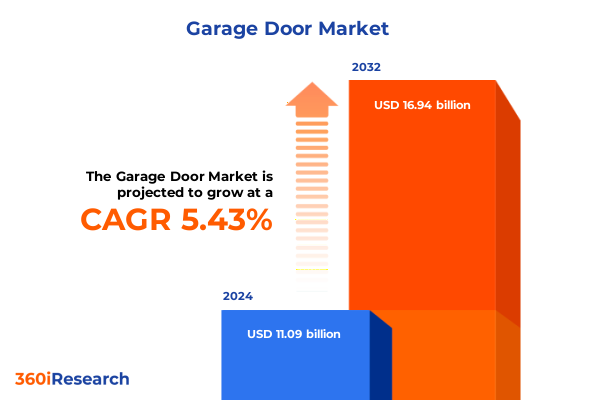

The Garage Door Market size was estimated at USD 11.65 billion in 2025 and expected to reach USD 12.25 billion in 2026, at a CAGR of 5.48% to reach USD 16.94 billion by 2032.

Opening the Doors to a World of Evolving Garage Solutions and Market Dynamics Shaping Tomorrow’s Demand for Residential and Commercial Spaces

In an era defined by rapid technological advancement and shifting consumer expectations, the garage door market has emerged as a critical touchpoint at the intersection of home functionality, security and aesthetic appeal. The humble garage door, once simply a protective barrier, has evolved into a sophisticated entryway that reflects broader trends in automation, sustainability and design. Homeowners and commercial operators alike have begun to demand solutions that not only enhance operational efficiency and safety, but also integrate seamlessly with smart home platforms and elevate property value.

Against this backdrop, supply chain resilience and material cost management have become paramount considerations for manufacturers and suppliers. After a period of relatively stable pricing and predictable lead times, the market has experienced fresh volatility driven by international trade measures as well as innovation cycles that accelerate the adoption of higher-performance materials and automated operation systems. As a result, companies across the value chain are reevaluating their sourcing strategies, investing in alternative materials and exploring partnerships to ensure continuity and maintain competitive pricing.

This introduction sets the stage for a deeper exploration of the transformative shifts reshaping the industry, the cumulative effects of new trade policies on production economics, and the segmentation and regional factors that offer targeted growth opportunities. It also previews strategic recommendations and methodological rigor designed to inform executives and stakeholders seeking to navigate the complexities of the modern garage door ecosystem.

Unprecedented Technological Integration and Regulatory Evolution Are Redefining Garage Door Industry’s Competitive and Innovation Landscape

Over the past several years, the garage door industry has been transformed by the convergence of digital connectivity, material innovation and evolving end-user requirements. The proliferation of Internet of Things (IoT) devices has driven manufacturers to embed sensors, cameras and wireless controls directly into garage door systems, enabling remote monitoring, automated diagnostics and seamless integration with home security platforms. This shift toward connected solutions has not only enhanced convenience, but also elevated expectations around reliability, data privacy and user experience.

Simultaneously, advances in materials science have introduced composite and fiberglass options that offer improved insulation, lower maintenance and greater design flexibility compared to traditional steel or wood doors. Manufacturers have responded by expanding their portfolios to include a broader spectrum of finishes, textures and performance attributes that cater to both high-end residential applications and demanding industrial or commercial environments. Consequently, product differentiation has become a key competitive lever as companies strive to deliver compelling value propositions at various price points.

Regulatory changes and sustainability initiatives are furthering this metamorphosis. Stricter energy-efficiency codes have heightened the importance of thermal performance, driving growth in sectional and insulated door segments that minimize heat loss in cold climates and reduce cooling loads in warmer regions. Environmental standards related to manufacturing emissions and end-of-life recyclability are prompting investments in closed-loop material systems and the adoption of eco-friendly coatings. Taken together, these transformative shifts underscore a landscape where agility, innovation and strategic foresight define market leadership.

Exploring the Far-Reaching Effects of Recent U.S. Import Tariffs on Steel and Aluminum Transforming Garage Door Production Costs

The escalation of U.S. tariffs on imported steel and aluminum in 2025 has had a profound cumulative impact on production costs and supply chain dynamics throughout the garage door sector. By raising duties on key raw materials, manufacturers have encountered steeper input costs that have reverberated across domestic fabrication centers, assembly operations and distribution networks. These additional expenses have necessitated careful cost-management exercises, compelling many companies to revisit supplier contracts and explore alternative material sources that soften the financial burden without compromising product integrity.

