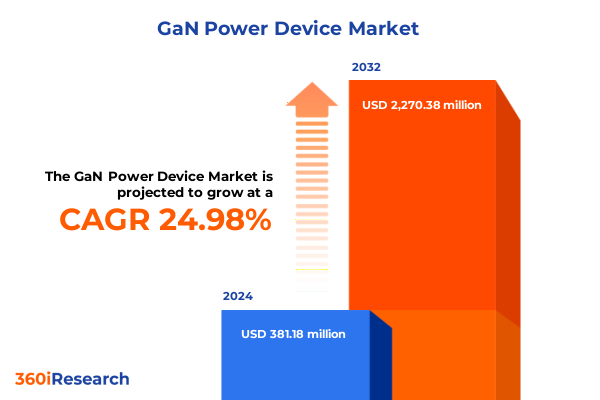

The GaN Power Device Market size was estimated at USD 470.76 million in 2025 and expected to reach USD 583.22 million in 2026, at a CAGR of 25.20% to reach USD 2,270.38 million by 2032.

How Gallium Nitride Power Devices Are Reshaping Energy Efficiency, Driving High-Performance Power Electronics, and Pioneering Next-Generation Innovations Across Industries

Gallium nitride (GaN) power devices have emerged as a cornerstone technology enabling dramatic improvements in energy conversion efficiency, power density, and thermal performance. By harnessing the superior electrical properties of GaN, engineers can develop compact, high-power solutions that outperform silicon-based semiconductors in applications ranging from electric vehicles to renewable energy systems. The ability of GaN devices to operate at higher switching frequencies with minimal energy loss has accelerated their adoption across telecom infrastructure and consumer electronics, where rapid charging and reduced heat dissipation are essential for next-generation performance. As regulatory frameworks worldwide tighten energy efficiency requirements and demand for sustainable solutions intensifies, gallium nitride’s unique characteristics position it as a transformative enabler in modern power electronics.

In recent years, leading semiconductor firms have advanced gallium nitride manufacturing processes, achieving breakthroughs such as 300mm wafer integration and GaN-on-silicon production lines. These technical milestones have driven down per-unit costs and enhanced supply chain scalability, prompting a shift from early adopters to mainstream applications. Consequently, industry stakeholders are forging research partnerships, expanding fabrication capacity, and standardizing performance benchmarks to ensure seamless incorporation of GaN power semiconductors into complex systems. Looking ahead, the interplay of technological innovation, regulatory incentives, and ecosystem collaboration will define the trajectory of GaN power device adoption, shaping the efficiency and sustainability of critical infrastructure across sectors.

Exploring Transformative Technological and Regulatory Shifts That Are Reshaping the Landscape of Gallium Nitride Power Devices Globally and Regionally

The landscape of GaN power devices is undergoing a series of transformative shifts driven by both technological advancements and evolving market demands. A pivotal development has been the large-scale introduction of 300mm wafer processing, which significantly expands production throughput and reduces manufacturing costs per chip. Semiconductor manufacturers that have successfully transitioned to this wafer size are now positioned to scale GaN adoption in high-volume applications more cost-effectively than ever before. Parallel to this, the refinement of GaN-on-silicon processes is enabling greater compatibility with existing silicon fabs, fostering a smoother integration path for foundries and allowing product roadmaps to leverage mature fabrication ecosystems.

Concurrently, regulatory initiatives aimed at improving energy efficiency and reducing carbon footprints are reshaping end-user requirements. Regions such as the European Union are introducing stringent performance and eco-label standards for electronic appliances, while North America is implementing incentives to accelerate the electrification of transportation and grid upgrades. As a result, power electronics designers are prioritizing GaN-based solutions for high-efficiency chargers, inverters, and converters. Moreover, the convergence of 5G network rollouts and renewable energy deployments has created a dual demand for GaN devices, as telecom base stations require compact power amplifiers and solar inverters seek maximized energy harvest. These diverse trends collectively reinforce gallium nitride’s strategic role and drive its integration across a widening array of applications.

