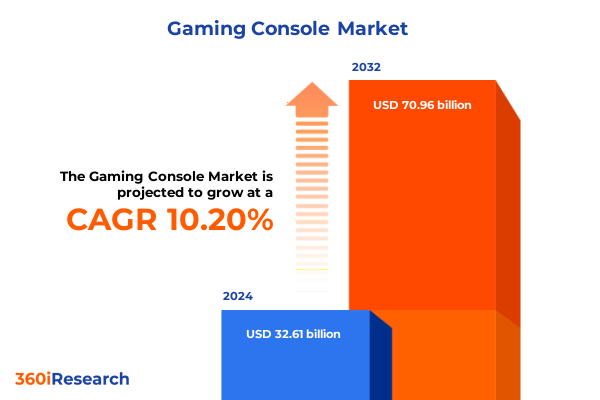

The Gaming Console Market size was estimated at USD 35.91 billion in 2025 and expected to reach USD 39.54 billion in 2026, at a CAGR of 10.21% to reach USD 70.96 billion by 2032.

Setting the Stage for the Next Evolution in Gaming Consoles: Market Dynamics, Consumer Expectations, and Innovation Drivers Shaping 2025 and Beyond

The gaming console industry has entered a pivotal juncture marked by accelerated innovation and evolving consumer behaviors, setting the stage for a new era of interactive entertainment. Fueled by advancements in processing power, graphics fidelity, and online connectivity, console manufacturers are increasingly focused on delivering immersive experiences that extend beyond traditional living-room setups. Consequently, the boundaries between hardware, software, and services have blurred, creating an environment where ecosystem strength is as critical as device capabilities.

Moreover, the rise of digital distribution and subscription models has transformed the way players access games, reducing reliance on physical media and elevating the importance of seamless platform integration. As a result, there is a growing demand for consoles that not only provide cutting-edge performance but also serve as hubs for cloud-streaming, social engagement, and cross-platform play. This convergence of technology and user expectations underscores the necessity for stakeholders to adopt a holistic view of the market landscape.

Throughout this executive summary, readers will discover an in-depth exploration of transformative market shifts, tariff implications, and segmentation and regional insights. Additionally, we highlight leading industry players and outline strategic recommendations crafted to help decision makers navigate an increasingly competitive and complex environment. In essence, this report equips executives with the knowledge required to make informed, forward-looking decisions in the rapidly evolving realm of gaming consoles.

Identifying Pivotal Transformative Shifts Reshaping the Gaming Console Landscape Through Technological Advances and Consumer Behavior Trends

The gaming console landscape has undergone dramatic transformation as cloud gaming infrastructures, subscription ecosystems, and cross-platform compatibility have emerged as key competitive differentiators. In recent years, major players have shifted investment towards edge computing and server-side rendering, enabling high-fidelity experiences on less powerful devices. As a result, developers are experimenting with titles that seamlessly transition between handheld, home, and mobile environments, effectively dissolving previous hardware silos.

Additionally, consumer behavior has shifted towards community-driven content and continuous engagement. Live services that offer episodic content releases and user-generated modifications are now central tenets of modern console lifecycles. Consequently, manufacturers are prioritizing modular architectures and over-the-air updates to maintain relevance in a landscape where longevity hinges on ongoing feature enhancements.

Furthermore, sustainability considerations have risen to prominence, with an increasing emphasis on energy-efficient designs and recyclable materials. This trend is catalyzing partnerships between console makers and component suppliers to innovate in power management and end-of-life retrieval. Thus, the industry is not only redefining entertainment paradigms but also embracing environmental responsibility as a core strategic pillar.

Assessing the Cumulative Impact of Newly Imposed United States Tariffs on Gaming Console Components and End User Pricing Structures in 2025

In early 2025, the United States government enacted a new set of tariffs targeting key semiconductor components and printed circuit board assemblies integral to console manufacturing. These measures have raised input costs for console OEMs, prompting re-examination of global supply chains and cost-optimization strategies. As each additional duty is applied at the port of entry, manufacturers face pressure to absorb expenses, renegotiate supplier contracts, or explore alternative sourcing locations in Southeast Asia and Latin America.

Moreover, the tariff landscape has accelerated the adoption of localized manufacturing and assembly operations to mitigate import duties. Several console makers have announced strategic partnerships with regional foundries and electronics assemblers, aiming to develop near-shore capabilities. However, the transition to localized production requires capital investment and time, creating near-term uncertainty for production schedules and component availability.

Consequently, end user pricing structures may experience incremental adjustments, depending on each manufacturer’s ability to offset higher costs through operational efficiencies or new revenue streams. Retail channels are also adapting promotional strategies to balance consumer affordability with margin preservation. Overall, the cumulative impact of tariffs in 2025 underscores the importance of agile supply chain management and proactive policy engagement to sustain profitability in a fluctuating trade environment.

