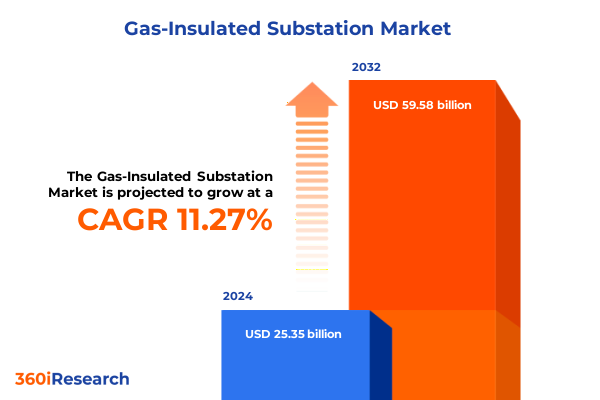

The Gas-Insulated Substation Market size was estimated at USD 28.07 billion in 2025 and expected to reach USD 31.13 billion in 2026, at a CAGR of 11.34% to reach USD 59.58 billion by 2032.

Pioneering the Evolution of Gas Insulated Substations Through Advanced Technologies and Regulatory Dynamics to Secure Reliable and Sustainable Power Transmission

The Gas Insulated Substation (GIS) sector represents a cornerstone of modern power transmission infrastructure, offering unparalleled reliability and a compact footprint that addresses the spatial constraints of urban and high-density installations. This technology leverages the exceptional insulating and arc-quenching properties of sulfur hexafluoride (SF6) gas, enabling equipment to operate at high voltage ratings with minimal land usage. As global energy systems evolve toward more interconnected and decentralized architectures, GIS deployments are increasingly favored to ensure stable voltage regulation and to facilitate the integration of renewable energy sources. The intrinsic design advantages of GIS, such as reduced electromagnetic emissions and enhanced safety through fully encapsulated conductors, have propelled its adoption across commercial, industrial, and utility applications.

Moreover, recent advancements in alternative gas mixtures and modular substation configurations are reshaping the sector’s trajectory. Research and development efforts have accelerated the commercial viability of low-global-warming-potential (GWP) alternatives like C4F7N-based gas blends and G3 mixtures, paving the way for sustainable substitution of SF6 in critical applications. Alongside these environmental drivers, digitalization trends-spanning from real-time condition monitoring to predictive maintenance enabled by AI algorithms-are fostering smarter asset management practices. By integrating sensors and digital twin frameworks, operators can anticipate potential failures, optimize maintenance schedules, and achieve higher system uptime, thereby reducing both operational costs and unexpected downtime.

In addition to technological innovation, regulatory frameworks are increasingly aligning with broader decarbonization objectives, compelling stakeholders to reconsider their insulation gas strategies and equipment lifecycles. Stricter GWP thresholds set by international agreements and national policies have prompted accelerated phase-down timelines for SF6 usage, while incentives for adopting eco-efficient solutions have emerged in key markets. These developments underscore the critical nexus between policy, technology, and market adoption, setting the stage for a transformative shift in GIS design and deployment methodologies. Consequently, industry participants are recalibrating strategies to navigate this complex landscape, as explored in the subsequent sections.

Unveiling the Transformative Shifts in Gas Insulated Substation Landscape Driven by Sustainability Goals Digitalization Modular Design and Regulatory Reform

The landscape of gas insulated substations is undergoing transformative shifts that extend far beyond incremental performance improvements, driven by an intertwined set of sustainability imperatives, technological breakthroughs, and evolving regulatory mandates. Central to this movement is the industry’s commitment to reduce greenhouse gas emissions, which has accelerated the development of innovative insulation gas alternatives. Traditional reliance on high-purity SF6 is being balanced by the integration of novel blends featuring compounds like C4F7N and hybrid G3 formulations, which exhibit significantly lower GWP profiles while maintaining equivalent dielectric strength. This shift not only addresses environmental stewardship but also reflects broader corporate social responsibility agendas that prioritize long-term system resilience and ecological integrity.

Concurrently, the adoption of modular substation architectures is redefining installation and maintenance paradigms. Prefabricated, skid-mounted GIS modules facilitate rapid deployment and enhanced scalability, enabling utilities and private operators to respond more agilely to fluctuating grid demands. These modular solutions streamline site preparation requirements and harmonize equipment interchangeability, ultimately driving down installation timelines and capital expenditures. Moreover, the integration of advanced sensor networks and digital-twin platforms is catalyzing a new era of condition-based monitoring, where predictive analytics algorithms interpret equipment health metrics in real time. Consequently, asset management evolves from reactive maintenance to proactive lifecycle optimization, elevating reliability benchmarks across end-user segments.

