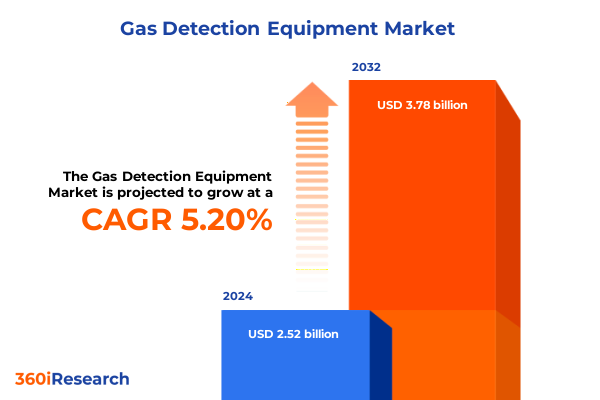

The Gas Detection Equipment Market size was estimated at USD 2.64 billion in 2025 and expected to reach USD 2.77 billion in 2026, at a CAGR of 5.25% to reach USD 3.78 billion by 2032.

Unveiling the Critical Role of Advanced Gas Detection Equipment in Safeguarding Environments Amid Evolving Industrial Safety Demands

As industries continue to prioritize safety and operational excellence, advanced gas detection equipment emerges as a non-negotiable cornerstone for safeguarding personnel, assets, and the environment. This introduction explores how recent innovations in sensor technology and digital connectivity are empowering organizations to detect and respond to hazardous gas exposures with unprecedented speed and accuracy, thereby transforming risk management practices across diverse sectors.

Over the past decade, the convergence of miniaturized electronics, artificial intelligence-driven analytics, and cloud-based monitoring platforms has elevated gas detection from static alarm systems to proactive safety ecosystems. These ecosystems enable real-time data visualization, predictive maintenance alerts, and seamless integration with broader facility management systems. As regulatory frameworks tighten and corporate sustainability agendas accelerate, this report sets the stage for understanding the evolving market dynamics, key drivers, and strategic imperatives shaping the future of gas detection equipment.

Exploring Revolutionary Technological and Regulatory Shifts Redefining the Gas Detection Equipment Landscape for Enhanced Operational Efficiency

In recent years, the gas detection equipment landscape has undergone transformative shifts fueled by technological breakthroughs, regulatory evolution, and shifting customer expectations. On the technology front, innovations such as electrochemical sensors with enhanced selectivity, infrared modules capable of simultaneous multi-gas analysis, and ultrasonic detectors that offer continuous, maintenance-free monitoring have redefined performance benchmarks. Meanwhile, the rise of wearable devices integrates personal safety with ergonomic design, enabling frontline workers to move freely while remaining protected.

Regulatory agencies across North America, Europe, and Asia-Pacific have implemented more stringent exposure limits and mandated continuous emissions monitoring, compelling end users to upgrade legacy systems. Simultaneously, digital transformation initiatives have accelerated adoption of cloud-native platforms that aggregate detector data across sites, enabling centralized incident response and compliance reporting. This convergence of innovation and regulation has set in motion a new era of proactive hazard management, where predictive analytics and interoperable architectures drive operational resilience.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Gas Detection Equipment Supply Chains and Cost Structures

The implementation of cumulative tariffs on imported gas detection components and finished devices in the United States throughout 2025 has exerted material pressure on supply chains and cost structures. Manufacturers reliant on overseas production of critical components such as catalytic bead modules or photoionization chips have had to navigate increased duties, longer lead times, and heightened inventory carrying costs. In response, several key suppliers have localized assembly lines and sought alternative sourcing corridors to mitigate exposure to punitive duties.

For end users, these tariff-driven cost increases have translated into tighter procurement budgets and prolonged replacement cycles for aging equipment. In turn, service providers have adapted by offering extended maintenance contracts and performance-based leases that spread capital expenditures over multi-year terms. As the market continues to digest the full impact of U.S. tariffs, stakeholders are re-evaluating strategic partnerships and exploring advanced manufacturing techniques-such as additive production of select sensor housings-to regain cost competitiveness.

