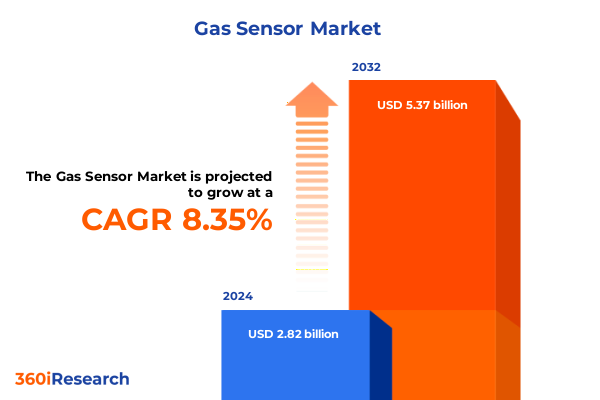

The Gas Sensor Market size was estimated at USD 3.05 billion in 2025 and expected to reach USD 3.30 billion in 2026, at a CAGR of 8.41% to reach USD 5.37 billion by 2032.

Understanding the Evolution and Strategic Importance of Advanced Gas Sensor Technologies Across Industrial, Commercial, and Residential Landscapes

In today’s rapidly evolving industrial and consumer landscapes, gas sensor technologies have become indispensable for ensuring safety, environmental compliance, and operational efficiency. From manufacturing floors to commercial buildings and residential dwellings, the ability to detect and quantify hazardous gases with precision underpins critical processes that protect lives and assets. As regulatory standards tighten and environmental monitoring gains prominence, organizations are increasingly turning to advanced sensing solutions to mitigate risks, streamline workflows, and uphold corporate responsibility.

As a result, the gas sensor market has witnessed a significant evolution in both form and function. Early analog devices, while reliable, faced limitations in terms of specificity and integration. By contrast, modern sensor platforms leverage digital architectures, miniaturized form factors, and sophisticated signal processing algorithms. This transformation has been fueled by breakthroughs in material science, microfabrication, and wireless communication, setting the stage for smart, networked systems that deliver real-time insights and predictive analytics.

Charting the Pivotal Technological, Regulatory, and Connectivity-Driven Transformative Shifts Shaping the Global Gas Sensor Landscape

Over the past few years, connectivity-driven innovations have reshaped the way gas sensors operate and communicate. The integration of wireless protocols and IoT frameworks now enables decentralized monitoring across distributed assets, empowering organizations to consolidate data streams and drive predictive maintenance. Concurrently, artificial intelligence and machine learning algorithms are being embedded into sensor platforms to enhance selectivity, reduce false alarms, and identify complex gas signatures in real time.

In parallel with technological advances, regulatory bodies worldwide have introduced stringent safety and environmental mandates that compel industries to adopt higher-performance sensing solutions. These directives, spanning emissions thresholds and workplace exposure limits, have catalyzed investments in low-power infrared and electrochemical sensors that deliver superior accuracy under harsh conditions. Moreover, the shift toward digital instrumentation has created synergies with building automation and industrial control systems, reinforcing the role of gas sensors as integral components of holistic operational architectures.

Assessing the Comprehensive Impact of 2025 United States Tariff Policies on Supply Chains, Costs, and Market Dynamics in the Gas Sensor Industry

Since the implementation of new United States tariff measures in early 2025, manufacturers and end users of gas sensing equipment have grappled with the repercussions of increased import duties on key components and raw materials. The cumulative effect of these tariffs has been felt most acutely in devices that rely on specialized alloys and semiconductor substrates, where cost pressures have either compressed margins or prompted price pass-through to customers. Furthermore, tightening supply chains have introduced longer lead times for critical parts, forcing some OEMs to requalify alternative suppliers or explore in-house fabrication options.

In response to these challenges, many stakeholders have undertaken strategic initiatives to mitigate tariff exposure. Some have accelerated localization efforts by establishing assembly and calibration facilities within the United States, while others have forged long-term agreements with suppliers in tariff-exempt countries. These adaptive strategies not only alleviate immediate cost burdens but also bolster resilience against future trade policy shifts, ultimately safeguarding continuity of supply and maintaining competitive positioning.

