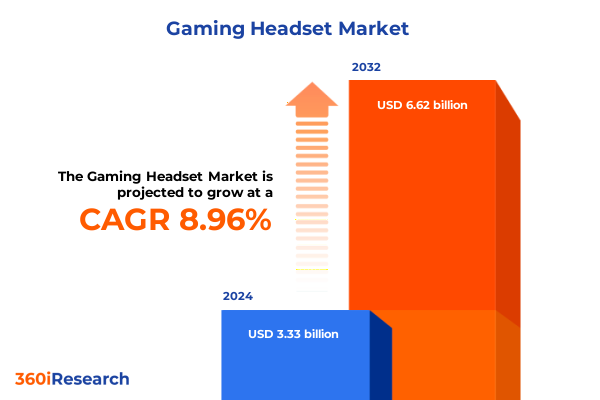

The Gaming Headset Market size was estimated at USD 3.62 billion in 2025 and expected to reach USD 3.93 billion in 2026, at a CAGR of 9.00% to reach USD 6.62 billion by 2032.

Introducing the Evolution of Gaming Headsets: Uniting Immersive Audio, Ergonomic Comfort, and Versatile Connectivity to Elevate Every Player's Experience

Introduction to the Gaming Headset Market presents a compelling narrative that sets the stage for understanding how immersive audio solutions have become indispensable for modern gamers. As gaming communities expand across competitive esports arenas and casual home setups, the demand for headsets that deliver accurate sound positioning, clear communication, and long-lasting comfort has grown exponentially. In parallel, technological advancements in audio codecs and ergonomic design have raised consumer expectations, prompting manufacturers to innovate at an unprecedented pace.

Moreover, the convergence of gaming and other interactive experiences such as virtual reality has elevated the role of headsets as multi-functional peripherals, bridging entertainment and productivity. As connectivity standards evolve to support low-latency wireless experiences and cross-platform interoperability, headsets are no longer niche accessories but foundational tools that influence player performance, social engagement, and brand loyalty. Consequently, this introduction underscores why understanding the competitive landscape, regional dynamics, and consumer drivers in gaming headsets is critical for decision-makers seeking to capture market opportunities.

Exploring the Key Transformative Shifts in Gaming Headset Technology as Wireless Innovation, Spatial Audio Advances, and Esports Demand Reshape the Market

Over the past few years, the gaming headset category has experienced transformative shifts driven by innovations in wireless technology, sound processing, and user-centric design. First and foremost, the maturation of RF-based and Bluetooth-enabled wireless connectivity has liberated users from cable constraints without compromising on audio fidelity or latency. As a result, leading brands have invested heavily in proprietary low-latency protocols and adaptive frequency hopping techniques to deliver seamless audio across consoles, PCs, and mobile devices.

In addition, spatial and wave-field audio processing has become a focal point, enabling players to pinpoint in-game sound sources with precision, thereby enhancing competitive performance. Active noise cancellation has also transitioned from premium flagship devices to mid-tier offerings, responding to growing consumer demand for noise isolation in multi-user environments. Meanwhile, ergonomic innovations such as adjustable headbands, memory foam ear cushions, and lightweight chassis have allowed extended play sessions without fatigue. These dynamics collectively redefine users’ expectations and drive manufacturers to continually realign product roadmaps with evolving gamer preferences.

Analyzing the Cumulative Impact of New United States Tariffs on Gaming Headset Manufacturing Costs, Supply Chain Dynamics, and Competitive Positioning

The implementation of new tariff structures by the United States in early 2025 has introduced a significant variable affecting manufacturing costs and global supply chains for gaming headsets. With tariffs targeting specific electronic components and assembly operations, many manufacturers have experienced cost pressures that erode margins if not managed effectively. Consequently, companies have been evaluating strategic sourcing alternatives, including shifting component procurement to Southeast Asia and exploring nearshoring options in Mexico to mitigate added duties.

Furthermore, the ripple effects of these tariffs extend beyond raw material costs. The need to reconfigure logistics networks and establish compliant manufacturing practices has prompted longer lead times and elevated freight expenditures. In response, several vendors have entered long-term partnerships with circuit board suppliers or pursued joint ventures to secure favorable pricing and ensure uninterrupted production. Although some cost increases may ultimately be passed on to consumers, industry leaders recognize that optimizing the balance between geographic footprint and tariff exposure will be instrumental in preserving competitive positioning moving forward.

Revealing Segmentation-Driven Insights to Guide Headset Design and Marketing by Connectivity, Platform Compatibility, End User, and Distribution Channel Trends

Insight into connectivity preferences reveals that the gaming headset market encompasses both Wired and Wireless models, with wireless solutions further bifurcated into Bluetooth-enabled and RF-based offerings. This segmentation informs design decisions ranging from battery life optimization to antenna engineering, as brands seek to satisfy demands for untethered gameplay without sacrificing audio quality.

