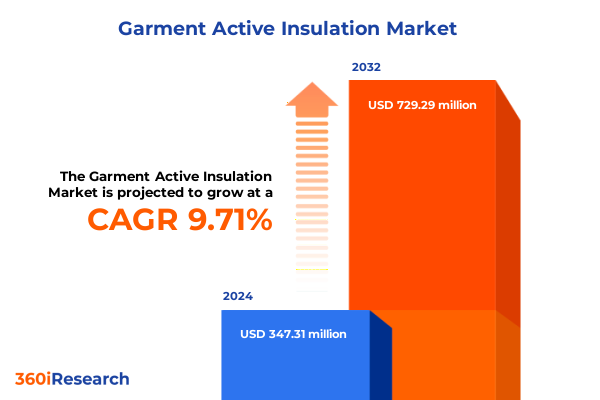

The Garment Active Insulation Market size was estimated at USD 377.66 million in 2025 and expected to reach USD 413.76 million in 2026, at a CAGR of 9.85% to reach USD 729.28 million by 2032.

Exploring Game Changing Developments in Garment Active Insulation Shaping the Future of Performance Apparel

Garment active insulation stands at the crossroads of innovation and performance, marking a pivotal moment in the evolution of performance apparel. Driven by a confluence of material science breakthroughs and shifting consumer preferences toward multifunctional, sustainable clothing, this sector is rapidly redefining expectations for thermal regulation and weight optimization. As climate variability and outdoor activity trends intensify, stakeholders across the value chain-ranging from raw material suppliers to retail partners-are recalibrating strategies to align with a demand for high-performance insulation that delivers both comfort and environmental responsibility.

This report’s introduction navigates through the myriad factors propelling the active insulation market, offering decision-makers a clear understanding of the competitive forces at play. It underscores the synergy between technological advances, such as novel polymer composites and eco-friendly down alternatives, with the imperative for streamlined manufacturing processes. By situating these developments within the broader context of consumer behavior trends and supply chain complexities, this executive summary sets the stage for a detailed exploration of the market’s transformational shifts and strategic implications.

Uncovering Pivotal Technological Innovations and Consumer Behavior Shifts Driving Next Generation Garment Insulation Solutions

Recent years have witnessed transformative shifts in the garment active insulation landscape, propelled by breakthroughs in smart textile integration and advanced thermal regulation technologies. Brands are harnessing nanofiber membranes and phase change materials to engineer garments that dynamically adapt to fluctuating temperatures and user activity levels. Concurrently, digital prototyping and 3D knitting platforms have accelerated time to market, enabling customized fits and on-demand manufacturing that reduce inventory burdens and waste.

Consumer behavior has also undergone a marked evolution, with an emphasis on low-impact, ethically sourced materials and transparent supply chains. Athleisure’s ascent has blurred the lines between performance gear and everyday wear, driving demand for insulated garments that seamlessly transition from trail to urban environment. These shifts underscore the importance of agility in product development and the cultivation of cross-functional partnerships with technology providers and material innovators. As the market matures, players who can anticipate and integrate these dynamic forces will secure a lasting competitive edge.

Analyzing Broad Repercussions of Recent United States Tariff Adjustments on Material Sourcing and Manufacturing Dynamics

The imposition of recent United States tariff measures on critical insulation materials and garment imports has introduced new cost and supply chain considerations. Manufacturers relying on specialized synthetic fibers face elevated input prices as duties affect polyester and primaloft components, compelling many to reassess sourcing strategies. Meanwhile, eco-friendly insulation alternatives, often produced in jurisdictions subject to lower tariff barriers, have gained relative cost competitiveness. This environment has stimulated the diversification of supplier networks, reducing overreliance on any single geographic corridor.

From a manufacturing perspective, additional compliance requirements and documentation protocols have extended lead times, prompting a shift toward greater vertical integration. Some brands have converted existing domestic facilities to accommodate final assembly stages, balancing duty liabilities against logistical efficiency. Retailers, in turn, are exploring more flexible inventory models and nearshoring options to mitigate stockout risks and respond more rapidly to seasonal demand fluctuations. These developments highlight the nuanced interplay between trade policy and the operational calculus of garment active insulation players.

Highlighting Strategic Segmentation Perspectives Illuminating Material Performance Product Type End User and Distribution Channel Insights

Insight into material segmentation reveals that down insulation continues to command premium positioning among consumers prioritizing natural warmth and compressibility. Within this category, goose down is particularly prized for its superior fill power, though duck down remains a cost-effective alternative for value propositions. Synthetic insulation, led by polyester and primaloft variants, is gaining traction due to improved moisture management and ethical sourcing narratives. Meanwhile, eco-friendly materials synthesized from recycled fibers are carving out a niche among environmentally conscious buyers, driving further innovation in material blends.