Assessing the Cumulative Impact of 2025 United States Tariff Measures on Gallium Nitride Power Device Supply Chains and Industry Competitiveness

The United States implemented a series of tariff measures in 2025 that cumulatively reshaped gallium nitride power device supply chains and cost structures. In early April, a universal 10% levy on all imports took effect under a national economic emergency declaration, although finished semiconductors were initially exempt. Shortly thereafter, the administration announced reciprocal tariffs raising Chinese imports by 34% and European Union exports by 20%, reflecting a strategic emphasis on balanced trade enforcement. Additionally, a high-profile Section 232 investigation into semiconductor security led to the prospect of a 25% duty on critical chip components, signaling the potential for further escalation and prompting proactive supply chain adjustments among device manufacturers.

Beyond these headline rates, President Biden also directed an increase in existing tariffs on Chinese semiconductors to 50% as part of broader efforts to bolster domestic production under the CHIPS Act. This decision intensified cost pressures for companies reliant on Asian-made gallium nitride wafers and epitaxial substrates, leading to a measurable uptick in domestic manufacturing investments. For example, GlobalFoundries committed an additional $3 billion to U.S. fabs to mitigate exposure to import levies and ensure a stable supply of specialty semiconductors, including gallium nitride-based components.

The cumulative impact of these measures has driven industry stakeholders to accelerate localization strategies, diversify vendor relationships, and optimize component design to reduce duty liabilities. While larger corporations have leveraged balance sheet strength to absorb or hedge increased costs, smaller firms have faced margin constraints, leading to strategic alliances and joint ventures to secure access to tariff-shielded supply channels. As the tariff landscape continues to evolve, manufacturers are actively monitoring policy developments and implementing flexible sourcing frameworks to maintain competitive positioning in an increasingly complex regulatory environment.

Deriving Key Insights from Segmenting Gallium Nitride Power Devices by Type, Voltage Rating, Material Composition, and End-User Applications

Insight into gallium nitride power device segmentation reveals distinct drivers and innovation pathways across multiple classifications. Devices are distinguished by type, spanning discrete power components such as Schottky and Zener diodes, integrated circuits, rectifiers in gallium nitride and silicon variants, and advanced transistors including high electron mobility and multi-gate architectures. This classification underscores how each device family addresses specific performance requirements, from low-loss switching to high-frequency amplification. Moreover, voltage rating segmentation-spanning low-voltage applications below 600 volts, moderate ranges between 600 and 1200 volts, and high-voltage scenarios above 1200 volts-reflects application demands from compact consumer chargers to robust industrial inverters.

Material type also plays a pivotal role, as gallium nitride on sapphire substrates offers exceptional thermal conductivity for high-reliability, high-frequency use cases, while gallium nitride on silicon provides cost-effective integration pathways and compatibility with existing wafer lines. End-user segmentation further clarifies market pull, with aerospace and defense demanding rugged, high-reliability solutions, automotive focusing on on-board chargers and traction inverters, consumer electronics seeking rapid charging and miniaturization, energy and power sectors adopting GaN for solar inverters and battery management, industrial systems prioritizing motor drives, and telecommunications leveraging GaN in base station amplifiers. Taken together, these insights illustrate how differentiated segments shape product roadmaps and strategic priorities, guiding companies toward targeted development and tailored go-to-market approaches.

This comprehensive research report categorizes the GaN Power Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Voltage Ratings

- Material Type

- End-Users

Illuminating Regional Dynamics and Growth Drivers for Gallium Nitride Power Devices across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics in the gallium nitride power device market highlight varied growth trajectories and strategic imperatives across Americas, EMEA, and Asia-Pacific. In the Americas, the United States leads with a robust ecosystem driven by incentives under the CHIPS Act, strong defense demand, and expanding electric vehicle manufacturing. Collaborative efforts between federal initiatives and private investment have spurred capacity expansions, particularly in Texas and Arizona, supporting both high-volume consumer electronics and specialized military applications. Canada contributes through its mature semiconductor research facilities and emerging green energy projects, while Mexico’s growing electronics manufacturing services sector offers cost-efficient assembly and packaging capabilities.

Within Europe, Middle East & Africa (EMEA), stringent energy efficiency regulations under policies like “Fit for 55” and national decarbonization targets are primary catalysts for GaN adoption in renewables, industrial automation, and automotive sectors. German and French automakers integrate GaN-based inverters for electric drivetrains, while Scandinavian countries lead in wind energy inverter deployments. In the Middle East, renewable power initiatives in Saudi Arabia and the UAE are driving demand for high-efficiency solar inverters, and African defense modernization projects are sourcing GaN-based radar and RF amplifier solutions.

