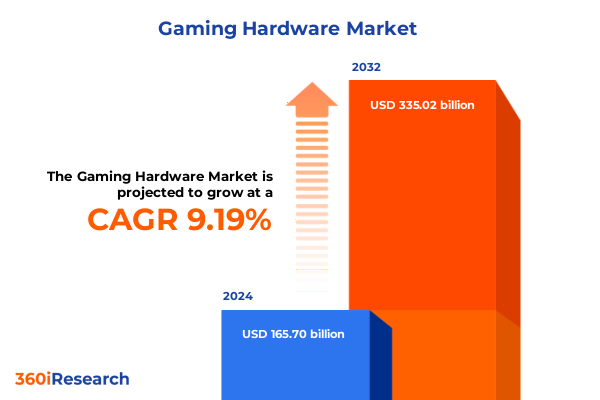

The Gaming Hardware Market size was estimated at USD 180.04 billion in 2025 and expected to reach USD 195.63 billion in 2026, at a CAGR of 9.27% to reach USD 335.02 billion by 2032.

Exploring the Modern Gaming Hardware Ecosystem Amid Rapid Technological Innovations, Diverse Consumer Demands, and Geopolitical Tariff Challenges Shaping Future Growth

The gaming hardware sector is experiencing an unprecedented convergence of cutting-edge performance and geopolitical complexity that is reshaping how companies innovate and bring products to market. High-performance graphics cards like NVIDIA’s GeForce RTX 50 series leverage the Blackwell architecture to deliver fourth-generation ray tracing and AI-driven rendering capabilities, redefining visual fidelity and enabling developers to craft ever more immersive experiences for both enthusiasts and competitive gamers. At the same time, escalating trade tensions and the imposition of steep U.S. tariffs on electronics imports have created notable supply chain disruptions, prompting industry leaders such as Nintendo to postpone U.S. console preorders amid rising input costs and logistical uncertainty.

Meanwhile, peripherals and immersive hardware are undergoing their own paradigm shifts. On the one hand, wireless gaming mice, headsets, and keyboards are attaining near-zero latency and extended battery lifespans, as breakthroughs in polling-rate optimization and power efficiency remove the performance gap between wired and wireless solutions. On the other hand, the boundaries between gaming and spatial computing are blurring, with vendors such as Meta rapidly scaling AI-powered smart glasses, while companies like Apple explore dedicated controllers to elevate the Vision Pro’s viability for interactive gaming.

Against this backdrop of rapid technological innovation and complex trade policy, it is essential for stakeholders across the ecosystem to understand the forces redefining product development, distribution channels, consumer segmentation, and regional demand. By examining these converging trends, decision-makers can identify strategic opportunities, anticipate market headwinds, and forge competitive advantages in a landscape marked by accelerating change.

Uncovering How Cutting-Edge Innovations Like AI-Enhanced GPUs, Wireless Peripherals, and Mixed Reality Are Revolutionizing Gaming Hardware Experiences

The gaming hardware landscape has been fundamentally transformed by the advent of AI-enhanced GPUs that deliver unprecedented processing power for real-time ray tracing, deep-learning upscaling, and adaptive shading. NVIDIA’s GeForce RTX 50 series, built on the Blackwell architecture and fabricated on a custom TSMC 4N process, debuted in early 2025 and signaled a leap forward in both graphics fidelity and computational versatility, enabling developers to integrate more sophisticated physics, AI-driven features, and realistic lighting in their titles. This generational upgrade underscores how semiconductor innovation continues to drive the envelope of what is possible in interactive entertainment.

Simultaneously, gaming peripherals have entered a new era of wireless performance parity. Breakthroughs in chipset design and high-frequency polling techniques now allow wireless mice and headsets to rival or even surpass the responsiveness of their wired counterparts, freeing gamers from cable clutter without sacrificing precision. Industry reports describe how ultra-low latency wireless solutions and optimized battery management systems are redefining user expectations for comfort and freedom of movement, prompting leading peripheral makers to expand their wireless portfolios to meet evolving consumer preferences.

Beyond traditional peripherals, immersive hardware is experiencing transformative convergence with spatial computing. Meta’s AI-powered Wayfarer smart glasses have achieved multi-million unit sales since 2023, demonstrating a growing market appetite for augmented interactions and hands-free experiences that complement gaming and everyday tasks. At the same time, the Apple Vision Pro platform is exploring integrations with dedicated gaming controllers to enhance interactivity and address current limitations in hand-tracking, signaling a strategic push toward more immersive console-style experiences on mixed-reality headsets. These developments illustrate how the hardware landscape is expanding far beyond traditional consoles and PCs, ushering in new modalities for play and social engagement.