Decoding Key Segmentation Dynamics Across Detector Types Technologies End Users Gas Types Components and Sales Channels

A granular examination of market segmentation reveals nuanced opportunities and challenges across detector types, technologies, and end uses. In the realm of detector typology, fixed systems-whether point-model installations at critical control points or open-path arrays spanning expansive perimeters-remain indispensable for facility-wide monitoring, while portable multi-gas monitors complement them by enabling spot checks and rapid hazard surveys. Wearable detectors, embedded into vests or helmets, are gaining traction for personal safety applications in confined spaces and mobile operations.

Underpinning these end uses, a spectrum of sensor technologies delivers optimized performance for specific gas profiles: catalytic bead sensors excel at combustible gas detection, electrochemical cells offer high-precision toxic gas quantification, infrared analyzers enable non-dispersive gas identification, and emerging ultrasonic detectors promise maintenance-free operation for combustible monitoring. End-user segmentation further highlights that chemicals and oil & gas operations demand the highest instrument reliability, hospital laboratories seek rapid, low-false-alarm toxic gas detection, and power generation and water treatment facilities prioritize integrated control software.

Additional segmentation by gas type distinguishes between combustible fuel leaks, refrigerant emissions, and toxic releases such as nitrogen oxides and sulfur dioxide, each requiring distinct calibration gases and sensor materials. From a component standpoint, the interplay between air pumps, sensor modules, controllers, calibration kits, and software platforms dictates supply-chain complexity and aftermarket service demands. Meanwhile, sales channels-ranging from direct enterprise agreements to distributor networks and emerging online platforms-reflect diverging purchase behaviors, and tiered price ranges influence procurement decisions across budget-conscious and high-end applications.

This comprehensive research report categorizes the Gas Detection Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Detector Type

- Technology

- Gas Type

- Component

- End User

- Sales Channel

Highlighting Regional Variations in Gas Detection Equipment Demand and Adoption Trends Across Americas EMEA and Asia-Pacific Markets

Regional insights underscore that adoption rates and market priorities diverge significantly across the Americas, Europe, Middle East & Africa, and the Asia-Pacific region. In North America and South America, stringent workplace safety standards and robust industrial investment have driven rapid uptake of networked fixed systems and portable multi-gas monitors, while Latin American mining expansions are fueling demand for wearable low-power devices. In EMEA, regulatory harmonization around the Seveso Directive and updated ATEX standards has aligned market expectations, with Europe leading in advanced electrochemical and photoionization sensor deployments and the Middle East accelerating infrastructure monitoring in oil & gas.

Asia-Pacific, characterized by a mosaic of regulatory regimes, exhibits dynamic growth in countries such as China, Japan, and Australia, where environmental emission controls have heightened demand for refrigerant leak detection and continuous emissions monitoring. Southeast Asian manufacturing hubs are increasingly integrating digital safety platforms, bridging the gap between traditional centralized control rooms and mobile workforce applications. These regional variations underscore the importance of localized product portfolios, service capabilities, and strategic partnerships to address specific regulatory, climatic, and industrial ecosystem requirements.

This comprehensive research report examines key regions that drive the evolution of the Gas Detection Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Positioning and Innovation Drivers Among Leading Gas Detection Equipment Manufacturers and Service Providers

Leading gas detection equipment providers have differentiated themselves through targeted innovation, strategic alliances, and comprehensive service offerings. Honeywell has leveraged its broad industrial automation portfolio to integrate gas sensors into overarching facility management systems, offering end-to-end safety platforms. MSA Safety has expanded its wearable detector lineup with Bluetooth-enabled devices that feed data into mobile applications, while Dräger has focused on modular fixed-system architectures that facilitate easy sensor swaps and system expansion.

Specialist firms such as Industrial Scientific and RAE Systems have driven innovation in battery-efficient portable monitors and cloud analytics, targeting small- to mid-sized enterprises seeking rapid deployment. Teledyne Gas & Flame Detection has emphasized ultrasonic sensing for high-temperature applications, capturing niche segments in power generation. Across the board, successful companies are those that balance robust hardware performance with value-added digital services, streamline calibration and maintenance workflows, and forge partnerships with system integrators to deliver turnkey solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gas Detection Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alphasense Ltd.

- Amphenol Corporation

- Crowcon Detection Instruments Ltd.

- Drägerwerk AG & Co. KGaA

- Emerson Electric Co.

- Figaro Engineering Inc.

- GfG Gesellschaft für Gerätebau mbH

- Hanwei Electronics Group Corporation

- Honeywell International Inc.