Asia-Pacific remains the fastest-growing region, accounting for the majority of manufacturing volume and revenue. China’s dominant foundry and substrate production infrastructure supports a vast spectrum of GaN applications, from fast chargers for mobile devices to telecom equipment for regional 5G networks. Japanese and South Korean firms focus on advanced material research and high-reliability modules, and India’s nascent power electronics market is poised for rapid expansion driven by national electrification goals and local manufacturing schemes. Collectively, these regional variations reflect how policy frameworks, supply chain capabilities, and end-user demands converge to define unique growth narratives around gallium nitride power devices.

This comprehensive research report examines key regions that drive the evolution of the GaN Power Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies and Strategic Moves That Are Defining Leadership and Innovation in the Gallium Nitride Power Device Sector

Industry leadership in gallium nitride power devices is defined by strategic investments, technological differentiation, and global scale. Infineon Technologies achieved a world-first integration of GaN on 300mm wafers, markedly reducing production costs while positioning its devices for high-volume applications in consumer electronics and automotive sectors. Texas Instruments has expanded its internal GaN manufacturing capacity fourfold by commissioning a new facility in Aizu, Japan, to complement Dallas operations, thereby ensuring supply resilience and advancing its GaN-on-silicon process lines. GaN Systems and Efficient Power Conversion (EPC) continue to pioneer discrete GaN transistor innovations, focusing on enhanced thermal management and integration features that deliver superior energy efficiency in server power and telecom infrastructure.

ROHM Semiconductor and STMicroelectronics have each announced new high-voltage GaN modules targeting automotive on-board chargers and industrial motor drives, leveraging proprietary packaging technologies to improve heat dissipation. Navitas Semiconductor’s emphasis on highly integrated GaN power stages underscores a trend toward simplicity in system design, enabling OEMs to accelerate time-to-market. Major foundries such as GlobalFoundries and UMC are also investing in GaN-compatible process lines, reflecting the strategic importance of offering full-service manufacturing for customers seeking both volume and performance consistency. Collectively, these corporate maneuvers define a competitive landscape driven by capacity expansion, strategic partnerships, and relentless innovation in materials and device architectures.

This comprehensive research report delivers an in-depth overview of the principal market players in the GaN Power Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIXTRON SE

- Analog Devices, Inc.

- Broadcom Inc.

- Efficient Power Conversion Corporation

- GaNPower International Inc.

- Infineon Technologies AG

- Infinitum Electric

- Kemet Corporation

- MaxLinear, Inc.

- Microchip Technology Incorporated

- Mitsubishi Electric Corporation

- Navitas Semiconductor

- Nexperia B.V.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Oxford Instruments PLC

- Qorvo, Inc.

- Renesas Electronics Corporation

- ROHM Semiconductor

- Sanken Electric Co., Ltd.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Toshiba Corporation

- Vishay Intertechnology, Inc.

- Wolfspeed, Inc.

Actionable Strategies for Industry Leaders to Navigate Technological, Regulatory, and Market Challenges in the Gallium Nitride Power Device Ecosystem

Industry leaders must adopt a multifaceted approach to navigate the evolving gallium nitride power device ecosystem successfully. First, companies should diversify their supply chains by establishing partnerships with multiple substrate and epitaxy vendors, thereby reducing exposure to single-source risks and potential tariff vulnerabilities. In parallel, investment in domestic fabrication capacity-either through greenfield facilities or alliances with U.S. foundries-will mitigate the impact of ongoing trade policies while enhancing responsiveness to regulatory changes.

Second, R&D collaboration across end-user industries can accelerate application-specific innovation. By engaging with automotive OEMs, renewable energy integrators, and telecommunications equipment providers early in the product development cycle, device makers can co-design solutions that meet unique performance and form-factor requirements. This co-innovation strategy not only deepens customer relationships but also enables better forecasting of technological roadmaps.

Third, to maintain cost competitiveness, firms must optimize thermal and packaging designs by leveraging advanced materials and simulation tools. Enhanced thermal management solutions-such as double-sided cooling and direct-bonded copper substrates-can unlock higher power densities without increasing system footprint. Finally, continuous monitoring of geopolitical and regulatory landscapes, including tariff developments and energy efficiency standards, will allow organizations to anticipate shifts and adjust operational strategies proactively. Together, these recommendations create a resilient, innovation-driven framework that empowers industry leaders to capitalize on gy developments and drive sustained growth in the GaN power device market.

