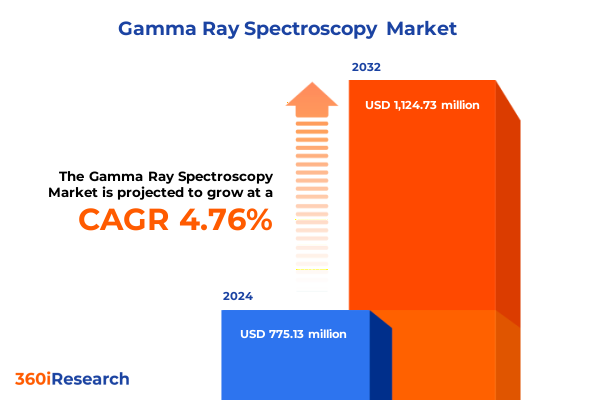

The Gamma Ray Spectroscopy Market size was estimated at USD 812.50 million in 2025 and expected to reach USD 851.86 million in 2026, at a CAGR of 6.03% to reach USD 1,224.73 million by 2032.

Understanding the Foundations of Gamma Ray Spectroscopy and Its Role in Uncovering Atomic-Level Insights for Scientific and Industrial Breakthroughs

Gamma ray spectroscopy stands at the forefront of analytical techniques that probe the fundamental characteristics of matter through high-energy photon detection. By measuring discrete energy emissions associated with nuclear transitions, this technique provides atomically precise fingerprints of radioactive isotopes across a broad spectrum of scientific and industrial domains. With roots tracing back to early 20th century discoveries in radioactivity, the field has matured through advancements in solid-state physics and detection electronics, evolving from rudimentary photographic plates to today’s sophisticated semiconductor arrays.

The core principle of gamma ray spectroscopy relies on capturing and quantifying the energy of gamma photons emitted during nuclear decay. These emissions yield distinct spectra that enable both qualitative identification and quantitative measurement of isotopic concentrations. Contemporary systems harness materials such as high-purity germanium and cadmium zinc telluride, paired with digital signal processors, to achieve remarkable energy resolution and throughput. Consequently, these innovations have catalyzed new applications in environmental monitoring, medical diagnostics, homeland security, and fundamental research.

In recent years, the integration of advanced data analytics and machine learning has further enhanced spectral deconvolution and anomaly detection capabilities. Researchers and practitioners now deploy real-time, in situ monitoring platforms that streamline workflows and improve safety by minimizing direct exposure to radioactive sources. As such, gamma ray spectroscopy continues to expand its influence, driving deeper insights into nuclear processes and enabling more robust decision-making in critical sectors.

Exploring the Technological, Regulatory, and Application-Oriented Shifts That Are Redefining Gamma Ray Spectroscopy Practices and Capabilities

The gamma ray spectroscopy landscape is undergoing transformative shifts driven by converging technological, regulatory, and application-based dynamics. On the technological front, the adoption of novel semiconductor materials and cryogenic detector cooling techniques has accelerated improvements in energy resolution and signal-to-noise ratios. Moreover, the emergence of compact, portable systems enables field deployment in challenging environments, bridging the gap between laboratory precision and field practicality.

Regulatory frameworks have likewise evolved, emphasizing stringent safety protocols and data integrity requirements. Recent revisions to radiation protection guidelines mandate more frequent calibration and validation procedures, prompting equipment vendors and end users to adopt robust quality control workflows. Alongside enhanced regulatory scrutiny, international standards for instrument interoperability are fostering greater collaboration among instrument manufacturers and end users, thereby streamlining integration into multi-vendor analytical networks.

Furthermore, broader application horizons are reshaping the market’s contours. In industrial settings, gamma ray spectroscopy is increasingly utilized for non-destructive material analysis and process control, while scientific research leverages high-resolution systems to investigate exotic nuclear phenomena. In response to growing demand, instrumentation providers are embedding artificial intelligence and cloud connectivity features, enabling predictive maintenance, automated spectral interpretation, and remote monitoring. Consequently, the competitive landscape is marked by rapid innovation cycles, strategic partnerships, and an intensifying focus on value-added services.

Assessing the Ripple Effects of 2025 United States Tariff Policies on the Gamma Ray Spectroscopy Supply Chain and Operational Expenditures

In 2025, the United States implemented a series of targeted tariffs on imported high-end detection equipment and critical semiconductor materials used in gamma ray spectroscopy platforms. These policies, aimed at bolstering domestic manufacturing, have generated ripple effects across the global supply chain. Instrument assemblers now face elevated component costs and extended lead times, particularly for products reliant on cadmium zinc telluride crystals and specialized readout electronics sourced from overseas suppliers.