- Industrial Scientific Corporation

- International Gas Detectors Ltd.

- MSA Safety Incorporated

- New Cosmos Electric Co., Ltd.

- RAE Systems, Inc.

- Riken Keiki Co., Ltd.

- Sensidyne, LP

- SENSIT Technologies LLC

- SGX Sensortech Limited

- Teledyne Technologies Incorporated

- Trolex Ltd.

Empowering Industry Leaders with Strategic Roadmaps for Innovation Collaboration and Compliance in the Evolving Gas Detection Equipment Market

To thrive amid intensifying competition and evolving risk landscapes, industry leaders must pursue a multipronged strategy centered on innovation, collaboration, and operational excellence. Manufacturers should accelerate the development of interoperable platforms that seamlessly integrate fixed, portable, and wearable detectors, leveraging open APIs and cloud-native architectures to foster ecosystem partnerships. By adopting advanced materials and manufacturing techniques, such as 3D printing for custom sensor housings, companies can reduce lead times and mitigate exposure to global trade tensions.

Service organizations must enhance value propositions by introducing performance-based contracts that align maintenance incentives with uptime objectives and deploying remote diagnostic tools to anticipate calibration needs. Collaboration with regulatory bodies and standards organizations will be essential for shaping emerging guidelines around wireless mesh networks and AI-driven predictive alerts. Finally, leaders should invest in workforce training programs that equip safety professionals with data-analysis skills, ensuring that the organization can translate real-time gas detection insights into proactive risk mitigation measures.

Detailing Rigorous Research Methodology Integrating Primary Interviews Secondary Data and Analytical Frameworks for Robust Market Insights

Our methodology combines rigorous secondary research with extensive primary interactions to deliver validated, forward-looking insights. We conducted a comprehensive review of industry white papers, regulatory publications, patent filings, and technical journals to map technological advancements and regulatory changes. Concurrently, we executed in-depth interviews with senior executives, product managers, safety officers, and system integrators across key end-user segments to gather firsthand perspectives on adoption challenges and unmet needs.

Data triangulation techniques were employed to corroborate quantitative findings, ensuring consistency between shipment volumes, aftermarket service revenues, and regional investment trends. Qualitative analysis frameworks, including SWOT and Porter’s Five Forces, facilitated a nuanced understanding of competitive dynamics, while scenario planning workshops helped forecast potential shifts in supply-chain resilience and tariff environments. This blended research approach ensures that the resulting insights are both evidence-based and pragmatically aligned with real-world strategic considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gas Detection Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gas Detection Equipment Market, by Detector Type

- Gas Detection Equipment Market, by Technology

- Gas Detection Equipment Market, by Gas Type

- Gas Detection Equipment Market, by Component

- Gas Detection Equipment Market, by End User

- Gas Detection Equipment Market, by Sales Channel

- Gas Detection Equipment Market, by Region

- Gas Detection Equipment Market, by Group

- Gas Detection Equipment Market, by Country

- United States Gas Detection Equipment Market

- China Gas Detection Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Critical Insights and Outlook for the Gas Detection Equipment Market to Guide Strategic Decision Making and Future Investments

As gas detection equipment continues to evolve, organizations that embrace technological innovation, align with emerging regulations, and optimize cost structures will secure a competitive edge. By synthesizing the transformative shifts, tariff impacts, segmentation complexities, and regional variances outlined in this report, decision-makers can craft informed strategies that balance safety imperatives with financial sustainability.

Ultimately, the path forward lies in harnessing data-driven insights from interoperable detection ecosystems, fostering collaboration between manufacturers and end users, and maintaining agility in the face of geopolitical and regulatory headwinds. With the right combination of advanced sensors, predictive analytics, and strategic partnerships, the industry is poised to achieve new heights of operational resilience and safety excellence.

Connect with Ketan Rohom to Explore Comprehensive Gas Detection Equipment Market Analysis and Unlock Strategic Growth Opportunities

To obtain a comprehensive deep dive into the latest developments, detailed data, and strategic analyses of the gas detection equipment market, please reach out to Ketan Rohom, Associate Director, Sales & Marketing, to request the full research report and unlock tailored insights for your organization.

- How big is the Gas Detection Equipment Market?

- What is the Gas Detection Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?