Furthermore, harmonization of international standards and cross-border regulatory reforms are fostering a cohesive market environment that supports global supply chain collaboration. As countries align on GWP thresholds and reporting protocols, manufacturers are incentivized to accelerate eco-friendly product roadmaps and to invest in sustainable manufacturing practices. Partnerships between technology providers, utilities, and research institutions are proliferating, yielding collaborative frameworks for field trials and standardized performance validation. These alliances underscore the industry’s collective drive toward operational excellence, underscoring that the shifts now underway are not mere technological upgrades but a comprehensive reshaping of the GIS value chain.

Analyzing the 2025 United States Tariffs Impact on Gas Insulated Substation Components with Insights into Supply Chain Resilience and Domestic Manufacturing Trends

The imposition of new United States tariffs in 2025 on imported electrical equipment and specialized components has exerted a cumulative impact on the gas insulated substation sector, compelling stakeholders to reassess procurement strategies and supply chain configurations. These tariffs, enacted under Section 301 authorities, primarily target assemblies and critical parts sourced from key manufacturing hubs in Asia, leading to increased landed costs for imported GIS modules. As a result, procurement cycles have become more complex, as buyers weigh the implications of duty escalations against delivery lead times and currency fluctuations. In response, many operators have sought to diversify supplier portfolios, exploring regional sourcing alternatives and incremental order segmentation to mitigate tariff exposure.

In addition to procurement pressures, the new tariff regime has incentivized the acceleration of domestic manufacturing initiatives within North America. Equipment providers and component manufacturers have ramped up investments in local production capabilities, supported by federal and state-level incentives designed to bolster supply chain resilience. Collaborative ventures between established engineering firms and emerging technology developers are facilitating the creation of homegrown manufacturing clusters, thereby reducing reliance on tariff-exposed imports. Simultaneously, Engineering, Procurement, and Construction partners are renegotiating contracts to incorporate flexible sourcing clauses and pass-through tariff mechanisms, ensuring that project budgets remain aligned with evolving trade policies.

Moreover, end users are recalibrating capital expenditure plans to account for potential tariff volatility, prioritizing retrofits and upgrades of existing installations over greenfield projects when feasible. This strategic pivot underscores a broader trend toward lifecycle optimization, as operators seek to extend the value of in-service assets while awaiting greater tariff certainty. Consequently, market participants are intensifying dialogue with policymakers and trade advocacy groups, advocating for targeted exemptions and safeguard measures that recognize the strategic importance of resilient power infrastructure. These developments collectively illustrate how tariff policy has become an integral factor in GIS project economics and long-term planning.

Extracting Key Segmentation Insights for Gas Insulated Substations by Insulation Gas Type Voltage Rating End User Component and Installation Type to Illuminate Market Nuances

A granular analysis of insulation gas type underscores the pivotal role of both SF6 and emerging alternatives in shaping GIS market trajectories. Traditional substations have long depended on high-purity SF6 for its unmatched dielectric and arc-quenching properties. Meanwhile, alternative gas solutions featuring C4F7N-based blends and G3 formulations are gaining traction, particularly in regions where stringent greenhouse gas regulations drive early adoption of low-GWP technologies. These alternative gases are being integrated into pilot installations and high-profile retrofit projects, signaling a shift toward hybrid insulation strategies that blend proven performance with environmental responsibility.

Voltage rating segmentation further delineates market preferences according to system requirements and grid integration challenges. Medium voltage installations maintain a strong presence in commercial and light industrial contexts, addressing localized distribution needs. High voltage GIS assemblies serve as critical nodes for bulk transmission, balancing reliability with cost-effectiveness. At the upper end of the spectrum, extra high voltage systems-categorized into the 245 to 550 kilovolt tiers and those exceeding 550 kilovolt-are prioritized for long-distance transmission corridors and large-scale power interconnections. These ultra-high voltage solutions prioritize minimal energy loss and enhanced power transfer capacity, driving demand in regions undergoing aggressive grid upscaling.