Product type segmentation illustrates that insulated jackets remain the focal point of innovation activity, integrating multifunctional pockets and adjustable ventilation systems. Gloves and accessories are capturing attention with thin-profile insulation technology, while trousers and vests are evolving to meet specialized use cases in outdoor sports and urban commuting. End user analysis shows that outdoor enthusiasts and sports participants demand high-performance specifications, whereas leisure and casual segments favor hybrid designs that balance style with thermal management. Distribution channels continue to bifurcate, with offline showrooms emphasizing experiential retail and online platforms leveraging virtual fit tools to streamline purchase journeys and reduce return rates.

This comprehensive research report categorizes the Garment Active Insulation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Product Type

- End User

- Distribution Channel

Examining Distinct Regional Dynamics Revealing Growth Patterns Consumer Preferences and Competitive Environments Across the Americas EMEA and Asia Pacific

Regional analysis underscores the Americas as an influential market driven by a culture of outdoor recreation and substantial consumer spending power on premium active insulation. The region’s diverse climate zones-from alpine environments to temperate forests-fuel demand for a wide array of insulated garment designs and performance specifications. Retail networks are evolving to include specialized outdoor chains and direct-to-consumer e-commerce platforms, each capitalizing on localized marketing strategies to engage both seasoned adventurers and lifestyle-oriented urban consumers.

In Europe, Middle East and Africa, the intersection of regulatory frameworks supporting sustainability and the legacy of craftsmanship in alpine countries has nurtured a thriving market for high-end down and hybrid insulation offerings. European brands often lead in setting environmental certification standards, influencing global benchmarks. In contrast, the Middle East’s luxury segment is exploring lightweight insulation solutions for indoor climate control, while African markets present untapped potential for affordable synthetic insulation in emerging urban centers.

The Asia-Pacific region exhibits rapid growth, underpinned by expanding middle-class demographics with an increasing affinity for outdoor sports and travel. Manufacturers in key hubs are leveraging proximity to raw material sources and robust textile infrastructure to scale production efficiently. In addition, local brands are investing heavily in R&D collaborations to align product portfolios with evolving consumer preferences for multifunctional, tech-enabled garments. This vibrant ecosystem underscores the region’s role as both a production powerhouse and an innovation incubator for the global market.

This comprehensive research report examines key regions that drive the evolution of the Garment Active Insulation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Innovators and Their Strategic Initiatives Driving Competitive Differentiation and Value Creation in Active Insulation Market

Leading players in the active insulation segment are differentiating through proprietary material technologies and strategic collaborations. A prominent outdoor apparel brand has launched an in-house line of sustainable synthetic insulation, integrating recycled substrates with bio-based coatings to achieve enhanced moisture vapor transmission. Another global innovator has expanded its patented down treatment process to reduce water usage and improve ethical traceability, earning industry recognition and consumer trust in equal measure.

Collaborative models are also reshaping the competitive landscape, with alliances between textile manufacturers and technology startups producing membranes capable of real-time temperature regulation. These partnerships enable brands to accelerate time-to-market for high-performance garments and reinforce their positioning in premium segments. At the same time, vertically integrated companies are investing in advanced recycling facilities, reclaiming down and synthetic fibers from end-of-life products to create circular supply loops.

Smaller agile brands are leveraging direct consumer insights through digital engagement platforms, tailoring limited-edition runs of insulated apparel based on real-time feedback. This customer-centric approach not only reduces excess inventory but also cultivates brand loyalty through co-creation experiences. As a result, the competitive terrain is defined by a blend of scale economies, material differentiation and digitally enabled collaboration across the value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Garment Active Insulation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- adidas AG

- Arc’teryx Equipment Inc.

- Black Diamond Equipment Ltd.

- Columbia Outerwear Inc. (brand under Columbia Sportswear)

- Columbia Sportswear Company

- DuPont de Nemours, Inc.

- Eider SAS

- Freudenberg SE

- Helly Hansen AS

- Jack Wolfskin GmbH & Co. KGaA

- KANUK

- KUIU Ultralight Hunting, Inc.

- L.L. Bean, Inc.

- Mammut Sports Group AG

- Marmot Mountain, LLC

- Montbell Co., Ltd.