Platform compatibility represents another crucial dimension, as headsets must deliver consistent performance across console ecosystems, mobile devices, and PC environments. Compatibility certifications and cross-platform software support have emerged as differentiators, guiding investments in firmware development and licensing partnerships.

End user profiles further refine product roadmaps. Casual gamers generally prioritize affordability and plug-and-play simplicity, while esports teams demand precision audio calibration and robust communication features. Professional gamers, in turn, require specialized tuning, lightweight construction, and integrations with coaching and analytics platforms. Addressing these distinct needs has led to tiered product lines and flagship models that underscore brand expertise.

Distribution channel strategies also shape market engagement. Offline retail continues to facilitate hands-on demonstrations, driving purchases in specialty gaming stores and consumer electronics outlets. Concurrently, direct-to-consumer channels allow brands to cultivate deeper customer relationships, while e-commerce platforms enable broad reach and rapid order fulfillment. Understanding the interplay between these channels is essential for allocating marketing budgets and refining go-to-market approaches.

This comprehensive research report categorizes the Gaming Headset market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Connectivity

- Platform Compatibility

- End User

- Distribution Channel

Decoding Regional Variations and Growth Drivers Across the Americas, EMEA, and Asia-Pacific to Optimize Market Entry and Expansion Strategies

Regional dynamics exhibit pronounced variations that influence product localization and go-to-market frameworks. In the Americas, strong franchise loyalty and high spending on premium peripherals have propelled growth in wireless gaming headsets, particularly those offering advanced spatial audio features and brand-aligned aesthetics. Retail partnerships and sponsorships of major esports tournaments further amplify visibility, reinforcing consumer trust in established names.

Meanwhile, Europe, Middle East & Africa reveal a diversified demand spectrum. Mature markets in Western Europe display heightened interest in sustainable materials and modular repairable designs, whereas emerging economies in Eastern Europe and parts of the Middle East show a preference for value-oriented headsets balancing price and performance. Local distributors play a pivotal role in adapting global product portfolios to regional price sensitivities and regulatory requirements.

In Asia-Pacific, the prevalence of mobile gaming and rapidly growing esports communities has driven widespread adoption of compact, entry-level headsets. Simultaneously, manufacturing hubs in China and Vietnam continue to attract OEM and ODM partnerships, facilitating innovation cycles and reducing time-to-market. As these markets evolve, brands must calibrate regional pricing strategies and channel investments to capture both mass-market volume and premium niche segments.

This comprehensive research report examines key regions that drive the evolution of the Gaming Headset market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies, Product Innovations, and Strategic Alliances of Leading Gaming Headset Manufacturers Driving Market Leadership

Leading companies in the gaming headset landscape have distinguished themselves through targeted product innovations and strategic collaborations. One prominent manufacturer has leveraged proprietary audio engines and co-branding agreements with audio technology firms to deliver differentiated signal processing features. Another market frontrunner has focused on ergonomic excellence, introducing modular headband systems and cross-compatible earcup designs that cater to diverse user anatomies and style preferences.

Strategic acquisitions and partnerships have also reshaped competitive dynamics, with certain players securing exclusive sponsorships of high-profile esports leagues to reinforce brand credibility. These alliances have enabled integrated marketing campaigns that resonate with professional gaming audiences and drive product narratives centered on performance under pressure. At the same time, specialty brands have carved out niches by emphasizing craftsmanship and customization, appealing to enthusiasts who prioritize artisanal finishes and bespoke fit.

Across the board, a common thread emerges: companies that invest in holistic ecosystems-spanning software suites, mobile applications, and community engagement platforms-are better positioned to foster brand loyalty and unlock recurring revenue streams. This ecosystem-driven approach underscores the importance of viewing headsets not merely as hardware products but as integral components of immersive user experiences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gaming Headset market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ASUSTek Computer Inc.

- Bang & Olufsen A/S

- Belkin

- Beyerdynamic GmbH & Co. KG

- Boat by Imagine Marketing Limited

- Bose Corporation

- Boult Audio

- Cosmic Byte

- Dell Inc.

- EKSA TECHNOLOGY PRIVATE LIMITED

- EPOS Group A/S

- GN Store Nord A/S

- HP Inc.

- JLab Audio

- Koninklijke Philips N.V.

- Lenovo Group Ltd.

- Logitech Europe S.A.

- Lucid Hearing Holding Company, LLC

- Meta Platforms, Inc.

- Samsung Electronics Co., Ltd.

- Sennheiser electronic GmbH & Co. KG

- Shure Incorporated

- Skullcandy, Inc.