End-user segmentation reveals nuanced adoption patterns across commercial, industrial, and utility applications. Commercial sites, including data centers and urban development projects, leverage the compact footprint and concealed installation profile of GIS to optimize land use. Industrial facilities, such as petrochemical and manufacturing complexes, value the robust fault tolerance and maintenance efficiencies that GIS affords. Utilities deploy these systems across transmission networks to ensure grid stability and to accommodate intermittent renewable generation. Component-level insights further clarify substation design priorities, as busbar systems, circuit breakers, disconnecting switches, earthing switches, and instrument transformers each fulfill critical roles in operational integrity and safety.

Installation type also constitutes a defining dimension of market strategy, contrasting new installations with retrofit initiatives. New GIS installations benefit from turnkey engineering and standardized modular assemblies, enabling rapid commissioning in greenfield projects. Conversely, retrofit applications often demand tailored solutions that can be integrated within existing conduit systems and constrained yard spaces, ensuring minimal disruption to ongoing operations. This duality in installation approaches highlights the importance of flexible engineering frameworks and cross-disciplinary coordination, as stakeholders seek to maximize asset utility while embracing next-generation substation technologies.

This comprehensive research report categorizes the Gas-Insulated Substation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Substation Type

- Component

- Insulation Medium

- Voltage Rating

- Installation Type

- End-User

Deciphering Regional Dynamics in Gas Insulated Substations Across the Americas Europe Middle East Africa and Asia Pacific to Inform Strategic Deployment Decisions

Across the Americas, the GIS landscape is characterized by a strong emphasis on grid modernization and resilience enhancement initiatives. In North America, utilities are investing in strategic network upgrades to accommodate growing distributed energy resources and to fortify transmission corridors against extreme weather events. Latin American adoption of GIS is similarly influenced by the need to optimize footprint in densely populated urban centers and to support cross-border interconnection projects. Furthermore, policy incentives for domestic manufacturing and infrastructure investment have catalyzed collaborative programs between equipment suppliers and utility operators, accelerating the roll-out of advanced substation solutions across the region.

In the Europe, Middle East & Africa region, regulatory alignment around greenhouse gas reduction targets and renewable integration is a key driver for GIS deployment. European utilities are pioneering the phase-down of high-GWP SF6 in favor of eco-efficient gas mixtures, leveraging robust standards frameworks that harmonize testing protocols and performance benchmarks. Meanwhile, the Middle East’s rapid urban development and megaprojects in sectors such as oil and gas necessitate high-voltage GIS systems capable of reliable operation under extreme climatic conditions. In Africa, strategic investments in network expansion and cross-border power pools are fostering a growing market for compact, modular substations that can be deployed rapidly to bridge infrastructure gaps.

Asia-Pacific represents a dynamic growth frontier for GIS technology, fueled by expansive grid build-out and decarbonization agendas. In China and India, government-led initiatives target the reinforcement of transmission corridors to meet surging electricity demand and to integrate large-scale renewable portfolios. Southeast Asian nations are likewise investing in urban electrification and industrial park development, where GIS’s space-efficient design offers compelling advantages. Japan and South Korea continue to advance digital substation concepts, incorporating AI-driven asset management and self-diagnostic features. These regional trends collectively underscore how Asia-Pacific markets are setting benchmarks for both scale and sophistication in GIS applications.

This comprehensive research report examines key regions that drive the evolution of the Gas-Insulated Substation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Shaping the Gas Insulated Substation Market through Technological Innovation Strategic Partnerships and Operational Excellence

The gas insulated substation market is distinguished by a competitive landscape populated by established global technology leaders, whose strategic investments in research and development, and in targeted alliances shape industry progression. Major original equipment manufacturers are leveraging proprietary insulation gas formulations, advanced manufacturing techniques, and digital innovation suites to differentiate their product offerings. This has given rise to an ecosystem in which incumbents pursue both organic product enhancements and inorganic growth opportunities to maintain technological leadership. Ultimately, this convergence of engineering prowess and market agility is accelerating the rollout of high-performance GIS solutions across diverse geographies.

Siemens Energy remains at the forefront of this evolution, coupling its portfolio of ultra-high voltage GIS with integrated digital services that encompass lifecycle management and condition monitoring platforms. Its recent roll-out of next-generation circuit breaker designs and modular enclosure systems underscores a deepening commitment to performance optimization and environmental stewardship. ABB, another sector pioneer, continues to invest in alternative gas research, having introduced hybrid C4F7N gas mixtures and testing protocols that align with evolving GWP regulations. The company’s emphasis on digital twin frameworks and cloud-based analytics further solidifies its position in enabling end-to-end substation intelligence.