Uncovering Key Segmentation Insights by Product, Connectivity, Technology, Category, Gas Type, Function, Application, and End User to Inform Precision Deployment

Within this context, segmentation analysis reveals a diverse array of market dynamics shaped by product type, connectivity, technology, category, gas type, function, application, and end user. Fixed gas sensors continue to dominate industrial safety and process control applications, offering robust performance under continuous monitoring scenarios, whereas portable gas sensors serve niche requirements for on-the-move leak detection and personal exposure assessments. Wired connectivity remains the backbone of many legacy installations, yet wireless architectures are rapidly gaining traction for retrofit and greenfield projects seeking greater deployment flexibility.

Moreover, the choice of sensing technology-spanning electrochemical, infrared, photoionization detection, and semiconductor-dictates both accuracy and operating environment compatibility, with infrared sensors excelling in hydrocarbon detection and electrochemical devices preferred for toxic gas monitoring. Analog category sensors provide cost-effective solutions for simple threshold alarms, while digital variants unlock advanced diagnostics and remote calibration capabilities. Gas type segmentation highlights broad use cases for carbon dioxide, carbon monoxide, and oxygen sensors, alongside a growing demand for toxic gas detection encompassing ammonia, hydrogen sulfide, and nitric oxide. Functionally, mixed gas sensors deliver multi-analyte detection profiles, whereas single gas sensors offer optimized performance for targeted monitoring. Applications span emission monitoring, indoor air quality management, leak detection, process control, and sophisticated safety and alarm systems, with end users ranging from commercial enterprises to heavy industries and residential settings.

This comprehensive research report categorizes the Gas Sensor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connectivity

- Technology

- Category

- Gas Type

- Function

- Application

- End User

Analyzing Regional Performance and Growth Drivers across Americas, Europe, Middle East & Africa, and Asia-Pacific to Shape Strategic Market Approaches

Regional analysis underscores distinct growth drivers and strategic imperatives across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, stringent workplace safety standards and the modernization of aging infrastructure have spurred investments in both retrofit and new-build sensing networks. Government incentives for emissions reduction and energy efficiency further amplify demand for integrated monitoring platforms that align with sustainability objectives.

Meanwhile, Europe, the Middle East & Africa region is characterized by rigorous environmental regulations and a strong focus on oil and gas sector safety, driving adoption of high-reliability sensor technologies capable of operating in corrosive or explosive atmospheres. Collaborations between regulatory agencies, research institutions, and private enterprises have accelerated the development of customized sensing solutions tailored to regional compliance requirements.

Across Asia-Pacific, rapid industrialization and urbanization have heightened awareness of air quality and industrial safety. Emerging economies in Southeast Asia and South Asia are prioritizing affordable, scalable sensor deployments to support smart city initiatives, while established markets such as Japan and South Korea lead in advanced semiconductor-based gas sensing research. This regional heterogeneity presents both challenges and opportunities for market entry and expansion strategies.

This comprehensive research report examines key regions that drive the evolution of the Gas Sensor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Landscapes and Strategic Initiatives of Leading Gas Sensor Manufacturers Driving Innovation and Market Leadership

The competitive landscape features a blend of multinational conglomerates and specialized sensor manufacturers pursuing differentiated strategies. Leading firms have bolstered their product portfolios through targeted acquisitions, strategic alliances, and in-house innovation. These efforts aim to deliver end-to-end sensing ecosystems that encompass hardware, software, and service offerings, ensuring seamless integration with broader automation and analytics platforms.

Innovation investments have concentrated on next-generation materials, miniaturization, and software-enabled calibration features that enhance accuracy and lower total cost of ownership. Several companies are also exploring subscription-based models and remote monitoring services to generate recurring revenue streams. In this context, agility and collaborative R&D partnerships have become crucial competitive levers, enabling rapid prototyping and time-to-market advantages in a landscape defined by evolving customer expectations and regulatory requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gas Sensor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- AerNos, Inc.

- Aeroqual Limited

- Alphasense Ltd. by AMETEK, Inc.

- Amphenol Corporation

- ams-OSRAM AG

- Applied Techno Systems

- Asahi Kasei Corporation

- Bartels Mikrotechnik GmbH

- Crowcon Detection Instruments Ltd.

- Danfoss A/S

- Drägerwerk AG & Co. KGaA

- Dynament Ltd.

- eLichens

- Emerson Electric Co.

- Flusso Limited

- Gas Sensing Solutions Ltd.

- Gastec Corporation

- Honeywell International Inc.

- Industrial Scientific Corporation

- Infineon Technologies AG

- Interlink Electronics, Inc.

- Ion Science Ltd.