Analyzing the Far-Reaching Effects of Recent Tariff Policies on Gaming Hardware Supply Chains, Pricing Strategies, and Consumer Accessibility

Recent U.S. tariff policies have had a tangible and compounding impact on gaming hardware manufacturers, distributors, and end users. In early 2025, the Trump administration imposed duties ranging from 24 percent to nearly 50 percent on electronics imports from key manufacturing hubs such as Vietnam, Cambodia, and Japan, prompting Nintendo to delay U.S. preorder availability for its forthcoming Switch 2 console due to the sudden spike in import costs and market uncertainty. These levies have forced companies to reconsider pricing strategies and raise retail prices, potentially dampening consumer demand.

Moreover, tariff-driven cost increases have reverberated through the PC gaming ecosystem. Leading system builders and component vendors have publicly acknowledged plans to relocate manufacturing out of China or adjust end-user pricing by upwards of 10 percent to offset the burden of import taxes. Prominent modular laptop and PC vendors temporarily paused U.S. sales of certain models to recalibrate pricing, while others embarked on geographic diversification of their supply chains, shifting production to Mexico, Taiwan, and Southeast Asia as a hedge against sudden tariff escalations.

Beyond consoles and PC systems, accessories and peripherals have also felt the squeeze. Controllers, headsets, keyboards, and racing wheels-often manufactured or assembled abroad-now carry additional tax burdens that are being passed through to consumers. This rise in peripheral prices risks suppressing attach rates, as budget-conscious gamers delay purchases of supplementary gear. As a result, industry participants are exploring innovative logistics strategies, tariff mitigation tactics, and collaborative advocacy efforts to influence trade policy, reduce duty exposure, and maintain affordability in the face of geopolitical headwinds.

Delving into Diverse Product, Connectivity, Consumer, and Distribution Segmentation to Illuminate Critical Market Dynamics

Market segmentation provides the foundation for understanding where growth opportunities and competitive pressures intersect. Examining the gaming hardware space through the lens of product type reveals a spectrum of diverse segments, from immersive VR headsets to high-performance GPUs. Within accessories, subcategories such as controllers, headsets, keyboards, mice, and racing wheels respond to very different usage patterns, from casual mobile play to high-intensity simulation, illuminating the need for tailored design and marketing approaches.

Connectivity type adds another dimension, distinguishing wired solutions-ranging from USB peripherals to audio jack headsets-from hybrid and fully wireless options utilizing Bluetooth or RF. Gamer demand for untethered experiences drives wireless innovation, while professional and esports environments often favor the deterministic latency of wired connections. These diverging preferences underscore how connectivity choices can shape both product roadmaps and channel strategies.

Consumer segmentation further refines the market picture. Casual gamers, who may oscillate between mobile and occasional gameplay, have different feature priorities and price sensitivities than console and PC enthusiasts, who seek cutting-edge performance. At the high end, professional content creators and esports athletes place a premium on specialized hardware optimized for reliability, low latency, and customization, driving demand for purpose-built peripherals that enable digital creators and competitive players to excel.

Finally, distribution channel segmentation highlights the interplay between offline and online sales. Traditional brick-and-mortar outlets-such as electronics superstores, general retail outlets, and specialty gaming boutiques-offer tactile product trial opportunities and instant gratification, while e-commerce platforms and manufacturer direct channels leverage convenience, breadth of selection, and data-driven personalization. Successful go-to-market strategies account for the unique advantages and limitations of each channel, ensuring that product launches and promotional programs resonate across the full spectrum of customer touchpoints.

This comprehensive research report categorizes the Gaming Hardware market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connectivity Type

- Consumer Type

- Distribution Channel

Identifying Vital Regional Characteristics and Market Drivers Across Americas, Europe Middle East & Africa, and Asia Pacific for Strategic Positioning

The Americas region encompasses not only the United States but also Canada, Mexico, and key Latin American markets, each characterized by strong consumer appetite for immersive gaming experiences and a mature console and PC infrastructure. In the United States, revenue in the VR hardware segment is projected to reach US$2.7 billion in 2025, underpinned by increasing user penetration and high average revenue per user, signaling robust consumer engagement in both entertainment and enterprise applications.

Europe, the Middle East & Africa presents a more heterogeneous landscape, with Western European markets such as Germany and the United Kingdom driving adoption through robust esports scenes and a strong tradition of hardware innovation. Germany’s industrial applications of virtual reality and the UK’s enduring gaming culture both contribute to a vibrant hardware ecosystem, while emerging markets across Eastern Europe, the Middle East, and Africa display growing potential as broadband access expands and consumer purchasing power evolves.