- Sony Corporation

- VOXX International Corporation

Empowering Industry Leaders with Actionable Recommendations to Navigate Technological Disruption, Tariff Impacts, and Evolving Consumer Preferences Successfully

Industry leaders can capitalize on technological and market developments by pursuing a multi-faceted approach that harmonizes R&D, supply chain agility, and consumer engagement. First, investing in next-generation wireless protocols and adaptive audio algorithms will help differentiate products in a crowded landscape while catering to rising expectations for low-latency performance and immersive soundscapes. Simultaneously, diversifying manufacturing footprints to include tariff-friendly jurisdictions can safeguard margins and mitigate geopolitical risks.

Moreover, prioritizing modular design and durable materials will respond to consumer demand for sustainable, repairable products that extend device lifecycles. In parallel, enhancing direct-to-consumer channels and optimizing digital storefronts will bolster customer relationships and provide richer data for personalized marketing and after-sales support. Collaborating with platform holders and gaming studios on co-developed audio profiles and branded bundles can further cement product relevance within key gaming communities.

Finally, aligning corporate sustainability commitments with operational practices-from eco-conscious packaging to energy-efficient production-will resonate with socially aware consumers and drive long-term brand equity. By orchestrating these strategic initiatives, industry leaders can navigate disruption effectively and secure a competitive edge in the evolving gaming headset arena.

Outlining Rigorous Research Methodology Integrating Primary Interviews, Secondary Data Analysis, and Quantitative Techniques to Ensure Comprehensive Insights

The research methodology underpinning this analysis integrates both primary and secondary approaches to deliver comprehensive insights. Primary research included in-depth interviews with industry stakeholders such as product engineers, supply chain managers, and professional gamers to validate key hypotheses and uncover nuanced user requirements. These qualitative engagements were complemented by online surveys targeting a diverse cross-section of gaming enthusiasts to quantify preference trends and willingness-to-pay for emerging features.

Secondary sources encompassed a thorough review of technical white papers, trade journals, public company filings, and regulatory documents related to tariff policies. Market intelligence databases provided historical shipment and unit growth metrics, which were triangulated with internal proprietary data to ensure robustness. Quantitative analysis included statistical segmentation and correlation assessments to identify high-impact drivers across connectivity modes, platform compatibility, and distribution channels.

Data triangulation was applied throughout to reconcile insights from multiple points of evidence, ensuring that strategic recommendations are grounded in verified patterns of consumer behavior and market dynamics. This rigorous approach fosters confidence in the findings and undergirds the strategic imperatives outlined in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gaming Headset market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gaming Headset Market, by Connectivity

- Gaming Headset Market, by Platform Compatibility

- Gaming Headset Market, by End User

- Gaming Headset Market, by Distribution Channel

- Gaming Headset Market, by Region

- Gaming Headset Market, by Group

- Gaming Headset Market, by Country

- United States Gaming Headset Market

- China Gaming Headset Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding Key Takeaways and Strategic Imperatives Shaping the Future of Gaming Headsets in a Rapidly Evolving Competitive and Technological Landscape

In conclusion, the gaming headset sector stands at a pivotal juncture defined by rapid technological evolution, shifting global trade policies, and dynamic consumer segmentation. Manufacturers that recognize the importance of low-latency wireless performance, nuanced spatial audio rendering, and ergonomic innovation will be best positioned to meet the diverse needs of casual players, esports professionals, and mobile gamers alike. Furthermore, navigating the implications of new tariff regimes requires a strategic balance between cost management and supply chain resilience.

Regional nuances underscore the necessity of tailoring product offerings and channel strategies to local preferences, whether it is high-end adoption in the Americas, sustainability-driven designs in EMEA, or volume-focused mobile solutions in Asia-Pacific. Competitive positioning hinges on ecosystem thinking, integrating hardware excellence with software platforms, brand partnerships, and community engagement to foster enduring loyalty and recurrent monetization.

Ultimately, the convergence of these factors creates both challenges and opportunities. By internalizing the insights and recommendations presented, industry participants can chart a clear path toward innovation leadership and sustained profitability within the ever-evolving gaming headset landscape.

Contact Associate Director Ketan Rohom to Unlock Full Market Research Insights and Secure Your Competitive Advantage in the Gaming Headset Industry

For those ready to transform their strategic approach and gain unparalleled insight into the gaming headset sector, we invite you to connect with Associate Director Ketan Rohom. In a brief consultation, you can explore how this comprehensive report aligns with your organizational goals and addresses the critical challenges and opportunities affecting your business. Beyond simply presenting data, this report equips you with actionable intelligence on emerging technologies, consumer behavior shifts, and competitive strategies that can make a decisive difference.

Reach out to Ketan Rohom to uncover the proprietary analyses on tariff impacts, segmentation-driven design imperatives, and region-specific growth drivers. By partnering directly with Ketan, you ensure that your unique questions are addressed and that you receive tailored guidance on leveraging the report’s insights. Secure your copy today and position your company at the forefront of innovation and market leadership within the dynamic gaming headset landscape.

- How big is the Gaming Headset Market?

- What is the Gaming Headset Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?