Moreover, the tariffs have generated notable ripple effects in inventory management and lead times. Dealers and contractors have responded to uncertainty around future sourcing costs by increasing stock levels of critical door components, creating temporary surges in warehouse storage requirements and affecting working capital allocation. At the same time, the dependency on domestic mill capacity-already operating near full utilization-has tightened delivery windows and prompted some fabricators to incorporate advanced scheduling and forecasting tools to optimize throughput and reduce order-to-installation delays.

Despite the challenges, the tariff environment has also catalyzed strategic investments in domestic manufacturing capabilities. Several major players have expanded or retooled U.S. production facilities, targeting enhanced automation and lean manufacturing practices to offset higher material duties. These initiatives are bolstering local resilience while positioning companies to capitalize on near-shoring trends and respond more swiftly to evolving customer demands. As the industry adjusts to this new cost paradigm, the cumulative impact of tariffs underscores the need for proactive pricing strategies and supply chain diversification to sustain profitability and service excellence.

Insightful Differentiation Across Product, Material, Operation, End Use, Application and Distribution Dimensions Revealing Targeted Growth Opportunities

A nuanced examination of product type reveals that sectional doors, with their superior insulating properties and customizable panel options, are capturing heightened interest among residential and light-commercial buyers seeking energy savings and design versatility. Roll-up doors continue to serve critical roles in high-throughput industrial settings due to their rapid operation and minimal floorspace footprint, while side-hinged and canopy models remain favored for specific architectural and aesthetic requirements. Slide-on configurations, though niche, are carving out appeals in retrofit scenarios where conventional track systems are impractical.

When evaluating material type, the traditional prominence of steel is tempered by accelerated uptake of composite and fiberglass alternatives, valued for their corrosion resistance and longer service lives in coastal and high-humidity environments. Aluminum doors are gaining traction among designers and commercial developers prioritizing lightweight structures and sleek, contemporary aesthetics. Wood and vinyl preserve their footholds where heritage charm or cost-effective maintenance are critical decision factors.

Operation mechanism continues to evolve as automatic systems dominate new installations, driven by end-users’ expectations for touchless access and integration with smart home platforms, while manual doors persist in budget-sensitive or low-frequency use cases. In terms of end-use, residential applications account for the bulk of volume yet commercial and industrial segments-spanning automotive repair, warehousing and distribution-deliver differentiated performance requirements around security, cycle life and operational speed. Within application contexts, the divide between new construction and replacement projects shapes procurement strategies, with specifiers in new builds often seeking bundled design-assist and preconstruction services, whereas retrofit jobs prioritize minimized downtime and compatibility with existing door openings.

Distribution channels have adapted accordingly; offline networks remain dominant for complex installations requiring certified technicians and on-site support, while online platforms-ranging from e-commerce aggregators to manufacturer direct portals-are capturing share among DIY enthusiasts and price-conscious buyers. The bifurcation of the online segment between established marketplace sites and vendor-direct channels underscores a shift toward hybrid service models that combine convenience with tailored technical assistance.

This comprehensive research report categorizes the Garage Door market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Operation Mechanism

- End-Use

- Application

- Distribution Channel

Unearthing Regional Nuances in the Americas, Europe Middle East and Africa and Asia Pacific That Drive Diverse Consumer Preferences and Industry Practices

Across the Americas, the market is buoyed by robust residential renovation activity and government incentives targeting energy performance improvements in both new and existing buildings. North American homeowners increasingly prioritize insulated and smart-enabled garage solutions, while Latin American commercial developers are exploring roll-up and sectional door systems that balance cost efficiency with heightened security needs. Regional preferences for certain material types have emerged, with coastal areas gravitating toward corrosion-resistant composites and inland manufacturing hubs favoring domestically produced steel.

In Europe, Middle East and Africa, regulatory rigor around thermal performance and sustainability is driving growth in ASEAN-style insulated sectional doors and eco-friendly composite products. European subsidies for green building certifications encourage property owners to adopt high-R-value door systems, while Middle Eastern logistics and warehousing operators value rapid-cycle roll-up doors that mitigate energy loss in extreme climates. In Africa, infrastructure development and urban expansion are fostering demand for durable, low-maintenance models capable of withstanding challenging environmental conditions and extended operational cycles.