- MEMBRAPOR AG

- Membrapor AG

- Microsens SA

- MSA Safety Incorporated

- N5 Sensors, Inc.

- Nemoto & Co., Ltd.

- New Cosmos Electric Co., Ltd.

- Nissha Co., Ltd.

- Niterra Co., Ltd.

- Process Sensing Technologies Ltd. by Dwyer Instruments

- Robert Bosch GmbH

- Sciosense B.V.

- Sensirion AG

- Sensirion AG

- Sensorix GmbH

- SGX Sensortech Ltd.

- Siemens AG

- smartGAS Mikrosensorik GmbH

- SPEC Sensors Inc.

- STMicroelectronics N.V.

- TDK Corporation

- Teledyne Technologies Incorporated

- Toshiba Corporation

- Vaisala Oyj

- Vighnaharta Technologies Pvt. Ltd.

- Zhengzhou Winsen Electronics Technology Co., Ltd.

Proposing Actionable and Impactful Recommendations for Gas Sensor Industry Leaders to Accelerate Adoption, Enhance Performance, and Ensure Sustainable Growth

Industry leaders are advised to prioritize interoperability and open architecture designs that facilitate seamless integration of gas sensor data with enterprise resource planning and building management systems. Investments in wireless and digital sensor modules will unlock new business models around predictive maintenance and condition-based monitoring. Moreover, developing modular platforms that support field-replaceable sensor cartridges can reduce downtime and enhance user experience in critical applications.

Simultaneously, organizations should broaden their supplier base and consider nearshoring key component assembly to mitigate the impact of future tariff fluctuations. Engaging with regulatory bodies and participating in standards development will ensure product compliance and establish early mover advantages. Finally, embedding sustainability principles into sensor design-such as low-power operation and recyclable materials-will resonate with eco-conscious customers and align with global decarbonization goals.

Detailing a Rigorous Research Methodology Integrating Secondary Research, Expert Interviews, and Data Validation to Ensure Robust Gas Sensor Market Insights

This analysis integrates comprehensive secondary research derived from industry publications, technical whitepapers, patent databases, and regulatory filings. Proprietary databases were leveraged to map historical technology adoption trends and to identify emerging material innovations. Market landscape studies and public financial disclosures provided additional context on competitive positioning and investment flows.

Primary research was conducted through structured interviews with senior executives, product managers, system integrators, and end-user representatives across key geographies. These conversations were complemented by data triangulation techniques, wherein multiple sources were cross-verified to validate findings and minimize bias. A rigorous peer-review process further ensured analytical accuracy and the robustness of strategic insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gas Sensor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gas Sensor Market, by Product Type

- Gas Sensor Market, by Connectivity

- Gas Sensor Market, by Technology

- Gas Sensor Market, by Category

- Gas Sensor Market, by Gas Type

- Gas Sensor Market, by Function

- Gas Sensor Market, by Application

- Gas Sensor Market, by End User

- Gas Sensor Market, by Region

- Gas Sensor Market, by Group

- Gas Sensor Market, by Country

- United States Gas Sensor Market

- China Gas Sensor Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Implications from the Gas Sensor Industry Analysis to Inform Decision-Making and Future Technology Development

The analysis reveals that the gas sensor market is at an inflection point driven by technological convergence, regulatory imperatives, and shifting trade dynamics. Evolving connectivity standards and advanced sensing materials are expanding application frontiers, while 2025 tariff policies underscore the need for supply chain adaptability. Segmentation analysis highlights nuanced opportunities across product types, technologies, and end-use scenarios, reinforcing the importance of tailored go-to-market strategies.

Strategic implications point to a future where data-centric sensing platforms will form the backbone of safety, environmental, and operational excellence initiatives. Organizations that embrace open architectures, invest in digital transformation, and maintain supply chain resilience will be best positioned to capitalize on emerging opportunities and to navigate an increasingly complex regulatory landscape.

Engage with Ketan Rohom to Unlock the Full Gas Sensor Market Research Report and Drive Informed Strategic Decisions for Your Organization

To explore in depth the comprehensive insights and tap into the full potential of the gas sensor market, contact Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch to learn how this report can support your strategic initiatives.

Secure your copy of the full market research report today and equip your organization with the actionable intelligence needed to navigate emerging trends, optimize product portfolios, and achieve sustainable growth in the dynamic gas sensor landscape.

- How big is the Gas Sensor Market?

- What is the Gas Sensor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?