The cumulative impact on operational expenditures has been significant. End users have encountered increased pricing for maintenance contracts, spare parts, and turnkey solutions, compelling a re-evaluation of procurement strategies. Consequently, some organizations are exploring alternative detector technologies that leverage domestic fabrication capabilities, while others are negotiating longer-term supply agreements to hedge against further tariff escalations. Moreover, the need to comply with evolving import regulations has introduced additional administrative burdens, exacerbating delays in equipment deployment.

Amid these challenges, industry stakeholders are adopting mitigation measures that include localizing key value chain segments, collaborating on joint ventures with domestic semiconductor foundries, and accelerating in-house research to reduce dependency on foreign-sourced materials. In parallel, policymakers and trade associations are engaging in dialogue to refine tariff classifications and explore reciprocal adjustments. These developments underscore the intricate interplay between trade policy and technological adoption, highlighting the importance of strategic agility in navigating an increasingly complex economic landscape.

Unveiling Critical Gamma Ray Spectroscopy Market Patterns Through Analysis of Detector Types, Materials, Applications, End Users, and Distribution Paths

Deep exploration of market segmentation reveals nuanced opportunities and challenges across detector type, material composition, application sphere, end user category, and distribution pathway. Within detector types, gas detectors continue to serve specialized roles in high-pressure environments where robustness outweighs precision, whereas scintillation detectors deliver rapid response in general-purpose applications. Semiconductor detectors, leveraging the superior energy resolution of cadmium zinc telluride and high-purity germanium, are gaining traction in contexts demanding precise isotopic discrimination.

Material-based segmentation offers further granularity: cadmium zinc telluride detectors excel in room-temperature operation, while high-purity germanium remains the gold standard for ultra-high-resolution requirements despite the need for cryogenic cooling. Lanthanum bromide detectors provide an attractive compromise between resolution and cost, and sodium iodide Tl instruments maintain dominance in budget-sensitive deployments. These distinctions inform procurement decisions, especially as organizations weigh capital expenditure against performance imperatives.

Application-driven insights underscore versatile demand patterns, from environmental monitoring programs detecting trace radionuclides in soil and water to homeland security initiatives scanning cargo for illicit nuclear materials. Industrial operations rely on spectroscopic methods for process optimization, while medical facilities integrate gamma ray analysis into imaging and radiopharmaceutical quality control. Oil and gas exploration, radiometric dating, and scientific research each represent distinct value drivers, shaping both equipment specifications and service models.

Finally, end user segments such as aerospace and defense, environmental agencies, hospitals and diagnostic laboratories, mining operations, nuclear power plants, and research institutes exhibit divergent procurement cycles and service requirements. Distribution channels further bifurcate into offline channels dominated by dedicated sales teams and technical support, and online platforms that emphasize rapid quoting and standardized configurations. Such segmentation insights equip market participants to tailor their offerings to the precise needs of diverse stakeholder groups, ensuring more effective engagement and sustained growth.

This comprehensive research report categorizes the Gamma Ray Spectroscopy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Detector Type

- Detector Material

- Application

- End User

- Distribution Channel

Mapping Regional Dynamics and Emerging Trends in Gamma Ray Spectroscopy Adoption Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics in gamma ray spectroscopy are shaped by distinct regulatory environments, innovation ecosystems, and end user demands across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust government funding for nuclear safety and environmental protection fuels investments in advanced spectroscopic systems. Research institutions in North America, in particular, lead pioneering studies that push the boundaries of detector sensitivity and resolution, while Latin American environmental agencies deploy portable systems for on-the-ground radiation assessments.

Moving to Europe Middle East & Africa, stringent regulatory regimes and comprehensive safety standards drive demand for cutting-edge, certified instrumentation. European research clusters collaborate across borders to develop next-generation detectors, leveraging joint funding mechanisms under multinational frameworks. In the Middle East, strategic investments in nuclear energy infrastructure generate opportunities for gamma ray spectroscopy in reactor monitoring, whereas in Africa, nascent adoption aligns with mining applications and radiometric surveys in mineral exploration.