Asia Pacific remains the epicenter of both gaming hardware manufacturing and consumption. Regional players benefit from deep semiconductor and electronics supply chains, with China, Japan, South Korea, and Taiwan leading in production capacity. At the same time, consumers across Asia Pacific are among the earliest adopters of new gaming technologies, contributing to an environment of rapid product iteration and intense competition. As evidence of this dynamic, Asia Pacific accounted for more than half of global VR headset revenue in 2024, a testament to its central role in shaping the future of immersive experiences.

This comprehensive research report examines key regions that drive the evolution of the Gaming Hardware market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Moves by Leading Hardware Manufacturers and Emerging Innovators Redefining Competitive Dynamics Across the Gaming Ecosystem

Leading hardware manufacturers are executing bold strategies to maintain leadership and capture new segments. NVIDIA’s introduction of the GeForce RTX 50 series dramatically expanded its addressable market by integrating AI inferencing capabilities alongside graphics acceleration, positioning the company at the forefront of next-generation gaming and professional workloads. Competitors such as AMD and Intel are responding with their own multi-architecture approaches, while niche innovators explore ARM-based designs as a means of reducing power consumption and heat generation in portable form factors.

In the peripherals domain, companies like Razer, Logitech, Corsair, and HyperX are differentiating through advances in sensor technology, customizable ergonomics, and seamless software ecosystems. The rise of proprietary sensors capable of ultra-high DPI and polling rates has fueled a wave of wireless mouse introductions that compete directly with wired benchmarks, reflecting consumers’ willingness to pay premiums for both performance and convenience. At the same time, headset makers are investing in spatial audio, noise-cancellation, and multipoint connectivity to address the needs of both hardcore gamers and professional streamers.

Console manufacturers continue to navigate complex supply chains and tariff pressures. Nintendo’s decision to delay Switch 2 preorders in the United States highlighted the sensitivity of manufacturing footprints to sudden duty increases and underscored the importance of diversified production networks. Microsoft and Sony are likewise exploring nearshoring alternatives, forging partnerships in Mexico and Southeast Asia to mitigate future trade-policy risks and preserve global competitiveness.

Emerging entrants and niche innovators are also reshaping competitive dynamics. Companies such as Framework and 8BitDo have demonstrated agility in adapting distribution models and pricing to address tariff-driven disruptions, while specialty vendors in the simulation and racing segment are expanding into new experiences-ranging from HC-grade steering systems to haptic-enabled flight controls-underscoring the importance of targeted product innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gaming Hardware market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A4Tech Co., Ltd.

- Advanced Micro Devices, Inc.

- Analogue

- ASUSTeK Computer Inc.

- Atari, Inc.

- BenQ Corporation

- Boat by Imagine Marketing Limited

- Dell Technologies Inc.

- DreamGEAR, LLC

- Eastern Times Technology Co., Ltd.

- HP Inc.

- Intel Corporation

- Kingston Technology Company, Inc.

- Koninklijke Philips N.V.

- Lenovo Group Limited

- LG Electronics Inc.

- Logitech International S.A.

- Mad Catz Global Limited

- Meta Platforms, Inc.

- Micro-Star INT'L Co., Ltd.

- Microsoft Corporation

- Nintendo Co., Ltd.

- Noise by Nexxbase Marketing Pvt. Ltd.

- NVIDIA Corporation

- Razer Inc.

- Samsung Electronics Co., Ltd.

- ScufGaming by Corsair Memory, Inc.

- SEGA SAMMY Holdings Inc.

- Skullcandy, Inc.

- Sony Group Corporation

- SteelSeries ApS by GN Store Nord A/S

- Toshiba Corporation

- V-MODA, LLC by Roland Corporation

- Valve Corporation

- Venom Limited

- Voyetra Turtle Beach, Inc.

Empowering Industry Leaders with Targeted Strategies to Optimize Supply Chains, Enhance Product Portfolios, and Navigate Geopolitical Trade Headwinds for Sustained Growth

To navigate escalating tariff risks, industry leaders should prioritize supply chain resiliency by diversifying manufacturing footprints across low-tariff jurisdictions and by engaging in collaborative lobbying efforts that advocate for more predictable trade policies. By proactively mapping critical component flows and establishing multi-sourcing agreements, companies can minimize the impact of sudden duty changes and maintain price stability for end customers.

Product portfolios should increasingly emphasize wireless and immersive hardware, capitalizing on proven consumer enthusiasm for clutter-free setups and next-generation mixed-reality experiences. Investing in in-house chipset development or strategic partnerships can yield performance advantages that differentiate offerings in saturated markets. Simultaneously, building out robust software ecosystems and SDKs around hardware launches will foster developer communities and enhance product stickiness.