The Asia-Pacific region represents a dual narrative of established markets-such as Japan and Australia-embracing automation and integration with building management systems, and emerging economies prioritizing cost-effective manual or semi-automated doors to support industrial growth. Rapid urbanization and rising disposable incomes in Southeast Asia and India are accelerating residential new construction, creating opportunities for both imported premium door brands and domestic fabricators aligning to local price sensitivities. This regional mosaic underscores the importance of tailored value propositions that align product features and distribution strategies with divergent regulatory frameworks and cultural preferences.

This comprehensive research report examines key regions that drive the evolution of the Garage Door market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves and Collaborative Efforts by Leading Manufacturers and Innovators Steering the Garage Door Market Forward

Market leaders are broadening their competitive arsenals through strategic partnerships and technology alliances that accelerate product innovation. Several top manufacturers have collaborated with IoT platform providers to co-develop integrated garage door controllers featuring advanced encryption, seamless voice assistant compatibility and real-time diagnostics dashboards. These synergies enable more agile feature roll-outs and support subscription-based service models that enhance customer engagement and generate recurring revenue streams.

In addition, major producers are investing in scalable manufacturing technologies-such as robotic welding and automated painting lines-to boost throughput, improve quality consistency and maintain tighter control over material utilization amid tariff-driven cost pressures. Regional fabricators are strengthening their offerings through targeted expansions into adjacent service areas, including preventative maintenance contracts and modular door repair kits that reduce downtime and foster long-term customer loyalty.

Mergers and acquisitions have also played a role in consolidating market share and augmenting technical capabilities. Recent deals have brought together complementary product portfolios, consolidated R&D centers, and delivered cross-selling opportunities across industrial and residential segments. These strategic moves underscore a broader trend toward integrated solutions providers that can address end-to-end lifecycle requirements, from initial specification and installation through performance monitoring and end-of-life recycling programs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Garage Door market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABi Garage Doors Ltd

- Albardoorsthailand Co. Ltd.

- Allegion

- Alluguard Ltd

- Aluplast GmbH

- Aluroll Ltd

- AMARR COMPANY by ASSA ABLOY Group

- Andersen Corporation

- ARCAT

- ASSA ABLOY AB

- Atrium Corporation

- B&D Australia Pty Ltd.

- Birkdale Manufacturing Group Limited

- C.H.I. Overhead Doors

- Clopay Corporation

- Cornerstone Building Brands

- Deceuninck NV

- Dongguan HengTaichang Doors Co, Ltd.

- Doormatic Garage Doors

- Doors and Worktops Ltd

- Dormakaba

- Fancy Doors & Mouldings

- Fenesta Building Systems

- First United Door Technologies

- FOREMATIC

- Garador Ltd

- Garaga Inc.

- Garolla Holdings Limited

- GATES & FENCES UK

- General Doors Corporation

- Gliderol Garage and Industrial Doors Ltd

- Griffon Corporation Inc.

- Honco Group

- Häfele Group

- Hörmann KG Verkaufsgesellschaft

- Internorm

- JELD-WEN Holding Inc.

- La Cantina Doors

- LIXIL Corporation

- Marvin Windows & Doors

- Masonite International

- MI Windows and Doors

- Novoferm GmbH

- Oknoplast

- Overhead Door Corporation

- Pella Corporation

- PGT Innovations

- Profine GmbH (Kömmerling)

- Quanex Building Products

- Raynor Garage Doors

- Rollerdor Ltd

- Rolux UK Ltd

- Rundum Meir Garagentorbau GmbH

- Ryterna UK Ltd.

- Safe-Way Garage Doors LLC

- Saint-Gobain

- Sanwa Holdings Corporation

- Schüco International

- Simpson Door Company

- Somfy SA

- Steel-Craft Door Products Ltd.

- SWS Doors Ltd.

- Teckentrup GmbH

- ThemorSecure Ltd

- Thermosecure Ltd

- Tyman plc

- UK Security Shutters Ltd

- VEKA AG

- Wessex Garage Doors

- YKK AP Inc.

Implementing Proactive Strategies and Adaptive Measures to Navigate Tariff Pressures and Technological Disruptions in the Garage Door Sector

Industry leaders should prioritize supply chain diversification to mitigate the impact of volatile material costs and regulatory shifts. Establishing alternate supplier relationships across multiple geographies can reduce single-source dependencies and provide greater negotiating leverage during tariff fluctuations. Concurrently, embedding advanced analytics into procurement functions will help anticipate cost spikes, optimize inventory levels and align production schedules with real-time demand signals.