Likewise, GE Grid Solutions has expanded its footprint through strategic partnerships aimed at advancing automation and grid resiliency. Through collaborative ventures with technology startups, the company is exploring AI-driven diagnostic tools and augmented reality maintenance aids. Hitachi Energy, formed from the synergy of Hitachi and ABB grid business lines, is enhancing its GIS offerings with advanced asset management services and commitment to net-zero targets. Meanwhile, regional specialists and innovative newcomers are carving out niches in retrofit solutions, system integration services, and customized insulation gas blends. These diversified capabilities collectively underscore a robust competitive dynamic that drives continuous refinement of GIS technology and delivery models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gas-Insulated Substation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Bharat Heavy Electricals Limited

- CG Power and Industrial Solutions Limited

- China XD Electric Co., Ltd.

- Eaton Corporation

- El Sewedy Electric

- Fuji Electric Co. Ltd.

- General Electric Company

- Hitachi Energy Ltd

- Hyosung Heavy Industries Corporation

- Hyundai Electric & Energy Systems Co., Ltd.

- ILJIN Electric Co., Ltd.

- LARSEN & TOUBRO LIMITED

- LS ELECTRIC Co., Ltd.

- Meidensha Corporation

- Mistras Group

- Mitsubishi Electric Corporation

- Nissin Electric Co., Ltd.

- Pinggao Group Co., Ltd.

- Schneider Electric SE

- Shandong Taikai High-Voltage Switchgear Co., Ltd.

- Siemens AG

- Sieyuan Electric Co., Ltd.

- TBEA Co., Ltd

- Toshiba Energy Systems & Solutions Corporation

- Weisho Electric Co., Ltd.

- Zhejiang Chint Electrics Co., Ltd.

Delivering Actionable Recommendations for Industry Leaders to Advance Gas Insulated Substation Adoption through Innovation Policy Engagement and Supply Chain Optimization

To capitalize on the emerging opportunities within the gas insulated substation sector, industry leaders should prioritize investment in alternative insulation gas research and pilot programs that validate low-GWP blends under real-world operating conditions. By forging strategic collaborations with academic institutions and specialized gas manufacturers, stakeholders can accelerate the commercialization of C4F7N and G3 formulations, aligning product roadmaps with tightening environmental regulations. Simultaneously, embedding modular design principles into platform development will enable more agile responses to client requirements and facilitate scalable manufacturing.

In parallel, operators must elevate digitalization initiatives by deploying advanced monitoring solutions and predictive analytics to transform maintenance regimes from reactive to proactive. Integrating sensor networks with AI-driven diagnostic frameworks empowers maintenance teams to anticipate component wear and schedule interventions during planned outages, thereby minimizing unplanned downtime and optimizing lifecycle costs. Transitioning to digital twin architectures will further enhance decision-making capabilities by providing virtual replicas that simulate substation performance across varying scenarios.

Engagement with policymakers and active participation in standards development are essential to steward favorable regulatory environments and to ensure alignment on testing protocols for alternative gases. Industry consortia should collectively advocate for balanced phase-down timelines and supportive incentive structures, safeguarding market confidence during transitional periods. Lastly, reinforcing supply chain resilience through nearshoring and local manufacturing expansions will mitigate tariff-induced cost volatility and reduce lead times. Establishing dual sourcing arrangements and flexible procurement strategies will position companies to adapt swiftly to evolving trade landscapes and to maintain continuity of critical substation projects.

Outlining Rigorous Research Methodology Incorporating Qualitative Expert Interviews Secondary Data Analysis and Triangulation Techniques for Robust Findings

This report employs a robust research methodology designed to yield comprehensive insights into the gas insulated substation market landscape. A mixed-methods approach integrates qualitative perspectives from expert interviews with quantitative analyses drawn from industry documentation and publicly available datasets. By synthesizing findings across multiple dimensions-technology innovation, regulatory developments, and supply chain dynamics-the research framework ensures depth of understanding and actionable relevance for decision-makers.

Primary research was conducted through structured interviews with senior executives and technical specialists from leading utilities, engineering firms, and equipment suppliers. These conversations provided firsthand accounts of emerging trends, strategic priorities, and operational challenges. Interview participants were selected to represent diverse geographic regions and end-user segments, enabling a holistic view of sectoral developments. Input from these experts was critically analyzed to contextualize market drivers and to identify nascent growth opportunities.