Detailing a Rigorous Research Methodology Integrating Primary Insights, Secondary Data, and Expert Validation for Gallium Nitride Power Device Analysis

This analysis employs a robust, three-tiered research methodology that integrates primary insights, secondary data, and expert validation. Primary research involved confidential discussions with senior executives, design engineers, and procurement managers from major semiconductor manufacturers, system integrators, and end-user firms across automotive, energy, industrial, and telecom segments. These interviews illuminated real-world challenges, adoption drivers, and future technology roadmaps.

Secondary research encompassed a comprehensive review of publicly available information, including company press releases, regulatory filings, technical papers, and industry news outlets. Credible sources such as Reuters, the Financial Times, and SEMI’s advocacy updates were leveraged to track tariff developments, manufacturing investments, and regulatory trends. Data triangulation techniques were applied to reconcile disparate data points, ensuring consistency and reliability.

Expert validation was conducted through a panel of independent advisors specializing in power electronics and semiconductor manufacturing. This group provided peer review of key findings, challenged underlying assumptions, and offered strategic perspectives to refine recommendations. Quality assurance protocols, including data integrity checks and source cross-referencing, were enforced throughout the research process to maintain the highest standards of analytical rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our GaN Power Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- GaN Power Device Market, by Device Type

- GaN Power Device Market, by Voltage Ratings

- GaN Power Device Market, by Material Type

- GaN Power Device Market, by End-Users

- GaN Power Device Market, by Region

- GaN Power Device Market, by Group

- GaN Power Device Market, by Country

- United States GaN Power Device Market

- China GaN Power Device Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Reflections on the Strategic Significance, Technological Advancements, and Future Trajectory of Gallium Nitride Power Devices in Modern Industry

Gallium nitride power devices stand at the forefront of a paradigm shift in power electronics, offering unprecedented efficiency, compactness, and performance. Technological breakthroughs in wafer scale, material integration, and design innovation have transformed GaN from a niche alternative to a mainstream solution worthy of strategic investment. Concurrently, regulatory pressures and tariff landscapes have underscored the importance of agility in supply chain management and local manufacturing capacity.

As markets evolve, segmentation insights reveal that tailored device architectures-from diodes and transistors to power modules-unlock specific value propositions for diverse end-users, spanning automotive, energy, industrial, and telecommunications. Regional dynamics further shape opportunity landscapes, with each geography exhibiting unique policy drivers, infrastructure priorities, and manufacturing capabilities. Against this backdrop, leading companies are demonstrating that sustained leadership hinges on synergistic strategies combining technological innovation, strategic alliances, and operational resilience.

Looking ahead, the gallium nitride power device market will continue to be defined by rapid innovation cycles, evolving regulatory frameworks, and global economic shifts. Organizations that proactively adapt through supply chain diversification, co-innovation partnerships, and design optimization will be best positioned to harness GaN’s potential. In doing so, they will not only gain competitive advantage but also contribute to broader sustainability and electrification goals that are essential for the future of power electronics.

Connect with Ketan Rohom to Access Exclusive Gallium Nitride Power Device Market Intelligence and Secure Your Definitive Research Report Today

Call today to speak with Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive Gallium Nitride Power Device market intelligence report

Unlock unparalleled insights into the rapidly evolving gallium nitride power device sector by engaging directly with Ketan Rohom, whose expertise in market dynamics and client-facing strategy ensures you receive a tailored consultation. Through this conversation, you will gain clarity on how the latest technological breakthroughs, regulatory shifts, and competitive developments influence your strategic positioning. Ketan’s guidance will help you navigate the intricacies of supply chain adaptations, tariff impacts, segmentation opportunities, and regional growth drivers.

Schedule your discussion now to explore how this extensive market report can empower your organization to accelerate innovation, optimize investment decisions, and strengthen your market footprint. Reach out to Ketan Rohom to initiate this transformative dialogue and secure the actionable intelligence you need to lead in the gallium nitride power device landscape.

- How big is the GaN Power Device Market?

- What is the GaN Power Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?