In product development, focusing on modularity and upgradable electronics will allow manufacturers to offer door systems that can evolve with customers’ technology investments, extending useful life and differentiating offerings in a crowded marketplace. Partnerships with smart home platforms and cybersecurity specialists will reinforce trust in data privacy and system integrity, essential for end-users integrating doors into broader connected ecosystems.

Operational excellence can be enhanced through lean manufacturing techniques and digital twin simulations, enabling continuous process improvement and faster iteration cycles. Developing flexible service models-combining remote diagnostics, predictive maintenance and on-site support-will improve uptime and generate new recurring revenue avenues. Finally, companies should cultivate talent pipelines with cross-disciplinary expertise in mechanical engineering, software development and data science to sustain innovation momentum and adapt swiftly to emerging market dynamics.

Employing Rigorous Mixed Method Approaches and Data Validation Techniques to Ensure Comprehensive Market Insights and Decision Support

This research employed a mixed-method approach, combining qualitative expert interviews with quantitative analysis of proprietary shipment and installation datasets. Primary discussions with fabricators, distributors and channel partners provided nuanced perspectives on emerging demand drivers and operational challenges. Concurrently, extensive desk research reviewed regulatory filings, technology white papers and supply chain disclosures to map the competitive landscape and identify critical success factors.

Data validation protocols included cross-referencing supplier cost trends with trade and customs records, ensuring that raw material price trajectories were accurately reflected in our assessment. Scenario modeling tools facilitated sensitivity analysis around tariff changes and material substitutions, enabling stress-testing of various strategic responses. Geographic segmentation leveraged both public infrastructure data and proprietary sales metrics to gauge regional adoption patterns and forecast potential shifts in client preferences.

A rigorous triangulation process reconciled insights from diverse sources, minimizing bias and enhancing the reliability of key findings. This robust methodological foundation underpins the strategic recommendations and market observations presented throughout this executive summary, providing decision makers with confidence in the depth, accuracy and relevance of the insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Garage Door market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Garage Door Market, by Product Type

- Garage Door Market, by Material Type

- Garage Door Market, by Operation Mechanism

- Garage Door Market, by End-Use

- Garage Door Market, by Application

- Garage Door Market, by Distribution Channel

- Garage Door Market, by Region

- Garage Door Market, by Group

- Garage Door Market, by Country

- United States Garage Door Market

- China Garage Door Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights and Strategic Implications to Provide a Coherent Vision for the Future of Garage Door Markets Worldwide

In synthesizing these insights, it becomes clear that the garage door industry stands at an inflection point where technological innovation, trade policy and shifting end-user priorities converge. Companies that anticipate regulatory changes and proactively adapt their supply chains will be best positioned to maintain cost competitiveness and service agility. Meanwhile, those investing in connected features, advanced materials and modular designs will capture both premium and emerging segments seeking differentiated performance and enhanced convenience.

Regional markets will continue to exhibit distinct dynamics, demanding customized strategies that align product portfolios with local regulations and consumer expectations. Partnerships across the value chain-from IoT integrators to contracting networks-will be crucial for delivering seamless customer experiences and cultivating long-term loyalty. At the same time, operational excellence underpinned by data analytics and lean practices will serve as the foundation for sustainable growth and profitability.

Ultimately, industry leaders must balance short-term responsiveness to material cost pressures with long-term investments in capabilities and relationships that drive continuous innovation. By embracing a holistic view that integrates product development, supply chain management and service delivery, organizations can unlock new value streams and secure their competitive edge in the evolving global garage door market.

Connect with Ketan Rohom to Secure a Detailed Garage Door Market Analysis Report and Propel Your Decision Making to the Next Level

To delve deeper into the evolving dynamics of the global garage door market and access a comprehensive, data-driven analysis tailored to your strategic priorities, reach out to Ketan Rohom, Associate Director of Sales & Marketing. With his expertise in translating complex market insights into actionable growth strategies, Ketan can guide you through the report’s extensive findings and customize an executive briefing that addresses your organization’s unique objectives. Contact him to secure your copy of the full market research report and empower your decision making with the depth of analysis needed to stay ahead in this rapidly changing industry landscape

- How big is the Garage Door Market?

- What is the Garage Door Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?