Secondary research involved an extensive review of academic journals, trade publications, regulatory filings, government policy briefs, and open-access technical reports. This step ensured that historical context and regulatory frameworks were accurately captured, while also illuminating recent technological breakthroughs. Key information was cross-referenced against multiple sources, with particular attention paid to the rigor of testing protocols for alternative gas performance and digital substation applications.

Data triangulation and validation processes were integral to maintaining the report’s credibility, with findings subjected to rigorous peer review and editorial oversight. Conflicting data points were reconciled through follow-up inquiries and iterative analysis, guaranteeing consistency across chapters. This comprehensive methodology underscores the report’s commitment to delivering reliable, real-world intelligence for stakeholders seeking to navigate the evolving GIS sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gas-Insulated Substation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gas-Insulated Substation Market, by Substation Type

- Gas-Insulated Substation Market, by Component

- Gas-Insulated Substation Market, by Insulation Medium

- Gas-Insulated Substation Market, by Voltage Rating

- Gas-Insulated Substation Market, by Installation Type

- Gas-Insulated Substation Market, by End-User

- Gas-Insulated Substation Market, by Region

- Gas-Insulated Substation Market, by Group

- Gas-Insulated Substation Market, by Country

- United States Gas-Insulated Substation Market

- China Gas-Insulated Substation Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Concluding Insights on the Gas Insulated Substation Landscape Highlighting Key Trends Challenges and Strategic Imperatives for Stakeholder Decision Making

As the global energy landscape continues its rapid evolution toward sustainability and digital maturity, gas insulated substations have emerged as critical enablers of reliable, high-voltage power transmission. The confluence of environmental imperatives, innovative insulation gas alternatives, and sophisticated digitalization frameworks is redefining GIS solutions, transcending traditional performance benchmarks. Stakeholders are now positioned at the intersection of technological possibility and regulatory urgency, tasked with balancing operational reliability with ecological responsibility.

The cumulative impact of recent policy measures, including the United States 2025 tariff adjustments, underscores the importance of supply chain adaptability and domestic production capabilities. At the same time, nuanced segmentation across insulation gas types, voltage ratings, end-user applications, component specifications, and installation frameworks reveals a market characterized by both complexity and opportunity. Regional dynamics in the Americas, Europe, Middle East & Africa, and Asia-Pacific further amplify these trends, as each geography confronts distinct challenges around grid modernization and decarbonization.

Leading companies are responding through targeted R&D, strategic partnerships, and digital innovation roadmaps, while industry leaders refine procurement strategies and maintenance regimes to achieve greater resilience. Actionable recommendations emphasize collaboration with policy-makers, investment in low-GWP gas technologies, and the deployment of predictive analytics to unlock operational efficiencies. Such strategic focus will be essential in harnessing the full potential of GIS platforms and in meeting the escalating demands of modern power systems.

In conclusion, the gas insulated substation sector stands on the cusp of transformative breakthroughs, driven by a synergy of environmental, technological, and policy catalysts. As the industry advances, those who successfully integrate sustainable insulation solutions with digital intelligence and robust supply chain frameworks will define the standards for next-generation power infrastructure.

Engage with Ketan Rohom to Access the Comprehensive Gas Insulated Substation Market Research Report and Empower Data Driven Decisions for Next Level Power Infrastructure Projects

For stakeholders seeking to navigate the intricate dynamics of the gas insulated substation market with confidence and precision, this comprehensive market research report delivers the strategic intelligence required to make informed investment and operational decisions. Its depth of analysis spans alternative insulation gas technologies, evolving voltage class applications, tariff-induced supply chain considerations, and regional deployment patterns across the Americas, Europe, Middle East & Africa, and Asia-Pacific. Armed with these insights, organizations can refine their innovation roadmaps, optimize asset utilization, and future-proof their infrastructure portfolios.

To access this invaluable repository of market intelligence, please engage with Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through the report’s key findings, arrange a tailored sample of its most critical chapters, and discuss how the data can be leveraged to achieve your strategic objectives. His expertise in articulating complex technical and commercial nuances ensures that you receive a briefing aligned with your specific business priorities.

By partnering directly with Ketan Rohom, you will benefit from personalized support and expedited delivery of the full report. Whether you require focused insights on alternative gas adoption, tariff impact scenarios, technology benchmarking, or executive-level recommendations, this engagement will equip you with the knowledge and clarity to drive organizational success. Don’t delay your advantage in this rapidly evolving market; reach out today to secure the comprehensive analysis that your decision-making demands.

- How big is the Gas-Insulated Substation Market?

- What is the Gas-Insulated Substation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?