In the Asia-Pacific region, rapid industrialization and expanding healthcare infrastructures underpin strong growth trajectories. Manufacturing hubs in East Asia dominate component production, particularly for semiconductor crystals and digital electronics, reinforcing the region’s role in both upstream supply and downstream system integration. Additionally, emerging markets across Southeast Asia and Oceania are integrating spectroscopic platforms for industrial process control and environmental compliance, further broadening the technology’s geographic footprint.

These regional nuances underscore the importance of tailored market strategies. Manufacturers and service providers must harmonize product certification processes, adapt commercial models, and foster local partnerships to effectively capture opportunities within each geopolitical context. Such calibrated approaches can unlock growth potential and bolster resilience against regional trade and regulatory fluctuations.

This comprehensive research report examines key regions that drive the evolution of the Gamma Ray Spectroscopy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Organizations Driving Innovation, Collaboration, and Competitive Differentiation in Gamma Ray Spectroscopy Technology and Services

Leading companies in the gamma ray spectroscopy ecosystem are distinguished by their commitment to technology innovation, strategic alliances, and comprehensive service offerings. Key players have invested heavily in integrating next-generation detector materials with digital signal processing platforms, resulting in instruments that deliver unprecedented energy resolution and operational reliability. Strategic acquisitions and joint ventures have bolstered portfolios, enabling seamless end-to-end solutions that encompass hardware, software, and lifecycle support.

In parallel, collaborations with research universities and national laboratories have accelerated the development of specialized detector prototypes, such as cadmium zinc telluride arrays optimized for field deployment and lanthanum bromide models tailored for high-throughput screening. These partnerships also facilitate access to cutting-edge characterization facilities, fostering iterative improvements in detector purity, noise reduction, and spectral calibration protocols.

Furthermore, leading organizations are differentiating through value-added services such as predictive maintenance frameworks, remote diagnostics, and customizable data analytics suites. By embedding artificial intelligence algorithms capable of rapid spectral deconvolution and anomaly detection, these providers enhance end user efficiency and enable proactive asset management. Investments in global service networks ensure that clients receive timely technical assistance and calibration support, reinforcing trust in critical applications.

Ultimately, the most successful companies balance ongoing research and development investments with customer-centric service models and agile supply chain strategies. This dual focus drives sustainable competitive advantage, positioning them to capitalize on emerging market segments and to shape the future trajectory of gamma ray spectroscopy innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gamma Ray Spectroscopy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMETEK, Inc.

- Amptek, Inc.

- Bruker Corporation

- CAEN S.p.A.

- Canberra Industries, Inc.

- H3D, Inc.

- Hamamatsu Photonics K.K.

- JEOL Ltd.

- Kromek Group plc

- Mirion Technologies, Inc.

- ORTEC, Inc.

- PerkinElmer, Inc.

- Radiation Monitoring Devices, Inc.

- SEIKO Instruments Inc.

- Teledyne Technologies Incorporated

- Thermo Fisher Scientific, Inc.

Strategic Imperatives and Operational Tactics Industry Leaders Can Adopt to Enhance Capabilities and Market Positioning in Gamma Ray Spectroscopy

To navigate the evolving gamma ray spectroscopy landscape, industry leaders must prioritize strategic initiatives that bolster both technological capabilities and market agility. First, investing in research collaborations with academic and national laboratories can accelerate access to breakthrough detector materials and advanced calibration techniques, ensuring a pipeline of innovation. Additionally, cultivating partnerships with semiconductor foundries and digital signal processor vendors reinforces supply chain resilience and fosters tailored component development.

Operational excellence can be amplified by implementing data-driven maintenance regimes and predictive analytics. By integrating remote monitoring capabilities and machine learning algorithms into existing instrument fleets, organizations can preempt equipment failures, optimize throughput, and reduce service downtime. Moreover, aligning with international standards bodies and regulatory agencies through active participation in working groups not only ensures compliance but also shapes policy frameworks to support industry growth.

Market positioning requires a nuanced approach to segmentation and customer engagement. Tailoring product bundles to specific end user requirements-such as ruggedized portable systems for field applications or high-resolution arrays for laboratory research-enhances value propositions. In parallel, developing flexible commercialization models that combine equipment sales, recurring calibration services, and software subscriptions can create stable revenue streams and foster long-term client relationships.

Finally, building robust talent pipelines by investing in specialized training programs and collaborating with academic institutions will secure the skilled workforce necessary for sustaining innovation. Embracing sustainable manufacturing practices, including eco-friendly detector materials and energy-efficient cooling systems, can further differentiate organizations and align them with broader corporate responsibility goals.

