiating a dialogue, organizations can leverage expert guidance on market entry approaches, supply chain optimization, and end-use application diversification. Ketan’s consultative framework is designed to translate complex market intelligence into actionable roadmaps that align with corporate goals and operational realities.

Whether refining product portfolios, entering new geographic territories, or enhancing sustainability credentials, this collaboration lays the groundwork for informed decision-making and accelerated value creation. Reach out to Ketan Rohom to secure your copy of the comprehensive galvanized steel market research report and unlock strategic pathways for robust market positioning.

- How big is the Galvanized Steel Market?

- What is the Galvanized Steel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?