Unlocking Key Segmentation Insights: Console Types, Distribution Channels, and End User Profiles Driving Market Differentiation

When evaluating product offerings, console type segmentation reveals distinct growth dynamics across handheld, home, and hybrid platforms. Handheld consoles, subdivided into next-generation and previous-generation form factors, continue to appeal to on-the-go gamers seeking portability and battery optimization. Next-generation handhelds integrate advanced chipsets drawn from flagship mobile processors, while earlier models maintain relevance through established game libraries and cost-effective hardware.

In contrast, home consoles are bifurcated between next-generation systems boasting ray-tracing and custom SSD architectures and previous-generation platforms that sustain budget-conscious households and emerging markets. As the performance gap widens, device ecosystems are increasingly differentiated by exclusive titles and service bundling rather than raw hardware supremacy. Hybrid consoles, which merge home docking capabilities with handheld mobility, are carving out a unique niche that leverages both physical and digital distribution capabilities.

Distribution channel segmentation further distinguishes market penetration strategies between brick-and-mortar retail and direct-to-consumer online platforms. Offline channels remain vital for gift purchases and hands-on demonstrations, whereas online marketplaces offer immediate digital downloads, bundled subscriptions, and dynamic pricing models. Meanwhile, end user segmentation into casual, hardcore, and professional cohorts informs content curation, pricing tiers, and community engagement tactics. Casual players prioritize ease of access and social connectivity, while hardcore enthusiasts demand performance and depth, and professional gamers require precision peripherals and service level agreements that guarantee uptime and tournament-ready features.

This comprehensive research report categorizes the Gaming Console market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Console Type

- Distribution Channel

- End User

Mapping Regional Dynamics Across Americas, Europe Middle East Africa, and Asia Pacific to Reveal Growth Catalysts and Adoption Patterns in Gaming Consoles

The Americas region exhibits strong uptake of next-generation home and hybrid consoles, underpinned by established retail networks and high-speed broadband penetration. Consumers in North America, in particular, are responsive to subscription bundles that integrate streaming media and game libraries, reinforcing the trend towards platform convergence.

Meanwhile, Europe, the Middle East, and Africa demonstrate heterogeneity in price sensitivity and localized content preferences. Western European markets lean towards premium console variants with robust digital marketplaces, while emerging economies in the Middle East and Africa rely on cost-effective previous-generation hardware supported by offline distribution partners. Localization of user interfaces and region-specific licensing agreements remain critical to driving engagement across these diverse territories.

In the Asia-Pacific landscape, handheld and hybrid consoles enjoy pronounced popularity, with an emphasis on mobile network integration and curated e-sports experiences. Key markets such as Japan and South Korea showcase a predilection for handheld gaming rooted in established cultural habits, whereas Southeast Asian countries are rapidly expanding their digital storefronts. Regional OEM partnerships and local content development continue to shape adoption curves, making Asia-Pacific a hotbed for innovation in form factors and service delivery.

This comprehensive research report examines key regions that drive the evolution of the Gaming Console market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Influencers in the Gaming Console Sector to Understand Competitive Strategies and Technological Leadership

A handful of technology titans remain at the forefront of console innovation, with strategies centered on exclusive content, platform ecosystems, and hardware differentiation. Sony continues to leverage its proprietary graphics architectures and a deep portfolio of first-party studios to reinforce brand loyalty and drive premium pricing tiers. Microsoft has expanded its cloud gaming infrastructure and subscription services to blur the line between home consoles and PC ecosystems, fostering a cross-device continuum.

Nintendo distinguishes itself through a unique approach to motion controls, family-friendly franchises, and hybrid device form factors, cultivating widespread brand affection across multiple demographics. Simultaneously, emerging players like Valve are disrupting the landscape with open-platform philosophies and modular hardware designs that enable user-driven customization. Meanwhile, technology companies from outside the traditional console space are exploring ecosystem expansions, with semiconductor firms and cloud service providers partnering to deliver next-level graphics performance and streaming reliability.

Competitive dynamics are further influenced by strategic acquisitions of development studios and investments in proprietary middleware, reinforcing the critical link between hardware capabilities and software experiences. Consequently, ecosystem strength-measured by title diversity, online services, and developer support-has become as vital as silicon performance in defining market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gaming Console market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Activision Blizzard

- Analogue, Inc.

- Atari Inc.

- Atari SA

- Capcom Co. Ltd.

- Cooler Master Co. Ltd.

- Corsair Components Inc.

- Dell Technologies

- Gameloft SE

- Hyperkin, Inc.

- HyperX

- Intellivision Entertainment, LLC

- Logitech Inc.

- Mad Catz Global Ltd.

- Microsoft Corp.

- Nintendo Co. Ltd.

- NVIDIA Corporation

- Ouya Inc.

- PlayJam

- Redragon

- Republic of Games

- Rockstar Games Inc.

- Sega Holdings Co. Ltd.

- SNK CORPORATION

- Sony Corp.