Segmentation-driven go-to-market strategies are essential. Tailoring features and price points to the unique requirements of casual mobile gamers, console and PC enthusiasts, and esports professionals will ensure that product roadmaps resonate with each audience’s specific preferences. Aligning distribution strategies across offline retail channels and direct-to-consumer platforms will maximize reach and margin optimization.

Finally, a regional approach that leverages local insights is critical. In mature Americas and Western European markets, emphasizing high-touch retail experiences and premium positioning can drive brand loyalty. In Asia Pacific, rapid product iteration and collaborations with local content creators will fuel momentum, while in emerging EMEA territories, targeted partnerships and affordable entry-level solutions can unlock latent demand.

Detailing Comprehensive Research Approaches Combining Primary Interviews, Secondary Data Analysis, and Rigorous Validation to Ensure Insight Accuracy and Relevance

This research integrates a balanced combination of primary and secondary methodologies to ensure the robustness of insights. Primary data was gathered through in-depth interviews with executives from leading hardware manufacturers, component suppliers, and distribution partners, providing firsthand perspectives on supply chain strategies, innovation roadmaps, and market adoption dynamics.

Secondary analysis drew upon a range of reputable sources, including industry-leading technology journals, regulatory filings, company disclosures, and third-party market intelligence reports. These inputs were synthesized to construct an accurate view of product segmentation, regional performance, and competitive positioning.

Quantitative data validation was performed using triangulation, comparing multiple independent datasets to confirm consistency across pricing trends, shipment volumes, and patent filings. Qualitative findings were corroborated through structured expert panels and cross-functional stakeholder reviews, ensuring that strategic recommendations align with both near-term realities and long-term industry trajectories.

Finally, the research framework adheres to rigorous quality-control protocols, including peer review, methodological audit trails, and continuous updates to capture emergent technologies and policy developments through mid-2025.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gaming Hardware market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gaming Hardware Market, by Product Type

- Gaming Hardware Market, by Connectivity Type

- Gaming Hardware Market, by Consumer Type

- Gaming Hardware Market, by Distribution Channel

- Gaming Hardware Market, by Region

- Gaming Hardware Market, by Group

- Gaming Hardware Market, by Country

- United States Gaming Hardware Market

- China Gaming Hardware Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Solidifying Key Takeaways on Innovation Imperatives, Trade Impact Navigation, Segmentation Opportunities, and Regional Dynamics to Guide Strategic Decisions

The confluence of AI-driven GPU architectures, wireless peripheral breakthroughs, and immersive mixed-reality platforms underscores a pivotal moment in gaming hardware evolution. At the same time, U.S. tariff policies have introduced new complexities, compelling companies to rethink manufacturing geographies and pricing strategies. By leveraging robust segmentation insights-spanning product types, connectivity options, consumer profiles, and distribution channels-stakeholders can pinpoint the most promising opportunities and tailor offerings to distinct market segments.

Regional analysis reveals that mature markets in the Americas demand high-performance solutions and premium experiences, while Europe Middle East & Africa present a mosaic of adoption patterns influenced by esports ecosystems and industrial use cases. Asia Pacific remains the primary driver of both manufacturing capacity and consumer demand, with its early-adopter communities fueling rapid product cycles.

Leading organizations are differentiating through strategic supply chain diversification, chipset innovation, and targeted channel strategies. Emerging entrants continue to disrupt traditional models with agile pricing, specialist peripherals, and novel immersive experiences. Ultimately, success in this dynamic environment requires a holistic approach that balances technological leadership, trade-policy agility, and customer-centric segmentation.

This analysis provides the critical insights and strategic guidance necessary for industry participants to thrive amid accelerating innovation and geopolitical headwinds, charting a clear path toward sustainable growth in the gaming hardware sector.

Engage with Associate Director Ketan Rohom to Secure Your Exclusive Copy of the Comprehensive Gaming Hardware Market Analysis and Drive Informed Growth

To access the full depth of analysis, detailed segmentation breakdowns, and actionable strategic recommendations tailored to your organization’s needs, please reach out to Associate Director, Sales & Marketing Ketan Rohom. He can guide you through the report’s comprehensive insights, ensuring you acquire the precise data and expert guidance required to navigate the dynamic gaming hardware landscape effectively. Elevate your market intelligence by securing your copy today and positioning your team ahead of emerging trends and regulatory shifts.

- How big is the Gaming Hardware Market?

- What is the Gaming Hardware Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?