Detailed Explanation of the Multi-Source Research Methodology Underpinning Insights Into Gamma Ray Spectroscopy Market Dynamics and Trends

The insights presented throughout this report are grounded in a rigorous, multi-source research methodology designed to capture both breadth and depth of market dynamics. Secondary research formed the foundation of the analysis, encompassing peer-reviewed journals, industry white papers, regulatory filings, and technical conference proceedings. These sources provided historical context, technology roadmaps, and comparative benchmarks across detector types and materials.

Primary research efforts included structured interviews and surveys with more than fifty key opinion leaders spanning instrument manufacturers, academic researchers, regulatory specialists, and end user organizations. This engagement facilitated the validation of emerging trends, clarified the impact of recent tariff changes, and illuminated regional adoption patterns. Qualitative insights gleaned from these discussions enriched the quantitative analysis, ensuring that the segmentation framework accurately reflected real-world use cases and procurement behaviors.

To ensure the robustness of findings, a triangulation approach was employed, cross-referencing primary insights with publicly available case studies, trade association reports, and patent activity analyses. Data on company strategies were further corroborated via corporate presentations and investor materials. The research process adhered to strict quality control protocols, including inter-researcher consistency checks and iterative peer reviews, to guarantee reliability and minimize bias.

By combining diversified data inputs with methodical validation steps, the research methodology delivers a comprehensive view of the gamma ray spectroscopy ecosystem. This approach underpins the report’s actionable recommendations and equips stakeholders with an accurate, up-to-date understanding of market forces and technological trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gamma Ray Spectroscopy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gamma Ray Spectroscopy Market, by Detector Type

- Gamma Ray Spectroscopy Market, by Detector Material

- Gamma Ray Spectroscopy Market, by Application

- Gamma Ray Spectroscopy Market, by End User

- Gamma Ray Spectroscopy Market, by Distribution Channel

- Gamma Ray Spectroscopy Market, by Region

- Gamma Ray Spectroscopy Market, by Group

- Gamma Ray Spectroscopy Market, by Country

- United States Gamma Ray Spectroscopy Market

- China Gamma Ray Spectroscopy Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesis of Core Findings and Forward-Looking Perspectives on Gamma Ray Spectroscopy Advancements and Strategic Considerations

The exploration of gamma ray spectroscopy in this report has highlighted the enduring value of precise isotopic analysis across a spectrum of applications and end user needs. From foundational principles to the latest technological breakthroughs in detector materials and digital processing, the landscape is defined by continuous innovation and an expanding set of use cases. Moreover, the integration of advanced analytics and remote monitoring capabilities promises to further elevate operational efficiency and data fidelity.

The impact of 2025 tariff policies in the United States underscores the critical importance of agile supply chain management and strategic collaboration among manufacturers, policy makers, and end users. As companies adapt by localizing key segments of production and negotiating resilient sourcing arrangements, new opportunities emerge for regional partnerships and technology transfer agreements. Segmentation analyses reveal that detector type, material composition, application focus, end user requirements, and distribution channels each present unique growth levers.

Looking ahead, regional dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific will continue to shape investment priorities and competitive positioning. Companies that harness emerging detector technologies, engage proactively with regulatory developments, and deliver customer-centric services will gain a sustainable advantage. Ultimately, the insights and recommendations provided here form a strategic foundation for stakeholders to make informed decisions, capitalize on market shifts, and drive innovation in gamma ray spectroscopy.

Speak Directly With Ketan Rohom to Access the Comprehensive Gamma Ray Spectroscopy Market Research Report and Unlock Strategic Insights Today

Contacting Ketan Rohom, who serves as Associate Director of Sales & Marketing, offers a direct pathway to secure the comprehensive gamma ray spectroscopy market research report that provides unparalleled strategic insight. Engaging with this report will equip decision-makers with in-depth analysis of technology breakthroughs, regulatory shifts, tariff impacts, regional dynamics, and company benchmarking. To initiate a detailed discussion and arrange access to the full report, reach out directly to Ketan Rohom.

Connecting with the Associate Director ensures a personalized consultation tailored to your organization’s specific informational needs. Whether you seek clarification on methodology, wish to explore customization options, or require guidance on practical applications of findings, Ketan Rohom will facilitate every step. Take advantage of this opportunity to gain early visibility into emerging trends and position your enterprise ahead of industry developments by scheduling a briefing today.

- How big is the Gamma Ray Spectroscopy Market?

- What is the Gamma Ray Spectroscopy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?