- Outlast Technologies, Inc.

- Patagonia, Inc.

- Polartec LLC

- PrimaLoft, Inc.

- Rab

- The North Face, Inc.

- Toray Industries, Inc.

- W. L. Gore & Associates, Inc.

Crafting Tactical Strategic Imperatives and Collaborative Models to Accelerate Innovation Enhance Agility and Strengthen Market Positioning in Insulation Apparel

Industry leaders should accelerate investments in advanced material research, forging partnerships with academic institutions and specialty fiber producers to unlock next-generation insulation performance. By co-developing proprietary formulations, companies can capture premium positioning and create barriers to entry. Equally important is the integration of digital tools throughout the product lifecycle- from AI-powered demand forecasting to immersive virtual retail experiences-enabling more precise inventory management and personalized consumer engagement.

Stakeholders must also strengthen supply chain resilience through diversification strategies, incorporating nearshoring and multi-sourcing models that balance cost efficiencies with reduced geopolitical risk. Developing flexible manufacturing capabilities that support rapid design iterations and regional customization will prove vital in responding to tariff fluctuations and shifting consumer tastes. Additionally, embracing circularity-through take-back programs and closed-loop recycling-will bolster sustainability credentials and appeal to environmentally minded audiences.

Finally, proactive collaboration with industry associations and regulatory bodies can shape favorable trade policies and sustainability standards. By contributing to the development of certification protocols and advocating for harmonized environmental labeling, companies can influence market rules while enhancing transparency. This multi-pronged approach will empower leaders to navigate complexity, seize emerging growth corridors, and reinforce their brand equity in the competitive active insulation arena.

Detailing a Robust Mixed Method Research Framework Integrating Primary Stakeholder Engagement Secondary Data Analysis and Advanced Synthesis Techniques

This study leverages a mixed-method research framework, combining in-depth interviews with senior executives across the insulation value chain and primary surveys of end-users to capture real-world requirements. Complementing primary insights, extensive secondary research was conducted using reputable trade publications, governmental trade databases, and technical whitepapers from material science research institutions. This dual approach ensures a balanced view of market dynamics and emerging technology trends.

Quantitative analysis incorporates historical trade flow data, production capacity reports, and retail channel performance metrics to identify structural patterns and competitive benchmarks. Qualitative findings are synthesized through thematic coding of expert interviews, enabling nuanced insights into strategic priorities, innovation roadmaps, and sustainability initiatives. The research design also includes a rigorous validation process, where findings are reviewed by an advisory panel of industry veterans to confirm accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Garment Active Insulation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Garment Active Insulation Market, by Material Type

- Garment Active Insulation Market, by Product Type

- Garment Active Insulation Market, by End User

- Garment Active Insulation Market, by Distribution Channel

- Garment Active Insulation Market, by Region

- Garment Active Insulation Market, by Group

- Garment Active Insulation Market, by Country

- United States Garment Active Insulation Market

- China Garment Active Insulation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Insights to Provide a Cohesive Perspective on Growth Levers Challenges and Opportunities Defining the Future of Insulation Clothing

The garment active insulation market is characterized by a dynamic interplay of material innovation, evolving consumer expectations, and regulatory influences. Key insights reveal that sustainability and performance are no longer mutually exclusive, as advances in bio-based and recycled insulation materials are meeting stringent functional requirements. Meanwhile, shifts in trade policy have underscored the importance of supply chain agility and diversified sourcing strategies.

Looking ahead, market participants who effectively harness cross-sector collaborations-coupling material science breakthroughs with digital manufacturing and circular economy principles-will define the next frontier of competitive advantage. As regional dynamics continue to diverge, tailoring strategies to local consumer behaviors and regulatory environments will be essential. This cohesive perspective lays the groundwork for strategic actions that balance short-term operational resilience with long-term value creation.

Engage with the Associate Director of Sales and Marketing to Secure Comprehensive Market Intelligence and Empower Strategic Decision Making

Engage with Ketan Rohom, Associate Director of Sales and Marketing, to obtain the full market research report and empower your organization with precise, actionable insights. By securing this comprehensive intelligence, your team will be equipped to identify emerging opportunities, mitigate risks stemming from regulatory shifts, and optimize product portfolios for maximum consumer appeal. Connect directly with Ketan Rohom to discuss customized data packages, enterprise licensing options, and complementary advisory services designed to catalyze growth in garment active insulation. Take the next decisive step toward strategic market leadership.

- How big is the Garment Active Insulation Market?

- What is the Garment Active Insulation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?