- Sony Interactive Entertainment LLC

- SteelSeries

- Ubisoft Entertainment SA

- Valve Corporation

Articulating Actionable Strategic Recommendations for Industry Leaders to Navigate Disruption, Enhance Consumer Engagement, and Accelerate Growth Trajectories

Industry leaders must embrace a multifaceted approach to thrive in a rapidly evolving console environment. First, diversifying distribution strategies by enhancing both retail partnerships and direct-to-consumer digital storefronts will optimize audience reach and revenue resiliency. At the same time, investing in advanced cloud-streaming and edge-computing technologies can expand player access while reducing dependence on high-end hardware iterations.

Furthermore, optimizing supply chain agility through near-shore manufacturing alliances and strategic component buffer stocks can mitigate tariff-related disruptions. Concurrently, strengthening community engagement via live events, user-generated content platforms, and subscription loyalty programs will deepen brand affinity among casual, hardcore, and professional cohorts alike. In addition, cultivating modular upgrade paths and scalable hardware architectures can extend device lifecycles and reduce the total cost of ownership for end users.

Finally, forging regional partnerships for localized content creation and distribution ensures relevance across Americas, EMEA, and Asia-Pacific markets. By proactively collaborating with local developers, network operators, and government agencies, console manufacturers can navigate regulatory frameworks, accelerate market entry, and tailor experiences that resonate with diverse player communities.

Outlining a Robust Research Methodology Blending Qualitative and Quantitative Approaches to Ensure Comprehensive and Reliable Market Insights

The insights presented in this executive summary are grounded in a rigorous research framework that integrates both qualitative interviews and quantitative data analysis. Primary research included in-depth discussions with senior executives across console manufacturers, component suppliers, and distribution partners to capture firsthand perspectives on supply chain dynamics and strategic investments.

In parallel, extensive consumer surveys were administered globally to identify usage patterns, platform preferences, and price sensitivity across casual, hardcore, and professional gamer segments. Secondary data sources, including trade publications, financial disclosures, and industry databases, were systematically reviewed to validate emerging trends and provide contextual depth. To ensure methodological robustness, findings from diverse data streams were triangulated, highlighting recurring themes and mitigating potential biases.

Additionally, regional workshops were conducted in key markets to refine interpretations of localization needs and regulatory considerations within the Americas, EMEA, and Asia-Pacific territories. The combination of empirical evidence and stakeholder insights underpins the reliability of this report’s conclusions, empowering decision makers to navigate the complex gaming console ecosystem with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gaming Console market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gaming Console Market, by Console Type

- Gaming Console Market, by Distribution Channel

- Gaming Console Market, by End User

- Gaming Console Market, by Region

- Gaming Console Market, by Group

- Gaming Console Market, by Country

- United States Gaming Console Market

- China Gaming Console Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Concluding Insights Summarizing Critical Findings and Highlighting Strategic Imperatives for Stakeholders in the Evolving Gaming Console Ecosystem

In summary, the gaming console industry stands at a crossroads defined by rapid technological innovation, shifting consumer expectations, and an increasingly complex trade landscape. The emergence of cloud-based services and subscription models is reshaping the competitive field, while new tariffs have underscored the critical importance of supply chain diversification and cost management. Segmentation analysis reveals nuanced opportunities across handheld, home, and hybrid form factors, with distribution channels and end user profiles further informing differentiated strategies.

Regional insights highlight the Americas’ appetite for premium offerings, EMEA’s diversity in price sensitivity and localization, and Asia-Pacific’s leadership in mobile and hybrid adoption. Competitive benchmarks demonstrate that ecosystem strength, developer partnerships, and exclusive content portfolios are as essential as hardware capabilities. Consequently, actionable recommendations emphasize distribution optimization, cloud investment, community engagement, and regional alliances as cornerstones for sustainable growth.

By synthesizing these findings, this executive summary provides a strategic blueprint for stakeholders seeking to capitalize on the market’s dynamic trajectory. The insights herein form the foundation for informed decision making, ensuring alignment between organizational objectives and emerging industry imperatives.

Driving Investment Decisions with a Targeted Call to Action Offering Direct Engagement Opportunities for Acquiring the Complete Comprehensive Market Research Report

To access the full-depth strategic analysis, comprehensive data tables, and exclusive expert interviews detailing the current and future state of the gaming console industry, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. By engaging with Ketan, you will gain personalized guidance on how the report’s insights can support your specific organizational objectives, whether that involves refining product roadmaps, optimizing go-to-market strategies, or exploring partnership opportunities.

Our team ensures that each client receives tailored recommendations alongside the standard report, including one-on-one briefing sessions and priority updates as new data emerges in 2025. Secure your copy today to capitalize on early access to emerging trend forecasts, detailed competitive benchmarking, and regional growth analyses that can inform critical investment and expansion decisions.

Connect with Ketan to discuss volume licensing options, enterprise deployment, or bespoke add-ons such as custom slide decks and data exports. Elevate your strategic planning process with a report that delivers not just information, but actionable intelligence crafted for decision makers committed to staying at the forefront of the dynamic gaming console ecosystem.

- How big is the Gaming Console Market?

- What is the Gaming Console Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?